Win McNamee/Getty Images News

Peak energy prices mean peak Exxon Mobil (NYSE:XOM). Exxon shares have plunged in recent weeks as oil prices have fallen sharply. There’s growing evidence to suggest the US economy may be heading toward a recession, and if that happens, oil prices will likely decrease further.

Much of Exxon’s significant gains in 2022 have been driven by the higher oil price. These higher oil prices have helped sell-side analysts push their revenue and earnings estimates for Exxon higher, which has propelled the stock price. But a sudden shift in the economic outlook and oil could cause analysts to start reducing those estimates, bringing Exxon’s stock price down.

A State of Disbelief

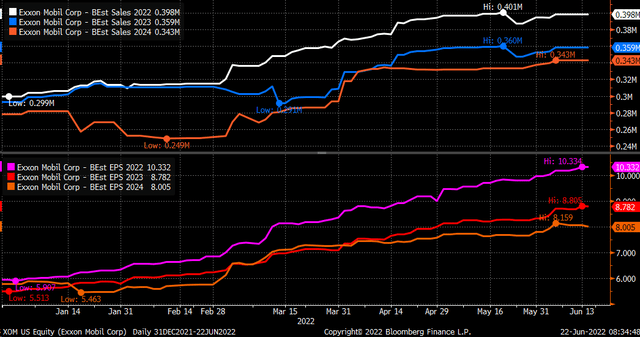

Sales and earnings estimates for 2022 have soared since the beginning of the year, climbing to $398 billion and $10.33 per share, respectively. But the problem is that estimates for 2023 and 2024 are forecast to be lower than 2022. In 2023, sales are forecast to drop to $359 billion with earnings of $8.78 per share, with sales falling to $343 billion in 2024 and earnings of $8.00.

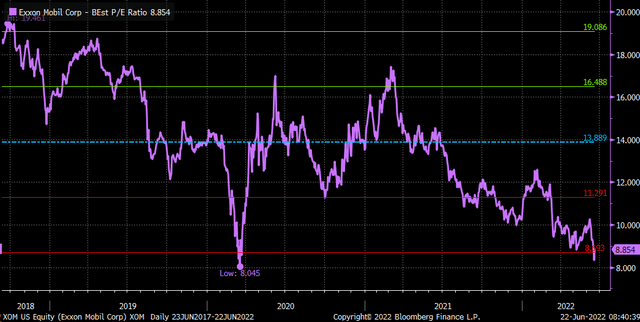

The outlook for declining sales and earnings estimates suggest that analysts do not see current oil price holdings. It’s also probably why the stock trades at just 8.85 times 2022 earnings estimates, which is well below its peak of 19.5 in 2018 and its five-year average of 13.9. It’s a message from investors that they, too, do not see current earnings estimates holding up into the future.

Oil Term Structure

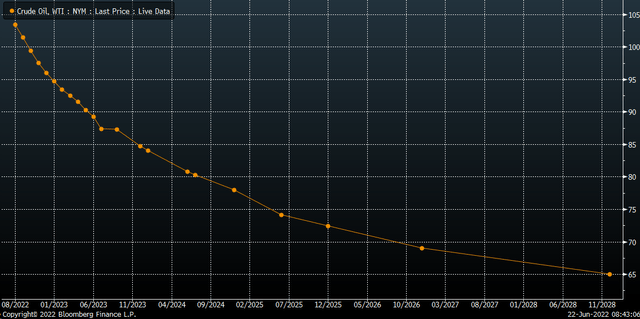

That’s because the term structure for oil is currently in backwardation, with prices expected to drop over time, back to around $78 by the end of 2024. The structure of that curve could indicate prices fall more in the future, especially if the outlook for a US recession rise as the Fed looks to tighten monetary policy.

Rising Risks

Currently, the Atlanta Fed GDPNow model is forecasting second quarter real GDP growth of just 0.0%, on the cusp of turning negative. That would follow a negative first-quarter real GDP print. A negative second-quarter real GDP print would put the US economy on the brink of a recession.

The war between Russia and Ukraine and the sanctions placed on Russian oil is helping to increase oil prices, creating the biggest unknown. The uncertainty in that war keeps oil prices trading at a premium valuation.

Volatility

This uncertain outlook could be driving traders to bet on increasing volatility in Exxon. On June 22, the open interest for the July 22 $91 puts and calls saw their open interest rise by around 6,700 contracts. The data shows that 6,600 puts were traded on the ASK and bought for $3.95 per contract. Meanwhile, 6,600 calls were traded on the ASK and purchased for $4.97 per contract. These two trades created a straddle position, with the trader spending $8.92 per contract. It indicates the trader sees Exxon trading above $99.92 or below $82.08 by the middle of July. Those are the prices the trader needs the stock to be above to below start earning a profit if holding the options until the expiration date. It’s a monster bet, with nearly $5.6 million paid in premiums to create the straddle.

Technical Trends Breaking Down

However, the technical chart patterns are bearish, suggesting that Exxon’s stock may see lower prices. There’s a rising megaphone pattern in Exxon, which is typically a bearish reversal pattern. It would indicate that the stock falls below the bottom of the megaphone and support around $83.50. Should that happen, the most substantial level of technical support would not come until roughly $71.

Additionally, the relative strength index for Exxon is flashing a bearish divergence, making a series of lower highs, despite the stock price making higher highs. The divergence indicates that momentum in Exxon has shifted from bullish to bearish, and the stock is more likely to head lower in the future.

The most significant risk to Exxon’s dropping is the Ukraine war’s uncertainty. If that war should escalate or grow worse, oil prices could rise meaningfully, while a de-escalation could help push oil much lower. That uncertainty seems to be reflected in the options data presented above and ultimately could drive Exxon’s share price.

However, the stock’s valuation and earnings estimates seem to reflect some uncertainty around oil prices being able to hold up. Otherwise, analysts’ earnings and sales estimates for 2023 and 2024 wouldn’t be lower than 2022 estimates. Additionally, the PE ratio wouldn’t be trading at a multi-year low. Those two factors may be reason enough for Exxon’s price to fall further over the short term.

Be the first to comment