PrathanChorruangsak/iStock via Getty Images

It’s no secret that small-cap stocks have been viciously hammered this year more than any other asset class, amid heightened market volatility. The majority of these names are down primarily due to sentiment, and I favor loading up on a diversified basket of small-cap names to capture the rebound upside. In some cases, however, steep share price drops have also been accompanied by massive erosion of fundamentals, and such is the case with EverQuote (NASDAQ:EVER).

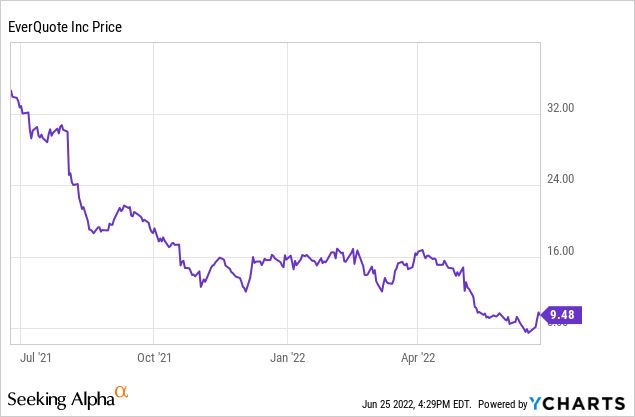

EverQuote is down 40% year to date and 70% over the past year. Once a high-growth, innovative insurtech marketplace, EverQuote has fallen victim this year to the sharp downturn in the auto insurance industry, which is responsible for the lion’s share of its revenue. With no clear path to recovery, EverQuote’s stock price graph has been nearly a vertical line downward:

The Ills Of The Auto Insurance Industry Have Only Intensified

The key question here that many investors are wondering: what, exactly, is going on in the auto insurance industry? Well, the problems are exactly the same as insurer Metromile cited prior to its acquisition by Lemonade (LMND). Accident ratios are spiking, replacement costs of cars are rising, and the auto insurance industry’s profitability is tanking. Because the majority of auto insurance carriers are “traditional” businesses that need to keep a close watch on short-term profits, the immediate solution is to cut down on customer acquisition costs.

EverQuote, meanwhile, derives the majority of its revenue by sending leads to insurance carriers through its comparison marketplace. If insurers are suddenly pulling back their demand for these leads, EverQuote’s core source of revenue suffers.

In EverQuote’s opinion, the problems will get worse before they get better. Speaking during his prepared remarks on the Q1 earnings call, EverQuote CEO Jayme Mendal noted as follows:

As a result, we remain substantially below the levels of carrier demand in our auto verticals that we saw in August 2021 which we believe to be the level to which we will normalize upon the markets recovering.

In Q2, we expect continued strong headwinds from auto carriers. We also expect to experience lower health demand in Q2 of 2022, reflecting seasonality entering the Medicare lock-in period that follows the Q1 open enrollment period.

Let me touch on what everyone wants to know. When will auto carrier demand return and why? To drive expectations about the timing of the recovery in auto carrier demand, we solicit direct input from our carrier partners and we closely monitor their publicly reported profitability trends. The latest collection of data suggests that Q2 demand will likely remain significantly depressed, but that some rebound is indicated to begin by the end of the year, with an expectation for full recovery in the first half of 2023.”

Expect Q2 to be a bloodbath. EverQuote is guiding to only $92-$97 million in revenue, representing a gory -12% y/y to -8% y/y revenue decline (versus 7% y/y growth in Q1). It’s also expecting adjusted EBITDA losses to widen to -$7 million to -$4 million, versus a slight gain in Q1.

Now, the company is banking on a rebound by year-end. There is some justification for this, as carriers like Metromile did apply for rate increases that are pending regulatory approval. Rate increases may help to bolster carrier profitability, but there is an element of risk here too, as policy demand from consumers may weaken in a time when inflation is pinching wallets. I’d prefer not to bank on a year-end/2023 rebound until we see hard evidence that fundamentals are improving.

Will EverQuote Survive Long Enough Through The Trough?

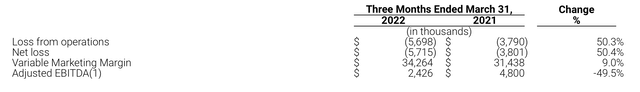

It’s all fine and well to bank on a longer-term rebound, but EverQuote is already in a bit of a pinch. In Q1, while EverQuote managed to maintain positive adjusted EBITDA, its adjusted EBITDA did fall by -50% y/y to $2.4 million, while adjusted EBITDA margins of 2.2% were far worse than 4.6% in the year-ago Q1.

EverQuote Q1 adjusted EBITDA (EverQuote Q1 earnings release)

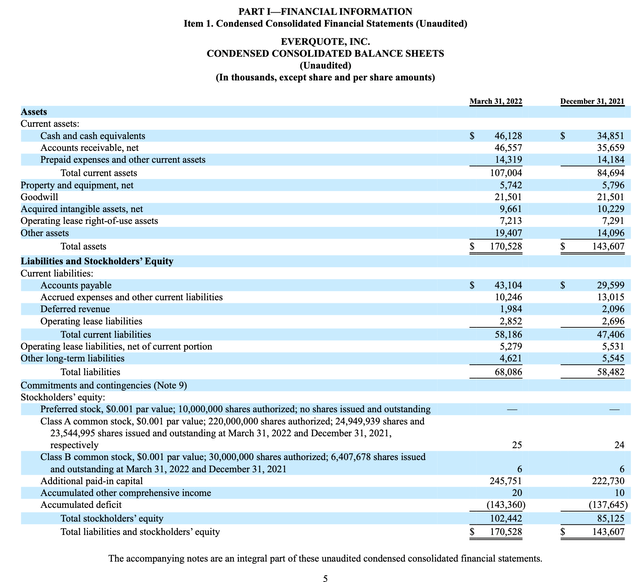

Cash burn also accelerated. Free cash flow of -$4.4 million in Q1 compared to a gain of $2.8 million in the prior Q1. And note that EverQuote isn’t exactly flush with cash. Take a look at the most recent balance sheet below:

EverQuote Q1 balance sheet (EverQuote Q1 earnings release)

The company has $46.1 million of cash left on its books. Part of this cash buffer was raised via a $15 million private placement that the company just executed now. Should this lifeline run dry, it will be hard-pressed to raise either debt or equity capital in this market.

Valuation And Key Takeaways

The only thing EverQuote has going for it: after a deep correction, the company barely has any market value left. At current share prices near $9, the company’s market cap is $287 million. After netting off the aforementioned cash on its balance sheet, EverQuote’s resulting enterprise value is $251 million, which is at just a 0.6x EV/FY22 revenue multiple versus the company’s updated FY22 revenue guidance of $400-$420 million.

But at the same time – we’ve seen EverQuote’s profitability turning south, and with auto insurance market fundamentals expected to continue declining, I’m not confident that EverQuote is anything other than a value trap.

Sell this name – in my view, losses are going to deepen.

Be the first to comment