bombermoon

Dear readers/Followers,

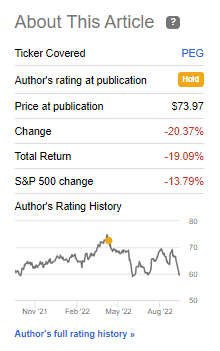

I last reviewed the Public Service Enterprise Group (NYSE:PEG), or PSEG, a few months and slapped it with a “HOLD” due to significant overvaluation (as I saw it). A combination of recent macro pressures and headwinds has caused the company’s valuation to drop far more quickly and steeply than I would have expected.

What we have, therefore, is a thesis change.

Seeking Alpha PEG article (Seeking Alpha)

Let’s look at what exactly is happening here.

Updating on Public Service Enterprise Group

We’re in a market where a 20% drop is no longer a strange thing, as odd as that may sound compared to where things were only a few months or a year back.

It may seem odd that a company like PSEG is suffering like this. After all, the company is new Jersey’s largest distribution utility for Electric and gas. What could possibly go wrong with this sort of transmission business, or such an appliance service provider founded over 30 years back?

As with all utilities, PSEG is a play on stable cash flows from conservative asset bases, decided on by regulators with rate cases and increases. The company has both electric and gas assets with millions of customers, most of which are Residential for Electricity, and commercial for gas, though the business also serves industrial customers.

All in all, any downturn should be viewed in the context of the company’s massive upward historical trajectory. There is a lot to like here about PSEG.

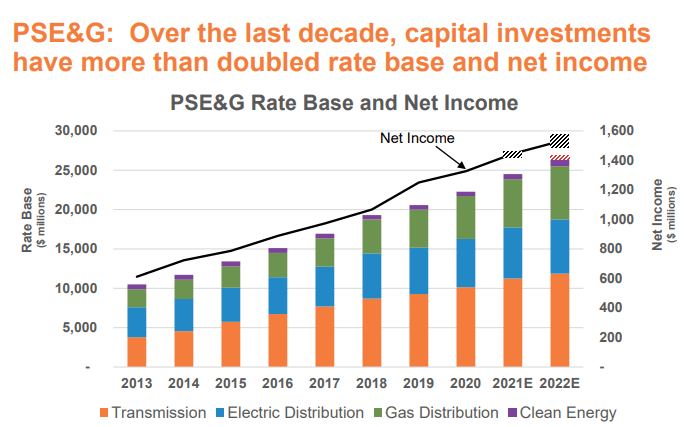

PSEG IR (PSEG IR)

The company essentially has three operating subsidiaries – PSE&G, PSEG Long Island, and PSEG Power. The company’s subsidiaries serve customers in New York City and New Jersey. The company is heavy with zero-carbon infrastructure and investments and is over 90% regulated with a very predictable sales mix and operations – like many utilities. Fundamentally, there is nothing wrong with this company, and PSEG has shown its ability to deliver ongoing EPS growth of 5-7% in the current environment.

We’ll be discounting growth slightly as we move forward, but even impairing the EPS growth around 20-30% to account for a combination of cost increases and macro, we’re still left with a very stable company that’s been paying dividends for nearly 115 years.

The PSEG of the future is, thanks to heavy renewable and appealing investments in new technologies, a highly predictable company with, again, a predictable set of cash flows due to its highly regulated nature in transmission, distribution, gas distribution, and clean energy investments.

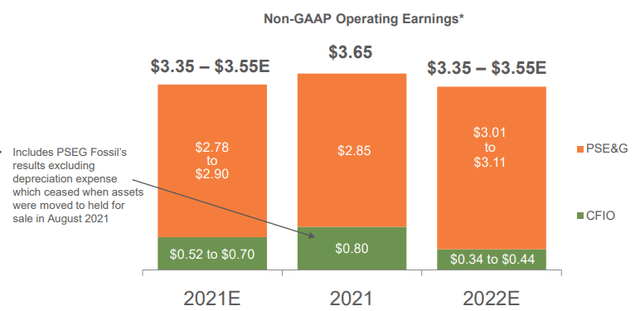

Recent results have mostly cemented this reputation and expectation, despite what the share price development would have you believe. 2Q22 is the latest quarter we have for PSEG, and this quarter came in with decent results, with the company generating a net income of $0.26 on a per-share basis. It’s flat, with the rate base growth offset by a settlement – but non-GAAP operating earnings growth reflects solid generation from the company’s nuclear assets, and PSEG has repurchased half a billion dollars’ worth of shares up until May 2022.

May seems like a long time ago as the market is constantly heaving at this time, but we should be looking forward anyway. And the company is continuing to invest its capital responsibly. During 1H22, PSEG went for $1.4B of its $2.9B in planned infrastructure investments in line with the state’s green energy goals. The 2021-2025 capital program is on track, with $15-$17B in investments, producing that multi-year EPS growth rate of 5-7% from the midpoint of 2022 to 2025 – and that company number is with the current macro considered. I’ll impair it anyway, but I want to clearly state that the company believes that it can do better.

I stated in my earlier article that I want Public Service Enterprise Group in my portfolio. I just don’t like the price I had to pay during the last article.

The company has reaffirmed 2022E, which calls for a slight reduction in non-GAAP EPS overall – but from here on out, the company is calling for that aforementioned EPS growth to come into place.

Headwinds on a 1H22 basis come from gross margins from generation, headwinds in Gas, power costs and D&A, activities in the parent company, and some slight tax impacts. These are offset in turn by positive transmission earnings, Gas and electricity margins, distribution, and lower share count.

There is still a lot to like about PSEG. Its assets, its customer base, its capital spending program, its dividend growth rate, its credit – all of these things are what I would consider attractive qualities of PSEG.

The current investment programs are expected to generate about 6-8% annual base rate growth over the next 3 years, much of this coming from what the company categorizes as “Clean Energy”.

This is especially important for PSEG, because New Jersey due to its geographical location and specifics, is one of the perhaps most impacted areas in the US (excepting the West coast) in terms of extreme weather, including massive floods and weather events. This challenges the existing assets and infrastructure and requires companies to adapt. This is why we as investors need to keep an extra-careful eye on the company’s investment plans to make sure these come in according to forecasts.

We want substation refits and upgrades, switching station upgrades (in order to handle more demand loads while providing reliability), electronics upgrades, and hardening and elevation (flood protection, modernizing, better capacitors). All of these things are, by the way, being done in many other nations worldwide as well, because many nations have a very outdated electrical infrastructure.

Overall though, I believe it’s fair to say that PSEG is an appealing, premium utility with good fundamentals, a great asset and customer base, and good circumstances to deliver base rate growth over the next few years.

The company is on track with its hardening and modernizing pushes, and from a capital perspective, there is nothing worrying about PSEG – at least not fundamentally.

Valuation would imply to us that the market, on the other hand, is worried about quite a few things.

Company Valuation

As I mentioned, company’s quality isn’t enough for me to invest. I want valuation as well.

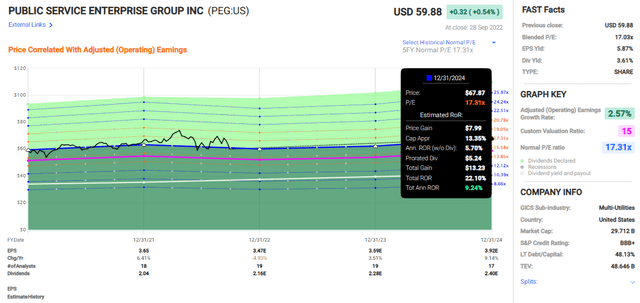

This is where the good news comes in. We now have a valuation that’s good enough to become interested in the company. PEG is for the first time in a few months, trading at a valuation below 17.5x P/E. For this BBB+, renewable-heavy utility that fully deserves its premium and yields over 3.7% here, that’s quite decent. Now, EPS growth is a spotty thing to forecast here. Why?

Because the company needs to invest heavily while handling difficult macro and interest, and also handle weather effects. This comes at a risk, but not a big enough one to keep me away entirely.

Current forecast calculations on a 17-18x P/E gives us a potential double-digit RoR if the company merely holds to its premium – which I believe it most certainly will do.

This isn’t the most exciting upside on the market, but it’s one worth highlighting, in the same way, some ultra-conservative businesses like Microsoft (MSFT), in some ways, are currently, actually buyable.

PSEG is rarely a very clear “BUY” – it’s barely a “BUY” at this time. But it’s still worth highlighting for the sake of what the company represents. The growth prospects for this company are very much intact. This is a 90%+ regulated utility. There’s almost no ambiguity in earnings, and forecast accuracy reflects this fact well, with 100% forecast accuracy, if including beats to forecast both on a 1-year and 2-year basis for the 5-year average.

So, there isn’t a lot of uncertainty about this stock and its performance. I believe uncertainty also won’t be a part of this company’s “Base case” going forward.

I said earlier that I believe the company’s growth estimates can be taken at face value, – I would now impair the 2023-2025E ones by around 10-20% to remain conservative in this environment, but it still calls for impressive growth, all things considered.

What’s more, this business is relatively stable over time. It’s protection against some of the chaos going on in the market right now. S&P Global analysts give the company the following rating considerations. 19 analysts follow the company and give it a range between $65 on the low side and $89 on the high side. Even the low is currently far higher than the current share price of below $60/share. 14 analysts are either at a “BUY” or a “Outperform” rating on the company.

This isn’t a complex thesis to me. This company, as a result of its quality, is now fairly valued and a weak “BUY”. I wouldn’t, as I said, touch it above 15-16X P/E, which gives it a current highest share price of around $60/share.

It is now below that price, which to me makes it a “BUY” in this market.

Thesis

My thesis for PEG is the following:

- The largest utility in New Jersey, with substantial, attractive assets that are likely to generate significant returns over the next few years.

- Very attractive fundamentals and credit safety scores make this company one of the better bets in the utility space.

- The valuation has now compressed, and we’re looking at a potential upside in double digits.

- I, therefore, consider the company a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment