Roland Magnusson

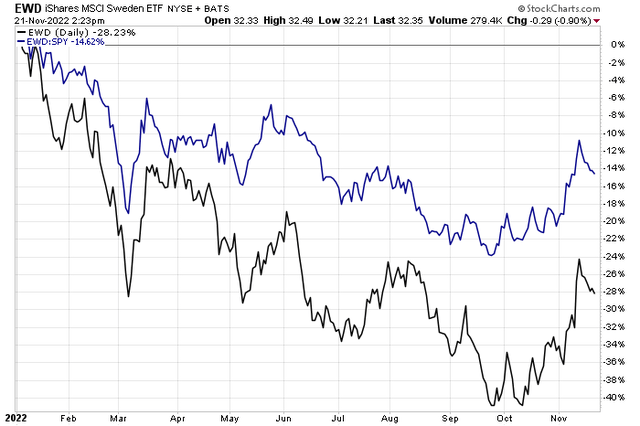

The Swedish stock market has been a sore spot across Europe this year. While broad Euro Area country ETFs have actually managed to climb to the flat line against the S&P 500 in 2022, the iShares MSCI Sweden ETF (EWD) features severe underperformance, and the fund appears to be rolling over once more. One of the nation’s I.T. stocks was once a household name but has suffered from a quickly shifting technological landscape. Is Ericsson a buy now after a steep fall? Let’s tune in.

Sweden: Pulling back after an early Q4 rally

According to Bank of America Global Research, Ericsson (NASDAQ:ERIC) is a leading global network equipment and software supplier to wireless carriers with a focus on Radio Access Network/RAN equipment, mobile core network/IMS, and OSS/BSS solutions. The company also provides professional services such as consulting and network outsourcing to carriers.

The Sweden-based $20.5 billion market cap Communication Equipment industry company within the Information Technology sector trades at a low 8.4 trailing 12-month GAAP price-to-earnings ratio and pays a 2.7% dividend yield, according to The Wall Street Journal. Earlier this year, the company completed an acquisition of Vonage.

While Ericsson’s management team had been on the hunt for new assets, there are current headwinds in the space which result in a poor earnings outlook. The stock price has largely reflected such pessimism. A major concern is a possible peak in the Radio Access Network (RAN) market and the rise of what’s known as Open-RAN. That market reality will likely pressure margins going forward and multiple contraction for the stock price. The upside potential stems from better cost-cutting measures by the management team, improved capex spending and investments, and a longer 5G cycle.

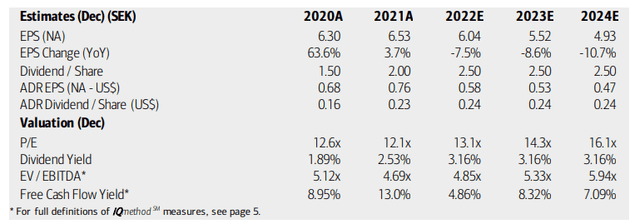

On valuation, analysts at BofA see earnings having fallen significantly in 2022. A further per-share profit decline is expected next year and in 2024. While the dividend is currently decent, near 3%, don’t expect any hikes soon given the uncertain fundamental backdrop. On the plus side, ERIC does generate a good amount of free cash flow, so I think the dividend is safe for now. Unfortunately, a low-teens P/E is probably still too high when looking at such poor growth prospects.

Ericsson: Earnings, Valuation, Free Cash Flow Forecasts

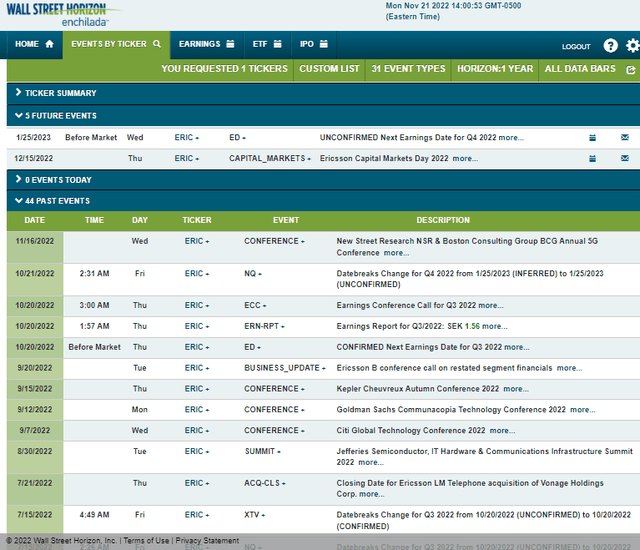

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, January 25. Before that, though, Ericsson’s management team will give more color on its operating environment during a Capital Markets Day on Thursday, December 15. Volatility could rise ahead of and during that event.

Corporate Event Calendar

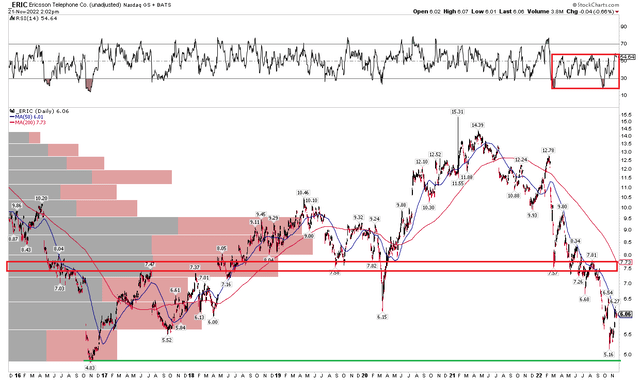

The Technical Take

ERIC has been mired in a steep downtrend off its early 2021 high. Shares pulled back by nearly 70% to a low last month after its earnings report, but it did manage to hold an old low from back in 2016 just below $5. That’s a reasonable trading pivot price for tactical investors to monitor. I think being long here with a stop under $4.83 can make sense, but profits should be taken should the stock rise to near $7.50 – that is where the falling 200-day moving average will come into play as well as where a significant amount of bearish overhead supply enters the scene.

I also find that the 50-day moving average has been a spot of selling over the last eight months or so, and ERIC is right at it now, so I would not be surprised to see shares retreat in the very near term.

Overall, though, the trend is down, and we need to see definitive signs of an inflection before a long-term bullish thesis can be made.

ERIC: Major Downtrend May Have Found Support, But the Onus Is On the Bulls to Reverse Course

The Bottom Line

With dismal EPS growth expected and a valuation that is not yet at extremely pessimistic levels, I am a seller of Ericcson right now. The chart offers some opportunities from the long side, but only on a short or intermediate-term basis.

Be the first to comment