Marco_Bonfanti/iStock Editorial via Getty Images

Allianz SE (OTCPK:ALIZF) is often seen as one of the best insurance companies in the world – and we can clearly argue if Allianz is the best insurance company (or one of the best) in the world. However, it is hard to dispute that Allianz is a well-run company that is providing stability and consistency for investors.

In my last two articles about Allianz (in August 2021 and March 2021) I was already bullish about Allianz and considered the stock undervalued. And in March 2021 and August 2021 when these two articles were published the stock was trading for higher prices than right now – one time slightly above €200 and one time slightly below €200.

I will now argue once again why Allianz is undervalued from a fundamental point of view, but why I am still cautious and expect the share price to drop lower over the coming quarters – an argument that may be familiar to you if you read my previous articles about different banks. But we will start with the attractive dividend yield of Allianz.

Attractive Dividend

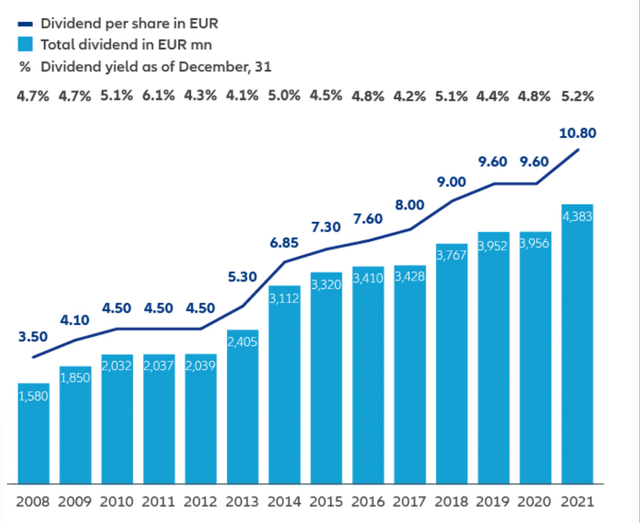

Allianz paid an annual dividend of €10.80 in May 2022 (for fiscal 2021), which represented an increase of 12.5% year-over-year (dividend for fiscal 2020 was €9.60). Right now, this dividend would result in a dividend yield of 6.2% and this is without any doubt an attractive dividend – even when considering that financial/insurance companies are usually paying an above-average dividend.

Allianz Investor Relations

And not only has Allianz increased the dividend with a solid CAGR of 9% since 2008 (yes, Allianz is cherry-picking its data as it cut the dividend in 2008), but according to its dividend policy the company is promising to increase the dividend at least 5% annually in the years to come.

Allianz is also targeting a payout ratio around 50% for its dividend, but when looking at €15.83 in earnings per share in fiscal 2021 we get a payout ratio of 68% and when using the expected earnings per share of €16.40 for fiscal 2022, we get a payout ratio of 66%.

As both payout ratios are clearly above Allianz’s target, we must assume that the company will cut its dividend or keep it once again only stable next year. However, we must consider an important aspect that had a huge influence on fiscal 2021 results and will also have an impact on fiscal 2022 results – the settlement with the Department of Justice and Securities and Exchange Commission concerning the Structured Alpha Funds.

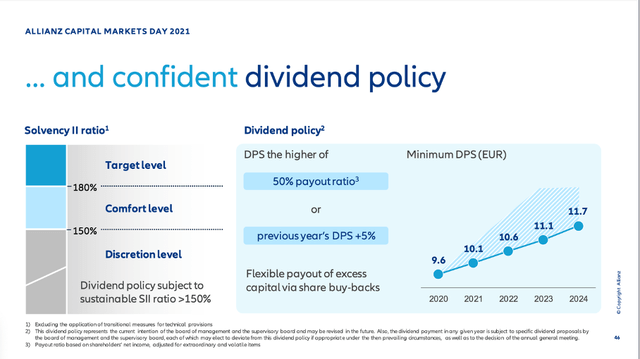

Allianz Capital Markets Day 2021 Presentation

And therefore, it is not surprising that management gave the following dividend guidance for the next few years – at a point they already knew about the high provisions necessary for the settlement. And as the footnote in the chart above is stating, the 50% payout ratio is adjusting for extraordinary and volatile items. Summing up, I would actually be confident that Allianz can keep the dividend at least stable for fiscal 2022. It probably depends on how bad the next potential recession will be.

Resolved Legal Issues

In my last article I talked about major risks Allianz is facing right now and the investigation over the Structured Alpha Funds was one aspect. Back then I wrote:

However, Allianz seems to be faced with a bigger threat right now. On August 1, 2021, Allianz announced that the U.S. Department of Justice has begun an investigation concerning the Structured Alpha Funds. Allianz also informed investors, that the DOJ is requesting documents and information. There was already a litigation pending in U.S. courts regarding the Structured Alpha Funds against Allianz. The investors, which include pension funds for truckers, teachers and subway workers lost a lot of money and Allianz had to shut down two of its most-aggressive Structured Alpha Funds last year, which led to huge losses as the two funds managed close to $2.3 billion.

In my last article I also wrote that I assume Allianz will have to pay billions of dollars – and now we know that prediction was quite accurate. The settlement includes a €2.33 billion criminal fine, €3.24 billion of restitution and a forfeit of €463 million. And in the fourth quarter of fiscal 2021, Allianz already announced the booking of a provision of €3.7 billion and in the first quarter of fiscal 2022, it announced another provision of €1.9 billion.

And of course, this had (in fiscal 2021) and will have (in fiscal 2022) a huge impact on the bottom line. In 2021, it reduced the net income by €2.8 billion and earnings per share would have been about 40% higher than reported numbers. And the provision in Q1/22 will once again impact the net income negatively by about €0.6 billion.

Quarterly Results

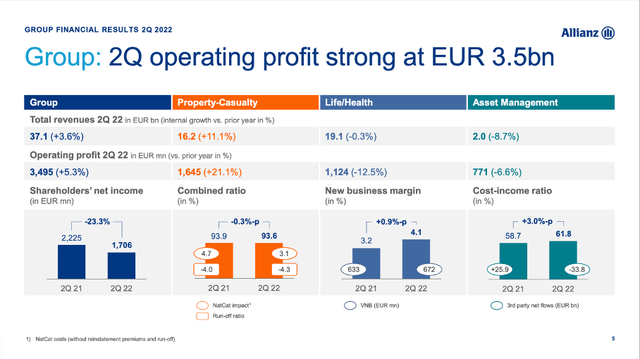

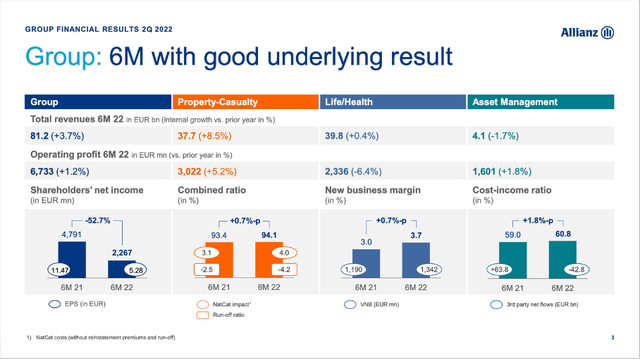

In August, Allianz reported second quarter results and the company could increase total revenue from €34.3 billion in the same quarter last year to €37.1 billion this quarter – resulting in 8.2% year-over-year growth. Internal revenue growth – which is adjusting for foreign currency effects and consolidation effects – was still 3.6%. Operating profit also increased 5.3% YoY from €3,319 million in Q2/21 to €3,495 million in Q2/22. However, net income and adjusted earnings per share declined year-over-year. Diluted earnings per share were 26.3% lower and declined from €5.22 in the same quarter last year to €3.85 this quarter.

Allianz Q2/22 Investor Presentation

When looking at the three segments, operating profit was especially driven by the “Property-Casualty” business segment, which saw its operating profit increasing 21.1% year-over-year while the other two segments had to report declining operating profits.

Optimistic Management Vs. Looming Recession

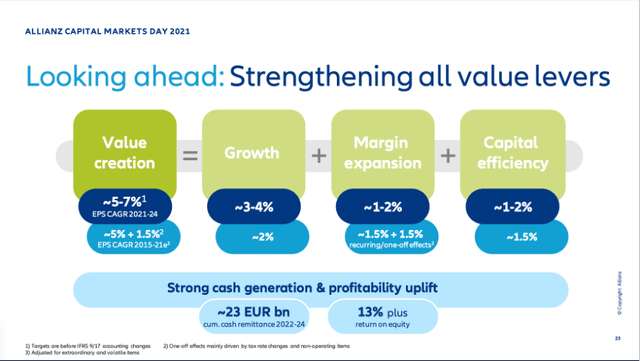

During its 2021 Capital Markets Day, management was quite optimistic for the next three years (until fiscal 2024) and was expecting earnings per share to increase with a CAGR of 5% to 7%.

Allianz Capital Markets Day 2021 Presentation

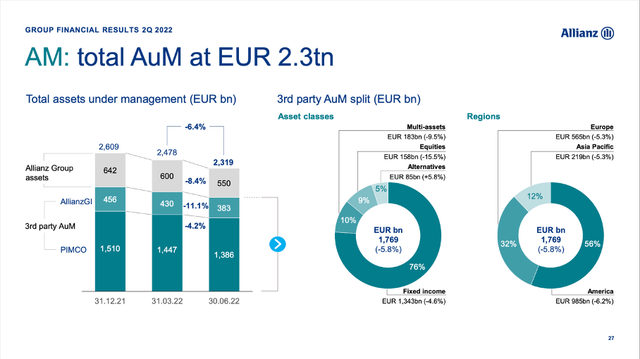

But similar to many banks and asset managers, I see Allianz also at a higher risk of performing horribly during a recession. Especially asset management is at a high risk to perform badly during bear markets and economic downturns. And we are already seeing total assets under management declining in the first half of 2022 from €2,602 billion at the end of December 2021 to €2,319 billion at the end of June 2022.

Allianz Q2/22 Investor Presentation

And when the bear market is getting worse (and in my opinion, it will get worse over the next few quarters), assets are probably withdrawn for different reasons (i.e., panic, liquidity) and declining asset prices will also lead to shrinking total AuM for Allianz. On the other hand, we should not forget that asset management is only one of three business segments. And in the first half of 2022, asset management was only responsible for €4.1 billion in revenue (about 5% of total revenue) and €1,601 million in operating profit (23.8% of total operating profit).

Allianz Q2/22 Investor Presentation

Without much doubt, asset management is important for Allianz as it is an extremely profitable business. However, we should not forget that asset management is only generating a part of operating income and even when asset management should struggle, there are two other segments which are less affected by an economic downturn: Property-Casualty as well as Life/Health. During an economic downturn, people will try to save money and maybe forgo taking out new insurances, however, I think it is unrealistic that people will terminate insurance contracts they already have. Additionally, insurance contracts for automobiles (obligatory in Germany in many other countries) or life and health insurance contracts are hard to forgo.

I would assume that Allianz is affected by a recession – as it has been in the past (unprofitable in 2002 and 2008), but the business will also recover again. And without provisions for settlements, analysts are expecting Allianz to be quite profitable in the coming years. For fiscal 2023, analysts are expecting earnings per share of €23.70.

Intrinsic Value Calculation

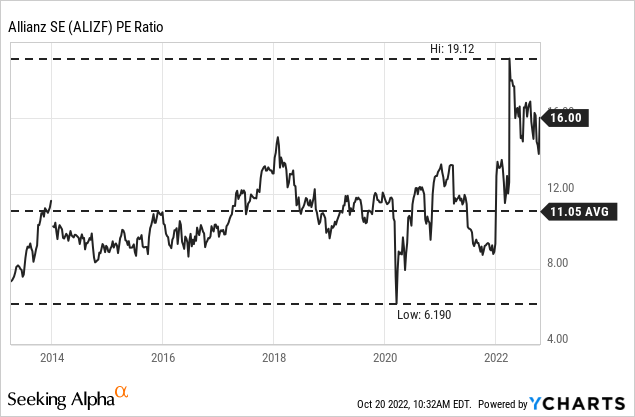

I indicated at the beginning of this article that Allianz is undervalued. I already considered the stock undervalued in my last two articles when the stock was trading for about 20-25% higher prices than right now. We can start by looking at the price-earnings ratio and Allianz is actually trading for one of the highest price-earnings ratios in the last ten years. The P/E ratio peaked at about 19 in early 2022 and with a current P/E ratio of 16 the stock moved away from its previous peak but is still trading above the 10-year average of 11.

And when trying to interpret that number it gets interesting again. One the one side, it is not great that Allianz is trading for one of the highest P/E ratios of the last ten years, however when comparing it to many other stocks right now, a P/E ratio of 16 is more than reasonable. And Allianz is facing a similar fate as many other banks and insurance companies – it was trading for an extremely low valuation multiple for many, many years.

Additional information could stem from a discount cash flow calculation. As basis we can take the net income of fiscal 2021, which was €6,610 million and analysts are expecting a similar amount for fiscal 2022 (management is also assuming a similar operating profit in fiscal 2022 as in fiscal 2021). For fiscal 2023 we are cautious and assume a stagnating net income. One can assume a higher net income in fiscal 2023 as the provision in Q1/22 had quite a negative effect in fiscal 2022 results. However, the recession might off-set this increase. For the following years we assume different growth rates, that lead to different intrinsic values for the stock (for the calculation we assume 10% discount rate and 408.5 million in outstanding shares).

|

Growth rates |

2% |

3% |

4% |

5% |

|

Intrinsic Value |

€198.58 |

€224.85 |

€259.88 |

€308.91 |

In the last few years, Allianz also started using share buybacks and for fiscal 2022, the company bought back shares worth of €1 billion (the announced share buyback was already completed by July 15, 2022), which decreased the number of outstanding shares about 1.2% and therefore contribute about 1.2% growth to the bottom line. Combined with revenue growth of 2-3%, growth rates of 4-5% don’t seem unrealistic for Allianz.

So, What’s The Problem?

By all “normal” metrics for determining an intrinsic value, the stock is clearly (and deeply) undervalued and should be trading for a much higher price. However, I would be cautious nonetheless as bank and insurance stocks are usually punished hard during recessions. In my last article about JPMorgan Chase I wrote:

Almost every bank is suffering during a recession, and when thinking about the basics of a recession, it is not really surprising: disposable income for people is lower during recessions, which leads to lower deposits for banks; companies are investing less, and people are buying less, which leads to a lower credit volume; and bankruptcies and unemployment led to higher delinquencies and higher charge-offs for banks. At this point, it is easy to see why banks are often reporting much lower earnings per share during recessions.

And this cautious position of mine not only applies to banks, but also to insurance companies and asset managers. So far, Allianz declined about 33% and when looking at the performance during the last three recessions this would be the best performance and only a moderate drawdown. During the COVID-19 recession the stock declined about 50% from €230 to about €115; during the Great Financial Crisis the stock declined from about €180 to about €45 – resulting in a 75% decline and following the Dotcom Bubble, the stock declined from about €355 to about €40 resulting an almost 90% decline. Of course, we can argue that Allianz is already trading for a low valuation multiple at this point and a further decline is unlikely.

But in my opinion, we will see price levels of €120 again and I would also not rule out lower stock prices. And one might also argue that as stagnating net income in fiscal 2023 is way too optimistic as Allianz report a loss in 2008 as well as 2022. For this reason, we also must assume Allianz also reporting a loss in 2023 or 2024 and the assumptions in our intrinsic value calculation might have been too optimistic.

Conclusion

If you are prepared for temporarily even lower share prices and have the stomach to withstand your investment declining, Allianz is probably a buy at this point. Just don’t panic if the stock price should drop lower as the risk for even lower share prices is quite high. A revisit of the COVID-19 lows seems likely in the coming quarters – even if such a decline does not seem justified by fundamentals right now. And strictly from a fundamental point of view, Allianz seems like a good buy at current prices.

Be the first to comment