PeopleImages/iStock via Getty Images

Pandemic disruptions are evident, but Farmers National Banc Corp. (NASDAQ: FMNB) remains sturdy. With its larger operating capacity, it enjoys more revenue streams. Even better, its profitability and liquidity are more stable. Thanks to its efficient asset management and prudent portfolio diversification. It remains competitive in a high-inflation environment. It is no wonder its loans, deposits, and investments generate stable returns. As such, it enjoys adequate capacity to cover its financial leverage and dividends. Also, the stock price moves in line with its impressive fundamentals. So, it is a secure and reasonable stock.

Company Performance

Banks face higher risks during economic volatility. From the downturn and recovery to sustained inflation, the challenge is still evident. Despite this, Farmers National Banc Corp. proves it is well-positioned against market disruptions. It benefited from the almost zero interest rate. Now, it makes sure it can sustain its returns in a high-inflation environment.

The second quarter shows a faster pace of inflation, interests, and mortgages. The real estate market is also a concern, given the skyrocketing house prices. Sales are now in a downtrend, which appears to be faster than a potential bubble burst. But, there are no speculative mania and unethical practices. I will discuss more of the external factors in the succeeding parts.

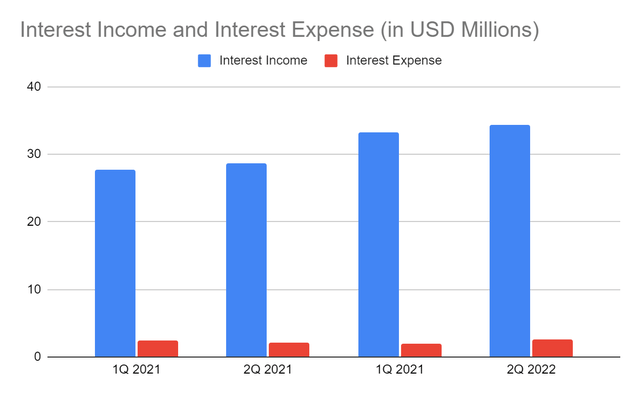

Meanwhile, its efficient asset management and enhanced portfolio quality make it sturdy. Investment securities are still stable amidst the valuation decrease. Loans and deposits, its lifeblood are well-managed. Reserves are higher with improved loan quality. So, it can sustain its earnings while remaining liquid and viable. Given this, interest income amounts to $34.3 million, a 20% year-over-year increase. Another primary growth driver is its M&As in the last year, especially the addition of Emclaire. It now has a larger operating capacity although the transition is yet to be completed. The half-year interest income of $68 million is 19% higher than in the first half of 2021. If the trend continues, the whole year value may amount to $130-140 million. Indeed, it takes advantage of the rising interest rates with its great asset quality. Its growth capitalization through M&As continues to pay off.

Its interest expense is higher at $2.54 million. It is logical, given the increase in deposits after the acquisition. Also, interest rates are higher, affecting both loans and deposits. Even better, it proves its efficient and prudent management of loans and deposits. The net interest margin is 92.6% vs 92.59% in 2Q 2021. So, it remains stable while it works on the completion of its expansion. Its non-interest segment is lower as expected. It is mainly driven by the higher expenses due to the acquisition. Its M&A-related expenses are $604,000 vs $104,000 in the comparative quarter. Salaries and occupancy expenses are way higher than in 2Q 2021.

Interest Income and Interest Expense (MarketWatch)

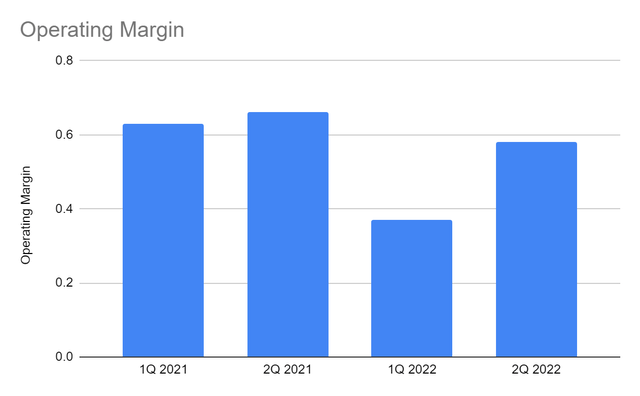

Amidst all these changes, the operating margin is 58% vs 66%. As discussed, the impact of M&A is visible. What matters is that the company maintains its high viability. In fact, it appears to be a solid rebound from only 37% in 1Q 2022. We can see that it has already adjusted to the acquisition. It continues to cope with the high-inflation environment to cushion the unfavorable blows. Given its market positioning, there may be higher returns in the following years. It may be more profitable after the completion of its transition.

Operating Margin (MarketWatch)

Potential Risks And Returns

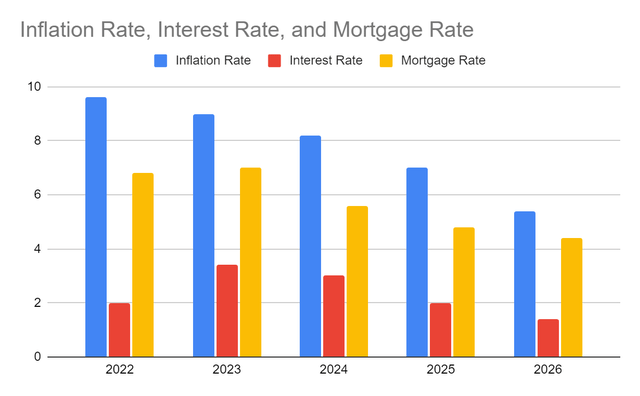

Farmers National Banc Corp. enjoys another solid quarter with sustained growth in its portfolio. But, more external pressures are present as the economy reopens. The high inflation persists although it seems to go into a lull with its decrease to 8.5% from 9.1%. But the market must be too relaxed, given the pent-up demand across industries. Revenge spending is still a fad despite the higher prices. It matches with the slow improvement in port congestion, affecting inventory levels. The geopolitical unrest in Ukraine and Russia is another issue, affecting energy commodities. With that, I choose to be conservative, estimating its peak at 9.6-9.8%. In the succeeding years, I expect the economy to stabilize, making inflation lower at 5-7%. It may still be higher than the pre-pandemic levels.

In the same way, the interest and mortgage rates are on the rise. Hikes may persist to manage inflation better, given the recent increase in the Fed Funds Rate. Analysts alike are expecting the interest rate to peak at 3-3.4%. Likewise, the mortgage rate of 5.7% may increase further to 6.8-7%. Note that the current values are higher than the estimation earlier this year. So like inflation, their decrease may also be gradual in the following years. Even so, the inflation, interest, and mortgage rates may become more stable.

There are some potential risks in FMNB. But most of them are due to external factors. For instance, the interest rate hikes is both a revenue growth driver and a hindrance to its growth. As discussed, investment securities comprise about 30% of the total assets. These are earning assets that have an immense impact on its interest and trading income. Continued hikes may happen, which may increase further to 3-3.4% interest rates. These may lead to higher valuation losses in investment securities and lower returns. Also, borrowings are way higher than in the previous quarter, which may lead to higher interest expense.

Higher mortgage rates also pose risks to the company. Mortgage loans are important to its operations. The inability to pay of borrowers may affect its performance. It is more crucial since economic fluctuations are still intense despite the notable decrease in inflation. Banks are susceptible to higher risks, given their sensitivity to interest and mortgage rate changes.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

Fortunately, FMNB is working better and is well-positioned in the high inflation environment. It capitalizes on prudent M&As and portfolio management to generate more returns. It is timely with the higher interest and mortgage rates to generate solid returns. Its asset-sensitive Balance Sheet growth is stable. The quality of its assets makes its risk tolerance and capital preservation higher. Its digital capabilities may improve its operating capacity and efficiency. Also, it continues to increase its market visibility in Ohio and Pennsylvania.

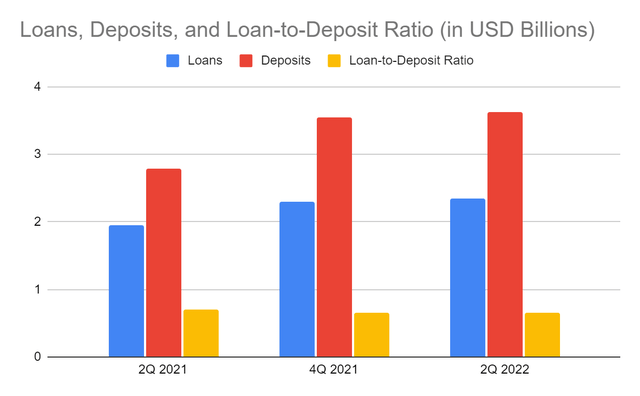

Why Farmers National Banc Corp. May Sustain Its Fundamental Soundness

The company enjoys more solid returns this quarter. Its rebound and expansion remain sustainable amidst the high inflation environment. One of its excellent attributes is its stellar Balance Sheet. For instance, its organic loan growth return is more solid. One way to see it is in the impressive interest income and net interest margin. It can also show that the loan quality of both FMNB and Emclaire is good. Its non-performing loans are lower at 0.59% vs 0.69% in 4Q 2021. Also, delinquencies are stable at 0.38%. It shows that both the quality and loan management of the company is excellent.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

Moreover, it remains conservative, given its loan-to-deposit ratio of 65% vs 70%. It can tell us two things. First, the quality of its loans is impressive. It is already proven by the lower percentage of non-performing loans. It generates more yields, allowing it to become viable and conservative at the same time. Also, the percentage of loan provision is 1.17%, which is higher than many other banks. The loan-to-deposit ratio of 65% is way lower than the ideal 80-90%. It means that it has not maximized its full potential yet. It has more means to optimize its growth. Also, it has more reserves when there are defaults and delinquencies. Second, the company is trusted by many clients, given the increased deposits. It offers more exposure, which may increase its market presence.

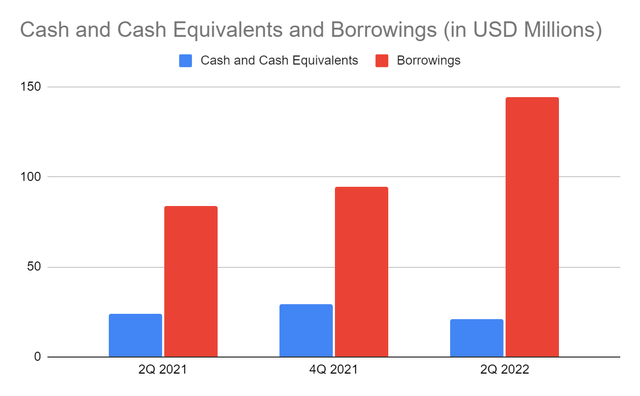

Cash and investment securities comprise 36% of the total assets, making FMNB liquid. Cash alone is $20 million, lower than in 2Q 2021. Borrowings amount to $144 million. The decrease in cash and increase in borrowings is driven by the acquisition. Also, Net Debt/EBITDA is 2.4x, which is still lower than the maximum range of 3x-4x. The company has adequate income to cover its borrowings. Also, it can sell its more liquid investments if it has to make a single payment for its borrowings. So, it has impressive liquidity, which is important in a high inflation environment.

Indeed, the company is well-positioned in the market. It has a larger operating capacity with high viability and liquidity. It has a high-risk tolerance and capital preservation to generate more returns.

Cash and Cash Equivalents and Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Farmers National Banc Corp. is still in a downtrend. It appears to be cheaper and more enticing. At $14.76, it has already been cut by 20% from the starting price. It is also lower by 8% than the price in my previous article. Many companies in the industry are on the rebound, making its price lower and more attractive. Its PE Ratio of 8.8 and Price/Operating Cash Flow of 7 show its potential undervaluation. More returns may be anticipated once the price rebounds.

Moreover, it remains consistent with dividends amidst economic uncertainties. With a dividend yield of 4.38%, it is higher than the average of the NASDAQ composite of 1.51%. It has an average dividend growth of 24%. It appears to be a good dividend stock that offers a high yield at a reasonable price. We can use the DCF Model and the Dividend Discount Model to assess the stock price better.

| DCF Model | |

| FCFF | $50,550,000 |

| Cash and Cash Equivalents | $21,000,000 |

| Borrowings | $144,000,000 |

| Perpetual Growth Rate | 4.80% |

| WACC | 9.20% |

| Common Shares Outstanding | $34,032,000 |

| Stock Price | $14 |

| Derived Value | $25.51 |

| Dividend Discount Model | |

| Stock Price | $14 |

| Average Dividend Growth | 0.246276 |

| Estimated Dividends Per Share | $0.64 |

| Cost of Capital Equity | 0.289636 |

| Stock Price | $20.32 |

Both models show the undervaluation of the stock price. The estimations are higher than in the previous article. It is still logical since the fundamentals of the company are more robust this quarter. Investors must watch out for this stock. There may be a 26-42% upside in the stock price in the next 12-18 months.

Bottomline

Farmers National Banc Corp. remains robust with its solid and stable returns. Its sound fundamentals make it well-positioned for market opportunities and against disruptions. It has an adequate financial capacity to cover its expansion, borrowings, and dividends. Also, the stock price is in a downtrend, making the stock undervalued. The recommendation is that Farmers National Banc Corp. is still a strong buy.

Be the first to comment