procurator/iStock via Getty Images

Investment Thesis

Post IPO Biotechs Have Been Performing Poorly For Investors – But Ideaya Is Bucking That Trend

Investors looking to buy pharmaceutical stocks are probably aware that a protracted bear market has been pulverising the biotech sector of the stock market, with early-stage drug developers particularly hard hit.

The blame for this partly lies with the private sector’s desire to keep building new biotech companies and bringing them to market via big money Initial Public Offerings (“IPOs”), usually raising sums in the triple-digit millions in the process, and often with only one or two pre-clinical assets in their pipelines. These types of companies have generally seen their share prices collapse post IPO, and the situation is particularly acute in the oncology field.

Despite promising breakthrough technology, precision medicines leveraging genetic profiling, new drug targets, and best-in-class safety and efficacy profiles across a range of cancers, the likes of, e.g., Relay Therapeutics (RLAY), Kymera Therapeutics (KYMR), and Recursion Pharmaceuticals (RXRX), which raised respectively $400m, $173m, and $435m, have seen their share prices decline by respectively 67%, 57%, and 79% since listing.

There are countless more examples of biotechs that have raised significant sums only to produce nothing of note in the clinic, and although it would be fair to argue that these companies need more time to fine-tune their approaches, it also would be fair to say that investors have to some extent been hoodwinked into thinking these companies would offer up some tangible signs of progress – or else why list on the public markets at all?

In this context, a biotech that IPO’d in 2019, Ideaya (NASDAQ:IDYA), raising a comparatively modest ~$55m, with a mission to develop targeted cancer therapies, and explore the field of “synthetic lethality,” is one that I would single out as having both maintained its IPO valuation, whilst delivering tangible progress in the clinic, and crucially, attracting two big pharma partners in GlaxoSmithKline (GSK) and Pfizer (PFE).

In this post, I will discuss what lies ahead for a company that I believe could realize some significant upside in the second half of 2022, although there’s a high level of risk here, since the market continues to punish anything but exceptional progress and data relating to oncology drug development with hefty sell-offs.

Ideaya Biosciences Overview and Pfizer/GSK Partnership

Ideaya was built from scratch by entrepreneurial biotech venture capitalist Yujiro Hata, who remains president and CEO of the company, and who was able to successfully raise $140m for the company prior to listing, attracting funding from the likes of Novartis (NVS) and Roche (OTCQX:RHHBY) as well as his own VC firm 5AM Ventures, fellow biotech VC Canaan Partners, and WuXi Healthcare Ventures.

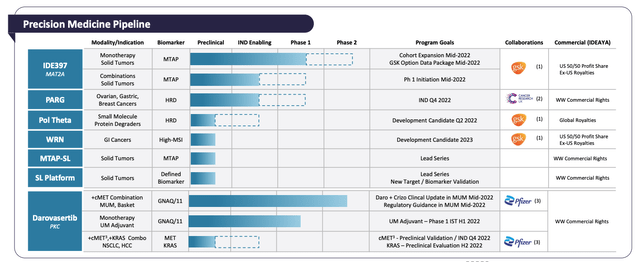

Ideaya’s Precision Medicine Pipeline: (Corporate Presentation)

Ideaya’s most advanced asset is Darovasertib, a Protein Kinase C (“PKC”) inhibitor, indicated for genetically-defined cancers having GNAQ or GNA11 gene mutations. This drug is progressing through a Phase 2 trial in combo with Crizotinib, a cMET inhibitor developed by Pfizer. Crizotinib is approved to treat second-line Non-Small Cell Lung Cancer (“NSCLC”) and pediatric lymphoma under the name Xalkori, earning ~$122m of sales in Q421.

The target is metastatic uveal melanoma (“MUM”), with 72 patients enrolled as of the end of Q122. Data from the study is set to be announced imminently, and if positive, the next step would be a potentially registrational trial in MUM.

On the synthetic lethality front, Ideaya’s partnership with GSK – which paid $100m up-front, and involves >$3bn in potential milestone payments across three programs, includes a candidate designed to inhibit methionine adenosyltransferase 2a (“MAT2A”) – called IDE397 – and indicated for patients with methylthioadenosine phosphorylase (“MTAP”) deletion – a patient population covering ~15% of all solid tumors. The dose escalation portion of its Phase 1 study had enrolled 21 patients as of Q122. Profits on future sales will be split 50/50 with GSK, with $465m of development milestones on the table.

The second candidate in this partnership is a Werner Helicase (“WRN”) inhibitor, indicated for patients with tumors expressing high microsatellite instability (“MSI”). According to a statement in Ideaya’s 2021 10K (annual report) submission to the SEC:

Germline loss of function mutations in WRN lead to premature aging and pre-disposition to cancer. MSI is a change in the DNA content of a tumor cell in which the number of repeats of microsatellites, short repeated sequences of DNA, differ as cells divide.

High MSI is present in about 15% of gastrointestinal tumor cancers, including in approximately 22% of stomach adenocarcinoma and 16% of colorectal cancer. Tumors with high MSI are routinely assessed in multiple diagnostic profiling tests.

Inhibition of WRN inhibits the survival of MSI cancer cells, and in in vivo studies, Ideaya says it has observed 100% tumor growth inhibition (“TGI”) in a cell line-derived xenograft (“CDX”) model. Management expects to nominate a single candidate for development in the clinic sometime in 2023.

The third candidate in the GSK agreement targets DNA Polymerase Theta, (“Pol Theta”), which “promotes DNA repair by Microhomology-Mediated End-Joining (“MMEJ”) – an error-prone mutagenic DNA repair pathway”, according to an Ideaya Corporate Presentation.

Pol Theta is over-expressed in Homologous recombination deficiency (“HRD”) cancers, and, in combo with Pfizer’s Niraparib – a PARP inhibitor marketed and sold as Zeluja, making sales of ~$120m in Q122 – has demonstrated “significant” tumor regression in a DLD1/BRCA2 xenograft model.

Pfizer Summary

To summarize the Pfizer/GSK opportunities, beginning with Pfizer, there is an obvious share price moving catalyst approaching soon in the form of the MUM combo trial data.

In May, the FDA granted Darovasertib Orphan Drug designation for Uveal Melanoma, which means the drug would have seven years of statutory marketing exclusivity if approved, and it appears management is targeting the first-line setting, after preliminary data showed “robust clinical activity with manageable side effect profile.”

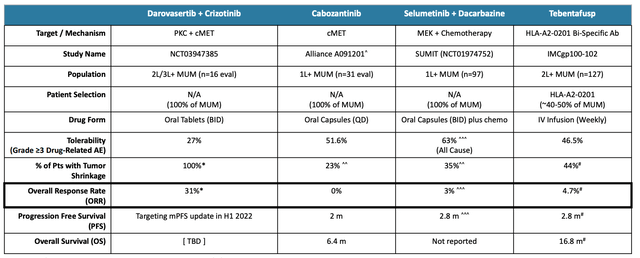

Darovasertib + Crizotinib vs the competition in MUM. (Corporate Presentation)

As we can see from the above table, management has some good reasons to believe an approval is likely, with an Objective Response Rate (“ORR”) of 31% being clearly superior to rivals, albeit from a smaller patient population, and with the caveat that is never wise to directly compare rivals’ clinical study data.

There are no currently approved therapies for MUM, although several drugs appear to be prescribed off-label, such as Roche’s multi-billion selling Rituxan, whilst Immunocore’s bispecific T-cell engager Kimmtrack has recently been approved in uveal melanoma.

The opportunity here is, therefore, a little uncertain, although investors can take comfort from the fact that MUM is a 4.2k patient population, implying a market opportunity potentially around the $420m mark based on a list price of $100k, which is about standard for new cancer drug product launches.

Darovasertib is still in trials as a monotherapy, as a UM adjuvant and in GNAQ/11 Skin Melanoma, which raises the addressable patient population to ~7.1k patients. Management will also look at the Darovasertib/Crizotinib combo in liver cancer and NSCLC, based on high MET expressions in these cancers of ~3-5% prevalence, provided Pfizer will agree to supply its drug for these trials.

GSK Summary

In the case of GSK, there are development milestones in play as well as commercial, which ought to provide Ideaya with regular income, although the biotech is cash-rich, with nearly $350m cash to deploy.

That cash is expected to fund operations until 2025, meaning there’s no danger of investors being diluted, unless Ideaya delivers such strong data that it raises at a significant premium, in preparation for a commercial launch, which shareholders are unlikely to object to.

Investors should not get too far ahead of themselves when it comes to the synthetic lethality programs – “a situation in which mutations (changes) in two genes together result in cell death, but a mutation in either gene alone does not,” according to the National Cancer Institute, however, because it’s a new and unproven approach, although certainly, the preclinical data has been impressive.

Management believes the addressable patient population for MTAP deletions is ~75,000 patients, with six indications in play – including NSCLC, head and neck, bladder, gastric, pancreatic, and esophageal.

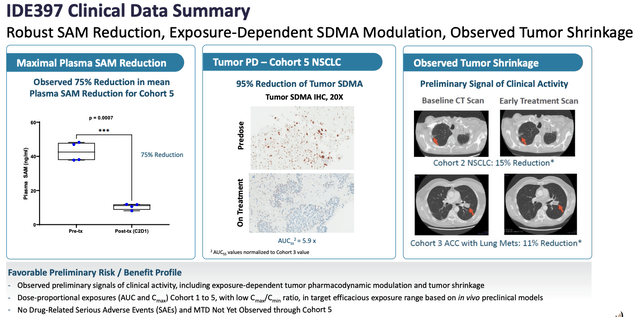

IDE397 clinical data summary. (Corporate Presentation)

As we can see above, there have been some initial signs of efficacy in the clinic for IDE397, although it’s still very early days, and importantly, no drug-related serious adverse events (“SAEs”).

There will be more data arriving soon, from further expansion cohorts, and management hopes to deliver an “option data package” to GSK by “mid-year,” triggering an evaluation period for GSK to decide whether to “opt-in” on the project.

Obviously, it would be a significant blow if GSK opts against co-development – the decision ought to arrive soon and if it does not go in Ideaya’s favor then there’s at least $1bn off the table, while the chances of earning the other $2bn decrease significantly, so investors can expect some significant losses in this scenario.

Presently, it seems as though Ideaya management may be running a little behind schedule since the Pol Theta program does not appear to have selected its final target, which was meant to happen in H122, but as discussed, if you take it on trust that this candidates’ selection will happen very soon, and the IDE397 option data package also arrives soon, then there are certainly some significant near-term catalysts in play that offer substantial upside potential.

It’s hard to speculate over what decision GSK, or indeed Pfizer may make, but according to Ideaya’s 10K, AstraZeneca (Lynparza), Pfizer (Talzenna), GSK itself (Zejula) and Roche are all involved in this development race, and it seems unlikely that GSK would back away now, unless the data was particularly bad, and so far, it hasn’t been bad.

Pfizer is already working on a next-generation version of Xalkori, so the pharma may be slightly less incentivized to continue its collaboration, although Michael White Ph.D, Ideaya’s Chief Scientific Officer (“CSO”), formerly swapped academia for a role as CSO for tumor biology at Pfizer, so there may be some additional leverage for Ideaya here.

PARG Proprietary Opportunity

Away from the collaborations, I also find the PARG program intriguing. The Investigational New Drug (“IND”) application is expected to go to the FDA before the end of this year, and the mechanism of action is similar to poly adenosine diphosphate-ribose polymerase, or “PARP” inhibitors – a successful class of drugs, which includes AstraZeneca’s Lynparza, targeting, e.g., prostate cancer, and breast cancer. Lynparza has already attained blockbuster status and broke $2bn in sales in 2021.

PARG may work in HRD cancers where PARP struggles, Ideaya believes, and it has the preclinical models to suggest that it has the edge over PARP in ovarian, breast, and gastric cancers. It’s very early days, but this is an apparently promising proprietary sideline for the biotech, and perhaps CEO Hata can persuade another large Pharma to join it on its journey through the clinic with its PARG inhibitor.

Conclusion – A Modest Precision Oncology Play That Offers Multiple Route To Success, With A Critical 6 Months Ahead

I opened this post with some observations about the poor performance of recently-listed precision oncology companies, and it seems clear that, outside of the private biotech accelerators and VC firms, much of the jargon surrounding genetic approaches to treating cancer is falling on deaf ears, and investors are losing faith in this sector.

That’s not necessarily surprising because although some great strides have been made in medicine, the likelihood of developing a successful cancer drug is still very low – about one in 10 cancer drugs make it from Phase 1, to being approved, commercially available therapies.

According to data from McKinsey, the top 10 oncology players – big pharmas like Roche, Pfizer, Bristol-Myers Squibb (BMY), GSK, Amgen (AMGN), AbbVie (ABBV), etc., have produced 31 out of 35 blockbuster cancer drugs, and seven cancer drugs accounted for $56bn of the total $143bn cancer drug market in 2019, with 28 others accounting for another $56bn, leaving 219 drugs sharing just $31bn of sales.

As such, investors are right to be wary of newly listed cancer drug developers, and frankly, the terminology used, pre-clinical modelling, xenograft data, etc. is confusing and occasionally, in the case of failing biotechs, deliberately so.

In Ideaya’s case, however, the biotech has had a satisfactory two and a half years since its IPO, both in terms of its valuation, which is higher than it was at the time of $10 per share IPO – shares currently trade at $12 – and in terms of its development pathways.

It has collaborated with two big pharma partners and the next six months ought to be a very interesting period for the company, with a registrational trial in MUM in the offing, which could give rise to its first commercialized product in 2023 perhaps, and a major opt-in decision from GSK expected.

Even if things go against Ideaya in the short term, the company has all the funding it needs to keep developing its technology platform, so it will have more shots at success even if investors endure some pain.

On the more positive side, if results impress and GSK or Pfizer see genuine potential, both of these acquisition-hungry companies could make an offer for Ideaya, which must be an exit strategy that its Venture Capital veteran CEO has considered carefully.

As such, although I wouldn’t say that Ideaya’s current market cap undervalues the company, shares traded as high as $26 only nine months ago, and on the science side, my gut feeling is that some of the company’s drugs and data are genuinely intriguing.

That being the case, there is a temptation to sign up for the Ideaya journey, although because companies are being so heavily punished for the slightest hint of failure at the present time, I may hold off until the catalytic events promised by the end of the first half of 2022 arrive. The risk then is having to pay a premium – Ideaya stock has already shown it can climb twice as high as it trades today.

Be the first to comment