Chesky_W

MicroVision (NASDAQ:MVIS) is a small technology company that has attempted to commercialize a variety of different ideas. Currently, the company’s primary focus is on light detection and ranging “lidar” systems, which are used in autonomous vehicles.

For a while, MicroVision was one of the only publicly-traded lidar stocks in the United States, giving it appeal and a sort of scarcity value on this technology. However, with the SPAC boom, a number of larger and better funded competitors such as Luminar Technologies (LAZR) came to market.

That being the case, interest in MicroVision has diminished recently, and the share price has slipped. Is there hope for a turnaround? Unfortunately, even at the lower share price, MVIS stock remains overvalued and highly risky going forward.

MVIS Stock Key Statistics

MicroVision was founded in 1993. What has the company accomplished over the years? According to the company’s 10-K, MicroVision has created all sorts of proprietary products and technologies:

“Throughout our history, we have combined our proprietary technology with our development expertise to create innovative solutions to address existing and emerging market needs, such as augmented reality microdisplay engines; interactive display modules; consumer lidar components; and, most recently, automotive lidar sensors and solutions for the automotive market.”

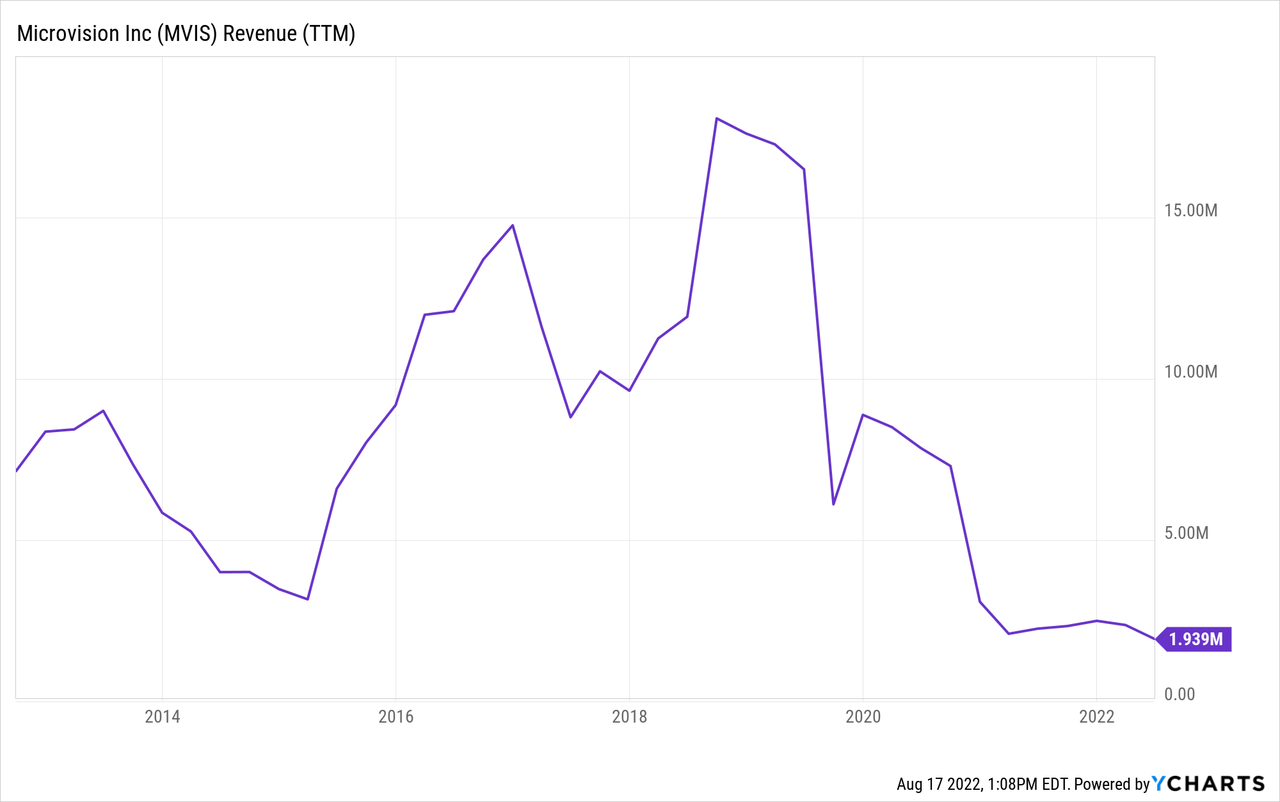

Sounds promising, right? Yet, when we turn to MicroVision’s most important stat – revenues – we find a major shortcoming:

Over the past decade, MicroVision has never produced more than $20 million of revenue in a single year. Even the relative success of 2018 would soon disappear as revenues dropped from a peak of $17 million to less than $2 million last year.

Is MicroVision Overvalued?

In a word: Yes.

MicroVision has a market cap of $845 million against less than $2 million of projected 2022 revenues. The company hasn’t produced an operating profit for even one year out of the past decade. And its past product launches routinely underwhelm.

Here’s former MicroVision CEO Perry Mulligan talking up interactive displays in July 2019:

“Consequently, we now expect Display-only and Interactive Display products could launch in mid-2020, with first revenue to us likely starting in Q2 2020 and the potential for profitability, depending on volumes and product mix considerations, one quarter later,”

Mulligan suggested that the company could be profitable by the end of 2020. Instead, MicroVision produced almost no revenues at all in 2020, from displays or otherwise, and came up with a large operating loss like usual. After more than twenty years as a publicly-traded company, MicroVision needs to deliver actual results rather than just an encouraging narrative.

Is MicroVision Expected To Go Up?

Some traders believe MicroVision shares should rally due to high short interest.

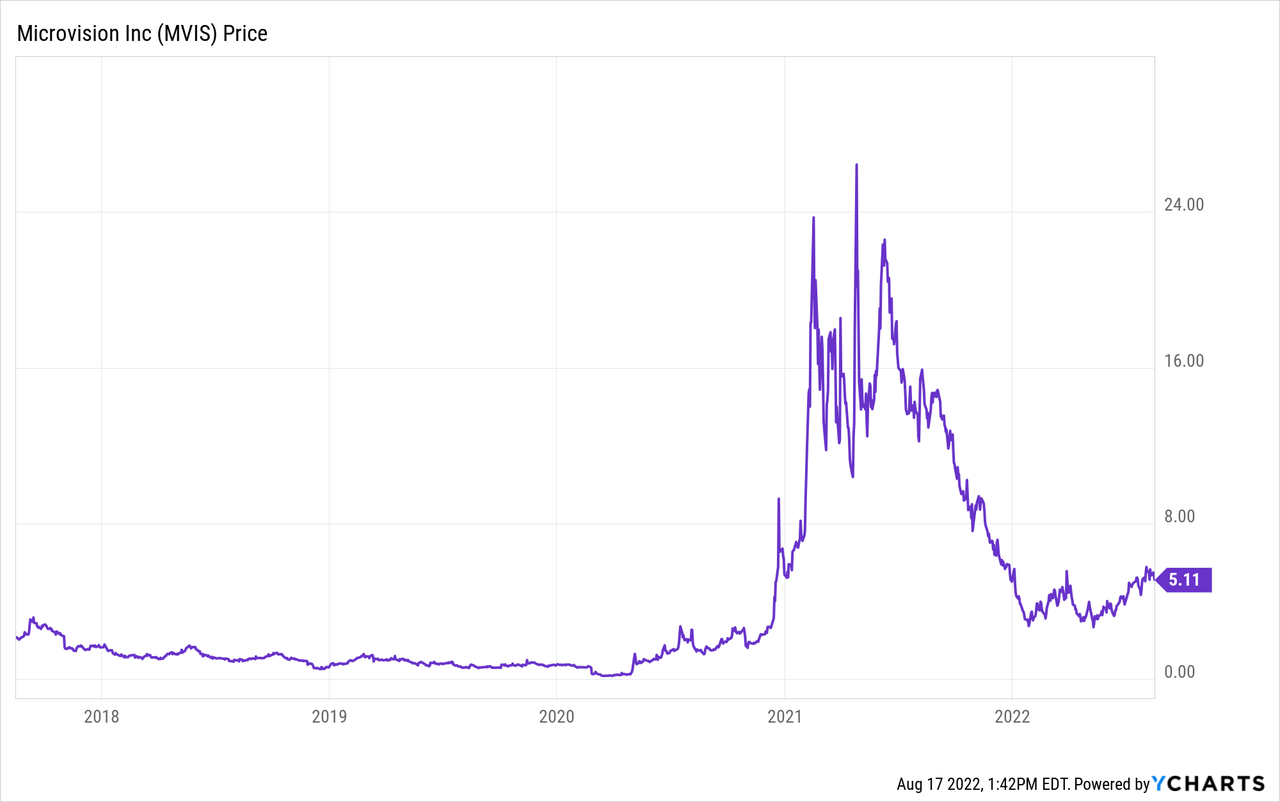

There is some precedence for this. MVIS shares rose spectacularly in 2021 during the Reddit/WallStreetBets meme stock phenomenon, with shares going from the pennies to $25 at one point:

On message boards and social media, unsubstantiated rumors went around suggesting that MicroVision was about to win major contracts or be a buyout target for a larger tech company such as Nvidia (NVDA).

Some disruption-themed ETFs also piled into MicroVision shares amid the excitement. The Direxion Moonshot Innovators ETF (MOON), for example, made MVIS stock one of its top holdings.

When nothing came of this chatter, however, shares quickly crashed. And, though meme stock excitement has bubbled up again lately in stocks such as Bed Bath & Beyond (BBBY), as of yet, there’s been little sign of any similar rekindling of interest in MicroVision.

Bulls can point to the fact that 26% of MVIS stock’s float is currently sold short. And short sellers are paying a high fee to borrow shares, currently 18% per year at Interactive Brokers, for example. However, high short interest is often a sign that a company’s prospects are dim. Bears rarely press bets against a company to this extent unless they’re quite confident that shares will trade lower in the future.

All that to say that MicroVision could enjoy another short squeeze if the right combination of press releases or positive social media chatter occurred again. However, traders banking on a repeat of the early 2021 excitement in MicroVision stock should be careful. There simply is very little in the company’s fundamentals which would justify such a move.

Is MicroVision Stock A Good Long-Term Investment?

No, MicroVision is not suitable for long-term investment. The company hasn’t generated an operating profit even a single time over the past decade. Its ability to generate revenues is also questionable at best.

While the company’s operations and new products rarely encounter much success, the company continues to suffer from high overhead expenses.

The company has lost at least $13 million from operations each year of the past decade. Losses accelerated to an eye-watering $44 million last year. Since the company does not generate meaningful sales, let alone profits at the moment, it has to fund these widening operating losses via stock sales.

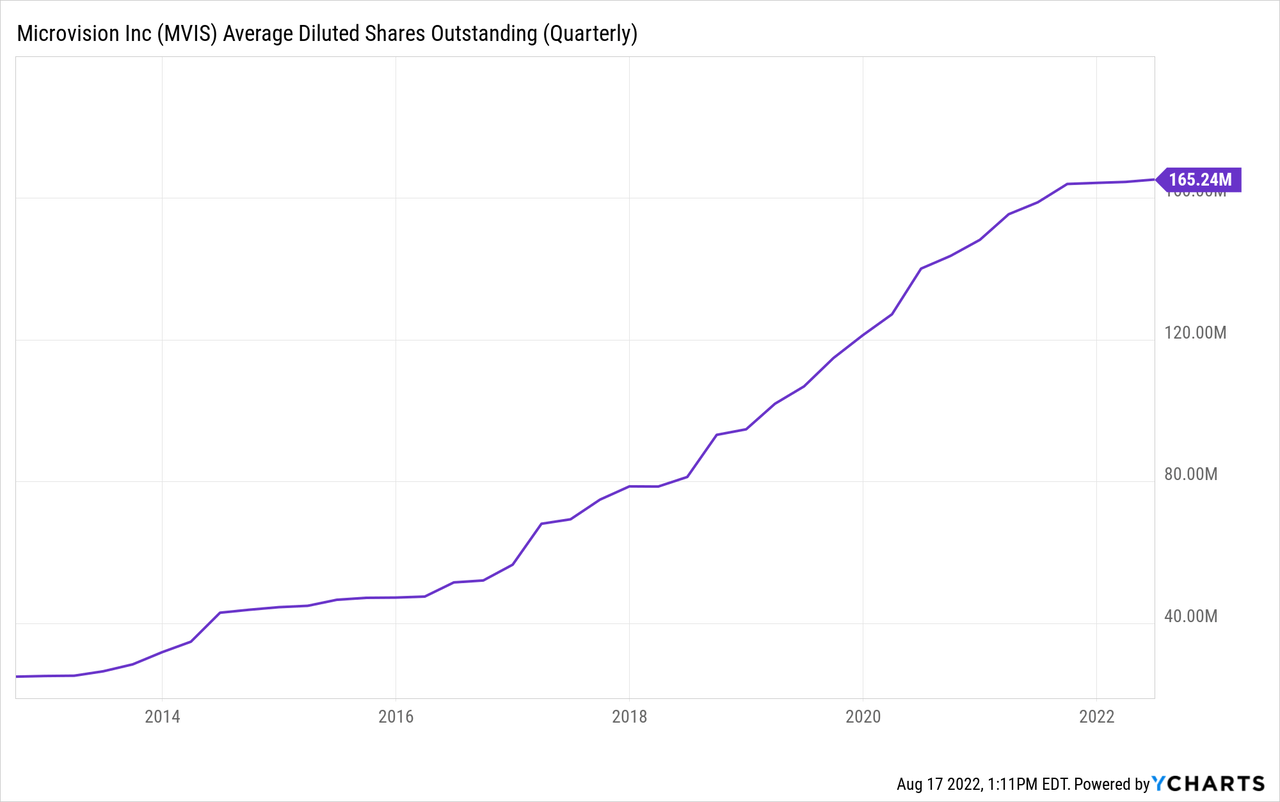

In fact, MicroVision has piled up a track record of massive share dilution:

Since 2013, the company’s shares outstanding have surged from around 30 million to more than 165 million today. A shareholder that has held the stock for the past decade has now been diluted to less than 20% of their original ownership position. If the company was putting all this new share capital to good use, that would be one thing. But there’s little evidence of shareholder value creation being accomplished by any of the company’s recent business ventures.

MicroVision shares peaked back at a split-adjusted $510 per share in 2000. It’s now down 99% since that point. And, over the decades, MicroVision has piled up an accumulated deficit of $656 million, meaning that it’s blown through more than half a billion dollars with little to show for it. At some point, investors may want to consider not giving this company any more funding.

Is MVIS Stock A Buy, Sell, Or Hold?

Given the above facts, it’s probably not surprising that I rate MVIS stock a sell.

Incredibly enough, MicroVision still has a market cap of more than $800 million despite producing virtually no revenues and not having any track record of commercial success. For comparison’s sake, Velodyne Lidar (VLDR) is producing more than $40 million in annual revenues and has a market cap of just $320 million today.

Do I think Velodyne is a promising investment? No, not especially. But at least it has proven there is some commercial demand for its products. MicroVision, by contrast, has little more than prototypes and press releases to point to. As such, MVIS stock’s $800 million valuation is rather ambitious.

Be the first to comment