hapabapa

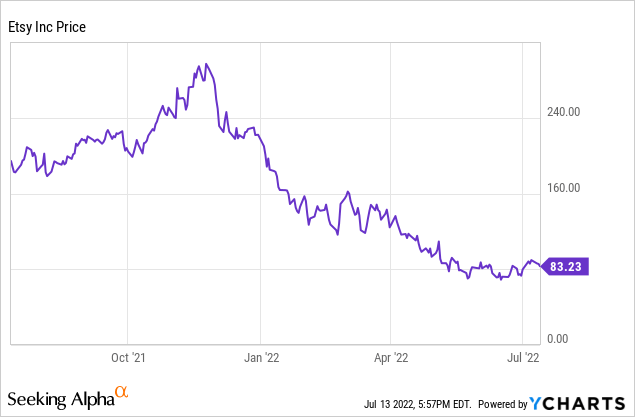

When we look at the breathtaking losses that many tech stocks have suffered this year, we find that many companies have lost the entirety of the gains they have made since the start of the pandemic. And as rational investors, we have to ask ourselves: is this fair?

Take Etsy (NASDAQ:ETSY), for example. COVID-19 and the boost of e-commerce gave second life to the arts and crafts website, which benefited especially alongside the suburban moving trend of 2020 and 2021 which gave a temporary lift to furniture and home decor vendors. But while many of these tailwinds are not going to have repeating benefits in the future, companies like Etsy have managed to preserve their post-pandemic scale.

Year to date, shares of Etsy have lost 60% of their value, taking the stock to multi-year lows not seen since May 2020. And while I agree that new risks of slowdown have emerged for Etsy, especially with a rather shaky macro outlook that has inflation pressuring consumer spending, I also think that the stock’s dramatically lower price overcompensates for these risks.

I am shifting my opinion on Etsy to neutral, from a prior bullish view. I still think the stock is attractive from a valuation perspective – but at the same time, I don’t see many near-term catalysts that can meaningfully lift Etsy from its current doldrums. If you’re looking for rebound plays that will have some elasticity in a year-end market rally scenario, I don’t think Etsy is your best bet; but at the same time, if your horizon is longer, and you’re willing to stomach volatility, I think this is a great low entry point for Etsy.

Let’s not discount the strides that Etsy has made post pandemic

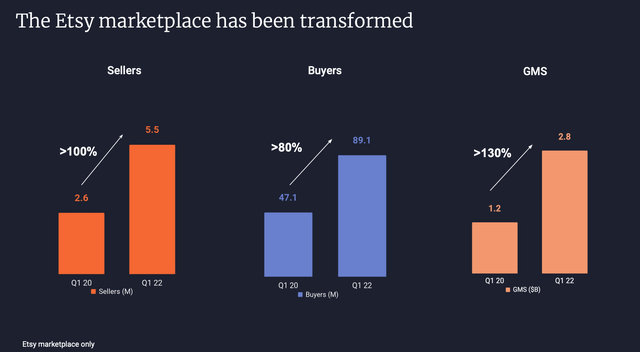

First – we should take a step back and address how magnificently this business has grown since the pandemic. As shown in the chart below, the number of Etsy sellers has more than doubled since Q1 of 2020; the number of buyers has nearly doubled (to a staggering 89.1 million active buyers, defined as a person who made a purchase over the past year), and overall GMS has grown more than 130%. At the same time, Etsy recently instituted a seller fee increase (more on this in the next section) that increases its slice of its marketplace activity and helps improve its profitability.

Etsy growth since 2020 (Etsy Q1 investor presentation)

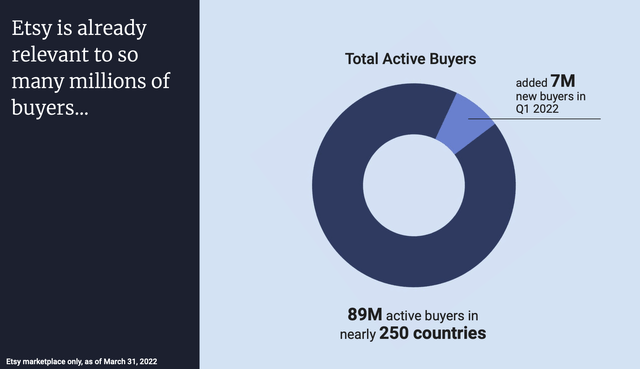

Etsy isn’t stagnant in its buyer base, either. In the most recent Q1, the company reported adding 7 million new buyers:

Etsy buyer growth (Etsy Q1 investor presentation)

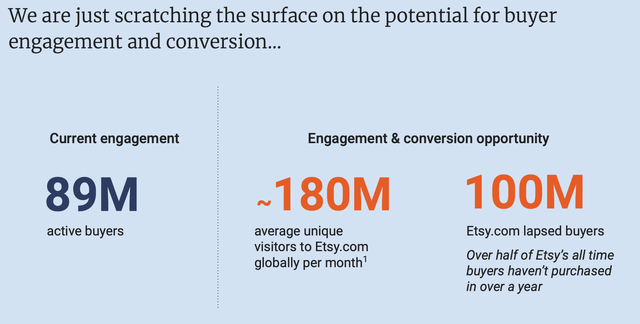

Etsy is also expanding its appeal in different categories and market segments. For example, Etsy is noting more traction with men. In 2021, the company reported that 35% of its new buyers were men. However, only 10% of men in the U.S. and the U.K. have made a purchase on Etsy over the past twelve months, indicating significant room for expansion.

Etsy notes as well that it had 180 million average unique visitors to its site in the past quarter, as well as 100 million lapsed buyers who have not had activity on the site over the past year. Add this onto the fact that Etsy is still predominantly a U.S. company, and we find that there are still significant opportunities to expand the buyer base.

Etsy buyer conversion opportunity (Etsy Q1 investor presentation)

In short, here: Etsy has put in significant work to expand its market reach since the pandemic began, and we should be rewarding the stock for it.

Seller Fee boost

In April, Etsy boosted its seller fee from 5.0% to 6.5%. While fee increases always attract a swarm of hostility from the seller base, the reality is that other marketplaces like eBay (EBAY) and Amazon (AMZN) carry much higher fees, depending on the product category. For example, most products sold on eBay carry a 12.9% seller fee.

The good news here is that Etsy seems to have pushed this increase through with minimal impact to seller retention. Per CFO Rachel Glaser’s prepared remarks on the Q1 earnings call:

Let me discuss the recent increase to our transaction fee, which went into effect on April 11. We’re committed to nurturing our marketplace in a way that enables millions of creative entrepreneurs to succeed. We’re incredibly proud that over the past 2 years, the number of sellers on Etsy Marketplace has more than doubled and the number of listings is up 55%. With more sellers on the platform than ever, we need to continue to grow the size of the pie. This requires us to invest more to scale our platform and most importantly, bring them even more buyers than the almost 90 million we bring them today.

When the fee change went into effect, we saw less than 1% of sellers go into temporary vacation mode. Active listings dipped less than 1% during that week and returned to the prior level when the week was over. Based on past experience and significant research leading up to the change, this was all within our expectations. The overall impact to our GMS for the week was not material and seller churn remains at normal levels quarter-to-date. At quarter end, we had well in excess of 95 million listings on etsy.com. And as you know, we have no shortage of items for sale.

And while no one likes fee raises, we actually heard from thousands of sellers supporting our efforts to invest in them. We really value input from our sellers and are confident in our investment plans. We trust that sellers will judge us by our outcomes when they see the value we are able to provide.”

GMV downtrend, profitability squeeze

That being said, it’s not a perfect story at Etsy right now. The key concern right now is softening GMS trends. Seller fee increases can only boost revenue for so long; in order for Etsy to keep growing, it will need to continue attracting more buyers and growing marketplace transactions.

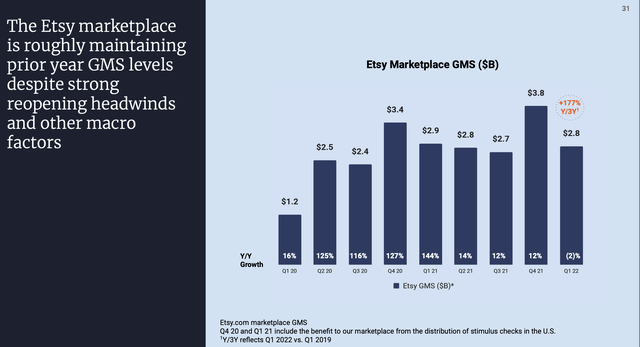

In Q1, gross merchandise sales fell -2% y/y to $2.8 billion. Against a three-year stack, GMS has still nearly tripled; but it does look like Etsy is looking at a period of flat-lining. Again, as previously mentioned, dormant buyer re-activation as well as international expansion are potential levers for growth.

Etsy GMV trends (Etsy Q1 earnings deck)

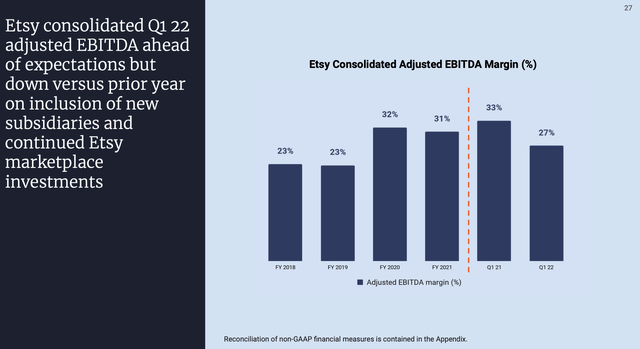

The other key concern is margin pressure. With revenue more or less flat-lined (though the GMS decline will be more than offset by the seller fee increase starting in Q2), Etsy has little defense against rising salaries and opex. Adjusted EBITDA margins in Q1 fell to 27%, six points weaker than 31% in the year-ago quarter:

Etsy adjusted EBITDA (Etsy Q1 earnings deck)

The Q2 outlook also calls for adjusted EBITDA to squeeze further to a guidance of “approximately 25%” margin, despite the boost to seller fees.

Key Takeaways

At current share prices near $83, Etsy trades at a market cap of $10.58 billion. After netting off the $1.04 billion of cash and $2.28 billion of debt on Etsy’s most recent balance sheet, the company’s resulting enterprise value is $11.81 billion – which stands at a 4.7x EV/FY22 revenue multiple versus consensus revenue expectations of $2.53 billion for the year, representing 9% y/y growth.

This is a cheap price for Etsy, but at the same time, it’s difficult to see any near-term catalysts that can help turn sentiment around on this name. The company will have to show a path toward GMS growth for me to get fully comfortable again. For this reason, holding Etsy is the right move, but there’s no major incentive to adding to the position.

Be the first to comment