carmengabriela/iStock Editorial via Getty Images

Article Thesis

BioNTech SE (NASDAQ:BNTX) has reported strong Q4 results and announced a couple of shareholder-friendly moves, such as a dividend and a buyback program. Based on forecasted profits for the current year, shares of BioNTech look very cheap. Investors should consider that profits will most likely not be this high beyond 2022, however. All in all, BioNTech SE is a company with attractive tech, but its future is uncertain. Investors should consider the risks before rushing into this stock that looks very cheap at first sight.

BioNTech Earnings Results

BioNTech SE reported its fourth-quarter earnings results on March 30. The company was able to deliver an outstanding revenue growth rate of 1,500%, made possible by the rollout of its vaccine against COVID over the last year. In late 2020, BioNTech’s sales had still been pretty small, which is why the reported growth rate was so high. Revenues totaled $5.5 billion, with almost all of that being attributable to BNTX’s COVID vaccine Comirnaty.

When we look at BNTX’s sequential growth rate, we see that Q4 actually was weaker than the two previous quarters. BioNTech had generated revenue of $6.2 billion and $7.1 billion in Q2 and Q3, respectively. On a quarter-to-quarter basis, sales thus dropped by around 20%. The explanation for that is the somewhat lower demand for vaccination. In many countries, large amounts of the population have already been double-vaxxed or tiple-vaxxed, which is why the demand for new doses of Comirnaty was weaker in Q4.

The same trend will remain in place going forward, according to management. BNTX’s guidance of €13 to €17 billion for the current year is equal to around $16.5 billion at the midpoint of the guidance range. This implies quarterly sales of slightly above $4 billion, which is well below the Q4 run rate. 2022 will also be significantly weaker than 2021 overall, as BNTX has generated €19 billion in sales last year, versus a guidance midpoint of €15 billion for the current year.

Thanks to the still pretty strong revenue generation in Q4, BioNTech unsurprisingly was quite profitable. The company’s earnings per share came in at €12.18, equal to $13.60. Annualized, that equates to a massive $54, which makes the current share price of $180 look quite low in comparison. But due to the aforementioned deceleration that is expected for 2022, and even more so for 2023, the low earnings multiple based on last year’s peak earnings does not automatically make BioNTech a strong buy.

BNTX Stock Key Metrics

BioNTech has turned from a research-focused, essentially pre-revenue biotech business into a highly profitable company in a very short period of time. The company’s success with Comirnaty has gone hand in hand with drastic improvements in a couple of key metrics.

BioNTech’s net profit margin during the fourth quarter stood at an incredibly high level of 57.3%. Likewise, BNTX’s net margin during all of 2021 was very high as well, at 54%. That is not sustainable in the long run, of course. Major biopharma players such as AbbVie (ABBV) or Pfizer (PFE) oftentimes generate net margins in the 20%-30% range. If BNTX becomes a more diversified biotech company over time, which will be necessary as vaccine revenues will eventually dry up, investors should expect its margins to compress from the current very high level. Profitability is distorted to some degree, thanks to strong revenues that do not require a large sales or R&D team for now, which is why profitability is comparatively high today.

Looking at BioNTech’s balance sheet, we see that the strong results from 2021 have had a huge impact on BioNTech’s equity. At the end of the fourth quarter, net equity stood at $12 billion, up from $1.4 billion at the end of the previous year. Somewhat surprisingly, BioNTech has not seen its cash surge, however. Instead, most of the equity buildup was recorded due to a steep increase in trade receivables. BioNTech has thus earned a lot of money last year, but most of that has not been paid out to the company yet. Presumably, this will happen at some point in 2022, which is why investors can expect BNTX’s cash position to increase meaningfully this year. For reference, a $12.4 billion trade receivables position, when combined with a current $1.7 billion cash position, could easily result in a $10+ billion cash position later this year. When we include profits that will be generated this year, cash could surge to an even higher level.

BioNTech has decided to share some of that wealth with its owners. The company has announced that it would pay out a one-time dividend of €2 per share. This pencils out to a yield of 1.2%, which isn’t especially high, but investors might still enjoy receiving some cash flow this year. More importantly, BNTX has also announced that the company will do a $1.5 billion share buyback program over the next two years. Relative to BioNTech’s current market capitalization of $40 billion, that makes for a return of 3.8%. It should be noted that BNTX’s share count has been rising in recent quarters, however. That is explainable by shares being issued to management and employees as a form of compensation. It is thus not clear how much the share count will actually sink once the repurchase authorization is utilized to buy back shares.

What Is The Outlook For BioNTech?

2022 will be another strong year for BioNTech, although not on the same level as 2021. Profits are forecasted to decline meaningfully this year, to around $27 per share.

In its current state, BioNTech is of course still very reliant on its vaccine sales. Since we don’t know the future trajectory of the pandemic, e.g. when it comes to possible mutations, there are significant uncertainties when it comes to the actual revenue and profit being generated this year. This is also reflected in the very wide range seen in management’s guidance — the €13 billion and $17 billion lower/upper bounds for this year’s sales are 30% away from each other.

A recent Israeli study suggests that a second booster/fourth dose is quite effective. But at the same time, it looks like a significant portion of the population in a range of countries, including the US, is not really interested in getting any further boosters. I do thus not believe that the availability of second booster doses alone will allow BNTX to perform on par with 2021 this year. Instead, it looks like 2021 was the absolute peak for Comirnaty, and future years will continue to see sales declines.

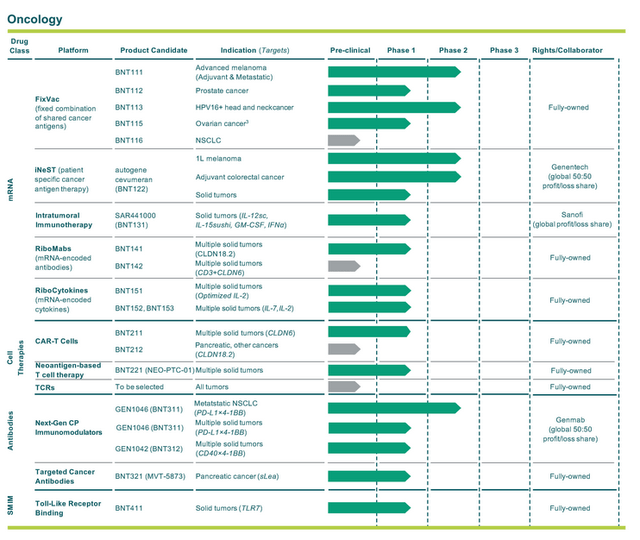

BioNTech is working on new products to replace the revenue currently being generated by its COVID vaccine. BNTX’s oncology assets are especially intriguing, of course. If the company were to be successful in this field, this would not only be great for patients but would also allow for a huge market opportunity.

BioNTech’s oncology assets include three assets that are being evaluated in five phase II studies right now. On top of that, the company has a range of compounds that are in phase I studies or in a pre-clinical stage today. The phase II candidates are in important and large markets, such as lung cancers (NSCLC), melanoma, or colorectal cancers. The treatment markets for these are worth billions of dollars a year — if successful, BNTX would likely generate considerable sales and profits with these agents.

Drug candidates do not necessarily turn into approved drugs. Future success is thus far from guaranteed, but there are opportunities for BioNTech.

Is BNTX Stock A Buy, Sell, Or Hold?

On a forward basis, BioNTech trades at around 4x net profits. This is a very low valuation in absolute terms, but since we don’t know what profits beyond 2023 might look like, this isn’t very telling.

BioNTech has ~$13 billion in equity today, most of that in cash and receivables. When we add the $6 billion in profit being forecasted for the current year, BioNTech should have close to $20 billion in equity at the end of the current year, with most of that in pure cash. I do believe that it is likely that vaccine sales beyond 2022 will be rather low, although this does depend on the potential development of new variants etc. With BNTX trading at a market capitalization of around $40 billion today, investors thus have to decide whether the non-COVID business is worth $20 billion or more today. The company has proven technology and the ability to scale production with international partners such as Pfizer. Its pipeline holds a range of assets in attractive markets. With success for these pipeline candidates not being guaranteed, it is possible that BNTX eventually disappoints.

Overall, BNTX is a company that combines risks and potential rewards. The COVID vax business should remain a cash cow this year, and with a huge cash and receivables position, BioNTech can invest in new growth areas aggressively. If the company manages to be equally successful in oncology compared to what the company managed to do with its COVID vaccine, BNTX could be a compelling buy at current valuations. But since success in non-COVID areas is far from guaranteed, I do believe that BioNTech is far from a sure bet today. For risk-hungry investors that believe that the company’s non-COVID business will eventually be worth well more than $20 billion, BioNTech could be a reasonable choice. But those seeking a lower-risk pick might want to focus on other biotech companies — many of those are attractively priced while offering way better diversification and fewer uncertainties.

Be the first to comment