John M. Chase/iStock Unreleased via Getty Images

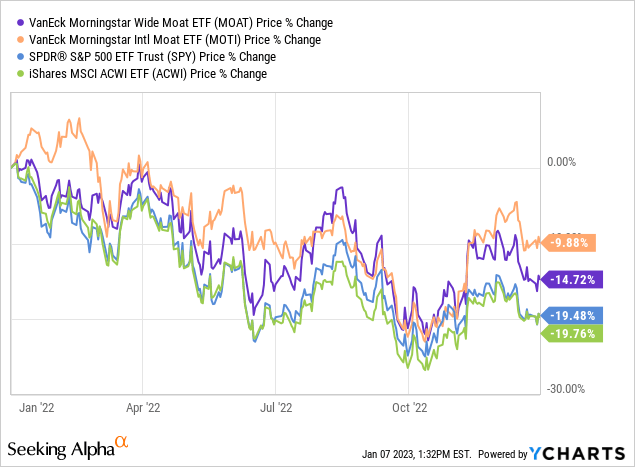

The VanEck Morningstar Wide Moat ETF (BATS:MOAT) is a semi-passive fund that rebalances its holdings on a quarterly basis (in fact, twice a year for each of its two sub-portfolios). Before we discuss the latest quarterly reconstitution, let’s see how MOAT fared during the tough year 2022. While the ETF could not avoid a yearly loss in the double digits, it held up well against the broader market – outperforming the S&P 500 by about 5 percentage points:

Let’s also mention the performance of the VanEck Morningstar International Moat ETF (MOTI), MOAT’s counterpart for international stocks, which lost only 10% despite the turmoil in global markets. It looks like the “moat-investing” strategy, that is, the focus on stocks that are considered to possess lasting competitive advantages, did reasonably well in 2022.

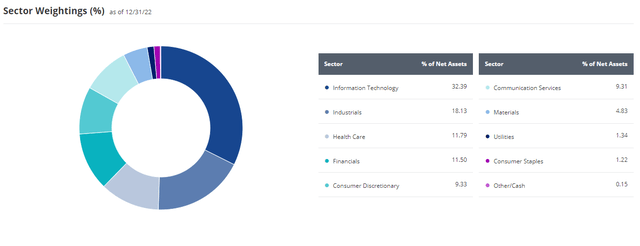

MOAT started 2023 with its holdings mostly unchanged from Q4 2022, with very few moves at the December reconstitution (more on this below). This leaves the ETF positioned for a potential rebound in tech stocks which make up about a third of its holdings. Cyclicals (Industrials, Financials and Consumer Discretionary) also constitute a sizable portion of the ETF:

This can of course cut both ways in 2023, depending on whether we get a recession, and how hard it hits. However, I would argue that short-term anticipations are not the right perspective for those interested in MOAT. Moat investing is all about the conviction that companies that enjoy strong competitive advantages will deliver superior returns over the long run. The MOAT ETF, therefore, is best suited for investors with a long-term horizon.

What’s more, MOAT can also be of value to stock-pickers, who may not buy the ETF but can still gain from periodically reviewing its holdings. This way, one can view a stock’s inclusion in MOAT as a vote of confidence. As an example, I added to Medtronic (MDT) and built a position in State Street (STT) during Q4 ’22, two stocks whose presence in MOAT confirmed my own due diligence.

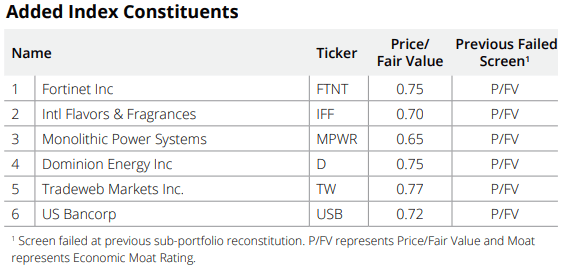

As I mentioned earlier, there were limited changes during the reconstitution in December 2022. Still, the removal of Intel (INTC) was significant, as it was based on a perceived weakening of the company’s economic moat (from “wide” to “narrow”). Other removed blue chips included BlackRock (BLK) and Honeywell (HON). Coming the other way were the likes of Dominion Energy (D), Fortinet (FTNT) and a few others that Morningstar considers to be trading at attractive valuations.

The MOAT ETF: An Overview

Note: Investors already familiar with the MOAT ETF and Morningstar’s methodology may want to skip this part and move directly to the December rebalance section.

The way the MOAT ETF works was well summarized by fellow contributor George Fisher in an earlier article:

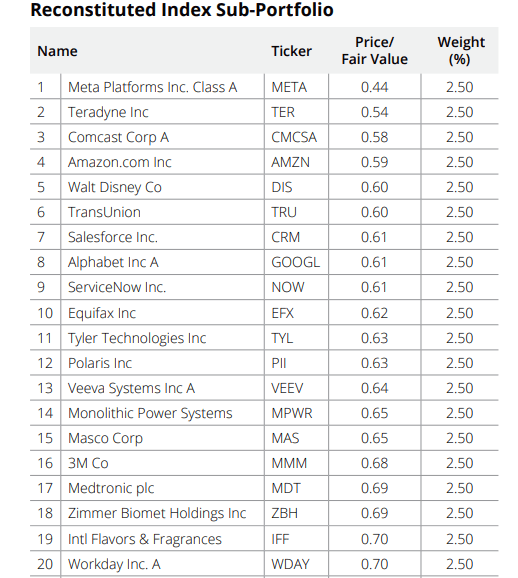

[MOAT] owns 40 to 50 stocks with wide moats and that are trading at a discount to fair value, usually in the 15% to 25% discount range. When moat ratings change or the discount to fair value becomes comparatively noncompetitive with others, the position is replaced. Not only do the components change based on moat rating and discount to fair value, but the portfolio is re-balanced to an equal weighting as well. This creates a relatively high annual portfolio turnover of around 25%.

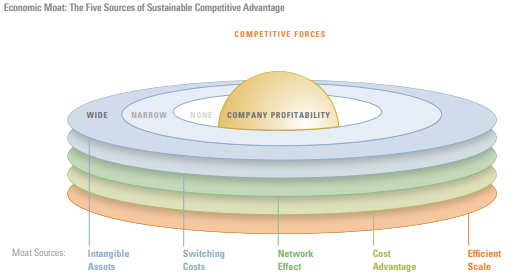

The ETF, managed by VanEck, is based on the Morningstar® Wide Moat Focus Index, which includes only U.S. stocks and, as the name suggests, only companies that possess wide economic moats. But what exactly does Morningstar mean by “economic moat”? As per VanEck:

Economic Moat ratings represent the sustainability of a company’s competitive advantage. Wide and narrow moat ratings represent Morningstar’s belief that a company may maintain its advantage for at least 20 years and at least 10 years, respectively. An economic moat rating of none indicates that a company has either no advantage or an unsustainable one. Quantitative factors used to identify competitive advantages include returns on invested capital relative to cost of capital, while qualitative factors used to identify competitive advantages include customer switching cost, cost advantages, intangible assets, network effects, and efficient scale.

Morningstar This strategy has enabled MOAT to outperform the S&P 500 since its inception in 2012. With this in mind, let us now discuss the latest moves as part of the recent December reconstitution.

December Rebalance: The Removed Constituents

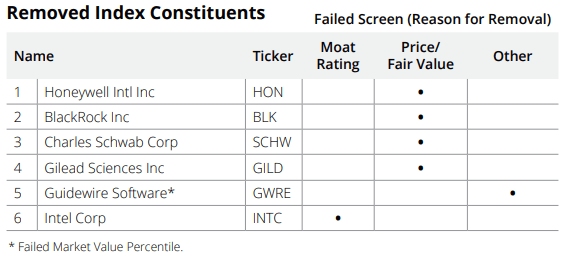

The recent mid-December reconstitution – affecting the sub-portfolio whose previous rebalancing happened in June – saw the removal of 6 stocks:

VanEck

(see VanEck’s full document here)

It’s rare for a stock to be removed due to a downgrade of its economic moat rating – usually, the moves are made on valuation grounds – but this is what happened to Intel. The company was downgraded by Morningstar from wide-moat to narrow-moat, ending its presence in the ETF (MOAT, contrary to MOTI, includes only wide-moat stocks). The leading microprocessor manufacturer is considered by Morningstar’s analysts to face a number of headwinds, with increased competitive pressure resulting in lower margins across its activities, and an expected loss of market share in the data center segment. Specifically, Morningstar fears the competition of AMD’s (AMD) latest EPYC “Genoa” processors, and prefers wide-moat NVIDIA (NVDA) – which remains a MOAT constituent.

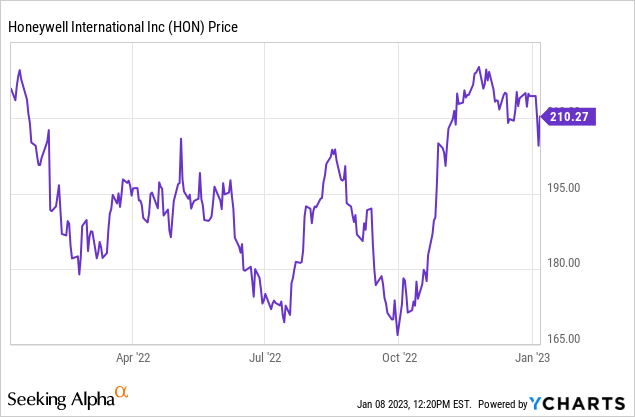

Another notable removal is Honeywell, this time on valuation grounds, despite a very positive assessment by Morningstar when it comes to the firm’s competitive position:

Honeywell is one of the strongest multi-industry firms in operation today. We think the firm has successfully pivoted to capture multiple ESG trends, including the need to drive energy efficiency, reduce emissions, and e-commerce, among others. […] Over the next five years, we think Honeywell is capable of mid-single-digit top-line growth, incremental operating margins in the mid-30s, low-double-digit adjusted earnings per share growth, and free cash flow margins in the midteens.

Source: Morningstar

The stock simply became too pricey in terms of discount to fair value (compared to other MOAT holdings) following its run-up in the fourth quarter:

The same goes for financials BlackRock and Charles Schwab (SCHW), which MOAT added as recently as Q1 ’22, but trimmed at year-end on valuation grounds. Gilead (GILD) and Guidewire Software (GWRE) are the other “victims” of the December reconstitution.

December Rebalance: The New Entrants

The 6 names removed gave way to another 6 wide-moat companies:

VanEck

This short-list includes stocks that were trading (at the time of their selection, i.e. early December) at discounts ranging from 35% for Monolithic Power Systems (MPWR) to 23% in the case of Tradeweb Markets (TW). One of the notable inclusions is utility Dominion Energy (D), for which Morningstar currently has a $78/share fair value estimate, even if they do not expect a near-term re-rating – due to a lack of catalysts. The stock had a difficult fourth quarter, with investors unnerved by the uncertainties surrounding the company’s strategic business review. This has made its valuation attractive in Morningstar’s view, for patient investors.

Let me highlight the inclusion of cybersecurity company Fortinet (FTNT), with a $68/share fair value estimate. This confirms MOAT’s appetite for tech – Morningstar typically finds strong competitive advantages such as network effects in these stocks. It’s worth noting that Alphabet, Microsoft, Amazon and Meta are all part of the ETF, which indicates that they not only possess a wide moat, they also trade at a significant discount to fair value (see below) – according to Morningstar obviously.

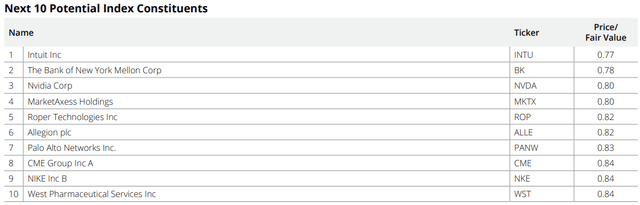

Those Waiting On The Sidelines

As always, VanEck provides a list of stocks that could be included as part of the next rebalance, should their valuations warrant it at the time. Various industries are represented in the current selection:

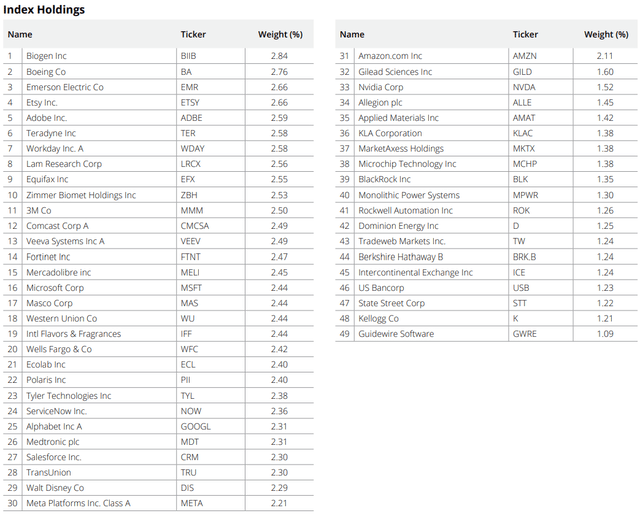

VanEck Below is the full list of 49 names included in the MOAT ETF at this point in time: VanEck

The list can be used as a source of ideas for investors looking for wide-moat stocks trading at reasonable valuations. In this respect, the Price/Fair Value ratio (as of mid-December) is a helpful metric, and the discounts for Big Tech were seen to be sizable:

VanEck

(see this document for full detail)

Takeaway

The MOAT ETF posted a decent performance in 2022 compared to the broader market. Morningstar has kept a consistent methodology and saw little reason to reshuffle the ETF’s holdings ahead of 2023, with very few changes made during the recent December reconstitution.

Be the first to comment