carlosgaw/E+ via Getty Images

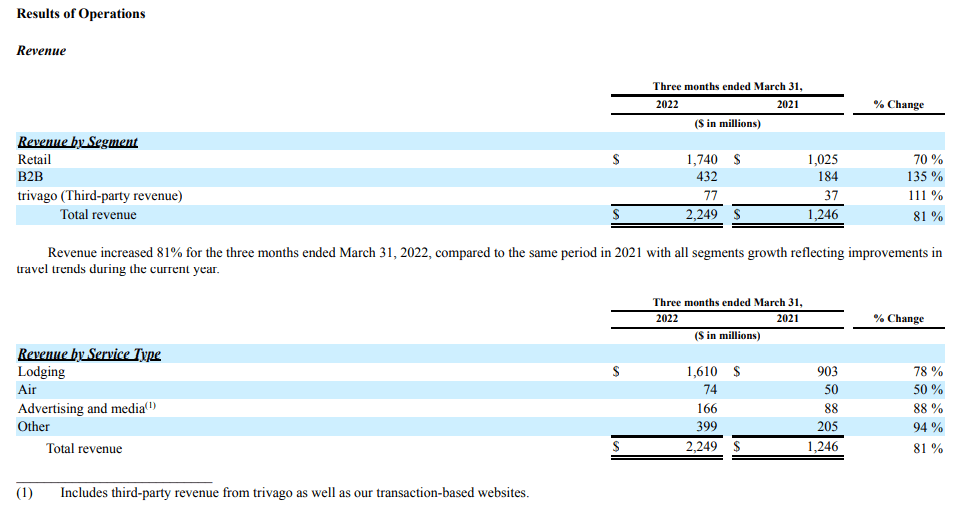

Online travel platform Expedia’s (NASDAQ:EXPE) Q1 2022 results reflected a recovery from the same quarter in pandemic-hit year 2021 although results remain below pre-pandemic year 2019. Revenues rose to USD 2.249 billion, up 81% YoY from USD 1.246 billion Q1 2021, but still lower than the USD 2.609 billion recorded in Q1 2019. The recovery, while stellar, was far outpaced by rival Booking Holdings (BKNG) however, who reported a 136% YoY increase in revenues during the quarter.

All service types and segments saw robust YoY growth. By segment, B2B (Expedia’s second biggest segment accounting for about a fifth of revenues) led the way with a 135% YoY increase in revenues. Expedia’s Retail segment (the largest accounting for 77% of revenues), saw revenues rise 70% YoY. Retail recovery lags B2B because several popular tourist destinations such as Japan were only recently opened to international tourists, however they were open to business travelers such as managers and investors of international companies.

By service type, Expedia’s Other segment (which includes car rental, insurance, destination services and other fees) led the way with a 94% YoY increase in revenues to USD 399 million followed by the Advertising & Media business which saw revenues rise 88% YoY to USD 166 million. Lodging, which accounts for 71% of revenues, saw revenues surge 78% driven by growing travel demand and a rise in average rates for rooms booked on the platform; room nights rose 52% in Q1 2022, compared to a 35% increase in Q1 2021, and a 55% decline in Q1 2020. Meanwhile Average Daily Rates (‘ADRs’) for rooms booked on Expedia Group websites rose 20% in Q1 2022, unchanged from Q1 2021 when ADRs also rose 20% but considerably better than Q1 2020 when ADRs increased just 3%. This in turn helped drive a 17% increase in revenue per room night during the quarter.

Expedia Q1 2022 Form 10-Q

Source: Expedia Q1 2022 Form 10-Q

Near term positives from continuation of global travel recovery

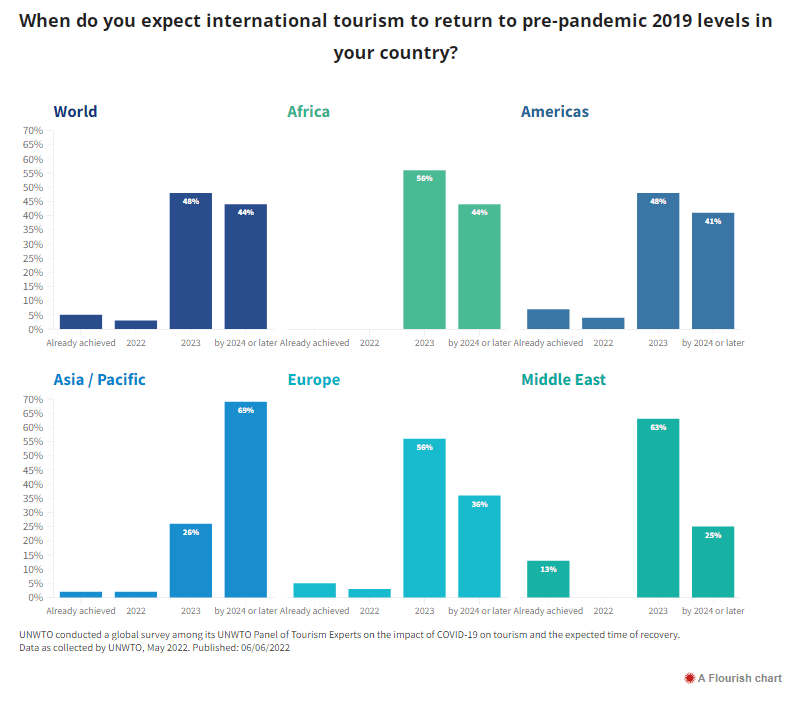

The emergence of new covid variants has so far had limited impact on global travel which has been recovering at a strong pace and the momentum is expected to continue. According to the UNWTO, international tourism saw a 182% YoY increase in the quarter ended March 2022 with an estimated 117 million international arrivals compared with 41 million in Q1 2021. Of the extra 76 million tourist arrivals recorded in Q1 2022, more than 60% (or 47 million) were recorded in March alone suggesting the recovery is gathering pace. International tourists arrivals remain below 2019 levels but could be reached by 2023 or 2024 according to experts surveyed by the UNWTO (in 2022, international tourist arrivals are expected to reach 55% to 70% of 2019 levels). The recovery could help Expedia’s top line catch up to pre-pandemic levels (FY 2021 revenues of USD 8.6 billion is slightly less than three-quarters of FY 2019 revenues of USD 12 billion).

UNWTO

Source: UNWTO

Risks

Although headwinds from the covid pandemic are gradually receding with border restrictions lifting and international travel recovering, soaring inflation could measurably cut into disposable incomes which could affect consumer spending on discretionary goods and services such as travel, delaying the industry’s recovery. Although pent-up demand might support travel demand despite macro challenges, travelers could trade-down towards more budget-friendly travel itineraries (travelers could opt for cheaper lodging for instance which could affect ADRs and therefore limit Expedia’s topline recovery).

Longer term, supplier consolidation and the threat of new entrants are key risks. Hotels are increasingly promoting direct bookings rather than relying on bookings from OTAs (Hilton’s ‘Stop Clicking Around’ campaign is an example of this ambition) not only to save costs by cutting out the middleman (according to a report, hotels pay 15% – 30% of the value of a booked stay, which is a significant percentage), but also to have greater control over customer relationships (for instance through loyalty programs which customers often cannot access through OTAs).

Meanwhile, tech giants such as Amazon (AMZN) and notably Google (GOOGL) (GOOG) are increasingly gaining traction in the online travel space and their entry could result in significant competitive pressures for pure-play OTAs such as Expedia which could impact profitability in the coming years. Google’s dominance in search as well as its massive financial resources give the company a tremendous advantage in terms of business model, data, and capital in the OTA space. Stiffer competition may necessitate increasing marketing spend for Expedia (much of which is spent on Google for traffic generation), which not only cuts into profitability, but also increases Google’s war chest, further amplifying Google’s competitive advantage. This risk is particularly pertinent to Expedia who tends to rely heavily on Google for traffic (as opposed to rivals such as Booking and Airbnb who generate more direct traffic).

Emerging markets are also seeing their share of competition from the likes of local players such as MakeMyTrip (‘MMT’) and AirAsia. These players likely have a better understanding of the local culture and market and may thus have an edge over Expedia when competing in these regions.

Financials

Cost saving measures to boost profitability and margins

Prior to the onset of the pandemic, Expedia had been actively implementing cost saving programs to increase efficiency and profitability. These programs were accelerated during the pandemic to conserve cash (Expedia highlighted the removal of USD 700-750 million in annualized run-rate fixed costs during 2020-2021) and the results of these efforts could help support margins and profitability in the coming years.

Expedia is quite highly levered which may constrain its ability to pursue inorganic growth opportunities. Rival Booking however has a slightly worse debt position.

Booking however has a superior working capital position, with Booking’s current ratio at 1.72 versus Expedia’s 0.89. This is largely due to Expedia’s merchant model (whereby OTAs buy hotel rooms in bulk and resell them at higher rates to customers) which accounts for more than 60% of revenues (as opposed to Booking who derives over 60% of its revenues from commission-based agency revenues).

|

Net margins % |

4.8% |

4.2% |

|

Return on assets % |

1.3% |

8.5% |

|

Current ratio |

0.89 |

1.72 |

|

Total debt to equity |

226.3 |

231 |

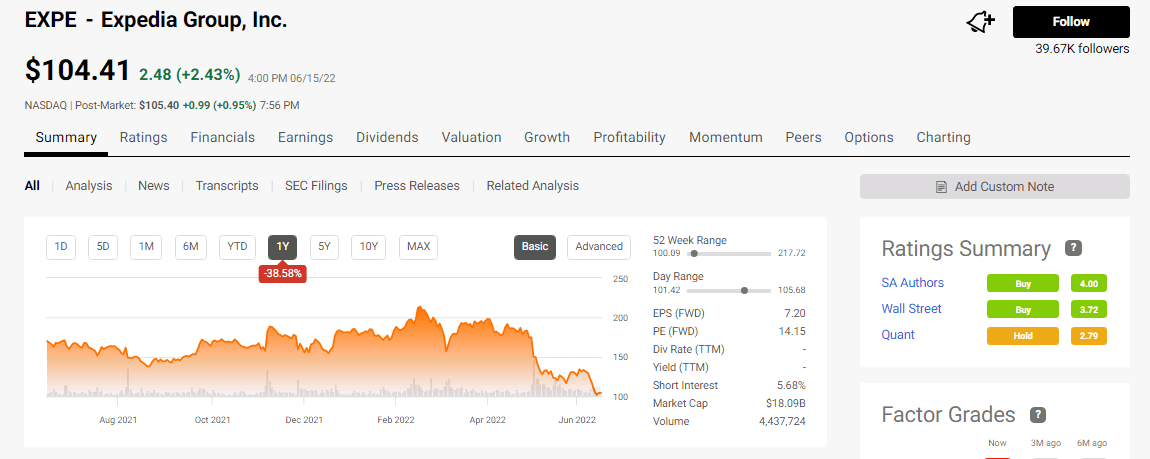

Expedia’s stock is down nearly 40% over the past year and the company trades at a P/E of about 15, lower than Booking who trades at a P/E of 19. Booking however has a much lower short interest of 1.95% versus Expedia which has a short interest of nearly 6%. Pessimism over Expedia’s prospects may partly be due to its core North American market where inflationary pressures appear to be stronger than other developed countries (last year’s inflation rate of 4.7% in the U.S. was the highest among G7 countries) and there are views that the outlook for U.S. inflation is likely be worse than the eurozone (while Expedia depends on North America, rival Booking is more dependent on Europe for business).

Seeking Alpha

Summary

The travel industry continues to recover and signs point to continued recovery going forward. However, soaring inflation may limit top line recovery as consumers either cut back on non-essential discretionary spending such as travel, or downgrade to more budget-friendly itineraries.

Despite risks from the rise of direct bookings and the entry of tech giants such as Google and Amazon, OTAs are still likely to exist given their numerous advantages such as offering customers greater choice and ease of comparison, and for smaller hotels, increased lead generation. Expedia, as the largest player, is among the better positioned to weather and adapt to rising competitive pressures; Expedia could for instance pursue growth by acquiring smaller competitors, and to counter competitive threats from tech giants, Expedia could explore strategic changes to its business model such as by transforming into a one-stop travel shop offering the entire gamut of travel planning services such as tours, tickets, etc, which not only serves as a major differentiator (since it would likely entail a greater level of human interaction than a tech company such as Google would provide), but could also be potentially more profitable too. Expedia already appears to be moving towards this direction; this year, the company announced it was revamping its website and apps to focus more on working with travelers rather than purely focusing on booking volumes. The new brand positioning includes the tagline, “It matters who you travel with” illustrating the company’s effort to be more of a travel companion or guide. Expedia noted that it will make its largest marketing spend in five years towards this rebranding effort. How successful this effort will be however remains to be seen.

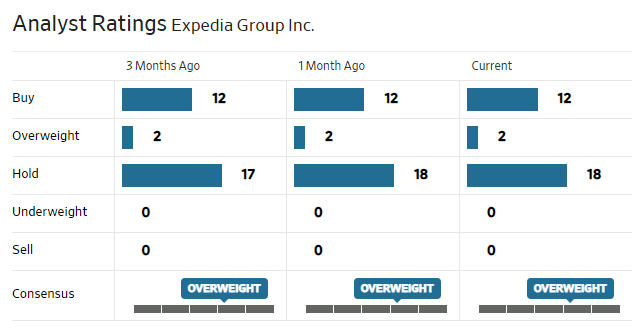

Analysts are largely neutral on the stock.

WSJ

Source: WSJ

Be the first to comment