metamorworks

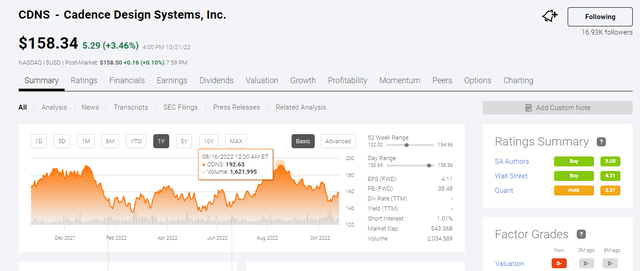

Cadence Design Systems, Inc. (NASDAQ:CDNS) deserves to be discussed here at Seeking Alpha. It will report its earnings later tonight. I cannot rate this stock as a buy. I endorse Seeking Alpha Quant’s rating of hold for CDNS. My neutral verdict is justified. CDNS posted a 52-week high of $194.96 last August. It now trades at less than $159. I doubt if tonight’s Q3 ER will pump CDNS back to $180 post-earnings.

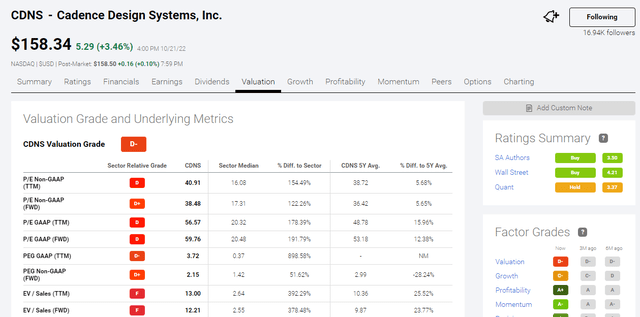

Staying out of the action pre-earnings is the safe choice. The $35.96 price drop from its 52-week high is not yet enough to dispel the truth that CDNS is relatively overvalued. If the Q3 numbers do not impress investors tonight, CDNS has more room to fall. A disappointing Q3 ER coupled with significant relative overvaluation could push CDNS lower.

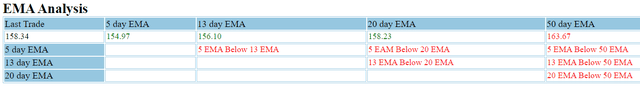

Due to the high valuation ratios, CDNS is not an attractive takeover target. For the near-term, do not go long and/or average down on Cadence Design Systems, Inc. The Exponential Moving Average [EMA] chart below is bearish for this company.

EMA numbers are very easy to understand. CDNS will get a bullish EMA indicator when it is trading above its trailing EMA numbers and below the current price. The most-recent closing price of $158.34 is still below the 50-day EMA of $163.67.

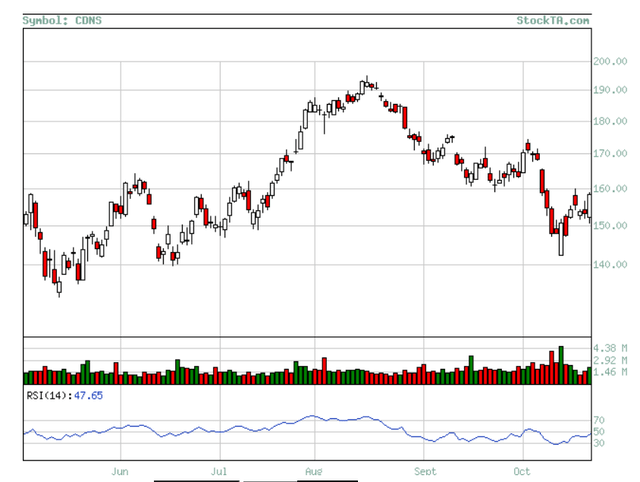

Relative Strength Index [RSI] is also an easy technical indicator that I use to gauge investor herd emotion. As per the chart below, the RSI score of CDNS dipped since August. This stock’s RSI score now is 47.65. This is below the neutral score of 50, but higher than the oversold score of 30.

I like Cadence Design Systems

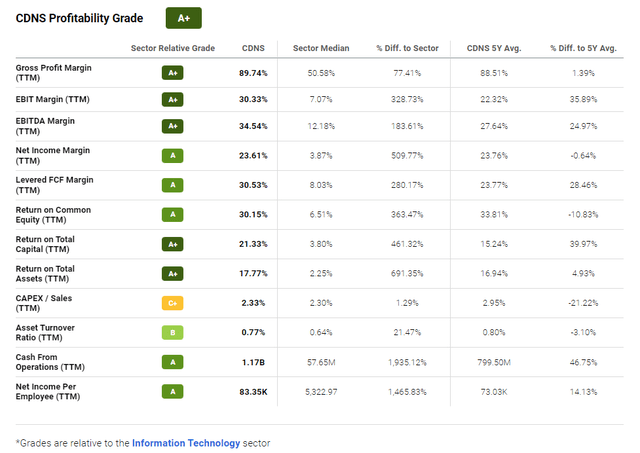

You can defy my Hold rating for CDNS. If you ignore that relative overvaluation, Cadence Design Systems is a great long-term investment. The high profitability of CDNS is probably why some investors gave it a high valuation. The quantitative chart below explains why Seeking Alpha Quant gives CDNS the maximum profitability grade of A+.

If you think that a five-year average net income margin of 23% justifies CDNS’ forward P/E of 59.76x, you should ignore my hold recommendation. I’m awed by that very high 88.51% 5-year average gross margin. Cadence Design Systems is in a niche business without notable rivals. This company is not under the pressure cooker of intense competition.

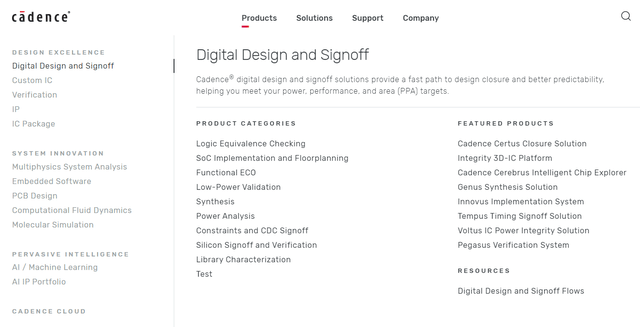

I do not have the time to dig deep on the many products/solutions of Cadence Design Systems. I already know it has multiple revenue streams. Multiple products assured me that the 23% net income margin and 88% gross margin are fortified. The screenshot below mentions Cadence is selling AI and cloud computing solutions. I like companies that compete in AI and cloud computing.

Going forward, the fast-growing $53.54 billion Artificial Intelligence software market could boost the revenue CAGR of Cadence Systems. The AI Software market is growing at a CAGR of $41.30%. The forward revenue CAGR estimate for CDNS is 12.71%.

The recent partnership with Google (GOOG; GOOGL) Cloud is also a solid tailwind for Cadence Cloud Passport. The cloud computing industry has a market size of $368.97 billion. Its CAGR is 14.8%.

Cadence Design Systems has a market cap of over $43 billion. Its TTM annual revenue is only $3.283 billion. My fearless forecast is that the very high CAGR of the AI industry could help Cadence reach $4 billion/year annual sales.

Excellent Financial Health

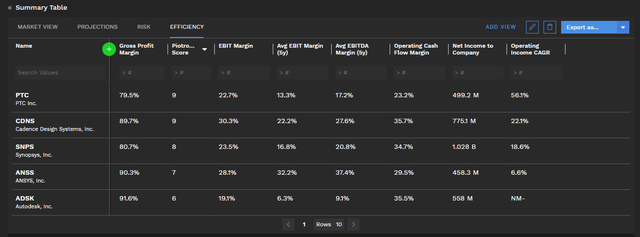

The expansion to AI and cloud computing could also further fortify the very strong financial health of Cadence Design Systems. The relative overvaluation of CDNS might be because its Altman Z-score is greater than 17. I like CDNS also because of its perfect Piotroski F-score of 9. The high Altman Z-score of Cadence Design Systems means it has zero chance of going bankrupt

Average down on CDNS if you like companies that boast perfect Piotroski scores. CDNS touts a total cash position of $1.03 billion. Its total debt is only $348 million, much lower than its levered free cash flow of $1 billion.

Conclusion

You should do what Seeking Alpha Quant says about Cadence Design Systems. The Hold recommendation for this profitable company is judicious. The stock is still relatively overvalued compared to its sector peers. The bearish EMA and RSI technical indicators are saying that you should not average down CDNS at the moment.

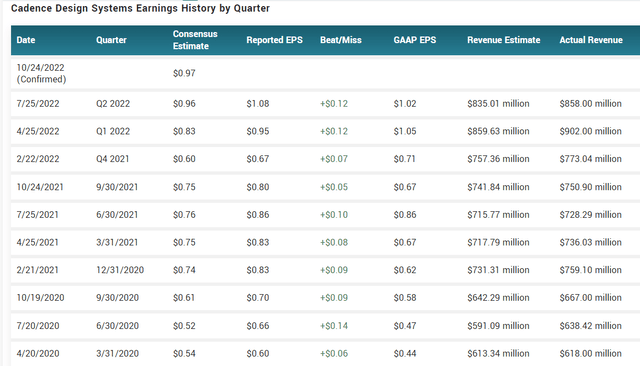

I expect management to report Q3 earnings beat tonight. CDNS has beaten EPS and revenue estimates for the past 10 quarters.

The only thing that we should speculate on is whether the Q3 beat will be enough to push CDNS beyond $65.

Management should consider paying dividends soon. Shareholders will buy more shares if they get annual dividends. Ten years of profitability and yet CDNS management has never rewarded its shareholders. My opinion is that dividend payment is preferable than the $100 million share repurchase agreement.

Dividends are more important than buying more companies. Cadence Design Systems already made 57 acquisitions. It recently bought OpenEye Scientific and Future Facilities. Inorganic growth through acquisitions is commendable. However, new purchases do not immediately become accretive to the company. That $1 billion cash hoard should be reduced through dividend payments.

Dividends are instant rewards to faithful investors. I might give CDNS a buy rating if it starts paying dividends in the future.

Be the first to comment