Catherine Delahaye/DigitalVision via Getty Images

Extra Space Storage (NYSE:EXR) is a Utah-based real estate investment trust focused on managing a portfolio of self-storage units across the United States. The company manages its vast portfolio by dividing itself into different segments, each of which is responsible for different types of operations, and working to both expand its portfolio, improve and develop existing assets, and provide a divided focus on the different aspects of the business and what is needed for continued growth. This includes tenet reinsurance, which relates to reinsurance of the loss of goods stored in one of the stores the company manages. The company’s self-storage operations also include rentals of wholly-owned stores. On top of this, Extra Space Storage LP functions as the company’s operating partnership, through which business is conducted.

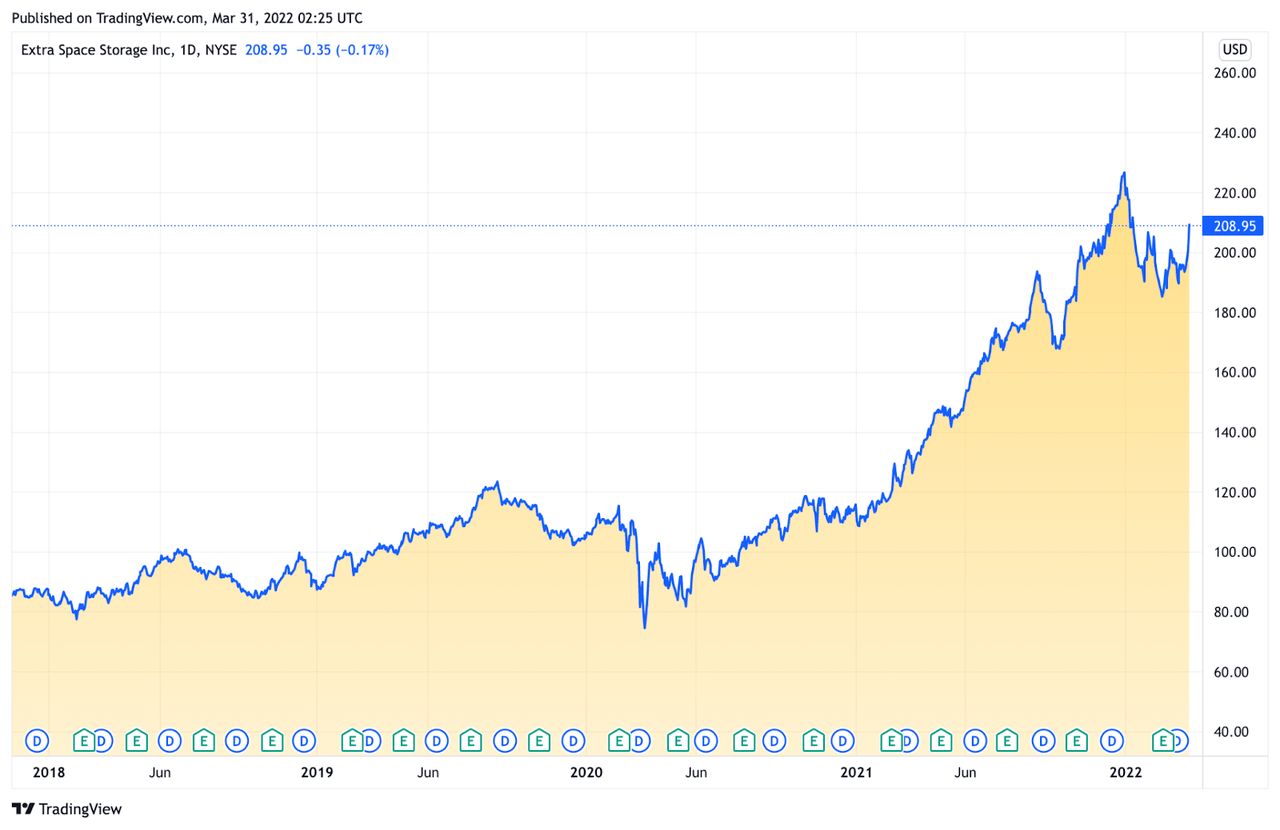

tradingview.com

As growth in both the company and the industry shows no signs of stopping, the question remains as to how substantial this growth can expect to be over the long term. The simple answer is that a case can be made on the bullish position investors can take on EXR, seeing that it is one of the most attractive options on the market.

Extra Space Storage Portfolio

Prior to the start of the past year, EXR ended 2020 on a high note, nabbing the Nareit Leader in the Light Awards, which recognized the company’s achievements in sustainability throughout the year. Fast forward just 11 months, and EXR went on to earn the award for the second year in a row through maintaining its environmental, social, and governance policies. The company hasn’t only seen recognition for its ESG policies either; after receiving recognition from Forbes as one of America’s best midsize employers in the past few years, it received Newsweek’s recognition as one of America’s best customer service companies. Such recognitions are great for PR, facilitating the company’s ability to be viewed favorably in the industry and make better deals. Regarding the company’s portfolio, it also has recent expansion, covering more and more ground with each passing year.

EXR expanded its portfolio by opening its first store in Maine, an announcement that came in August 2021, with the company now including 41 states in the company’s portfolio. The company also received an award as the Best Third-Party Management Company after its third-party management platform, ‘ManagementPlus’, reached 800 total managed stores. As the company continues to expand both regionally and in the number of managed stores, it also recognized a need for improved technology platforms to help manage its growing portfolio. Investors will find further encouragement in the collection of yet another reward the company received last year, after being recognized among the 2021 CIO Awards for their implementation of Rapid Rental, helping customers interact quickly and efficiently by providing them with the complete storage unit rental process online. The company had started the year with good news after announcing in January 2021 that it had been assigned a Baa2 issuer credit rating by Moody’s Investors Service. This at least proved to be correct throughout the year with the way the company handled its portfolio and public image, but the real question is, what do the company’s finances look like?

EXR Financial Profile

Diving straight into the EXR’s cash flow, the company reported a Funds from Operations (FFO) figure of $1.91 per diluted share as of the fourth quarter in 2021. This represented a year-end FFO figure of $6.91 per diluted share or an annual increase of 30.9%. This came from a net income increase of 66.8%, at a reported $6.19 per diluted share, thanks in part to increased revenue. While the fourth quarter reported revenues of $427.383 million in Q4, there wasn’t much difference from Q3 figures, which reported $412.492 million in total revenue. However, looking at the total annual revenue of $1.577 billion in 2021, compared to the $1.356 billion reported in 2020, it is evident the company is experiencing steady growth. Increased numbers of stores in key areas and geographical expansion in the location of stores all contributed to the company’s continued growth throughout the past year. Occupancy rate is a key factor, however, demonstrating whether the quantity and location of the company’s stores are being used. EXR reported same-store occupancy of 95.3% at the end of 2021, an increase of just 0.40% in 12 months, but overall maintaining a high number and reaching peak records of 97.2%. High prices also helped drive income growth as demand increased during a recovery year for the economy.

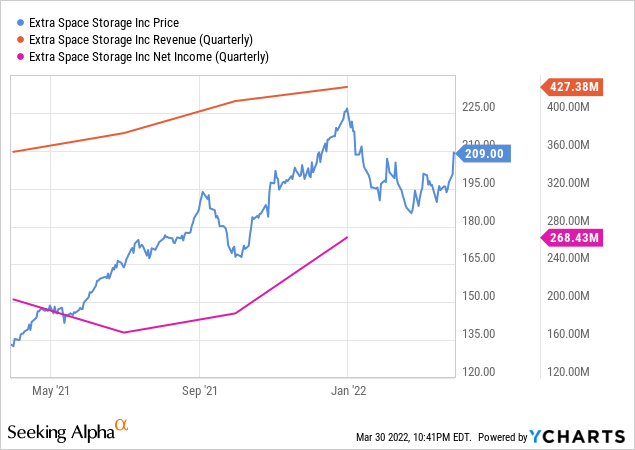

ycharts.com

EXR sold a total of 33 stores throughout the past year, 16 of which included wholly-owned stores for a total of $168.9 million and 17 others for a total of $210.6 million. The proceeds were used in part to acquire a further 70 stores, at a total of approximately $1.1 billion in 2021. The company also made some sales in shares, approximating $273.7 million in value, for a total of 2.2 million shares of common stock. This was by no means an indication that the company’s optimism is faltering, as all signs continue to indicate growth, but instead comes as part of a strategy to strategically expand the company’s portfolio. Rounding off what proved to be a successful year, EXR paid a quarterly dividend of $1.25 per share at the end of the fourth quarter.

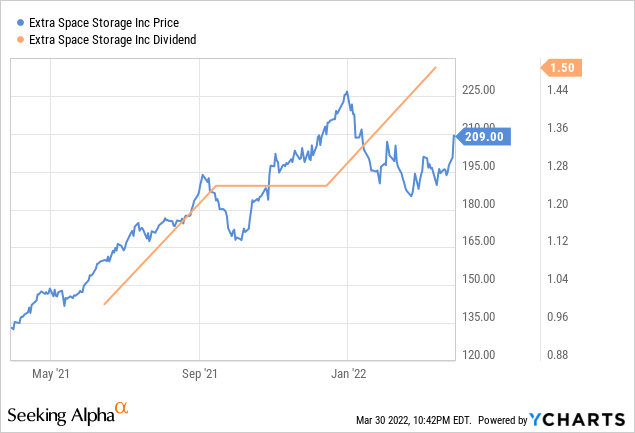

ycharts.com

The company has a decade-old track record of 831% return to shareholders, placing it as one of the top REIT companies by that measure. It also declared a quarterly dividend of $1.50 per share of common stock, an announcement that came in February of this year, payable by the end of the first quarter.

Industry Outlook

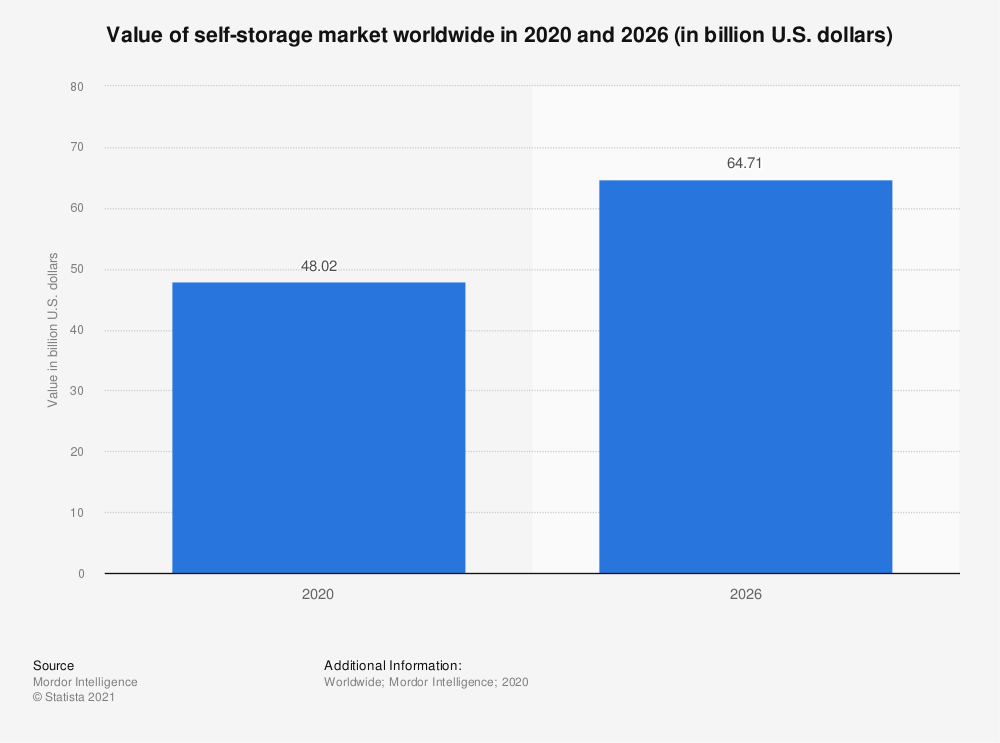

The Self-Storage sector of the REIT industry, of which EXR is a part, was the most prominent performer in 2021. The sector saw returns of 70.4%, the highest since the pandemic began. A strong housing market and increased sales saw this particular sector boom in the past year as the industry as a whole saw recovery. The Self-Storage sector is expected to grow at a compound annual growth rate of 5.45% until 2026. It was valued at $48.02 billion in 2020, and as prices and demand continue to increase, it is estimated to reach $64.71 billion by the end of the forecasted growth period. Various factors will propel this growth, such as the recovering US economy, including ease of global lockdowns and restrictions.

statista.com

EXR has drawn the long stick when it comes to REIT sectors. Not only is it in the most successful market of the industry, but covering a majority of states, it finds itself with a diverse portfolio. As of the end of 2021, the company managed stores in 41 states, at a total of 2,096 locations, comprising approximately 1.5 million storage units.

Conclusion

There is no current indication that growth will slow soon, as long as the company can maintain its high occupancy rate and continue to reward investors who have expressed faith in the company. Population growth and the increased ownership of items mean that storage space will continue to become valuable in the foreseeable future. There is no way around this, and this is a good thing for those optimistic about EXR’s future.

Be the first to comment