Justin Sullivan/Getty Images News

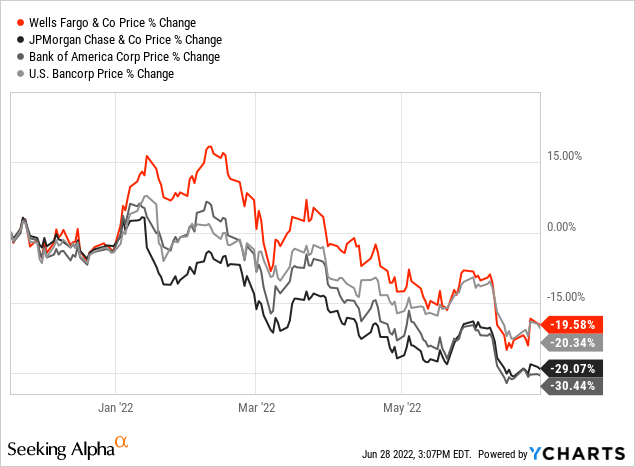

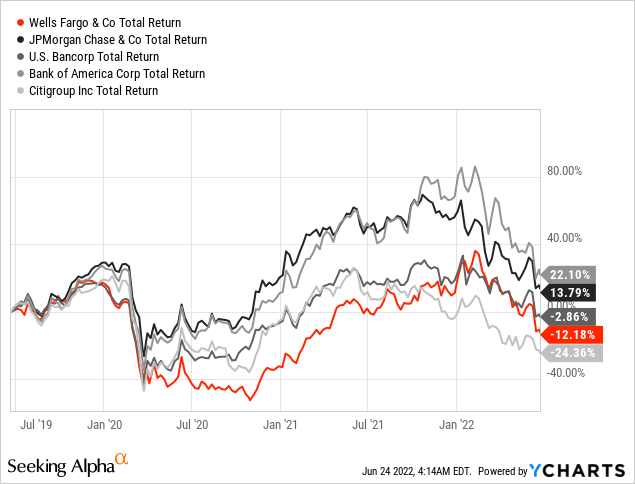

In November 2021, when my last article about Wells Fargo (NYSE:WFC) was published, I considered many of the major U.S. banks to be a better investment and the headline was “Pick a competitor instead”. Since then, Wells Fargo has gotten about 20% cheaper and that might be a good incentive to consider the stock as a good investment now. However, all the other major U.S. banks declined rather steep as well. On the one hand this means that Wells Fargo would have been a better pick in November 2021 – as it performed better. On the other hand, other banks might be a similar good investment right now as they are also trading for extremely low P/E ratios.

In the following article, I will look at Wells Fargo once again, talk about the most recent stress test results and ask the question once again if Wells Fargo is a good investment or if we should rather choose another bank (combined with the question if we should invest in banks at all right now).

Results

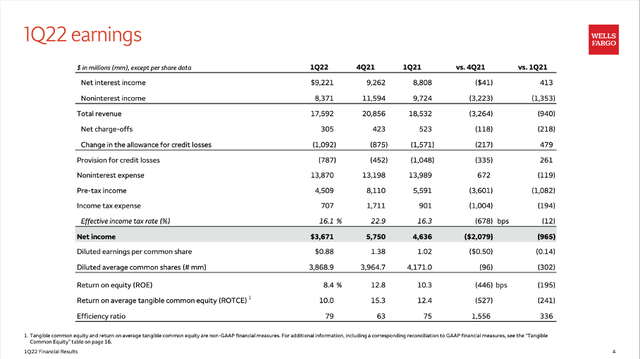

Let’s start by looking at the last quarterly results: Wells Fargo’s performance in the last quarter was solid, but not great. In the first quarter of fiscal 2022, Wells Fargo could increase its net interest income from $8,808 million in the same quarter last year to $9,221 million this quarter – an increase of 4.7% YoY. However, noninterest income declined from $9,724 million in Q1/21 to $8,371 million in Q1/22 – a decline of 13.9% YoY. As a result, total revenue declined from $18,632 million in the same quarter last year to $17,592 million this quarter and diluted earnings per share declined 13.7% YoY from $1.02 to $0.88.

Wells Fargo Q1/22 Presentation

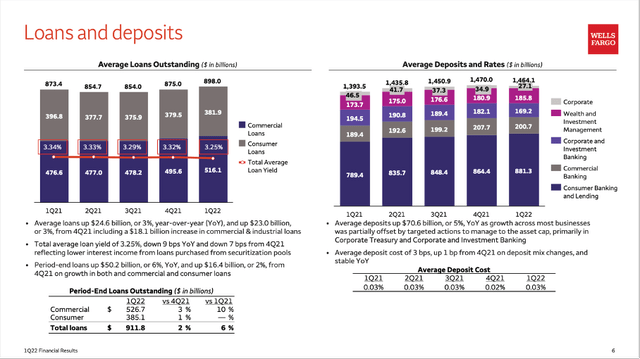

And when looking at the results in more detail, we can also focus on loans and deposits. While average loans outstanding could increase 2.6% quarter-over-quarter and 2.8% year-over-year, average deposits could increase 5.1 % year-over-year but declined 0.4% quarter-over-quarter.

Wells Fargo Q1/22 Presentation

This is a picture that is not untypical, and we see similar results for some other banks. However, Wells Fargo has been lagging especially with its average deposits in the last few years and could not match the performance of other banks, which is probably still a result of the scandals several years ago.

Stress Test Results

Recently, the FED also released its 2022 stress test results and all 34 banks passed the test – even in the severely adverse scenario. In its press release, the FED states:

All banks tested remained above their minimum capital requirements, despite total projected losses of $612 billion. Under stress, the aggregate common equity capital ratio-which provides a cushion against losses-is projected to decline by 2.7 percentage points to a minimum of 9.7 percent, which is still more than double the minimum requirement.

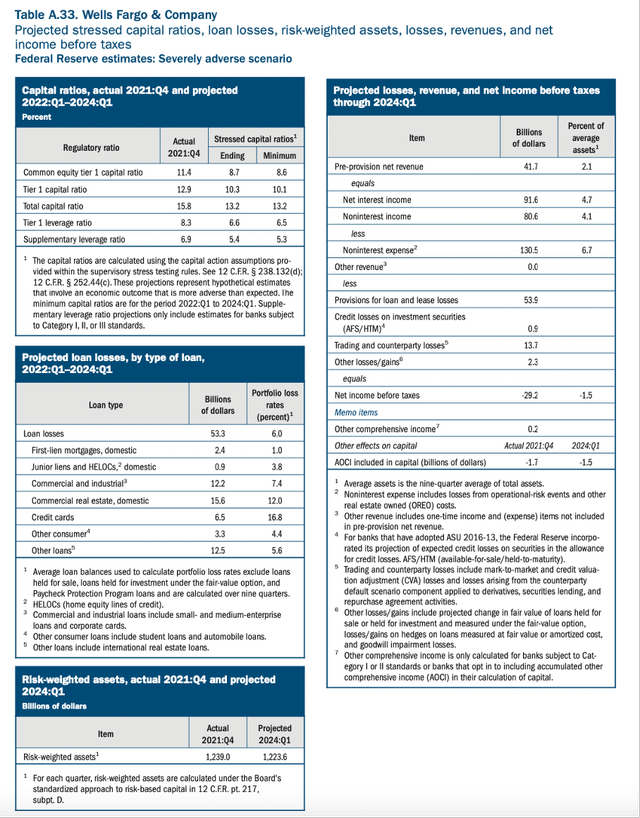

As one of the biggest banks (by asset) in the United States, Wells Fargo also must participate in the stress test. The simulation is projecting Wells Fargo’s common equity tier 1 capital ratio to decline from 11.4% (in Q4/21) to a minimum of 8.6% and the tier 1 capital ratio to decline from 12.9% in Q4/21 to a minimum of 10.1%. Loan losses for Wells Fargo are estimated to be around $53 billion in the severe adverse scenario.

I believe that banks in the United States are less risky than before the Great Financial Crisis and we probably won’t see a similar crisis again, but past recessions and bear markets also showed us that analysts, investors as well as the FED often tend to underestimate the risks and often don’t seem to fully take into account how interconnected the financial world is. And the extremely complex financial world is often leading to chain reactions. While I don’t think we will see a similar catastrophe as 15 years ago, I don’t want to rule out that banks might get in trouble again – and with a potential recession on the horizon we should be cautious.

Recession

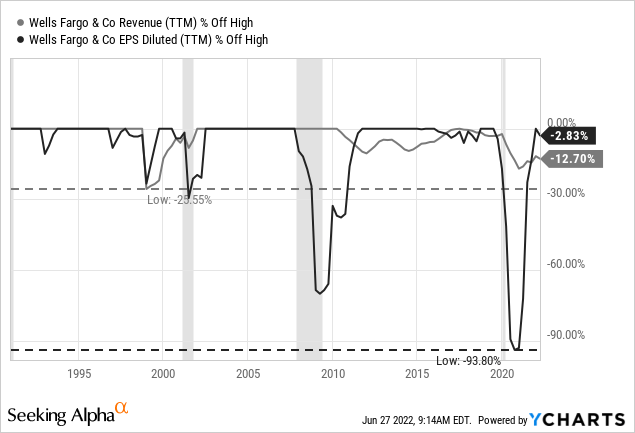

In a recent article about U.S. Bancorp (USB), I argued that we should not buy the stock right before a recession. And I would make a similar argument for Wells Fargo (and most other banks). When looking at the performance of Wells Fargo during the last few recessions, we should not expect such a great performance for Wells Fargo during the next recession.

Wells Fargo actually performed surprisingly well during the Great Financial Crisis – at least when looking at revenue. However, we must keep in mind that Wells Fargo was acquiring Wachovia at that time, and it was quite easy to increase revenue due to the acquisition. Earnings per share on the other hand declined rather steeply in each of the last three recessions and we must assume a similar performance during the next recession.

In the past, Wells Fargo was one of Warren Buffett’s favorite banking stocks – and the reasons were the stable performance and maybe lower risk taking than other banks. However, that changed in the last few years and since the scandals it seems like Wells Fargo is a different bank and we seriously must question if the status as solid and well-run bank is justified. At least Berkshire Hathaway (BRK.B) seems to have a clear answer as Buffett and Munger sold off the last remaining shares recently.

Dividend

Like most other banks, Wells Fargo is also paying a quarterly dividend. While most of the other major U.S. banks only froze the dividend at the beginning of the COVID-19 crisis, Wells Fargo cut its dividend pretty steeply from $0.51 per quarter before the crisis to $0.10. In the last few quarters, Wells Fargo increased the dividend again, but $0.25 per quarter is still below the pre-crisis level. This is currently resulting in an annual dividend of $1.00 and a dividend yield around 2.6%.

However, when comparing the dividend to earnings per share of the last four quarters ($4.87), we get a payout ratio of only 21% and such a low payout ratio should enable management to increase the dividend in the coming quarters (at least in theory).

Not Investing in Banks Right Now

In my last article about U.S. Bancorp, I argued that I am still a bit torn between two different points of view. On the one hand, there are the stormy clouds Jamie Dimon mentioned recently and we can see the United States at the eve of a recession. On the other hand, U.S. banks could be a great long-term investment over the next few decades (considering the extremely low P/E ratios right now as well as the potential of rising interest rates). In my last article about U.S. Bancorp, I wrote the following:

On the one hand, I see the stormy clouds in the not too distant future, and I expect the stock to perform not really well during a bear market. When looking at the last few recessions, U.S. Bancorp usually declined about 50% during a recession (and bear market) and in case of the Great Financial Crisis, the stock declined even 75%. And we must expect a similar decline in the next recession (and bear market).

(….)

So, I am torn between seeing banking stocks (including U.S. Bancorp) as a solid long-term investment and assuming that we need patience as the time to buy is not now. U.S. Bancorp is a solid long-term investment due to the wide economic moat banks usually have and the justified speculation that interest rates might rise again over the next two or three decades making banks more profitable again.

In my opinion, we are basically at the peak (considering debt and asset prices) or the bottom (considering interest rates) of a long-term cycle (which is usually taking 70-100 years). Nobody knows how long we will stay close to zero percent interest rate (the times could already be over now, or it could take a few more years), but sooner or later interest rates will rise again.

What is true for U.S. Bancorp is also true for Wells Fargo. In many aspects the two banks are quite similar. Both are among the major U.S. banks and both will profit (or be burdened) in a similar way from the FED’s decisions.

And if I was to invest in U.S. banks, I still don’t want to pick Wells Fargo for several different reasons. Not only did Wells Fargo’s stock underperform most of the large U.S. banks in the last three years (only Citigroup (C) performed worse). Wells Fargo did also not manage to reach previous all-time highs again. While banks like JPMorgan Chase (JPM), Bank of America (BAC) or U.S. Bancorp managed to reach pre-COVID-19 highs again, Wells Fargo still is underperforming.

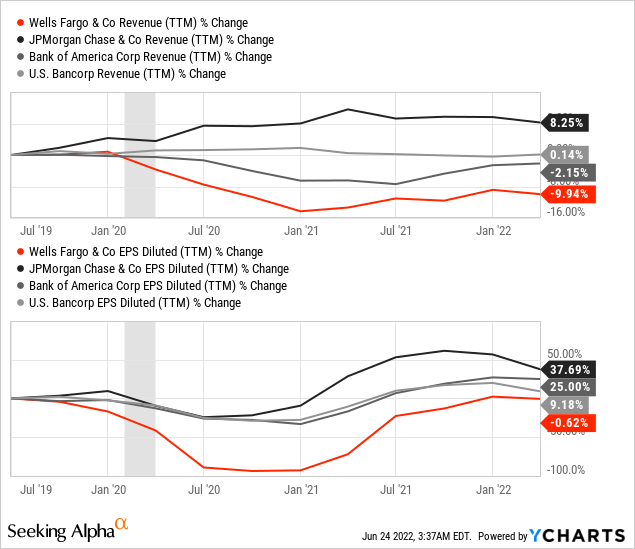

And when looking at revenue as well as earnings per share, Wells Fargo barely managed to get them at the same level as before the COVID-19 crisis. JPMorgan Chase for example managed to increased earnings per share 38% and Bank of America increased earnings per share 25%.

And an underperformance in the past does not necessarily lead to an underperformance in the future. But since all the major banks are trading for similar low P/E ratios right now, there is not much reason to choose the bank which has not only to struggle with macroeconomic challenges (like all other banks) but is also struggling with its own issues and was therefore underperforming in the recent past.

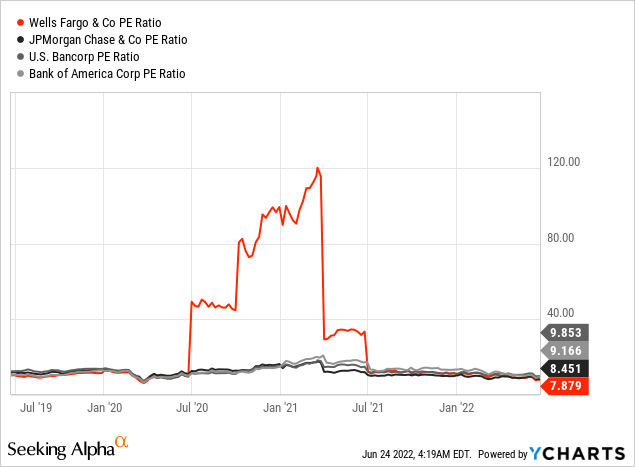

Wells Fargo seems cheap (with a P/E ratio around 8) and it also seems to be the cheapest among the major U.S. banks, but it also has trouble performing. However, most other major banks are also rather cheap and banks like JPMorgan Chase, U.S. Bancorp, or Bank of America also trading for single digit P/E ratios right now.

Wells Fargo could return to previous “performance levels” and in such a scenario it would be rather cheap. But we also must be skeptical right now, if Wells Fargo can perform at a similar level as back then. The scandal is already several years ago, and Wells Fargo is still struggling and has trouble to return to previous performance levels.

Conclusion

Like I was rather cautious in my last article about U.S. Bancorp, I would also be rather cautious about investing in Wells Fargo right now. In my opinion, we should wait the next few quarters and will probably get most of the major U.S. banks even cheaper as the upcoming recession is a huge risk for banking stocks. And even if I would buy a major U.S. bank right now, it would not be Wells Fargo – despite the stock trading for an even lower P/E ratio than is peers.

Be the first to comment