Автор/iStock via Getty Images

Looking to take advantage of supply chain disruptions and inflation? With Europe shifting from Russian energy supplies, there has been a lot of disruption in the energy market, leading to higher prices.

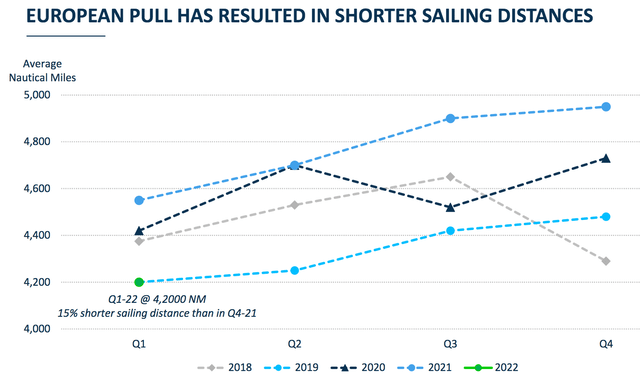

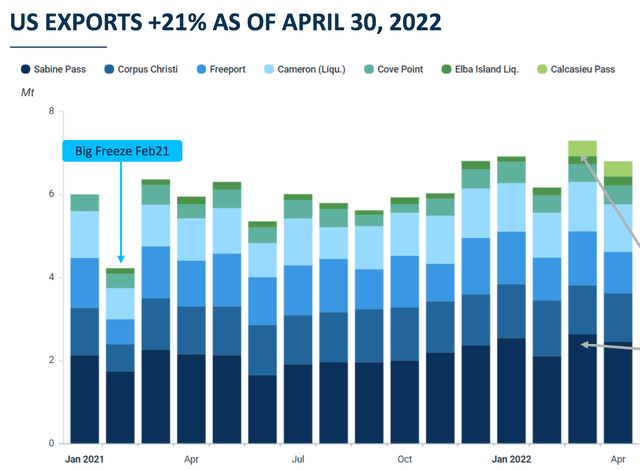

Initially, this decreased the sailing time by 15% in Q1 ’22 for LNG vessels, with U.S. LNG exports to Europe jumping 21% in January – April ’22:

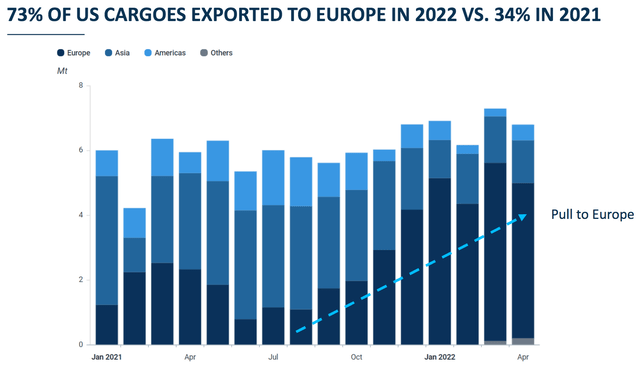

Europe has more than doubled its U.S. LNG imports so far in 2022, with 73% of U.S. cargoes going to Europe, vs. 34% in 2021:

We’ve long wondered why Europe wasn’t buying more LNG from the U.S., a long-time ally, instead of buying so much from Russia, a potentially unstable supplier. Price isn’t everything, is it? What good is a cheaper price when your major supplier wants to destabilize a nearby region via an invasion?

Profile:

Flex LNG Ltd.(NYSE:FLNG), through its subsidiaries, engages in the seaborne transportation of liquefied natural gas (LNG) worldwide. As of February 16, 2022, it owned and operated nine M-type electronically controlled gas injection LNG carriers; and four vessels with generation X dual fuel propulsion systems. It also provides chartering and management services. Flex LNG Ltd. was incorporated in 2006 and is based in Hamilton, Bermuda. (FLNG site)

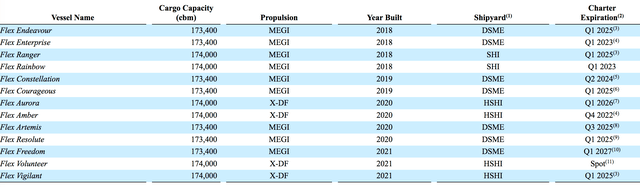

FLNG has one of the youngest fleets in the LNG shipping sub-industry – ranging in newbuild dates from 2018 to 2021:

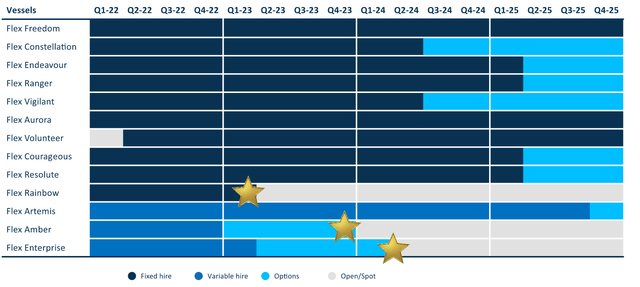

It already has 98% of its vessels fully utilized for 2022, and this week management just secured long term charters for 3 other vessels, the Flex Rainbow, Flex Enterprise, and Flex Amber, on new Time Charters for 7 years with a supermajor. These charters will start in Q3 2022 with expiry in Q33 2029.

Also, the Charterer of Flex Rainbow, a large global trading company, has agreed to a new 10-year fixed rate Time Charter for Flex Rainbow, which will start in direct continuation of the existing Time Charter, which expires in January 2023. The new Time Charter will expire in early 2033.

These charters add ~$750M of fixed backlog to FLNG’s backlog, for a firm minimum backlog of 54 years. (FLNG site)

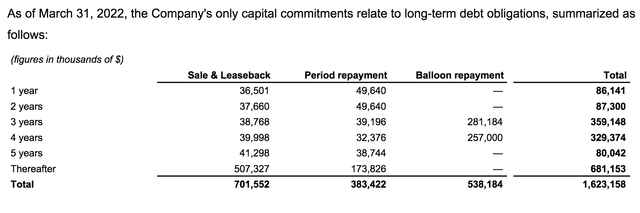

Earnings:

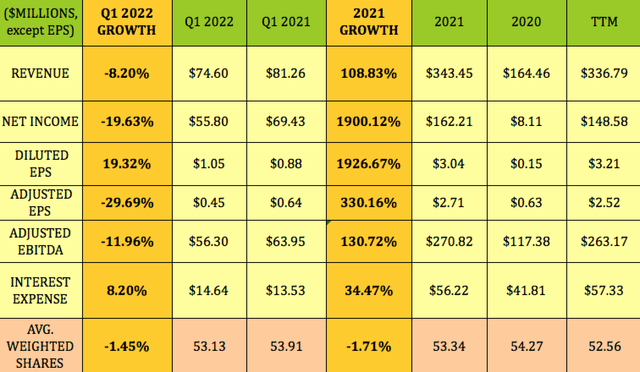

2021 was a big growth year for FLNG, with 3 new vessels added to the fleet, and surging prices. Revenue more than doubled, while Net Income and Diluted EPS had 4-digit gains. Adjusted EPS and EBITDA both had 3-digit gains.

Q4 ’21 saw all-time high revenues, net income, EBITDA, and Adjusted net income, thanks to high TCE rates, which averaged $95,908/day, vs. $68,341/day in Q4 ’20.

The spot market cooled off in Q1 ’22, with the average Time Charter Equivalent “TCE” rate of $62,627/day, vs. $95,908/day in Q4 2021. However, they began to recover in late February, with the result that FLNG began getting higher, premium long term charter rates for its vessels. Management reported that the forward market was also pricing in a much tighter freight market for the second half of 2022.

That should bode well for FLNG’s Q3 -Q4 earnings.

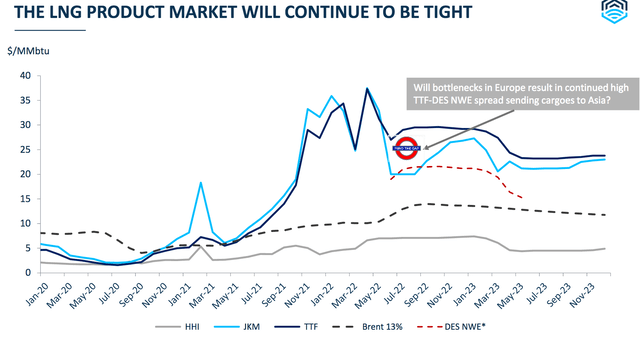

Looking forward, the LNG product market is expected to have strong demand in 2022-2023. There are bottlenecks in Europe, as the overall supply chain must develop the correct infrastructure to handle different sourcing.

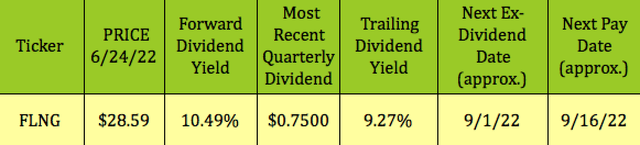

Dividends:

The most recent dividend was $.75, giving FLNG a forward dividend yield of 10.49%, with a trailing yield of 9.27%.

Management appears to be committed to a $.75/quarter dividend, which may not be covered by earnings in some quarters, but should be covered on average for the year. Management said on the Q1 ’22 call that:

“we prefer having a stable dividend level rather than adjusting up and down every quarter. This means that we sometimes pay out more and sometimes less than earnings, but over the longer term this nets out and we aim to pay out our full earnings over the cycle.

“We apply a balanced scorecard to assess the appropriate dividend level. For Q1 the earnings only received a yellow light, but with a large backlog strong outlook and very sound financial position, we expect all the lights to turn green again shortly.”

Management uses Adjusted Net Income to assess its earnings and dividend sustainability:

“Adjusted net income represents earnings before write-off and accelerated amortization of unamortized loan fees, foreign exchange gains/loss and gain/loss on derivatives financial instruments held for trading.” (FLNG site)

FLNG’s trailing dividend payout ratio is over 1X on an Adjusted EPS basis- a high figure.

However, the Adjusted EPS figure also includes a large amount of non-cash Depreciation. Adding back the $1.34/share in depreciation for the last 4 quarters brings a dividend payout ratio of 68.57%:

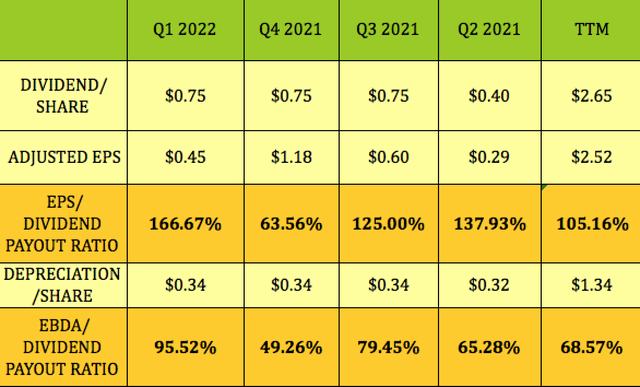

Profitability & Leverage:

FLNG’s ROA trails the shipping industry average, whereas its ROE is superior, as is its EBITDA Margin. Its Debt/Equity leverage is much lower, Net Debt/EBITDA leverage

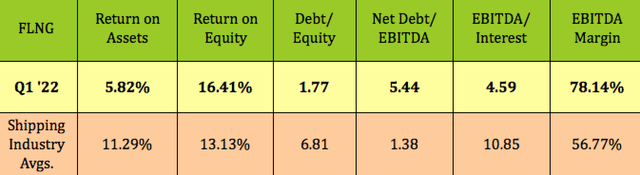

Debt & Liquidity:

In March 2022, management signed a $375M term and revolving credit facility, with an accordion option to increase this by $125 million, secured against an additional vessel. The facility will be secured by the vessels Flex Ranger, Flex Rainbow and Flex Endeavour, while Flex Enterprise is a candidate for the accordion option. In April 2022, the Flex Ranger and Flex Rainbow completed their re-financing, with net cash provided to the Company of $11.5 million. (FLNG site)

FLNG’s earliest balloon payment won’t come until 2025, when ~$281M comes due. 2026 will have a $257M balloon payment due:

Performance:

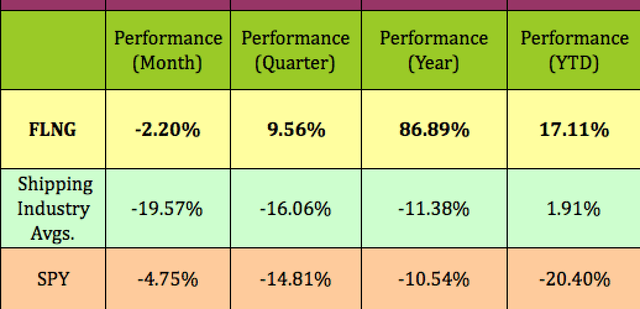

Like other Energy-related stocks, FLNG has outperformed the market over the past month, quarter, year, and so far in 2022, turning in mostly positive price gains, vs. the S&P’s (SPY) negative price movement. It has also outperformed its industry by wide margins over these periods.

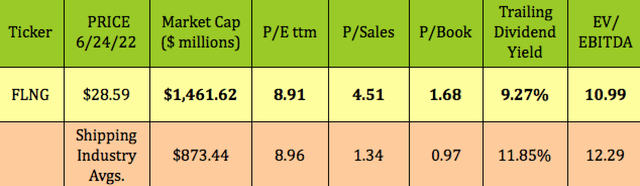

Valuations:

Except for EV/EBITDA and P/E, FLNG is getting higher than average valuations than those of its industry.

Hidden Dividend Stocks Plus Hidden Dividend Stocks Plus

Analysts’ Price Targets:

At $28.59, FLNG is ~2% over analysts’ $27.94 average price target, and 16.6% below the $34.27 highest price target.

Parting Thoughts:

Given its strong updated charter backlog, FLNG should have stable and strong earnings in 2022 and beyond, which should support its dividend. However, the shipping industry can be quite volatile, so don’t bet the ranch. We rate FLNG a speculative BUY.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment