Black_Kira

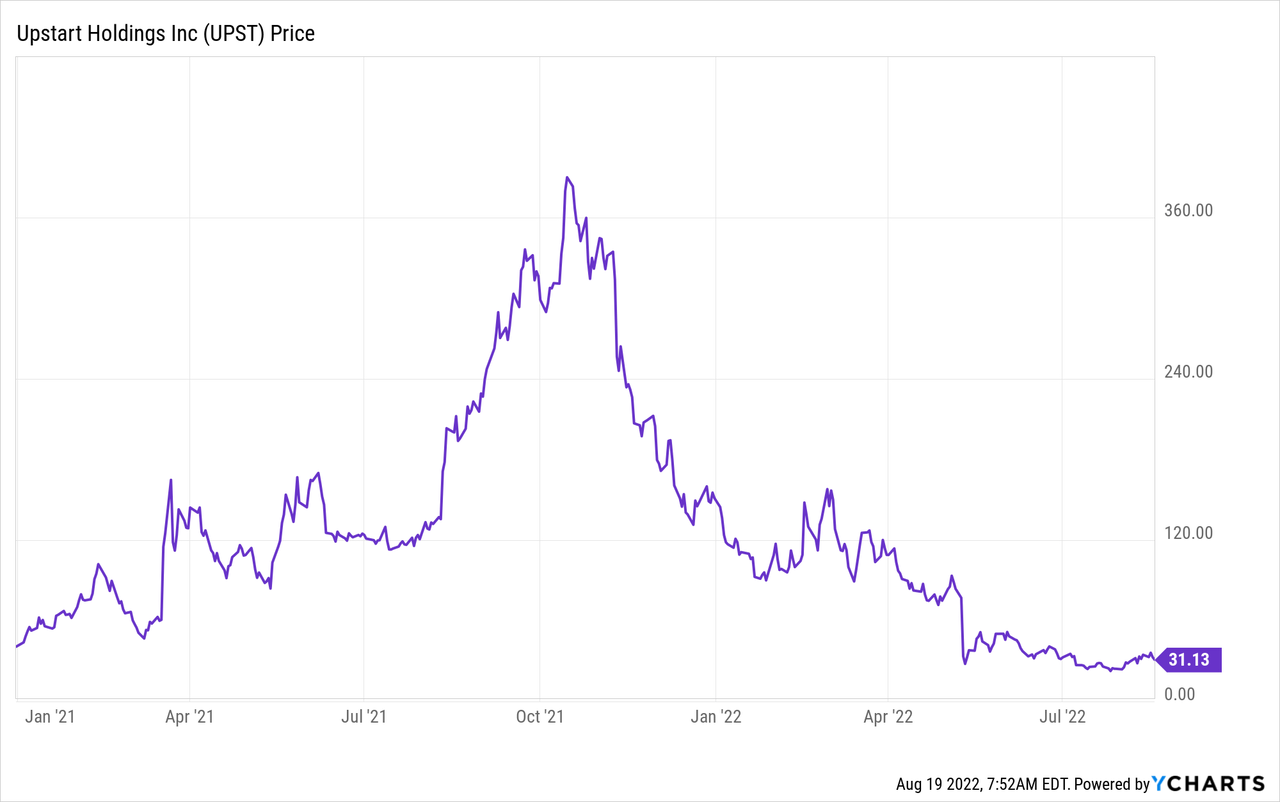

As already noted by most commentators, Upstart (NASDAQ:UPST), the cloud-based artificial intelligence lending platform, had a very disappointing Q2 2022, following an already catastrophic share price decline. As I have written positive articles on Seeking Alpha about this name in the past, I think it is only fair to give my opinion after the many disappointments.

Upstart is in many ways a failed growth stock, and a good reminder of the risks of investing in high-growth businesses. It is probably too early to conclude definitively if Upstart was one of the classic bubble stocks of 2021, but there are some signs that it might go down as such. In any case, the investment thesis has already deteriorated on multiple fronts. I give the stock a “hold” rating, only because I haven’t decided what to do with my remaining shares, which are a small part of my portfolio. There remains hope, but hope, unfortunately, rarely is a good investment thesis.

Revenue Declines As Macro Environment Hits Hard

The most important takeaway from Q2 2022 is that the company is not growing anymore. Revenue was down 26.5% sequentially from Q1 to Q2 2022, and management guided for another sequential decline of 25.4% in Q3. That is a huge decline in a very short time frame. I highlighted this risk in my first article, noting that Upstart has no recurring revenue, and therefore is more vulnerable to fluctuations.

Upstart is currently operating in a funding-constrained environment, which is the primary cause of the revenue shortfall. They announced a plan to improve the funding side of the marketplace by bringing a “significant amount of committed capital on board from partners who will invest consistently through cycles” and are “currently evaluating a variety of opportunities to do just that”. However, asked in the conference call who these partners or investors are in terms of committing capital, and what Upstart’s exact target group is, management simply didn’t answer. It was the third question of the same analyst, and they usually only get two questions. Still, it’s disappointing that they didn’t answer this important question. My interpretation is that Upstart is in the early stages of finding these “committed capital partners” and doesn’t really have anything to show yet.

Can Upstart pull itself out of the macroeconomic headwinds by its own strength?

No Revenue Visibility And Rising Delinquencies

Recent results have shown that Upstart is a cyclical business and that its fortunes are dependent to a large degree on the macro environment. Also, investors’ appetite to invest in Upstart’s loans is highly dependent on the performance of these loans – delinquency and default rates are key.

Management tried to highlight the performance and returns on their loans in the earnings release and also indicated at times that the worst might already be over, but one analyst pushed back on that narrative in the conference call: “Are we really cross cycle? Are you modeling that this is the bottom, and we’ve turned the corner on kind of the low-end consumer that is contrary to what most of our economists are saying at this point? So, I want to just understand what you mean and whether or not you think that these delinquencies are going to get worse from here or better.” Of course, the CFO negated this question, citing that they expect “further degradation in loss trends”. He explained further, though, that they believe that the changes in the overall environment from now on will not be as drastic as the changes that happened from mid-2021 until now.

This remains to be seen. My feeling is that, thinking prudently, we probably haven’t seen the worst yet in terms of consumer defaults and that the credit cycle has not yet “completed”. This again would spell bad news for revenue in coming quarters.

From today’s perspective, there is almost no visibility into future revenue. Asked about how the June loan origination numbers compared to the July numbers in the Q2 conference call, the CFO replied that “the trend right now is volatile” and that “there’s no real directionality in our numbers with respect to June versus July”. As investors, we are completely in the dark about when the company will return to growth or how bad the revenue decline will get in the end.

Considering the catastrophic misses of revenue guidance in 2022 so far (they guided for 65% growth for 2022 but are currently on a trajectory to see no growth at all), management projections should, at the very least, be taken with a grain of salt.

Balance Sheet Usage And The Platform Business Model

Suspicion towards management should also be heightened due to its recent “tango” regarding the use of its balance sheet to fund loans. As a reminder, Upstart shocked investors in Q1 2022 by suddenly taking on roughly $600 million of loans onto their balance sheet. From the Q1 call: “We have used our balance sheet in the last quarter to do what I call sort of a market-clearing mechanism. And by that, what I mean is when interest rates in the economy change quite quickly, I think it would be fair to say that our platform, its ability to react to the new market-clearing price, it’s probably not as nimble as we would like. It’s somewhat manual. It requires a bunch of conversations and phone calls.” Talk about high-tech Artificial Intelligence…

Although management indicated in Q1 that they would like to get rid of these loans as quickly as possible, Q2 saw another turn. From the Q2 call: “We aren’t becoming a bank, but certainly, we see ourselves in a transitional phase where we are – we’re recognizing the need for permanent or more committed capital on the platform. And as a bridge to that, we want to have the freedom to do the right things at the right time to get from here to there. It doesn’t really change our overall philosophy, but we nor do we think it’s great at this time to have sort of a litmus test of not using our balance sheet whatsoever with a lot of cash in our balance sheet. And we want to use it to the advantage of the business over the long haul.”

This shift is another major red flag in my opinion. Up to this point, Upstart sold itself as a platform business with no credit risk, only taking on small amounts of loans for R&D purposes. Now, the company has $628.5 million dollars of questionable loans on its balance sheet and around $914.4 million of cash remaining. Free Cash Flow for the first six months of 2022 was approximately -$326 million.

The CEO stated that the move towards using its balance sheet does not change the long-term strategy of Upstart – it still sees itself as a platform. But my concerns are not just limited to the question of whether Upstart is a platform, which should be seriously doubted at this point, but how this zig-zag reflects on management itself. Shouldn’t they have had a plan in store for a changing economic environment? Did this change really come as such a surprise, since interest rate changes have been telegraphed since November 2021? What happens to Upstart’s loans when unemployment rises and the higher risk tiers that comprise a significant component of Upstart’s borrower base start defaulting?

Maybe I am overreacting to management’s on- and off-decision about the use of its balance sheet, but I think it is an important issue and was rightfully addressed multiple times by analysts in the Q1 and Q2 calls. You cannot blame management for a changing macro environment, but you can question how they handle it. In my opinion, they could have done a better job and shown a steadier hand.

Bottom Line

The bottom line is that the investment thesis in Upstart is, to a large degree, broken. Let me recap my investment thesis, laid out in past articles, and add some commentary from today’s point of view:

- Phenomenal Growth and strongly outperforming expectations: The company is not growing anymore (after growing 264% in 2021, and guiding for 65% growth in 2022), missed expectations by a large amount, pulled full-year guidance, is guiding to a huge contraction in revenue in Q3, and there is no visibility into the future. This point – the most important in my opinion – is completely broken.

- Cheap valuation compared to growth: With no growth, it is hard to make any positive comments regarding valuation. Yes, the TTM EV/S has dropped to 2.65 as the share price dropped significantly. But the fundamentals have also changed completely. I would not argue that this is an attractive valuation at this time because there are simply too many unknowns.

- A huge market opportunity in lending: This point is probably unchanged, but what I have learned (the hard way) is how exposed Upstart is to the credit cycle. While this might be a giant market, it is maybe not a market one wants to be invested in in the first place. I see the funding troubles that Upstart had as a private company in a new light now – possibly these early investors knew that this is a difficult business to be in.

- The advantage of the AI model (disruption of FICO model): Probably also unchanged, although we have to take management’s word on this. There were comments in the past about performance problems on Upstart loans but as an industry outsider, it is hard to verify. I also thought that the AI model may show its advantages in a changing rate environment as it should be able to adjust more quickly. Looking at the comments from management (“manual” adjustments) and the actual numbers, this hasn’t happened.

- A strong platform business model: The usage of their own balance sheet to fund loans raises big question marks on this point. Furthermore, there is still a big concentration risk according to the last 10-Q. The company continues to add bank partners but how much do they actually contribute to the lending volume? Is this really a platform business model? I have more doubts after observing the zig-zag moves by management.

Yes, you could point to some positives like the increasing take-rate, the stable rate of automation, or the strong guidance towards a 59% contribution margin for Q3 2022 (from a previous range of 46-47%) – which taken together do show some potential resilience in the business model – and you could also point to the “long-term” thesis that might still be intact. But at the very least one has to admit that things do not look good at the moment. The (remaining) investment thesis is currently supported mostly by hope, the belief that their AI model remains superior (which is difficult to evaluate ex-ante for an outsider), and that the valuation has “derisked”. In other words, it’s hard to find any near- to mid-term catalysts for this business and stock (except maybe an irrational meme short-squeeze, which, unfortunately, can still be an investment thesis nowadays, but is not something I like to speculate on).

I wrote in my second article on Upstart: “This is still a young business with very little history as a public company. It looks like a great opportunity but there are also risks. So don’t fall in love with the story or the stock and follow the numbers.”

Unfortunately, this brief warning came to full effect. Growth investing is highly dependent on the execution of the business, and currently, the business is not performing. The bad performance, of course, is a function of macro conditions changing drastically, but it is still bad performance, nevertheless. The question for investors is: Do you want to be part of this?

Another key question I haven’t found an answer to yet: Was Upstart’s outperformance in terms of revenue growth and lending volume in 2021 a product of their superior business model, or were they simply riding a wave of easy credit that was not sustainable? The numbers will tell the answer eventually, but from an investor perspective, today, it is an undeniable fact that Upstart has become a growth stock without growth. In my opinion, the investment thesis is falling apart on that fact alone.

I currently look at Upstart as a prime candidate to harvest capital losses for tax purposes. I might hold on to a tiny position to keep the stock on my radar – it remains an interesting story in my view – but it is certainly not a stock to put new money into for me right now.

Be the first to comment