Editor’s note: Seeking Alpha is proud to welcome Shri Upadhyaya as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

thitivong

Thesis

I think one of the biggest struggles to face as an investor is how invested you need to be during uncertain/recessionary periods. Two statements are usually thrown around –

- Go for value buys, businesses that you know can survive a downturn in the economy

- Go for growth plays, stories that have recently fallen out of favor in the general sense but still growing at a brisk pace.

Can there be a stock where we can be confident of not only surviving a downturn but also capable of unleashing growth once the economy eventually turns?

I recently had the opportunity to look into Expeditors International of Washington, Inc (NASDAQ:EXPD) and realized some interesting points on how it could be one of the best defensive plays of the next few years.

Ever since its history as a public company Expeditors has exhibited strong financial growth with its performance during and post recessions being remarkable. As evidenced, the company’s fortress balance sheet not only allows it to survive well but also be poised for growth once the economic uncertainties end.

Recent market gyrations and a company-specific issue (cyber hack) has unfairly punished this stock. Market’s fear has played to our advantage. The stock has fallen 23% from its highs and during the same time the company had its strongest first two quarters in its history which makes its valuation very attractive.

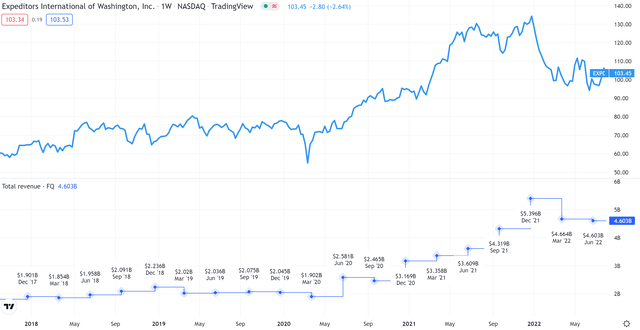

Price Action and Revenue reported (QOQ) (Tradingview)

Company Overview

Expeditors International of Washington, Inc. is an asset light, logistics provider that purchases cargo space from carriers (air freight and ocean freight) on a volume basis and resells that space to their customers. They also provide additional transportation services related to order management, customs brokerage, cargo insurance and a full suite of global logistics services with a seamless and integrated information systems to support the movement and strategic positioning of goods. Expeditors aims to understand a customer’s logistics and supply chain processes which allows it to identify targeted areas of opportunity for improvement, and deploy the right services and solutions for their customers.

Financial Dive

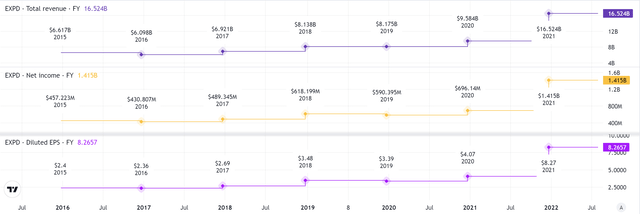

I like to analyze companies with a strong history of growing their top and bottom line consistently with a strong focus on the last three years.

- Average growth in revenue is 29% for the last three years (2019 YE – 2021 YE)

- Average growth in Net Income is 39% for the last three years (2019 YE – 2021 YE) with EPS more than doubling in the last three years

Top and bottom line performance (Tradingview)

As an early investor, it is natural to look at growing revenues and EPS and feel wonderful about a business. However, spending some more time to look at certain nuances in the financial statements goes along a far way to making a sound investment.

Is Expeditors International prioritizing earnings per share at the cost of cash flows?

While it is much easier to manipulate Earnings per share, Cash flow per share is much more difficult to alter which could more accurately portray sustainability of the Expeditors business model. Three year operating cash flow per share has grown at an impressive clip of 56% with 2021 YE operating cash flow at $868 million

Has top line growth come at the cost of increased borrowing?

Here we want to check if it is “debt fueled growth” that has been driving the top line. Expeditors has been very good at managing debt. In fact, net debt is negative which means that both short term and long term debt is well covered by cash on hand. Over the last three years total debt has remained within a tight range and when compared with total equity is at a ratio of 0.13

Is growth coming from big acquisitions?

Lack of organic revenue growth can always be masked by big acquisitions. Here we look at goodwill and see that it has stayed at $8 million in the past few years. If goodwill is big and increasing, it could give us clues that recent acquisitions is what has contributed to revenue growth. It could also mean that if things don’t go as planned it could result in big write-downs.

Are revenues being driven by increased spend in sales and marketing?

Although, this is not a conventional way to look at things, I like this metric plainly for the reason that “anything will sell if you are spending everything on selling”. Here too, when we compare the percentage of sales &marketing spend to revenues it has been minor and trending down for the last couple of years.

How is Expeditors International returning value to shareholders?

Here we see that EXPD has been buying back stock regularly in addition to paying a consistent dividend. From their recently filed 8-K report

All of our products performed well during the quarter and we returned $659 million to shareholders in repurchased stock and dividends.

Now this can get tricky if the company is buying back stock or paying dividends through increased borrowing. However, as we saw earlier and also from the recent quarterly statements the company’s debt is extremely well managed and therefore not an issue here. Also, looking back on their dividend history, Expeditors has been consistently increasing dividend at least for the last ten years further proving that the company has been very shareholder friendly.

I am no forensic financial investigator and there are plenty of ways inorganic top and bottom line growth can be hidden in a financial statement. However, looking at the above four metrics will weed out the “obvious” situations where the quality of financial statement is not up to standard.

Financial performance prior to, during, and post recessionary periods

Let us see how Expeditors fared in its existence as a publicly listed company during past economic downturns.

- Gulf War Recession: July 1990 – March 1991 (GDP Decline: 1.5%) Revenue still managed to grow in 1990 although at a much smaller pace than other periods

|

1989 |

1990 |

1991 |

1992 |

|

|

Revenues YE ($ millions) (Source: Company data) |

194 |

207 |

254 |

333 |

2. Dot-com Recession: March 2001 – November 2001 (GDP Decline: 0.3%) Slight dip in revenues but rebounded sharply the year following the recession

|

2000 |

2001 |

2002 |

2003 |

|

|

Revenues YE ($ millions) (Source: Company data) |

1,695 |

1,653 |

2,297 |

2,625 |

3. The great Recession: December 2007 – June 2009 (GDP Decline: 4.3%) Noticeable dip in revenues but rebounded sharply the year following the recession

|

2007 |

2008 |

2009 |

2010 |

|

|

Revenues YE ($ millions) (Source: Company data) |

5,235 |

5,634 |

4,092 |

5,968 |

4. “Name yet to be decided Recession”: January 2022 – ? . We have had two consecutive quarters of negative GDP (-1.6% and -0.9%) and the jury is still out on whether we are in a recession. But how has the top line fared in the last two quarters? Expeditors had the best Q1 and Q2 in its history as a public company with QOQ revenues up at 39% and 27% respectively. With all the talks of inflation and wage growth, Expeditors has also been able to grow its bottom line significantly over the same periods

|

Source: Company data |

2021 – Q1 |

2021-Q2 |

2021-Q3 |

2021-Q4 |

2022-Q1 |

2022-Q2 |

|

Revenues ($ millions) |

3,357 |

3,609 |

4,319 |

5,396 |

4,664 |

4,603 |

|

EPS (Diluted) |

1.67 |

1.84 |

2.09 |

2.66 |

2.05 |

2.27 |

Valuation

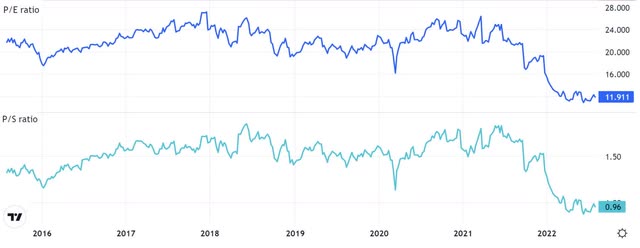

Valuation is always tricky for young growing companies and when investing is all the rage in these companies. Arguments can be made on both sides on why something is over valued or undervalued. However, for a mature business such as Expeditors this gets easier.

We will briefly touch upon PE and PS ratios and leave out PB ratio as PB ratio would not work well for an asset-light company such as Expeditors. Looking at the chart below, you can see that recent gyrations of the market has resulted in both the ratios trending down over the last year.

Valuation metrics (Tradingview)

Calculating the PE ratio using trailing twelve month data

To calculate current PE ratio by incorporating the earnings from the latest quarter let us use the stock market price as of this writing ($103) and trailing twelve month earnings (Diluted EPS – $9.07). This gives us a ratio of 11.3 far below the highs from last year.

Calculating the PS ratio using trailing twelve month data

To calculate current PS ratio by incorporating the latest quarter results let us use the market capitalization of the stock as of this writing ($16.75 B) and divide it by the trailing twelve month revenues ($18.98 B). This gives us a ratio of 0.88 far below the highs from last year.

As a step further in our exercise, let us see how our current multiples stack against the broader market.

By comparing the EXPD’s metrics with SP500, sector average and industry average it is quite clear that the stock has been unfairly punished from recent market turbulence. One of the other contributing factors could be the cyber attack where the company had to make their systems non-operational for a period of time to recover from the attack. From their February press release –

We are incurring expenses relating to the cyber-attack to investigate and remediate this matter and expect to continue to incur expenses of this nature in the future. Depending on the length of the shutdown of our operations, the impact of this cyber-attack could have a material adverse impact on our business, revenues, results of operations and reputation

Naturally from their recent earnings call, I was curious to see if the management was able to quantify the impact and how this affected their recent quarter. From their recent earnings press release –

During the second quarter we continued the recovery from the February cyber-attack and re-established digital connections with many of our customers, which limited our ability to move cargo through our systems…

In the three and six months ended June 30, 2022, the Company incurred, as a result of our inability to timely process and move shipments through ports, approximately $22 million and $62 million, respectively, in incremental demurrage charges, where the Company has direct liability for this obligation. These costs are recorded in customs brokerage and other services expenses…

Additionally, principally in the first quarter, the Company incurred investigation, recovery, and remediation expenses, including costs to recover its operational and accounting systems and to enhance cybersecurity protections…Total amounts recorded for the items above for the three and six months ended June 30, 2022 were approximately $6 million and $28 million, respectively, and are reported in other operating expenses. The Company does not expect to incur significant capital expenditures as a result of the cyber-attack

From the above statements it is clear that the cyber attack incident is in the rear view mirror and given that the company had the best Q2 in its history, the financial impact has been minimal. If the low valuation is because of this reason, it is not justified and the stock can be considered a bargain at these levels.

Forward PE and PS multiples

I try to avoid forward looking multiples as much as I can, since they can be steeped in bias or arbitrarily set low expectations so that the estimates could be beaten or continuously adjusted to suit a story. However, if we are forced to take this path let us see how this would look at least for the full year 2022. Going by the strong performance of Q1 and Q2, let us consider a range of growth scenarios and see how this would affect our valuation ratios with the current stock price.

| EPS Growth | 10% | 20% (Avg QOQ observed for Q1 and Q2) | 30% |

| Forward PE (full year 2022) | 11.3 | 10.4 | 9.58 |

| Revenue Growth | 10% | 30% (Avg QOQ observed for Q1 and Q2) | 40% |

| Forward PS (full year 2022) | 0.92 | 0.78 | 0.72 |

Even going by the most conservative estimate of 10% (far below the growth observed in the last two quarters), we see compressed multiples suggesting us that the stock is undervalued at current levels.

Assumptions and factors affecting the ratios

Elaborated further on risks and challenges, forward looking ratios can be affected by a variety of factors. In the considered scenarios, we assume growth to stay at a minimum of 10% with the most optimistic scenario exceeding the growth seen in the first two quarters. If we are presented with a sector slowdown or face macro challenges, growth may remain flat for the year or even decrease YoY which would put our ratios near or above market average.

Risks/Challenges

With a strong presence in China where a large part of Q1 and Q2 were affected by lockdowns, a slowing economy and an overall drop in demand, Expeditors was still able to pull off the strongest Q2. Could we see some lag effects on the financials in the following quarters? Possibly. Management in its recent earnings release mentioned the word “uncertain” five times and this could adversely impact revenues. Management still mentions about unmet capacity and various other bottlenecks in addition to any left over fallout from the cyber attack, continuing to affect operations in the near term.

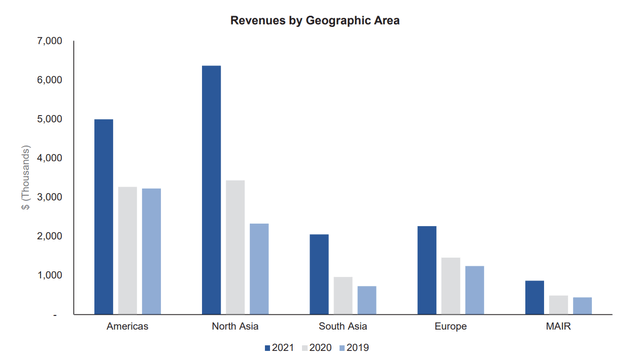

Additionally, notwithstanding the fallout from the Ukraine crisis, there are strong geopolitical risks associated with China and from their latest annual report, biggest portion of their revenues (39%) are associated with North Asia which could come under pressure in the worse case scenario.

Revenue breakdown by area (Annual Report)

Source: Annual Report 2021

Decision and Final Position

Global logistics market expected to grow at a 6.8% CAGR during 2022-2030. With a surge in growth in e-commerce logistics hampered by container shortages, port congestion, truck driver shortages, and restricted capacity in freight market, it only makes more sense to leverage the expertise of global logistics companies such as Expeditors.

A strong balance sheet and financial health, unjustified low valuation, a consistent history of returning value to shareholders through dividends and stock buybacks in addition to its past performance during recessions, it’s hard to dismiss the defensive play here. In the coming weeks, I will be initiating a long position in EXPD and hope to benefit from its performance in the future.

Be the first to comment