RoschetzkyIstockPhoto/iStock Editorial via Getty Images

Preamble

Sometimes I think I’ll scream if I see yet another white Model 3; the limited range of color options accentuates already dated styling. I’m not alone in this, except that most readers of this article are more enamored of Tesla’s styling than I. It’s not just Tesla. A dealer friend had a customer who always bought two identical cars, his and hers, differing only in color because neither could stand to be seen driving their spouse’s preferred one. There were the buyers who presented a nicely boxed set of keys to a new car for their other half’s birthday. Sometimes it went well, but one time the color was unacceptable, another time, despite carefully soliciting comments, it was one they really didn’t want. There are “pink flamingoes”, cars the dealer can’t imagine anyone being seen in, yet ultimately someone buys them. Consumers are fickle, tastes are inexplicable and varied. That has important implications for thinking about Tesla (NASDAQ:TSLA) as an investment.

Overview

Passenger vehicles are differentiated durable consumer goods. (Yeh, I’m an economist.) I look at data from China, Europe, and the US to emphasize the extent to which this results in highly fragmented markets. I then sketch the added competition from used cars. This leads to the third piece of my argument, that car companies provide a portfolio of products, and regularly update it – in the case of BMW, with 3 product launches a year, year in and year out. I conclude by looking at Tesla’s product pipeline in light of the above.

My bottom line is simple: without new product, by 2023 Tesla will hit a growth ceiling. Since the stock is priced for growth, this implies that the company is currently overvalued.

I. Product Differentiation

China

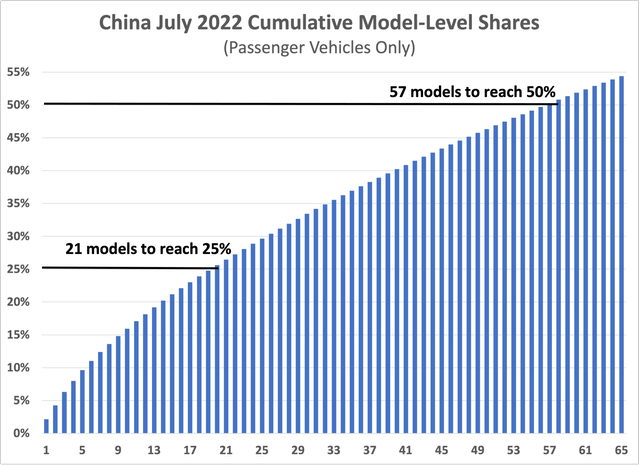

In July 2022, some 542 distinct passenger vehicles were sold in China. The actual model count is higher, because this is only domestically assembled vehicles – in 2022H1, there were 446,000 imports or about 150,000 a month, including many high-end models. The best-selling Nissan Sunny 轩逸 (OTCPK:NSANY) (OTCPK:NSANF) (Sentra in the US, Sylphy in Japan) sold 493,000 in CY2021 and 217,000 in CY2022H1.

Most models sell in very low volumes; only 208 sold over 2,000 units. More important, no model has a large market share. The top-selling Nissan Sunny holds but 2.16% of the market, and only two others – the BYD Song Plus (OTCPK:BYDDF) and the GM Wuling Hongguang (GM) – had over a 2% share. Twelve other models had 1%-2%; fifty had between 0.5% and 1%.

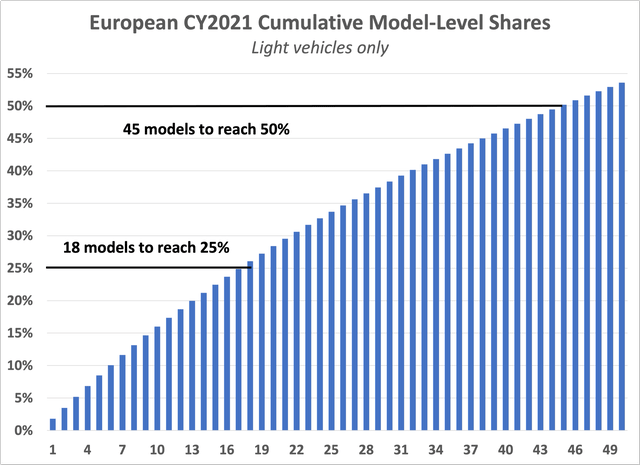

Europe is much the same. Using ACEA data for CY2021, I compiled a spreadsheet of model-level sales data. Counting “other” lines as but a single model, consumers bought 404 different vehicles in CY2021. Compared to China, per-model sales are even more diffuse: no single vehicle hit even 2% of the overall market of 11.4 million units. Some 25 models had between 1.0% and 1.8%; another 44 had between 0.5% and 1.0%. As in China, the market is comprised of highly differentiated vehicles, none of which achieves more than a small share.

Author’s calculations using ACEA data

The USMCA

I don’t have similar detailed data for the USMCA (US-Mexico-Canada), so I focus on the leading model: the Ford F-series (F). Ford sold an amazing 851,813 of those in CY2021, seemingly giving a much higher market share than the top vehicles in China and Europe (4.5% of USMCA CY2021 sales of 18,160,120 units).

That is misleading, because Ford’s Dearborn Truck Plant assembles F-150s with 3 different length beds and assorted cab configurations (0′, 5½’, and 6½’ beds with 3 different cabs). The F-150 Lightning has its own assembly line in the same complex, sharing stampings, frame welding, and paint shop with ICE versions. Dearborn, though, doesn’t assemble versions with 8 foot beds, those are done in the Kentucky Truck Plant, again with multiple variations. Kansas City does additional variations, such as the Transit vans built on the “F” chassis. To those, we must add F-250s, F-350s, stripped chassis versions sold to up-fitters and “dually” versions. Each has its own customer base. Talking to plant managers, that variety makes full-sized pickup truck plants the most difficult-to-run operations in the industry. But it hides that volumes for any single version of the F series are a fraction of the headline number.

In sum, only a handful of vehicles ever reach 2% of the market in the US, China, and Europe. None today hold 3% or more. In order for Tesla to grab more than a small slice of any market, they need 8-10 models.

II. Used Cars

In the US, there are roughly 280 million registered vehicles. In normal times, there are almost 3x more used cars sold than new. Indeed, most drivers will never have the income to purchase a new vehicle. More important, of those who do purchase new – such as my son, who just took delivery of a Subaru Legacy – many are on the borderline, and shop both new and used.

The prototypical case is the Model T. Even though Henry Ford kept lowering the price, eventually to $350, by the early 1920s, sales stalled. Why? – a used Model T could be had for less than that and was readily repairable. Indeed, even today, you can get any part needed to fix one delivered overnight, except for the engine block, with perhaps a half-million still in operating condition. In other words, cars are durable goods, and by focusing exclusively on the Model T, Henry almost put himself out of business. [Aside: the original Model T factory survives, unlike the subsequent Highland Park Plant of assembly line fame. It’s now the Ford Piquette Avenue Museum, with 2 floors of Model Ts, from treaded “snowcats” to pickup trucks and leather-fitted versions for social climbers.]

Do not make the mistake of reading current market conditions into the general story. During the pandemic, rental car fleets unloaded cars – Hertz didn’t do it fast enough and went bankrupt – but when business and vacation travel resumed, rental companies could not “refleet” due to the chip shortage. In a normal year, Enterprise purchases 1 million units, and sells a like number of used units. Now they and their rivals are straining to renew their fleets, to the point of becoming net purchasers of used cars. Similarly, lease returns are normally an additional input into the used vehicle stream, but with prices above the contracted “residual” price at lease-end, that source has likewise dried up. As a result, when my son went car shopping, he discovered that low-mileage used inventory was priced above sticker, whereas he could wait and have a new car at MSRP. Not all car shoppers can wait, so even such high-priced used cars quickly disappear from dealership lots. My son, fortunately, could and did wait. [Aside: when the balance shifts, both new and used car prices will decline precipitously. That will be enough to push the US CPI from inflation to deflation, at least briefly.]

The bottom line remains that as time passes, competition from like-model used vehicles becomes significant. The average sedan on the road is now over 12 years old, and pickup trucks even older. A critical long-run issue with cars (and other durable goods) is to limit competition from the used car market.

The one set of studies I know that is specific to automotive (Adam Copeland of the NY Fed, with various co-authors) estimates that as a result of this competition, new car prices fall at an annual average of 9.2% per annum, reflected in increasing rebates and fewer sales of high-trim versions. That is, at the end of a standard 4-year model cycle, prices are almost 30% lower than at launch. Furthermore, later purchasers are lower in income. That is, competition from like-model used cars increases over time, eroding margins as car sellers dip lower down the income profile. No one can avoid that, not even Tesla.

III. Product Portfolio and Product Pipeline

Car companies respond to the above pressures in two ways. First, they offer a portfolio of products from a smaller number of platforms. That helps them increase platform-level economies of scale. (The irony is that the ease of engineering “top hats” for a platform, enabled by the ability to digitally engineer a vehicle – even to modeling assembly-line ergonomics before the first prototype is made – exacerbates the number of models and lowers sales per model.) The key work here is “portfolio”, with a car for every pocket, and a brand hierarchy differentiated by social status.

The second response is the regular redesign of models, with a typical cadence of a “refresh” every 2 years (fascia and interior) and a redesign every 4 years (with new sheet metal). As a result, cars that launch in 2023 are already a “done” deal, and a lot of the work on 2024 models is complete. Engineers are now turning their attention to cars set to launch in 2025.

I present a summary below, drawn from Automotive News, focused on a number of the luxury brands with which Tesla competes. Now car companies vary in the extent to which they detail new product plans in public. They are inconsistent in distinguishing whether their plans are on a model year or a calendar year basis. I don’t know individual models, to distinguish whether a “GT” version is a distinct model, so there’s some potential error on my end. Audi (OTC:AUDVF) and Porsche (OTCPK:POAHY) share engineering resources, and it’s likely that there’s overlap between Volvo (OTCPK:VOLAF) and Polestar (PSNY). And so on. It’s an indicative table using soft data.

I use only AN’s coverage and have not modified them against the more reliable product pipelines that suppliers have shared with me under an NDA, which includes the month of launch. What I can share from years of presentations by suppliers on new technologies they’re bringing to market is that launch dates are “hard”. They not only tie into marketing, assembly line upgrades, and supplier production/engineering schedules, but missing a launch target ties up engineers slated to move to other projects. It’s unusual if launch dates slip by more than a few weeks, even though they are set 2 or more years ahead of time.

With those caveats, here is my summary, excluding model names, and not reporting models with a scheduled end of life.

| Total Model Count (JATO 2021) | 2022H2 | 2023 | 2024 | 2025 | 2026 | ||

| Audi | 15 | Refresh/Addition | 1 | 2 | 0 | 3 | 1 |

| New/Renewal | 1 | 0 | 5 | 2-3 | 1 | ||

| Total | 2 | 2 | 5 | 5 | 2 | ||

| BMW | 19 | Refresh | 1 | 3 | 1 | 2 | 0 |

| New | 3 | 4 | 2 | 2 | 3-5 | ||

| Total | 4 | 7 | 3 | 4 | 4 | ||

| Cadillac | – | Refresh | 3 | 1 | 1 | ? | |

| New | 2 | 3 | ? | 1 | |||

| Total | 5 | 4 | 1 | 1 | |||

| Genesis | – | Refresh | 1 | 2 | 1 | 1 | 2 |

| New | 1 | 1 | 0 | 2 | 1 | ||

| Total | 2 | 3 | 1 | 3 | 3 | ||

| Lexus | 9 | Refresh | 1 | 1 | 1 | 2 | 1 |

| New | 1 | 2 | 1 | 2-3 | 1 | ||

| Total | 2 | 3 | 2 | 4 | 2 | ||

| Lincoln | – | Refresh | 1 | 1 | |||

| New | 2 | 1 | 3 | ||||

| Total | 1 | 3 | 1 | 3 | ? | ||

| Mercedes | 21 | Refresh | 1 | 3 | 1 | 0 | 0 |

| New | 4 | 5 | 4 | 2 | 3-5 | ||

| Total | 5 | 8 | 5 | 2 | 5? | ||

| Polestar | 2 | Refresh | 1 | ||||

| New | 1 | 2 | 1 | ||||

| Total | 1 | 1 | 2 | 1 | |||

| Porsche | 6 | Refresh | 2 | 2 | 0 | 0 | |

| New | 1 | 2 | 2 | 1 | 1 | ||

| Total | 3 | 4 | 2 | 1 | 1 | ||

| Range Rover | 7 | Refresh | 1 | ||||

| New | 2 | 3 | 2-4 | 0-2 | |||

| Total | 3 | 0 | 3 | 3 | 2? | ||

| Volvo | 7 | Refresh | 3 | 1 | |||

| New | 0 | 1 | 1 | 3 | 2-3 | ||

| Total | 3 | 2 | 1 | 3 | 3? |

What this table does not show is that this pattern of refreshes, renewals, and new models extends back in time. Audi, Porsche, BMW (OTCPK:BMWYY), Mercedes (OTCPK:MBGAF), and Lexus have a constant stream of new products in their pipeline, so that over the course of a decade, each model is replaced or refreshed 2-3 times. That is the only way to avoid cannibalization by used cars, plus of course, it’s necessary to keep up with styling trends and to incorporate the constant stream of better components and improved functionality that require new hardware and not just new software.

IV. Tesla’s Pipeline

It’s 10 years since the launch of the Model S, Tesla’s first proper model. Since then, it has launched only 3 new products, and carried out a minor refresh of the interior of the Model S. None of the other models has been refreshed, much less renewed with new sheet metal. Yet the Model Y is 10 years old, the Model X is 7 years old, and the Model 3 is 5 years old; only the Model Y, launched in 2020, is fresh. That understates the issue: because of the many delays in both development and launch, the styling of these models is older than those of competitors who launched on time after a short period of development and engineering. In a style-conscious industry, Tesla has chosen to rely on each new model hitting a home run, that is, setting trends rather than adapting to trends. That’s a high-risk strategy, amplified as its lineup ages.

Two rumored future products, the Semi and the Roadster, do not yet have clear timelines – maybe 2023, maybe a bit later. In any case, both are niche vehicles that will not generate sufficient top line revenue or bottom line profits to move the needle.

That leaves a single model in the pipeline: the Tesla Cybertruck. It begins production by summer 2023 and goes on sale sometime thereafter. It’s all still vague, and the initial $39,999 price is DOA. More to the point, it’s a quintessential California/Texas vehicle: a performance pickup with only a single cab-bed variant. That is in stark contrast to the multiple products hiding behind the F-150 moniker. Worse, Tesla needs global vehicles if it is to grow.

Unfortunately for the Cybertruck, full-sized pickups are a North American thing. Despite a market 40% larger than the USMCA, fewer pickups sell in China than Ford sells in the US – only 259,000 in 2022H1. Great Wall (OTCPK:GWLLF) has 45% of the market, followed by the truckmakers Jiangling (OTCPK:JGLMY) (15%), Zhengzhou Nissan (10%), and Jiangxi Isuzu. Unlike the US, pickups are not an offspring of the passenger car market. Furthermore, only 14% of pickups are sold in the Tier I and Tier II cities that are the core market for Tesla (see Wikipedia here for a list of major cities). In contrast, 19% are sold in Tier III cities, 24% in Tier IV cities, and 42% in rural areas. (Source: CPCAA data.) To sell the Cybertruck in those markets would require Tesla to more than double its sales and service center network, because farmers and rural construction firms can’t wait for repairs. Of course, there’s no rural charging network, either, but unlike urban apartment dwellers, most truck drivers would have access to overnight charging. But who would want to use a Cybertruck to haul manure?

Europe is worse – in CY2020, the most recent data I found, sales were only 116,000, in a market about the size of the USMCA. Nissan, Renault (OTCPK:RNSDF), and Mercedes have all exited the market. [Source: Automotive News June 14, 2021] In addition, most are compact pickups – in 2020, the Ford Ranger held over a third of the pickup market. [Source: carsalesbase] Even in the US, the Cybertruck is both idiosyncratic and late to market, well behind Ford and Rivian (RIVN). It will certainly find a following among Tesla aficionados, but it is unclear that it will gain much traction among current pickup truck owners. Ford dominates there. The contractors who lease them have the local dealership service desk on speed-dial – work trucks take a beating, and a history of reliable service keeps them loyal.

In any case, the Cybertruck is not one of the global models that Tesla needs.

Summary

Quite simply, Tesla is not spending enough on new products, and lacks a clear product strategy. R&D expenditures have risen from $825 million in 2020Q2 to $2,632 million in 2022Q2, so product development shouldn’t be starved for resources. [As a data point, the GM-Honda Cruise autonomous driving joint venture spent $496 million in 2022Q2, a spend rate that would eat up 19% of Tesla’s R&D.]

Tesla has too many irons in the fire: autonomous vehicle development, solar and energy products, service and sales centers, charging stations, and pet projects of Elon Musk such as robots. It needs to fill its product pipeline and communicate about what it is doing with investors.

V. Conclusion

Tesla has tremendous brand value. Without new models, however, they will not be able to monetize it, and will instead start to see sales stagnate and margins compress. As the many projections on Seeking Alpha make clear, its stock market valuation is based on continued high growth. New factories support growth only if there is a new product to fill them. Unfortunately, management is providing no guidance to suggest they are bringing a product portfolio to market in a systematic, disciplined, and timely manner.

Be the first to comment