Massimo Giachetti

Many people do not feel confident trying to time the market in order to short stocks, which is the opposite of being long, as often shorting just makes the risk worse. You can see getting lucky once or twice, but it feels like gambling and sitting at the roulette table for another spin.

Now, if you are all in cash and are waiting for the market turmoil to dissipate before dipping your toe, or have a very long-term buy-and-hold stance, this thesis which will elaborate on shorting strategies is probably not for you. On the other hand, it tries to address the requirements of those who want to make money through shorting using the ProShares UltraShort QQQ ETF (NYSEARCA:QID). Refining the concept of shorting further, I use the ProShares Short QQQ ETF (NYSEARCA:PSQ) to elaborate on the “insurance premium concept” for people who remain invested and want to protect their gains.

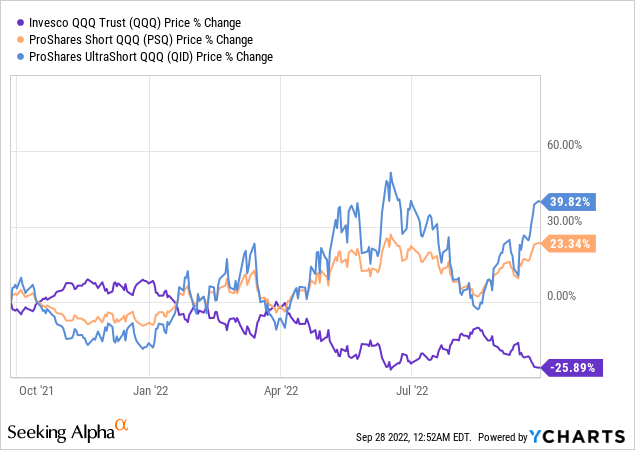

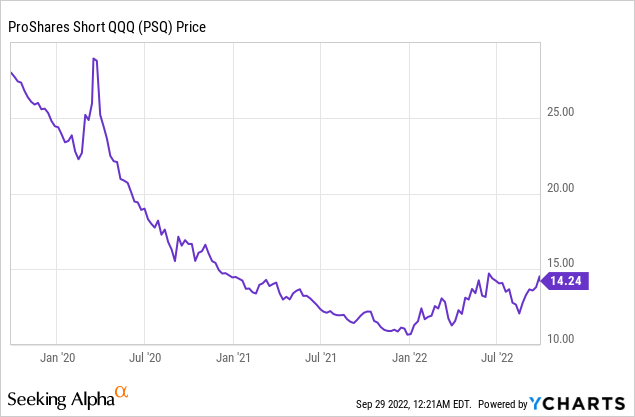

Both exchange-traded funds (“ETFs”) allow investors to short the Nasdaq-100 index, with the charts below providing an idea of their outperformance relative to the Invesco QQQ Trust ETF (QQQ).

As shown above, despite some bold rallies by the Nasdaq, namely in April and August, the two short ETFs have managed to deliver upsides, and, a combination of factors which I will enumerate later show that the Nasdaq’s downtrend could be sustained in 2022.

I start with QID.

Shorting Tech with QID

There are different ways to view shorting of stocks. Depending on the investor’s profile, shorting can even be used as part of a portfolio hedging strategy as I highlighted in a previous thesis consisting of using the ProShares UltraPro Short (SQQQ) to short the Nasdaq, targeted at holders of technology stocks they see as possessing great potential.

Now, SQQQ provides three times the inverse performance of QQQ, and, as such, can fluctuate wildly in both directions, enabling whopping gains or disastrous losses. As a highly leveraged ETF, it comes with compounding risks and is for the most experienced traders, who are astute at timing the market and prepared to incur big losses before breaking even and making a profit.

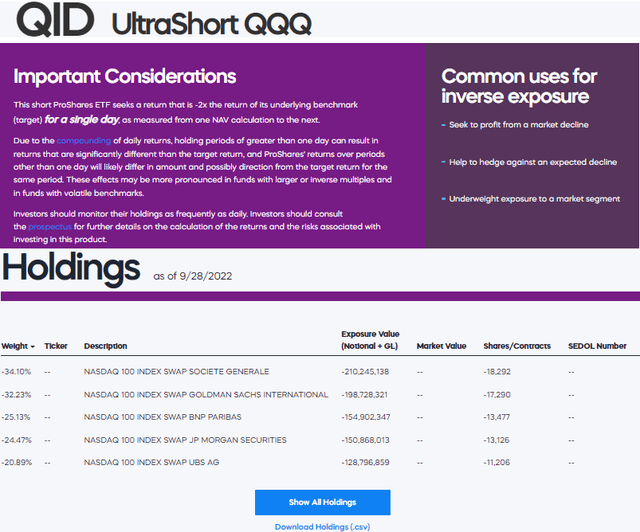

Moving along a less risky path comes QID. It provides two times the inverse performance of QQQ, but, it still uses compounding of daily returns and its holdings include swaps as per the picture below.

QID – Important Considerations and Holdings (www.proshares.com)

This is the ETF to choose if you think that the worst is not behind us in terms of market volatility. In this case, uncertainty will seemingly still reign this year mostly due to inflation, and there are reasons to think so, according to Bank of America (BAC). Now, no one can predict the future, and QID remains a highly leveraged ETF that has been designed for investors who are active in the stock market and have the ability to time it. To this end, I will provide some guidelines on how to trade it later.

On the other hand, for those who do not wish to short the tech sector and have suffered from a large drawdown this year, and are wondering whether to sell everything and go into cash, I assess whether it makes sense to buy insurance for your holdings.

The Insurance Premium Concept with PSQ

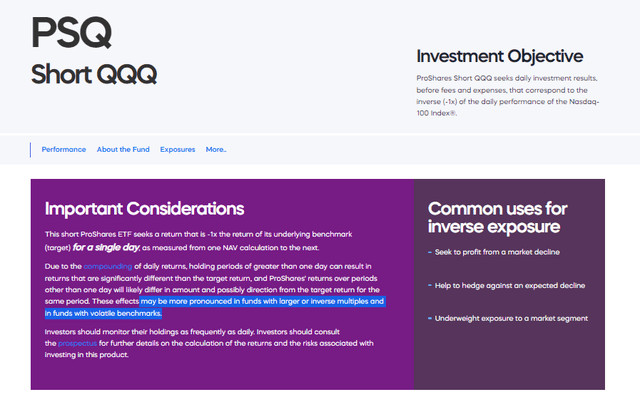

First, shorting the market is the opposite of value investing, where you typically buy and hold a stock that has long-term potential. For this purpose, PSQ represents a more moderate shorting method that provides inverse (-1x) exposure to the performance of the Nasdaq 100. It does use leverage but is impacted by the compounding of daily returns, whereby the more fluctuations within a time period, the lesser the gains obtained.

PSQ Details (www.proshares.com)

Still, by being short QQQ, you can make gains when tech goes down, in a way compensating the losses being incurred in your portfolio. This acts as an insurance premium, just like you insure your car, your health, and your life against risks, then, why wouldn’t you insure your stock portfolio?

In this respect, contracting an insurance plan has now become more of a norm rather than a necessity, for example, when taking coverage for a house. Thus, we end up paying coverage for decades after getting regular renewal notices from our agent. Using the same reasoning, we own stocks over decades, and it would be wise to use insurance to mitigate risks, unless, as I mentioned at the very start, you are all into cash. For this matter, cash, especially the dollar, is a great asset class to own presently.

Talking diversification, some own bonds as part of a 60:40 portfolio, but, the overall performance of fixed income, whether it is treasuries or investment grade, has been dismal on a year-to-date basis. Even commodities and gold have not fared well due to the strong dollar.

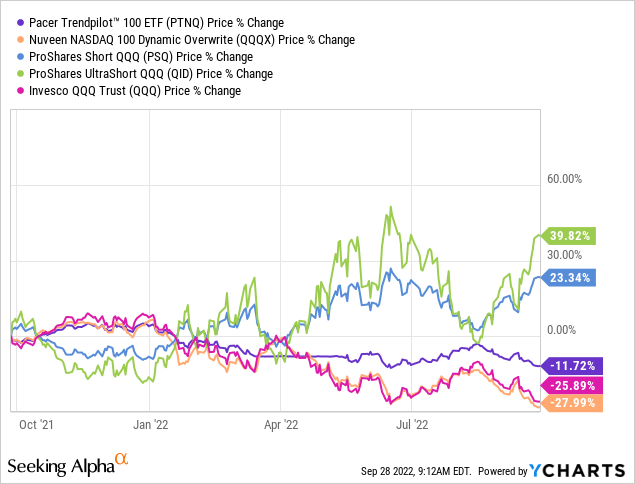

Looking specifically at portfolio protection, ETFs like the Pacer Trendpilot 100 ETF (PTNQ) and the Nuveen NASDAQ 100 Dynamic Overwrite (QQQX) make use of treasury bills and covered calls, respectively, to allow for a less volatile approach to investing in tech. However, while providing some protection, they do not provide the same degree of gains as the shorting mechanism, as shown in the blue and green charts below.

In these circumstances, whether you think of it as hedging or insuring your portfolio, shorting can be used as a portfolio strategy, and I further make the case for PSQ by learning from the past.

Discussion About the Fed’s Actions

One of the reasons why shorting has not worked consistently since August 2021 is because many investors bought the dips, thinking that inflation was going to be transitory. But, looking into the rearview mirror, the buy-the-dip strategy has its origins in the Covid market crash. That strategy worked very well, with the Nasdaq gaining more than 100% from March 2020 till the end of 2021, despite several downside episodes for tech, all resulting in making shorting highly unpredictable.

However, things changed completely at the end of 2021. Those who invested at that time when PSQ was at $11.15 had a terrific run, with the ETF now at $14.60. However, this has not been a smooth upside, as from time to time the Nasdaq did fight back, following positive earnings results by big tech and assumptions about inflation stabilizing.

This upside was helped by the brutal sell-off since mid-August, but, even after such a run, PSQ is still far from its historical highs as shown in the above chart. Now, the question is whether it can benefit from an upside. The answer is yes, considering the actions of the U.S. central bank.

First, the post-Covid rally was juiced by the Fed dropping interest rates and ballooning its balance sheet. That was the era of cheap money, particularly favorable to tech stocks, which require a lot of cash to sustain their high rate of revenue growth. Now, the very opposite is happening with the Fed both raising rates aggressively and reducing its balance sheet, with no pause likely to be seen until inflation comes down to 2%.

However, there are doubts about whether the Fed can achieve this objective without tragic damage to the economy. After all, this is the same organization that just one year before failed to realize that inflation was NOT transitory and as a result did not act rapidly to increment interest rates. Being late, it is now hiking aggressively, and, with the Fed fund rates already at 3%-3.25%, liquidity is actively being drained out of the monetary system, thereby reducing the cash available for tech companies to burgeon.

Consequently, the ingredient for the Nasdaq to fall are around, but, it is not all smooth though.

Conclusion: PSQ as Buy and QID for Trading

In this respect, with the Bank of England triggering massive support for Gilts, which are bonds issued by the U.K. government for public financing purposes, the demand for U.S. treasuries on this side of the Atlantic went up on Wednesday. This, in turn, propped up equities, with PSQ losing over 2%.

However, this has proven to be a temporary respite for stocks, as on Thursday, the market was all red and PSQ gained more than 3%.

Now, QQQ is still below the 50-day and 100-day SMAs as shown in the chart below, which makes it unlikely for the tech-heavy ETF to deliver any meaningful upside, implying that PSQ can rise further.

QQQ Momentum Factors (www.seekingalpha.com)

The same is the case with QID, which at one time was 6% up on Thursday. However, in order to make a winning trade, you had to invest on Wednesday itself, when the market was all green. Frankly, few have the guts to do so, unless they are sophisticated traders.

Moreover, in light of the Nasdaq’s most valuable company, (AAPL) showing signs of demand fatigue, and potential recession fears, the Fed’s chairman may blink, or shift to a more dovish tone. Also, with crude oil around 30% down from its August high, inflation could drop slightly if there is a sustained fall in commodity prices. There could also be massive state interventions to support bonds. Therefore, even if the long-term prospects for QID are favorable as shown in the above chart, with the 200-day SMA for QQQ being above all the other moving averages, near-term uncertainties could prevent a sustained upside. As a safety net, I would venture into it only after QQQ rises to the $300 support level.

Finally, for PSQ, I am bullish on the ETF not only because of momentum factors all pointing to tech’s plight continuing but also for the insurance it provides for my portfolio.

Be the first to comment