Vladimirovic/E+ via Getty Images

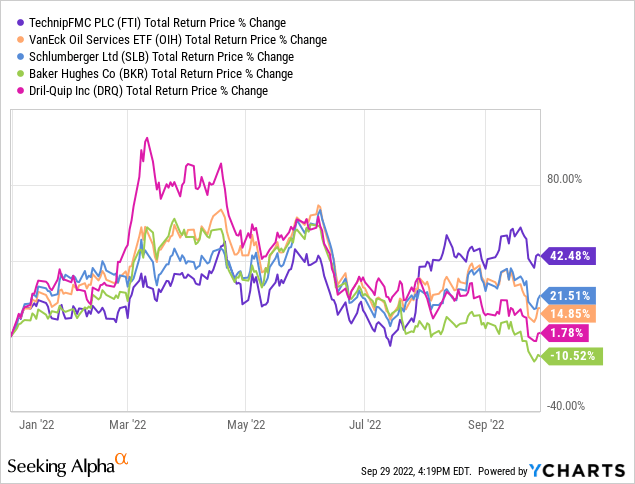

TechnipFMC plc (NYSE:FTI) is one of the world’s largest oil & gas industry service providers specializing in subsea technologies and equipment. Despite the recent volatility in energy prices, the sector’s strong production and exploration activity this year has supported demand for new contracts with TechnipFMC driving positive earnings momentum. Indeed, shares of FTI are up over 40% in 2022, favorably outperforming its peer group. We are bullish on the stock which benefits from several long-term operating tailwinds and overall solid fundamentals.

FTI Key Metrics

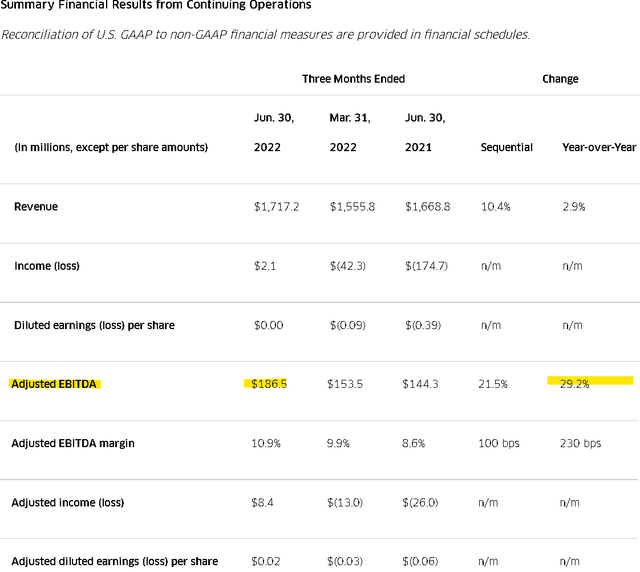

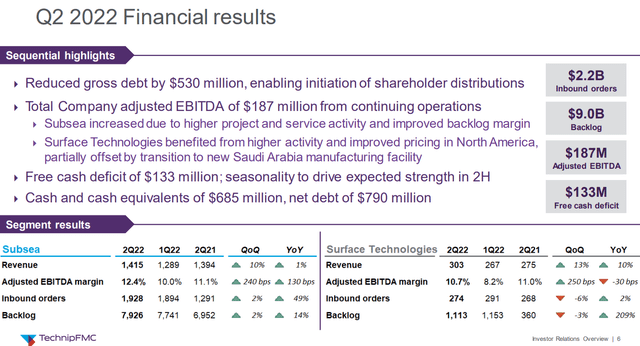

The company last reported its Q2 earnings in late July with non-GAAP EPS of $0.02 which reversed a loss of -$0.06 in the period last year. Revenue this quarter at $1.7 billion, climbed by 3% year-over-year and was ahead of estimates. The story was sharply higher profitability with adjusted EBITDA reaching $187 million, up 29% year over year as the margin increased by 230 basis points to 10.9%. The trend reflects a growing number of active projects and higher pricing on new orders.

By operating segment, keep in mind that “Subsea” operations represent around 82% of the total business while the smaller “Surface Technologies” group has also seen stronger activity. The total backlog of orders at $9.0 billion is up from $7.3 billion in the period last year and provides some visibility for a continued growth runway as the scheduling of projects accelerates.

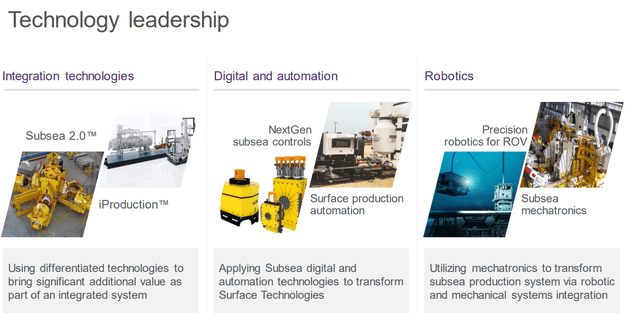

The company has seen a good customer response to its new products, like the “Subsea 2.0“, of offshore oil and gas production systems that are recognized as improving project economics with higher reliability. On the Surface side, a new manufacturing facility going online in Saudi Arabia is expected to ramp up through the rest of the year with increased capacity for parts as a new growth driver.

Another important theme has been ongoing deleveraging. The company ended the quarter with $685 million in cash against $1.4 billion in long-term debt, down from $1.7 billion at the start of the year. Considering the current annualized Q2 adjusted EBITDA run rate of around $750 million, the net leverage ratio of around 1x highlights the strong balance sheet and liquidity position.

With the positive operating and financial backdrop, TechnipFMC is moving forward with shareholder distributions including a new $400 million stock buyback authorization, representing approximately 10% of the current $4.1 billion market value as a shareholder yield. The company has also announced plans to initiate a regular quarterly dividend by next year, although the amount and further details are still unknown.

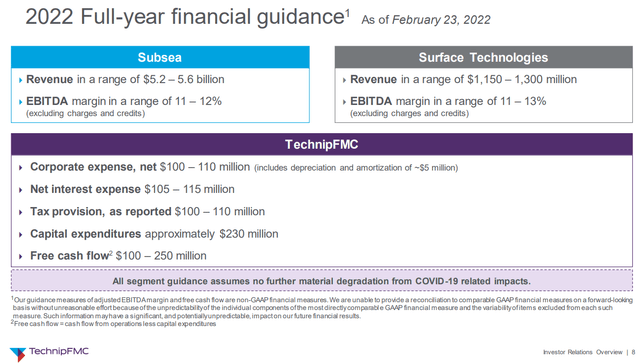

In terms of guidance, the forecast is for full-year 2022 revenue between $6.4 billion and $6.9 billion, representing an increase of 4% from 2021. Within the estimates, an EBITDA margin of around 12% of $780 million, if confirmed, would be 35% higher than the $580 million generated in 2021. The company also expects free cash flow of between $100 million and $250 million.

FTI Stock Price Forecast

There’s a lot to like about TechnipFMC with a sense that the oil and gas equipment and services industry is well positioned to capture positive long-term trends in the energy sector. The high pricing environment this year in the context of the broader “energy crisis” amid the Russia-Ukraine conflict has accelerated the urgency for new oil and gas projects as a global theme. The key point here is that whether the price of oil is at $70 a barrel or levels seen in Q1 above $120, oil and gas producers are highly profitable which translates into strong demand for TechnipFMC services.

The attraction here is the company’s leadership position in the specialized side of subsea oil and gas production integration systems which includes automation controls and robotic mechatronics as valued-added high-tech solutions. In other words, TechnipFMC has a differentiation compared to other industry players that focus more on commoditized “platforms” or drilling rigs.

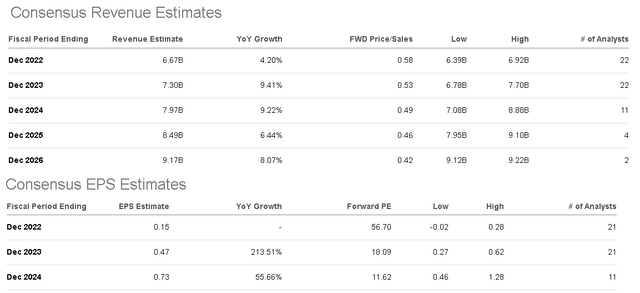

According to consensus, the forecast is for full-year EPS of $0.15 on a revenue at $6.7 billion, in line with the current company guidance. Looking ahead, the market sees earnings accelerating into 2023 towards EPS of $0.47 and $0.73 by 2024.

This outlook considers both the order backlog disclosed by the company and the expectation that the E&P Capex cycle by major oil and gas producers ramps up going forward to take advantage of attractive market pricing. On this point, it’s encouraging to see regular updates from TechnipFMC of new contract awards from global majors like ExxonMobil (XOM) and Shell Plc (SHEL) announced in recent months as ongoing opportunities.

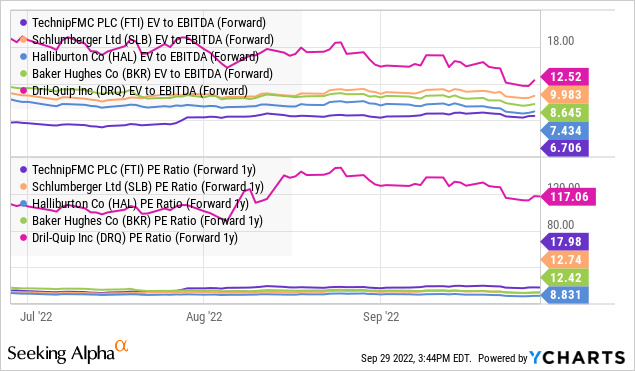

As it relates to valuation, the way we’re looking at FTI is that the metrics present an otherwise mixed bag. The stock looks “cheap” trading at a 6.7x EV to forward EBITDA multiple relative to other industry players like Schlumberger Ltd (SLB), Halliburton Corp (HAL), Baker Hughes Co (BKR), and Dril-Quip Inc (DRQ).

On the other hand, the forward P/E of 57x on the 2022 consensus EPS or even 18x for the 1-year forward 2023 estimate, is at a premium compared to a multiple closer to 12.5x for SLB and BKR. The other dynamic at play is that stocks like SLB, HAL, and BKR currently offer a dividend while FTI is only expected to initiate a payout in the second half of next year.

Recognizing that each of these companies has their differences, what we can say is that FTI is doing everything right to generate value for shareholders. Notably, FTI has outperformed its peer group and even the industry VanEck Oil Services ETF (OIH) this year highlighting its underlying strength. We think this trend can continue.

Final Thoughts

The bullish case for FTI is that there is an upside to its earnings estimates, particularly in a scenario where the price of oil and gas rebounds higher following the recent correction. We rate shares as a buy with an initial price target for the year ahead of $11.00 which would represent a return to its high from 2021.

While some pessimism towards global growth has weighed on the sector sentiment, there is a case to be made that the selloff has already gone too far considering tight global supply conditions. Headlines related to the Russia-Ukraine conflict have the potential to kickstart another leg higher in energy prices. We expect shares of FTI to outperform the broader sector to the upside as energy prices rebound.

On the downside, a deeper deterioration of the global macro outlook could open the door for a leg lower in the stock as a risk to watch. Monitoring points for the company in the Q3 results expected to be released by late October include the trend in its order backlog and adjusted EBITDA margin.

Be the first to comment