Kwarkot/iStock via Getty Images

Ares Commercial Real Estate Corporation (NYSE:ACRE) remains an appealing investment for those seeking a consistent stream of passive income.

In the second quarter, the commercial REIT continued to cover its dividend with distributable earnings because it is well-managed and has a healthy portfolio. Furthermore, the trust has significant floating rate exposure, shielding investors from rising inflation and interest rates.

Since the central bank’s stance on inflation has become much more aggressive in 2022, Ares Commercial Real Estate can be considered not only a passive income generator but also a top inflation hedge.

Q2-22 Originations Driving Portfolio Growth

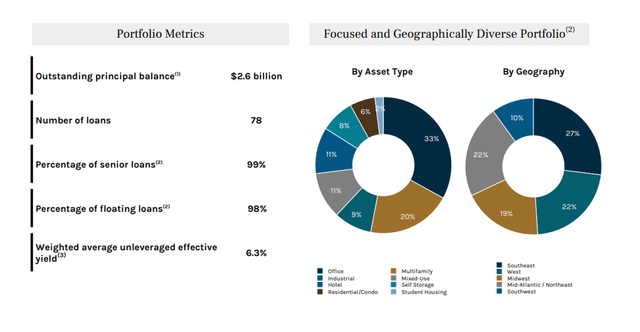

Ares Commercial’s loan portfolio is expanding and in good shape. As of June 30, 2022, the trust’s loan portfolio was valued at $2.6 billion, representing an 8% QoQ increase amid strong demand for new loan originations in the commercial real estate market.

Ares Commercial’s loan composition has not changed significantly since the end of the first quarter, implying that office and multi-family properties accounted for roughly half of all loan investments.

Portfolio Overview (Ares Commercial Real Estate Corp)

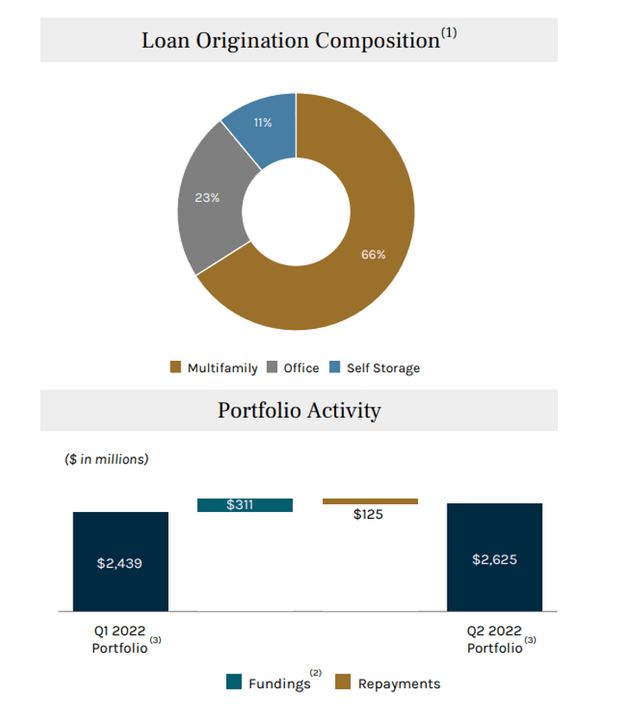

As previously stated, Ares Commercial’s portfolio increased by 8% QoQ in Q2-22, or approximately $200 million, as a result of $311 million in new funded loans minus $125 million in loan repayments. The multi-family sector received the majority of new loans (66%) in the second quarter. Ares Commercial’s new loans in Q2-22 were all senior secured and, importantly, attached to floating rates.

Loan Origination Composition (Ares Commercial Real Estate Corp)

Because the central bank has shifted its monetary policy and is now determined to combat out-of-control inflation, the feature of floating rate loans has become significantly more important in 2022.

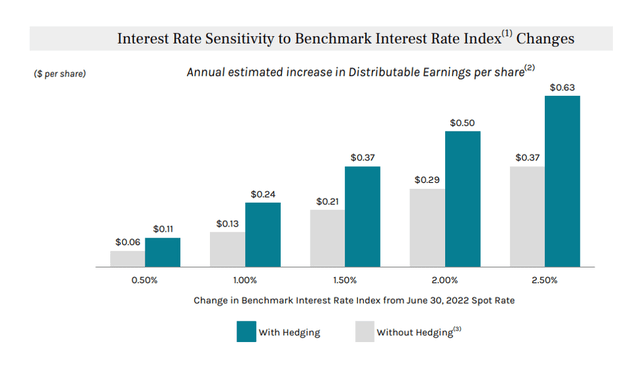

Ares Commercial has positioned its loan portfolio to profit from interest rate increases. Loan portfolios weighted toward floating rate loans will generate higher net interest income if the central bank continues to raise interest rates, as we are seeing right now. In June and July, the central bank raised interest rates by 75 basis points in a row, and more are on the way.

Ares Commercial investors can expect higher distributable earnings because the trust’s agreed loan rates are resetting to higher market interest rates, resulting in a safer dividend (lower pay-out ratio) and more cash for the company to potentially increase its pay-out.

According to Ares Commercial’s most recent interest rate sensitivity table, a 100-basis-point increase in the benchmark interest rate index would result in $0.24 per share higher annual distributable earnings.

Interest Rate Sensitivity Table (Ares Commercial Real Estate Corp)

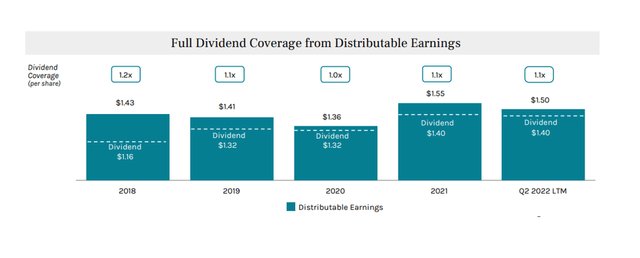

Ares Commercial’s dividend has been fully covered by the trust’s distributable earnings, which amounted to $0.38 per share in the second quarter, while the core dividend pay-out (excluding $0.02 per share supplemental dividends) remained at $0.33 per share.

Since 2018, Ares Commercial has consistently covered its dividend with distributable earnings, with pay-out ratios ranging from 1.0 to 1.2x.

Dividend Coverage From Distributable Earnings (Ares Commercial Real Estate Corp)

7% Discount To Book Value

Given the performance of its portfolio and the interest rate upside attached to its floating rate-heavy senior loans, I believe Ares Commercial’s stock should trade around book value.

Ares Commercial’s stock is currently trading at a 7% discount to book value, while competitors like Starwood Property Trust Inc. (STWD) and Blackstone Mortgage Trust Inc. (BXMT) trade at a premium. I don’t see why Ares Commercial shouldn’t trade at least at book value.

Why Ares Commercial Could See A Lower Stock Price

Ares Commercial is benefiting from strong loan origination demand, with new loan commitments exceeding repayments in the second quarter, resulting in an increasing portfolio value.

Having said that, a commercial real estate market downturn would almost certainly hurt Ares Commercial. The trust is dependent on the demand for new commercial real estate-backed loans. If the music were to stop in the industry, the trust’s earnings potential may suffer as recent distributable earnings tailwinds turn into headwinds.

Interest rates are expected to rise further as long as inflation continues to harm consumers. Because Ares Commercial’s investment portfolio is heavily weighted toward floating rate loans, a sudden change in the short-term interest rate path may also be viewed as a risk.

My Conclusion

The trust’s distributable earnings more than cover Ares Commercial’s $0.35 per share distribution ($0.33 per share base + $0.02 per share supplemental).

Net fundings were strong in the second quarter, thanks to steady demand for new commercial real estate loans.

The interest rate upside is appealing in this high-inflation environment and contributes to the trust’s distributable earnings prospects.

Be the first to comment