turk_stock_photographer/iStock via Getty Images

Many tech stocks have staged a recovery since hitting their near term lows in recent weeks. There are, however, pockets of value in real estate and financial stocks that are still trading in bargain territory. This brings me to Citigroup (NYSE:C), which I find to be rather cheap at present.

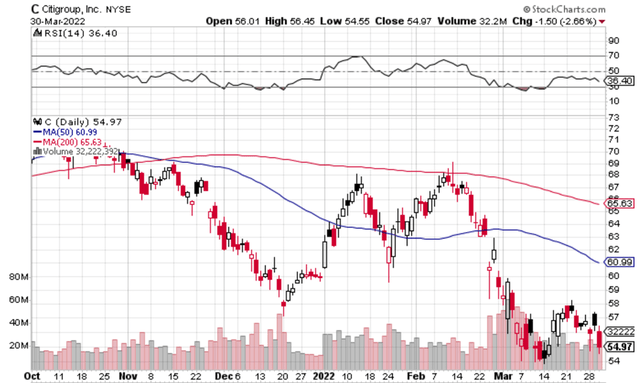

At present, it trades well below its 52-week high of $80, and as shown below, carries an RSI score of 36, indicating that it’s approaching oversold territory.

Citigroup Stock Technicals (StockCharts)

In this article, I highlight why now may be a good time to layer into this well-known banking juggernaut, so let’s get started.

Citigroup: Your Opportunity Is Knocking

Citigroup is one of the four largest banks in the U.S. and unlike its peers, also carries a strong global presence, doing business in more than 100 countries and territories. It’s divided into the global consumer banking segment and the institutional clients group, and provides its customers with the ease of cross-border transactions as one of the few truly global banks.

This wide reach serves as a competitive advantage for the bank as its network is hard for competitors to replicate. It’s also a double-edged sword, as this presence is difficult and expensive to maintain. That’s why the bank is in the middle of a strategic shift, as it seeks to exit consumer units in APAC and Mexico, as reflected during its recent conference call:

We announced that we intend to focus our franchise in Mexico solely on our institutional and wealth management businesses, and therefore, to exit the consumer small business and middle-market banking operations there. This was not a decision we took lightly. We took a clinical look at our franchise in Mexico, and we drew the hard conclusion that the noninstitutional businesses do not fit our new strategic direction. Now to be clear, these are terrific, they’re scaled, high returning franchises. But our strategic goal is to invest in businesses that are fully aligned with our core strengths and to simplify our firm.

I believe the bank will be more simple to measure and structurally focused at the end of this process, with the goal of having a more predictable and stable return profile.

Meanwhile, Citigroup maintained a healthy return on total common equity of 14% during full year 2021, excluding the impact of Asia divestitures. This was driven by solid client engagement and fee growth across its institutional client group. Also encouraging, North America and Asia wealth management AUMs were up by 8% and 13%, respectively.

It also maintains a BBB+ rated balance sheet, with a healthy common equity tier 1 capital ratio of 12.2%, up 50 bps from the prior-year period. Citi also grew its tangible book value by 7% YoY, to $79.16. This means that Citigroup is trading at a material discount at the current price of $54.97. At this price, Citi’s price to GAAP book value ratio sits at just 0.6x, sitting well below that of its large U.S. peers, as shown below.

Citigroup Price-to-Book (Seeking Alpha)

It also pays a respectable 3.7% dividend yield, which is well-covered by a low 20% payout ratio. It also had double-digit dividend growth in the years leading up to the pandemic, and I would expect for growth to resume as it makes progress towards its geo-strategic shift.

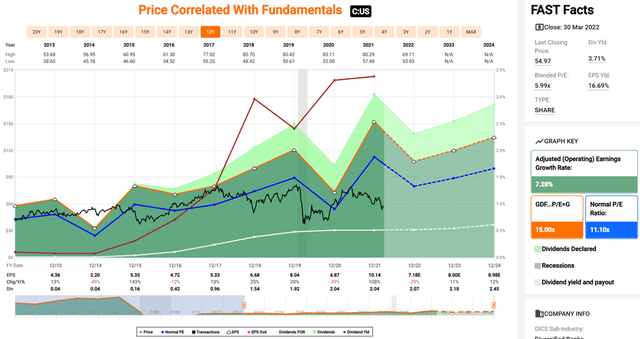

I see value in the stock at the current price of just under $55, with a blended PE ratio of just 6.0, sitting well below its normal PE of 11.1 over the past decade. Sell side analysts have a consensus Buy with an average price target of $71, and Morningstar has a fair value estimate of $79, implying the potential for double-digit returns over the next 12 months.

Citigroup Valuation (FAST Graphs)

Investor Takeaway

Citigroup is a global bank that is in the midst of a strategic shift that will see it exit consumer banking operations in certain regions. This should result in a more simplistic and more profitable business model that’s easier to forecast. It maintains a healthy balance sheet and the stock is attractively priced at present, trading at a material discount to its peers. I view Citi as being a Buy at the current price for potentially strong long-term returns.

Be the first to comment