ekapol/iStock via Getty Images

Investors’ first look at Q2 ’22 financial sector earnings will come on Thursday, July 14, ’22 before the opening bell when JPMorgan (NYSE:JPM) and Morgan Stanley (NYSE:MS) report their Q2 ’22 financial results:

JPMorgan: $328 bl in market cap. JPM has fallen out of the top 10 market cap names in the S&P 500, now in the 15th position per the Morningstar data.

The perfect combination of investment, consumer, and commercial bank will actually have that work against them in the 2nd quarter of 2022.

The Street is expecting $2.88 in EPS on $31.9 bl in revenue for expected y.y growth of -28% and 5% respectively. The big problem – at least temporarily – is the tough compares from Q2 ’21 when JPM printed $3.78 in EPS on lower revenue of $30.5 billion.

Here are the last 5 quarters’ actual EPS and revenue growth for JPM:

- Q1 ’21: $4.50 in EPS and $32.3 bl in revenue

- Q2 ’21: $3.78 in EPS and $30.5 bl in revenue

- Q3 ’21: $3.74 in EPS on $29.6 bl in revenue

- Q4 ’21: $3.36 in EPS on $29.3 bl in revenue

- Q1 ’22: $2.63 in EPS on $30.7 bl in revenue

- Q2 ’22: $2.88 in EPS on $31.9 bl in revenue (consensus estimates per IBES data by Refinitiv)

JPMorgan earned $15.34 in EPS in calendar ’21, a figure they are not expected to reach again until 2026. 2019’s EPS was $10.72, which I’d expect is the more realistic base to evaluate JPM’s growth. Relative to 2019’s actual EPS, 2022 is still expecting 5% EPS growth this year and 2022’s expected revenue growth of $127.6 billion is roughly 10% above the $119 billion printed in 2019.

The amazing distortions in monetary and fiscal policy in 2020 and 2021, all found their way to some degree in the US financial system in those two years and now we are seeing a “normalizing” post stimulus.

The issue for JPMorgan will be the expected addition to credit reserves, which was $1.5 bl in Q1 ’22, so we should probably expect at least $1 billion and probably the same of $1.5 billon as Q1 ’22 until the powers that be are convinced that this won’t be a deep recession. As a comparison, JPM had a “net benefit” to credit reserves of $4 billion in 2021 after the pandemic passed and re-opening began, which averages $1 billion per quarter.

Also, JPM’s corporate and investment bank was 43% of revenue and 53% of segment net income, so I’d expect given the tough quarter in the capital markets in Q2 ’22, that the segment – also lapping tough comps from ’21 – will see another slimmer quarter.

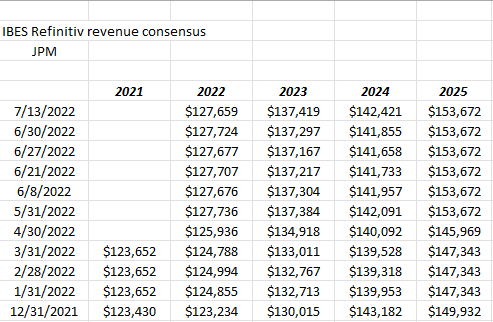

JPM EPS estimate revisions: source – IBES data by Refinitiv JPM revenue revisions: source – IBES data by Refinitiv

The stock is now trading at 10x the 2019 EPS of $10.72, with a 3.5% dividend yield. In terms of book value, JPM is trading at one of its lowest premiums to both BV and TBV in some time at 1.3x and 1.6x.

We added a little more stock on Tuesday, but small amounts around core positions.

Morgan Stanley:

The current consensus estimates for MS are for $1.53 in EPS on $13.47 billion in revenue for expected y.y declines of -17% and -9% respectively. Both of those consensus estimates have come down since the April ’22 report.

Morgan Stanley’s Wealth Management group is 52% of net revenue but only 34% of pre-tax income as of Q1 ’22, so WM will be a stabilizing segment relative to the inherent leverage in the Institutional Securities Group Inst’l Securities was 42% of Morgan Stanley’s total revenue in Q1 ’22, and 61% of segment pre-tax income.

MS EPS estimate revisions: source – IBES data by Refinitiv MS revenue estimate revisions: source – IBES data by Refinitiv

What’s interesting about Morgan Stanley is that like so many financials, MS is racing to build their asset management and with E-Trade, they’ve got the perfect no commission, discount broker as part of their portfolio. MS isn’t as cheap as JPMorgan at 1.7x and 2.6x book and tangible book value and is not nearly as cheap as Goldman Sachs (GS) on a book value basis, (GS is trading right at book value the last week) but MS is yielding 3.7% at $75 per share.

My own opinion is the traditional banks and brokers are too cheap here and offer good value, but investors need to see an end to the string of bad bond and stock market news. If investors can look out longer than 2022, I do think the traditional investment banks and bigger commercial banks like JPMorgan, and Bank of America (BAC) offer good value.

That’s one opinion. Take it all with great skepticism. JPM would need to trade back above $130 to make me think the downtrend is over, and it will likely take some time to regain the old all-time-high at $171 – $172.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment