INDU BACHKHETI/iStock via Getty Images

A Quick Take On Fair Isaac

Fair Isaac Corporation (NYSE:FICO) reported its FQ3 2022 financial results on August 3, 2022, beating expected revenue and EPS estimates.

The company provides a range of credit scoring and software capabilities to organizations worldwide.

The firm’s high debt load has me concerned as well as the downturn underway in the U.S. economy.

These two factors, when combined with the potential for higher U.S. interest rates, lead me to wonder if the best course of action at this time is to Hold FICO as we wait to see which way interest rates and the U.S. economy progress.

Fair Isaac Overview

Bozeman, Montana-based Fair Isaac Corporation was founded in 1956 to provide credit scoring and later software solutions to businesses seeking to determine the creditworthiness of their customers.

The firm is headed by Chief Executive Officer, Will Lansing, who was previously CEO of InfoSpace and ValueVision Media.

The company’s primary offerings include:

-

FICO Platform Software

-

Business Scoring

-

Consumer Scoring

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals and online marketing.

Fair Isaac’s Market & Competition

According to a 2021 market research report by Allied Market Research, the market for credit rating software was an estimated $420 million in 2020 and is expected to reach $1.92 billion by 2030.

This represents a forecast CAGR of 16.5% from 2021 to 2030.

The main drivers for this expected growth are a growing demand for loans of all types by consumers and businesses worldwide.

Also, the cloud method of deployment is forecast to grow at the expense of on-premise installations, with growth estimated to be 18.3% from 2021 to 2030.

Major competitive or other industry participants include:

-

Equifax

-

Experian

-

Pega

-

Brighterion

Fair Isaac’s Recent Financial Performance

-

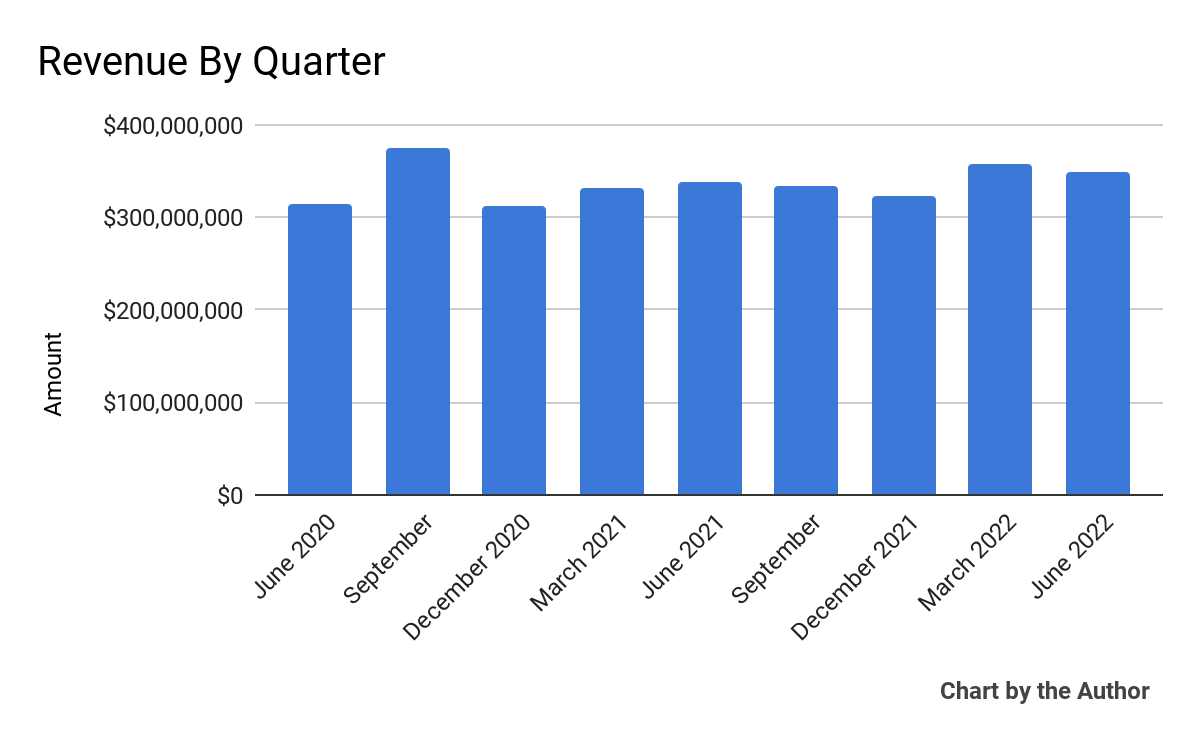

Total revenue by quarter has progressed according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

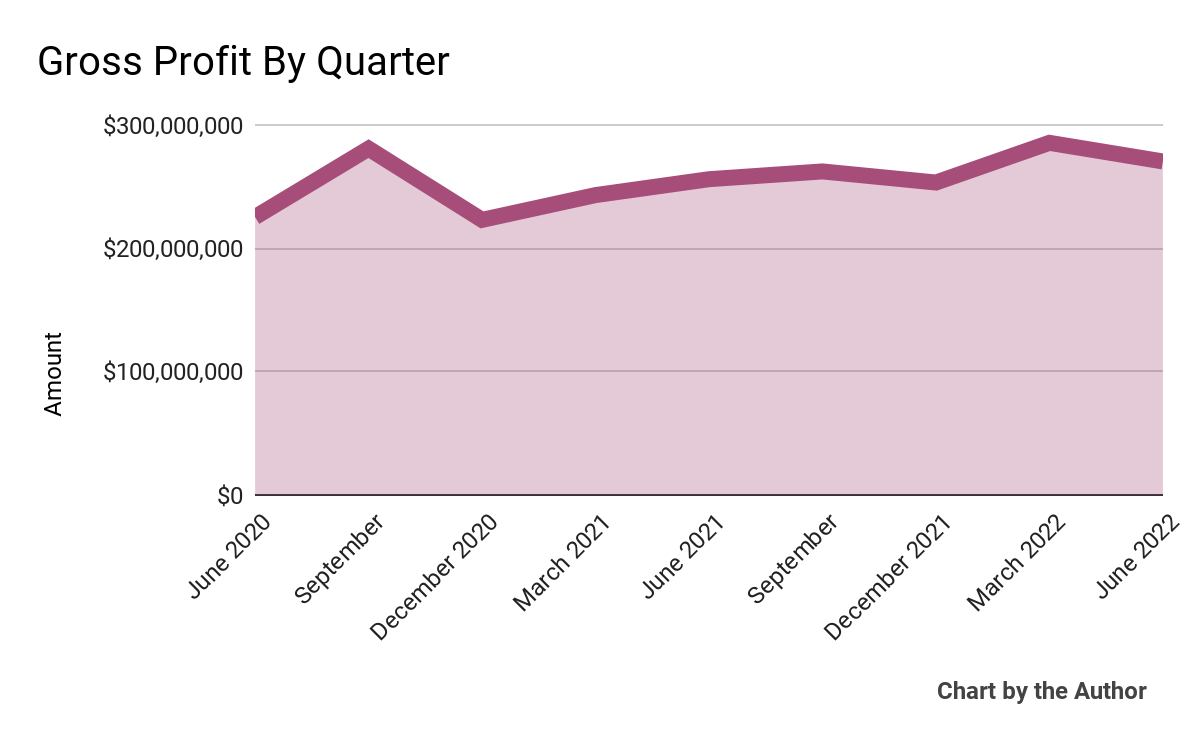

Gross profit by quarter has followed a similar trajectory as that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

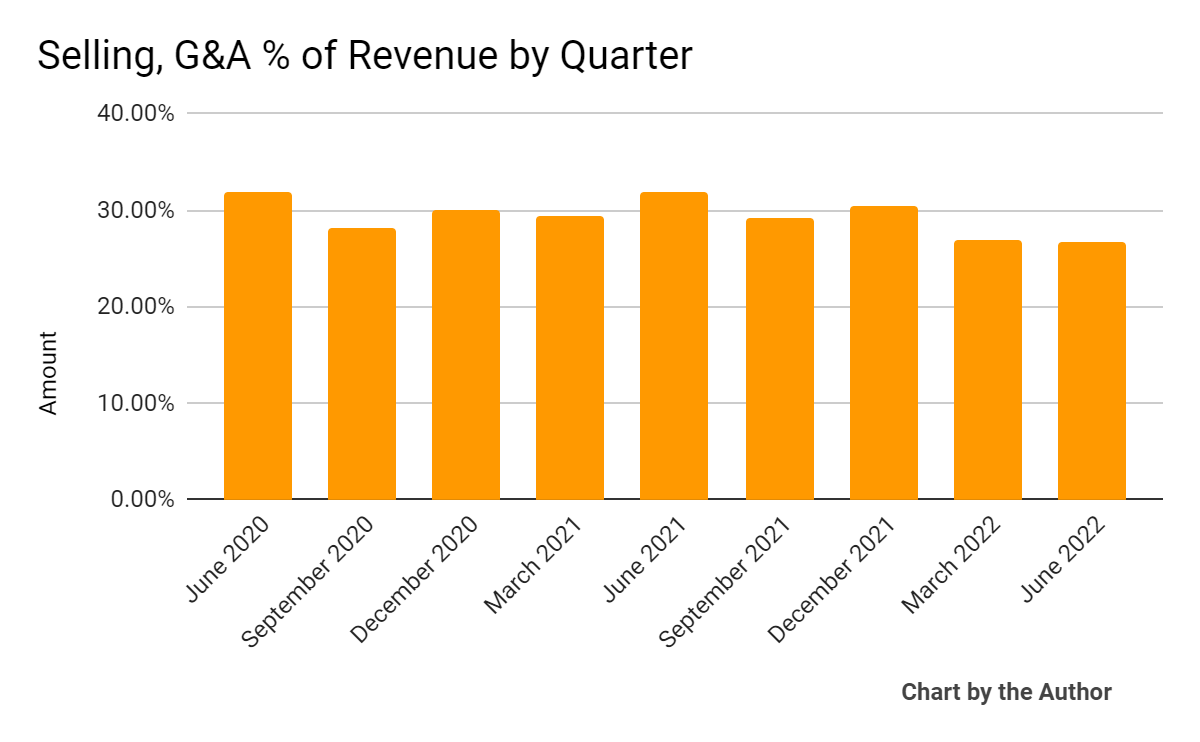

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

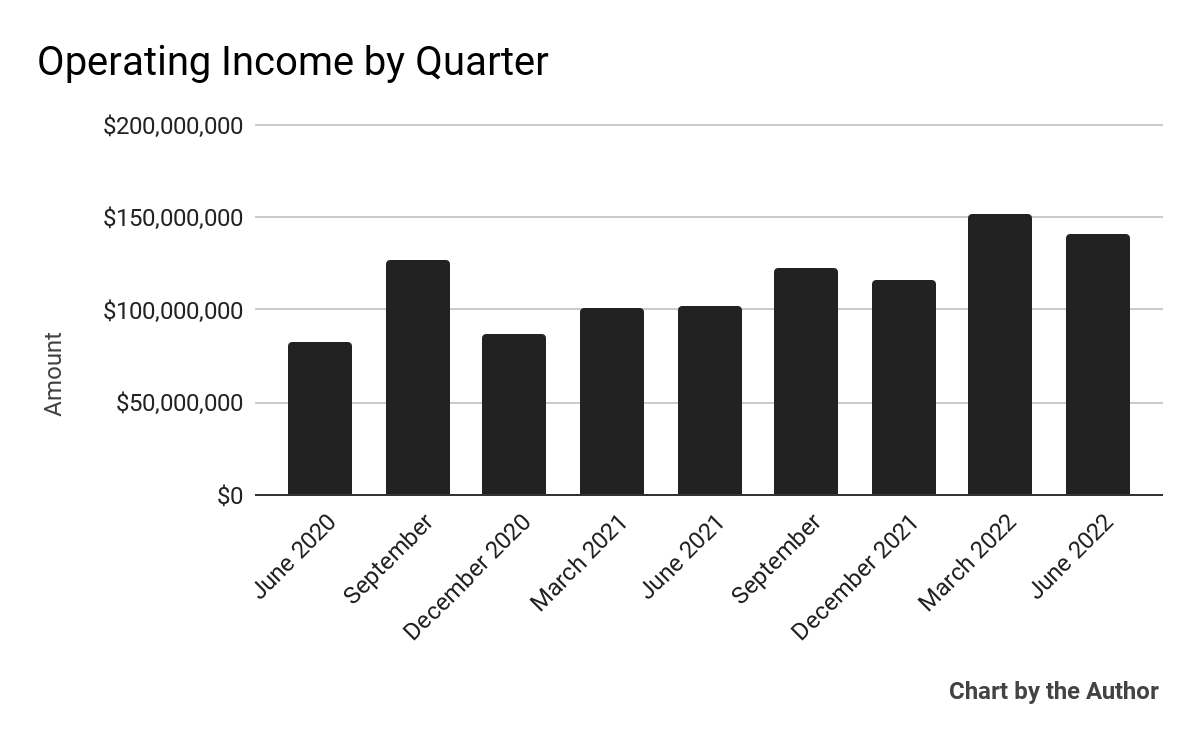

Operating income by quarter has risen in recent reporting periods:

9 Quarter Operating Income (Seeking Alpha)

-

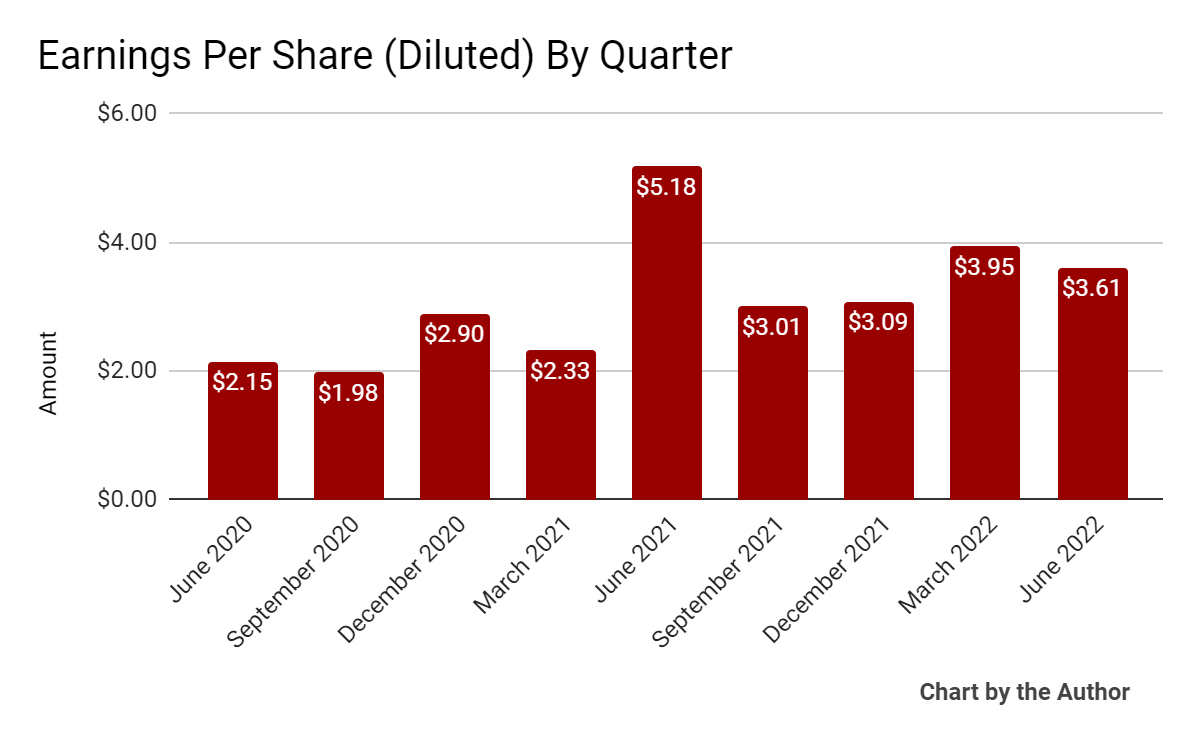

Earnings per share (Diluted) have trended higher more recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

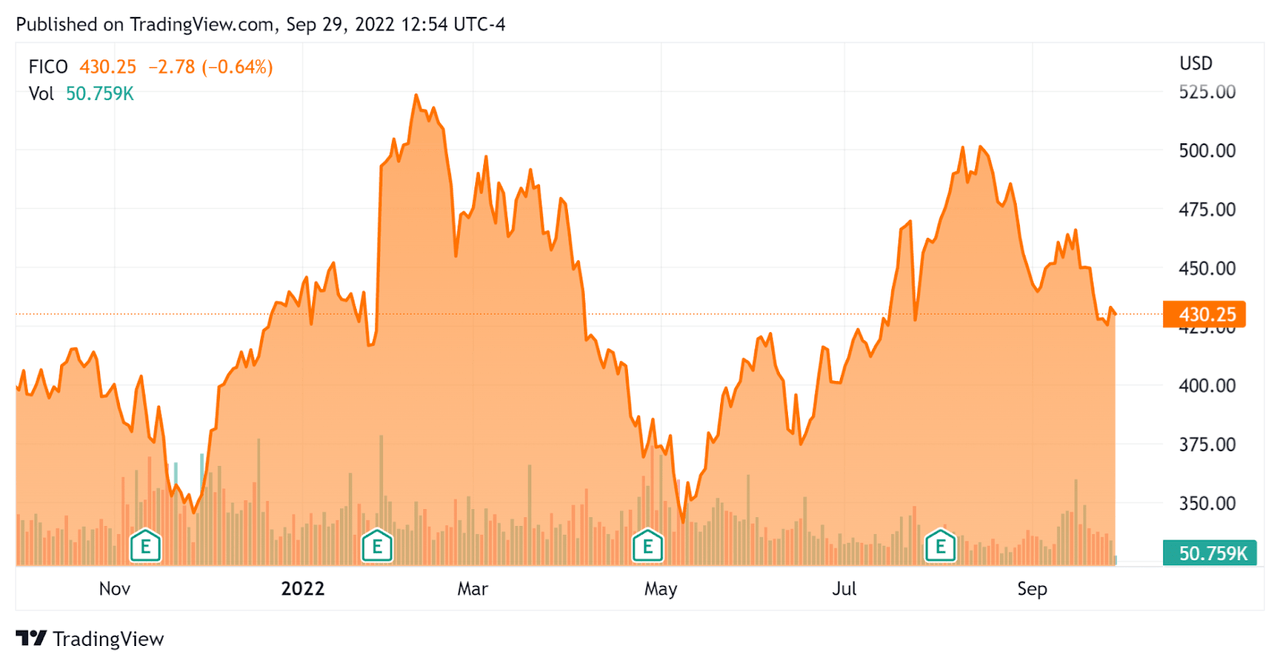

In the past 12 months, FICO’s stock price has risen 7.8% vs. the U.S. S&P 500 Index’s drop of around 16.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Fair Isaac

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

9.24 |

|

Revenue Growth Rate |

0.50% |

|

Net Income Margin |

27.0% |

|

GAAP EBITDA % |

40.5% |

|

Market Capitalization |

$10,750,000,000 |

|

Enterprise Value |

$12,590,000,000 |

|

Operating Cash Flow |

$456,380,000 |

|

Earnings Per Share (Fully Diluted) |

$13.66 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Experian (OTCQX:EXPGF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Experian |

Fair Isaac |

Variance |

|

Enterprise Value/Sales |

4.73 |

9.24 |

95.3% |

|

Revenue Growth Rate |

17.1% |

0.5% |

-97.1% |

|

Net Income Margin |

18.5% |

27.0% |

45.9% |

|

Operating Cash Flow |

$1,800,000,000 |

$456,380,000 |

-74.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

FICO’s most recent GAAP Rule of 40 calculation was 41% as of FQ3 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

0.5% |

|

GAAP EBITDA % |

40.5% |

|

Total |

41.0% |

(Source – Seeking Alpha)

Commentary On Fair Isaac

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted the growth in its annual contract value (ACV) of 64% year-over-year.

Management continues to focus on its software platform approach while mortgage originations dropped significantly from a sharp rise in interest rates, so its Scores business is at some degree of risk going forward.

As to its financial results, revenue rose by 3% year-over-year, or 7% when adjusted for the divestiture of its Collections and Recovery business.

The company’s net dollar retention rate was 108%, indicating good product/market fit and sales & marketing efficiency.

FICO’s Rule of 40 results have been impressive, despite revenue growth being anemic.

Selling, G&A expenses as a percentage of revenue have been dropping recently, but total operating expenses rose sequentially and management expects operating expenses to continue rising ‘modestly in our fourth quarter.’

For the balance sheet, FICO finished the quarter with $182 million in cash and investments and total debt of $1.96 billion at a weighted average interest rate of 3.86%.

Over the trailing twelve months, free cash flow was an impressive $449 million, although it has been using some of that bash to buy back its stock.

The company still has $119 million remaining on the Board’s current repurchase authorization plan.

Looking ahead, management reiterated previous full year 2022 guidance that it raised in the previous quarter.

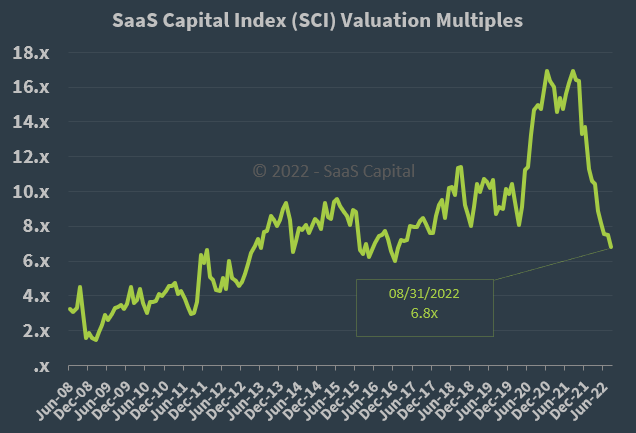

Regarding valuation, the market is valuing FICO at an EV/Sales multiple of around 9.24x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although Fair Isaac is not a pure subscription software company, it is currently valued by the market at a significant premium to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow usage of its Scores product and reduce its revenue growth trajectory.

A potential upside catalyst could be a pause in U.S. Federal Reserve interest rate hikes, which would likely have a positive effect on the valuation multiple for the stock.

However, the firm’s high debt load has me concerned as well as the downturn underway in the U.S. economy.

These two factors, when combined with the potential for higher U.S. interest rates, lead me to wonder if the best course of action at this time is to Hold FICO as we wait to see which way rates and the U.S. mortgage market move.

Be the first to comment