Funtap

SAP SE (NYSE:SAP) is a German-based European multinational software corporation that makes enterprise software to manage business operations and customer relations. It operates in 130 countries, and it’s basically credited for creating ERP systems that companies love to rely on today. The company recently gained attention from investors as a part of the software as a service (“SaaS”) craze that lifted middle-tier tech stocks like these to elevated levels. The move was partly attributable to loose monetary policy on the part of the Fed, but now the situation has changed drastically. The Federal Reserve has adopted a hawkish tone in response to inflation figures, and this has rewritten the growth story across the board for middle-tier technology stocks like SAP. Today we’ll take a look at the company’s current events and discuss what investors can expect from the stock going forward.

SAP has dominated the ERP space for decades. Its on-premise offerings became very popular with medium to large size corporations due to its relatively standardized deployment requirements and its versatility in accepting and processing data. As the market leader in enterprise application software, SAP empowers users to streamline processes, utilize live data to predict business trends, drive growth initiatives and define new possibilities. Recognized as one of the world’s most innovative and trustworthy independent computer technologies developers, SAP offers a product portfolio that ranges from pioneering ERP software to industry-leading data solutions like SAP HANA.

Product & Category Outlook

CRM became the largest software market in 2017 and will be the fastest growing software market in 2022, according to Gartner. The global CRM software market is expected to grow from $106.23 billion in 2021 to $123.51 billion in 2022 at a compound annual growth rate (CAGR) of 16.3%. In 2022, CRM software revenue will continue to lead software markets and be the fastest growing software market. AI-powered CRM activities will drive new efficiencies in how companies sell, service, and market, ultimately expected to create more than $1.1 trillion in new GDP impact worldwide and 800,000 net-new jobs by 2022 – surpassing those lost to automation.

SAP SE developed the SAP Cloud Platform as a service for creating new applications or extending existing applications in a secure cloud computing environment managed by SAP. The SAP Cloud Platform integrates data and business processes. Cloud computing is the company’s fastest growing business line in the first quarter of 2022, it has managed to increase cloud subscriptions and support revenues by 34%, ahead of planned performance.

One of SAP’s impressive and latest product innovations is the SAP internet of things. SAP internet of things is a digital innovation system, an umbrella term that helps customers access SAP’s components and products across emerging technologies, such as Machine Learning, Big Data, the Internet of Things (IoT), and Blockchain. It is often associated with SAP Cloud Platform services, but it’s not limited to this, as it covers anything that fits into modern technologies and includes predictive capabilities in S/4HANA – whether on-premise or in the cloud. SAP now offers additional services such as a webinar series and training to complement its core products and differentiate itself from the competition. Moreover, SAP engages in sustainability activities. For example, SAP developed tracking devices to protect animals from poachers and preserve wildlife. SAP also committed to becoming carbon neutral by 2025.

The Cloud Conundrum

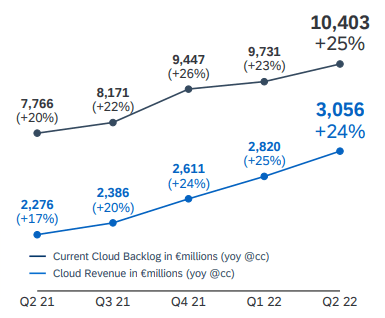

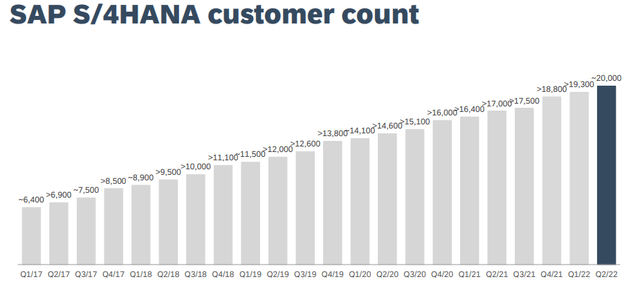

As the cloud became more prominent large companies like Oracle (ORCL) (discussed here) quickly jumped on board and, as a result, benefited briefly from some first mover advantages, but SAP is responding well, and there are promising signs that their cloud and on-premise offerings are beginning another stint of dominance. In the recent Q2 report, the company highlighted its success from its pivot into cloud-based ERP solutions almost two years ago with an impressive €2.2 billion backlog for the SAP S4/HANA. This is a very important sign for investors as it shows the proof of concept being built out. We can see that backlog trends have been favorable.

SAP

The company also posted impressive figures for S4/HANA in the cloud with roughly 6000 customers and more than 600 wins in the quarter. The company also continued its strong trends across both options.

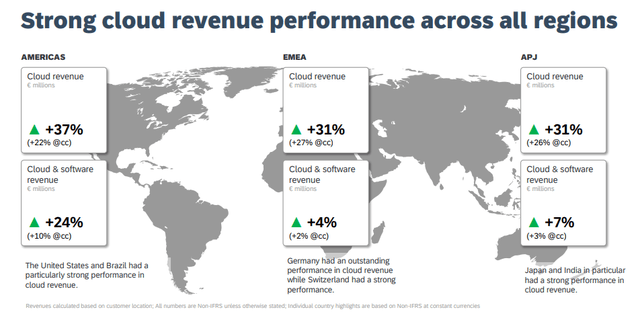

In the past, I have criticized SAP for their slow start into the cloud, even going as far as mentioning that Oracle could well eat their lunch if they don’t begin to be more aggressive in this space. The company is now posting geo-diverse revenue growth in its cloud segment, which is a testament to the strong scaling capabilities of these types of offerings.

Investors should be pleased with the company’s moves here. Due to its dominance in the past, people like SAP, it is well known and familiar to most customers, so stepping into the cloud space will cover a major risk for potential disruption of its longstanding dominance.

I expect to see steady sales growth for the cloud-based offerings, mirroring the overall software industry. It is important to note that cloud-based ERP systems are still just ERP systems with a few new perks and often new billing frameworks. Cloud-based ERP systems often offer quicker turnarounds using autonomous databases and data indexing options, with superior data visualization offerings, but they are not a new concept like the blockchain or the metaverse. Cloud-based ERP systems are just a new way of delivering an old product that happens to be more efficient, especially in terms of deployment. It has shown consistent execution and is one of the few companies to demonstrate steady gains in both on-premises and cloud products.

Valuation and Forward-Looking Commentary

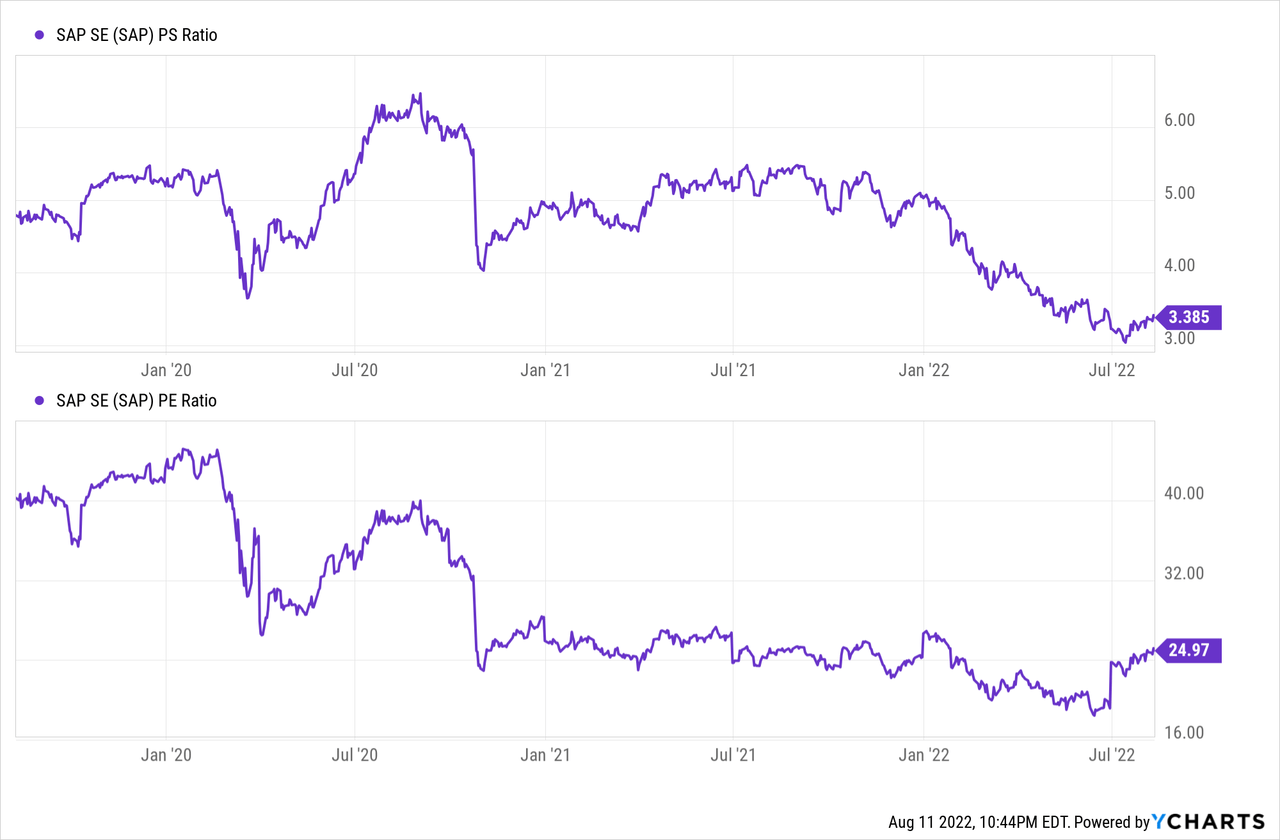

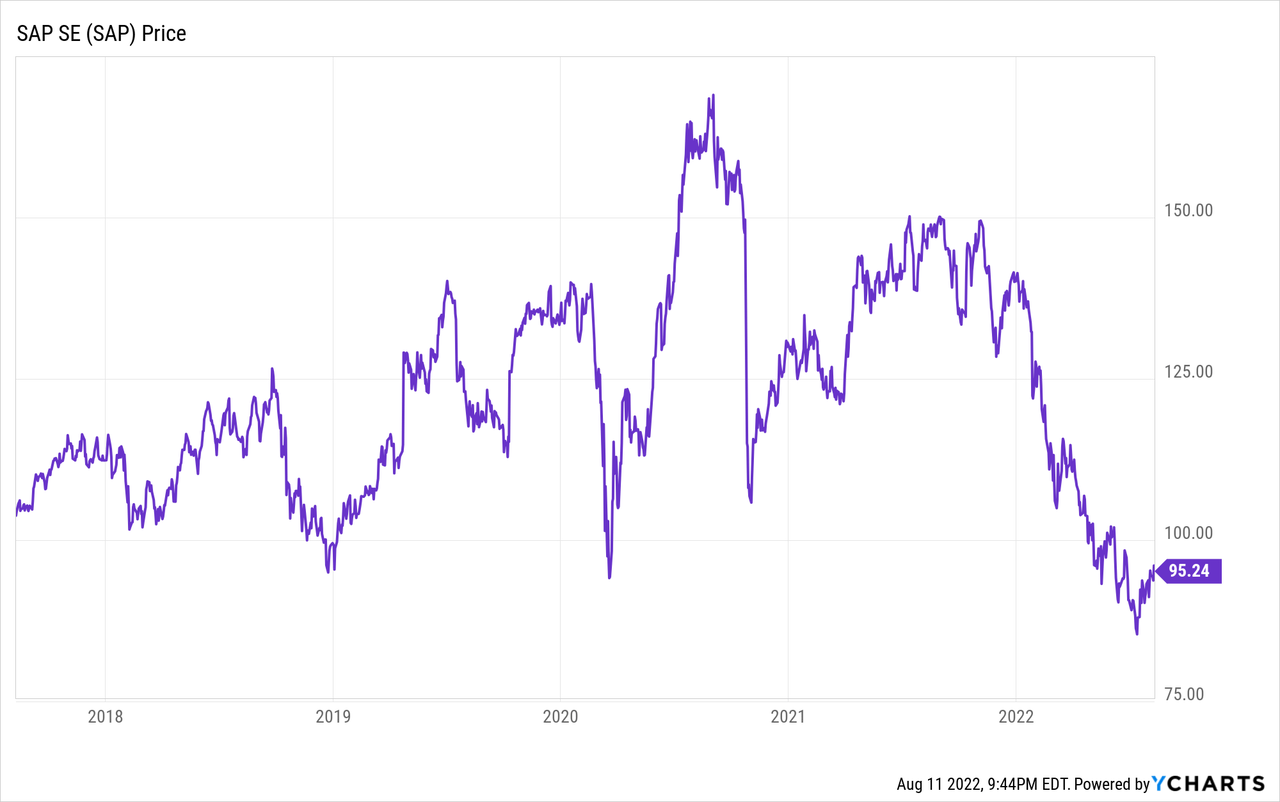

There are no two ways about it; SAP is trading at discounted levels. We can see investors today are paying record low prices for each dollar of the company’s revenue and earnings.

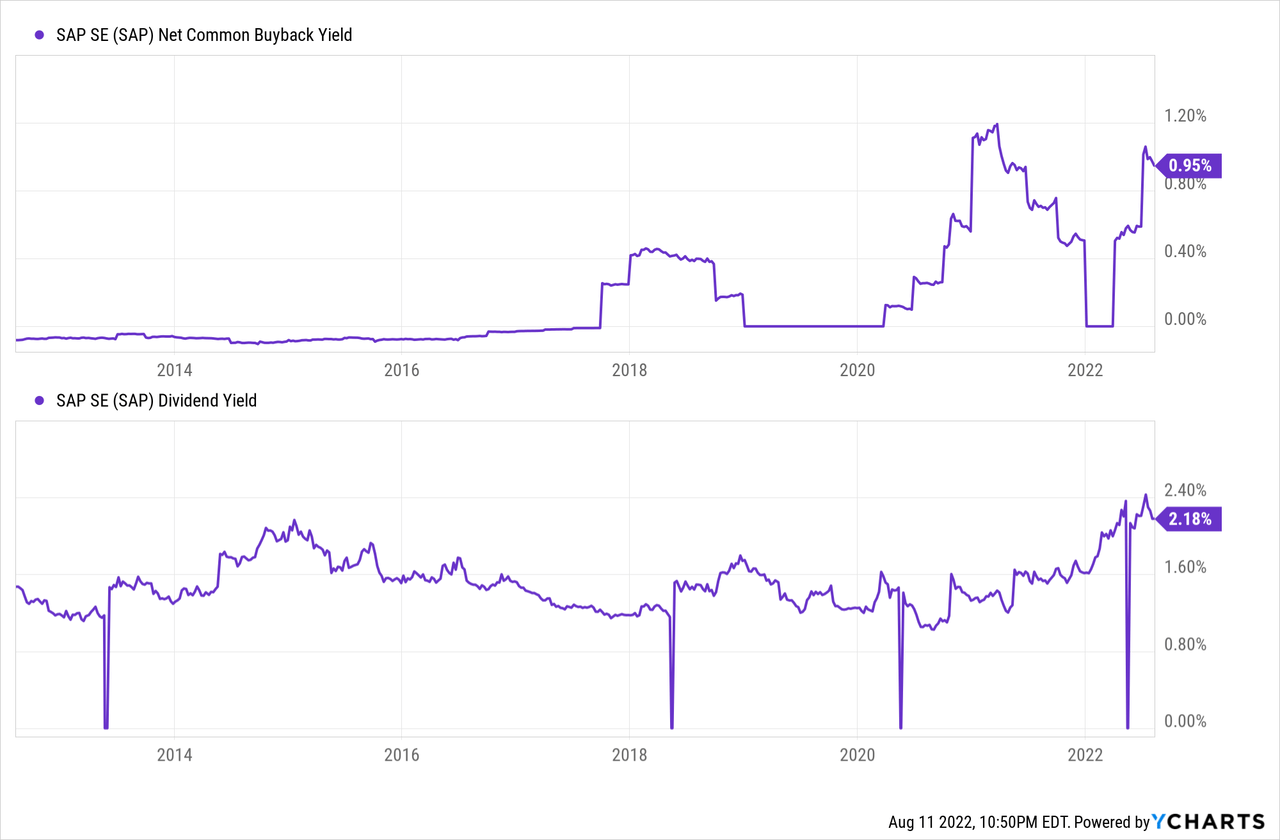

It is important to remember that this is a very mature company that has a long track record of returning wealth to its shareholders in the form of dividends and repurchases. This is very unusual for a large tech company.

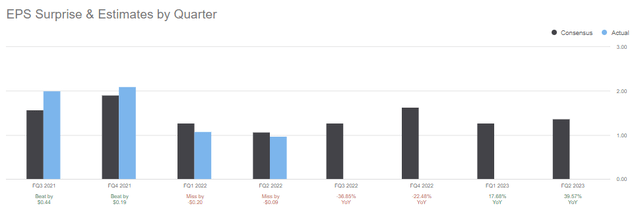

SAP recently authorized a new share repurchase program with a total value of up to €500 million and a planned execution between August 1st and December 31st, 2022. The repurchase is primarily slated for stock awards granted in 2018. So investors shouldn’t place too much weight on this program. The company is currently navigating an EPS hiccup which is partly due to the €1 billion reduction in the contribution to financial income by Sapphire Ventures.

The company recently reaffirmed its FY22 revenue targets, which simplifies things. As conditions improve for growth stocks like SAP, the price-to-sales ratio should easily get back up to $6 per $1.00 of the company’s revenue. This, combined with our roughly $31.3 billion revenue number, gives us a price per share of roughly $152.82. If we take the usual 20% margin of safety, we end up with a target of roughly $122, which represents a 28% upside from the $95 price the stock was trading at the time this article was written.

The Takeaway

SAP is currently a great company at an amazing price. Their business model is secure, they are a sector leader, and they are ahead of schedule on their cloud solutions buildout. Investors should feel really good about starting a position here as they are getting a proven company at historic lows. I rate SAP as a long-term buy.

Be the first to comment