cokada/iStock via Getty Images

Thesis

Since last Fall, Standard Lithium Ltd. (NYSE:SLI) has been the target of two activist short seller reports. These have questioned, among other things, the company’s patent pending LiSTR technology on which much of the company’s value rides. And while management has responded to the activist investors, they have also been selling the stock over recent months. Investors should, therefore, wait for greater clarity on the company’s patent portfolio before committing capital.

Standard Lithium

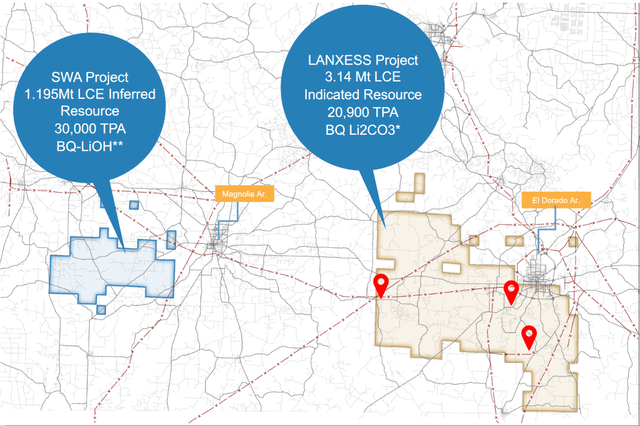

Standard Lithium’s flagship projects are bolt-on lithium extraction and conversion facilities that it plans to attach to a pair of LANXESS AG’s (OTCPK:LNXSF) existing bromine operations in Arkansas. The plan is for Standard to divert tail brine coming out of bromine plants and send it to its own facilities, where it would use LiSTR, its Direct Lithium Extraction (“DLE”) technology, to extract the lithium before reinjecting the tail brine back into the aquifer.

The company points out that if the technology proves to be successful, it would allow it to begin extracting lithium from the gigantic mineral-rich Smackover formation that underlies a large part of the Southeastern United States.

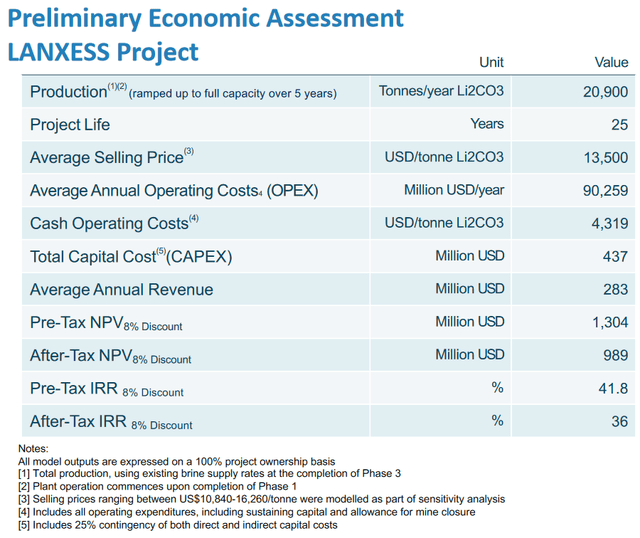

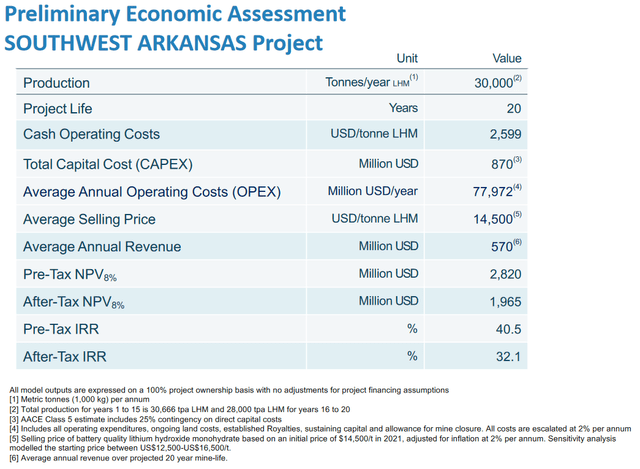

The company completed the Preliminary Economic Assessment (“PEA”) for the Lanxess site in August 2019 and finalized the PEA for the nearby Southwestern Arkansas location last November. Results for both of the locations were very impressive.

Fully-ramped output at the Lanxess location would be 20.9k tpa of carbonate, while the Southwestern Arkansas site will eventually provide 30k tpa of hydroxide. Pre-tax NPV8% for the two locations are $1.3B and $2.8B, while their respective pre-tax IRRs come in at 41.8% and 40.5%. And last month, the company announced that it was beginning work on the Pre-Feasibility Study for the South West Arkansas property.

Investor Presentation Investor Presentation Investor Presentation

These numbers were good enough to attract the attention of Koch Investment Group, who in November announced the purchase of nearly 13.5 million common shares at a price of $7.42 each. The $100 million investment helped give the company a major boost. The relationship was further solidified in December when the company signed an LOI with Koch Engineered Solutions for the provision of engineering services, and again in January when it signed another LOI, this time with Koch Minerals and Trading LLC, for lithium offtake.

LiSTR Technology

The PEA numbers are impressive, and the Koch seal of approval, along with the capital that comes along with it, allow Standard to stand out from the lithium crowd. However, in spite of the impact that these announcements may have had on the stock’s short-term performance, Standard’s long-term value will be mostly determined by management’s ability to deliver on its DLE promises.

That’s because, unlike most other lithium miners currently trying to implement Direct Lithium Extraction processes, Standard does not own the lithium resource. The only asset that the company owns with any long-term price appreciation potential are the patents to its LiSTR technology. Patents that it has not yet secured.

If we compare it with a company like Lithium South Development Corporation (OTCQB:LISMF), a lithium miner currently developing properties in the Lithium Triangle and which I previously covered, we see how much additional risk an investment in Standard Lithium carries relative to that in a more typical DLE operation.

Lithium South is currently evaluating three Direct Lithium Extraction technologies and plans to select the best one to increase recovery without having to build evaporation ponds. However, it has included ponds in its planning phase as a fallback in case none of the technologies pans out. If this were to occur, the impact to shareholders would be minimal. In contrast, if Standard Lithium’s technology doesn’t pan out, the impact to shareholders will be substantial because the company has nothing to fall back on. LANXESS AG owns the resource, and Standard’s deal is contingent on its technology working.

Controversy

Management is confident that its technology will work out as planned. However, the stock hasn’t been without controversy. In November of last year, the company was the subject of a report put out by Blue Orca Capital, an activist investment firm that focuses on short selling. Among other things, the report cited regulatory filings and questioned the recovery rate that Standard claimed its DLE technology could achieve and the amounts of carbonate produced in the demonstration plant. The company responded by explaining how it arrived at the data listed on the regulatory forms.

In February of this year, Standard was again the subject of a report, this time put out by Hindenburg Research. The report discussed many aspects of the company, including the possibility that its patent applications may be rejected. The company again responded by addressing some of the points brought up in the report.

In and of itself, the release of a report by an activist investment firm is not a reason to avoid or even sell a stock. In this case, management addressed some of the concerns voiced by the activist firms by responding to some of the issues that were brought up.

Insiders are Selling

But as a potential investor in the company, I would have also liked to see that accompanied by some insider buying. The release of reports by activist short sellers often has the effect of depressing the target company’s stock price, presumably making it a better buy. Nothing speaks louder than management defiantly buying a company’s stock after the release of an activist short seller report.

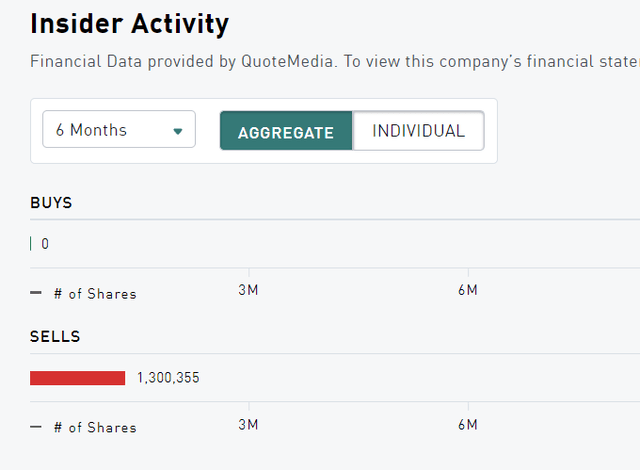

However, that’s not what happened here. Standard Lithium has a listing on the Toronto Stock Exchange which freely provides the insider trading activity for the company for anyone wishing to see it. As can be seen below, over the last six months insiders have sold over 1.3 million shares in the company and have not purchased any stock. The transactions were made by 5 individuals, including Robert Mintak, the company’s CEO.

Conclusion

Much of Standard Lithium’s value rides on it being granted the patents for its LiSTR DLE technology, something which is not a foregone conclusion. That uncertainty is only amplified by the cloud brought about by the activist short seller reports. In spite of that, I may have considered buying the stock if I had seen management also buying up shares for themselves, as that would have given me greater faith in the DLE tech.

But, given all this uncertainty, I’m not going to buy a stock if it’s being sold to me by an insider looking to reduce their position. For that reason, I believe Standard Lithium stock should be avoided until there’s greater clarity on the company’s patent portfolio.

Be the first to comment