gleitfrosch/iStock via Getty Images

Turtle Beach (NASDAQ:HEAR) is a fan-favorite gaming headset and accessory company based in San Diego. The company has posted strong fundamentals that indicates growth throughout many areas. 1Q22 earnings report coincided with the expectations for the company as net revenue and adjusted EBITDA stood higher than estimates. Donerail, an activist investment firm, has made multiple attempts to acquire the company, and has recently been given three seats on the board of directors. The firm has made three offers to purchase Turtle Beach to date, with each offer increasing the premium over the share price. With Donerail joining Turtle Beach’s board and pursuing acquisition of the company, a deal could be agreed on in the near future and bring great value to investors. This potential acquisition along with the stock being fairly undervalued solidifies my Buy rating to HEAR stock.

Growing Fundamentals Strengthen the Company’s Value

Turtle Beach has solid fundamentals which helps to solidify the company as the leading console gaming headset manufacturer. Revenue has seen huge growth as it has increased from $149.14 million to $366.35 million from FY17 to FY22. Gross profit has also seen a great increase of 51.00 million to 128.38 million over the past 5 fiscal years. EBIT has followed this income statement growth as it has rose from $4.8 million to $20.43 million over this span.

From FY17 to FY22, cash rose from $5.25 million to $37.72 million. The company’s current ratio is 2.47 which is mainly due to its $101 million in inventory. Turtle Beach has an impressively low debt of $8.5 million which will allow for the company to better survive a possible recession paired along with its growing cash. The company’s Net Debt/EBITDA ratio sits at -2.1 which is also reflective of the small amount of debt throughout the company. The company’s retained earnings is currently negative at -$57.05 million. However over the past 5 years, its retained earnings have been trending in the right direction as it has rose from -$170.05 million in FY17. This is because Turtle Beach is recently profitable and does not pay a dividend.

Over the past 5 fiscal years, the company’s cash from operating activities has decreased from $3.42 million to -$327,000. Capex has increased from $4.41 million to $5.62 million. The company is currently buying back a net of $56,000 worth of shares; however, the overall trend shows inconsistency as the company seems to be issuing more shares than retiring them.

First Quarter Earnings Indicate Company Is On Track With Expectations

Turtle Beach posted 1Q22 Earnings which were mostly in line with estimates for the quarter. CEO Juergen Stark attributed the solid quarter to its new innovative gaming accessories, steady lead in the console gaming headset market, and advancements in non-console headsets.

During the quarter we unveiled a variety of innovative new gaming accessories – including new additions to our best-selling Stealth wireless headset series, maintained our clear leadership position in the console gaming headset market, and continued our strong progress across non-console headset categories, all while executing in-line with expectations.

Net revenue outperformed expectations at $46.7 million, but was a huge drop from last year’s revenue of $93.1 million. Gross margin was 30.1% which was also much less than the 37.5% from the year-ago quarter. The drop in gross margin was associated with the rise in freight costs and fixed cost de-leveraging. Operating expenses were $22.3 million which was roughly on-par with 1Q22 operating expenses of $22.6 million. Turtle Beach’s lower sales expenses and lower marketing spending, with higher product development to support growth, indicate the small drop in operating expenses. The company posted net loss in 1Q22 of -$6.5 million, which is very divergent from the net income of $8.8 million set in 1Q21. Adjusted EBITDA stood higher than expectations at -$5.7 million, but was still far off from the $15.3 million reported in the year-ago quarter which reflects the decrease in revenue and increase in logistic purchases the company made this quarter. Notably, Turtle Beach’s cash dropped from $63.0 million in 1Q21 to $23.7 million in 1Q22. Overall, Turtle Beach outperformed expectations but is far below last year’s fundamentals.

Activist Investors Could Bring Great Value

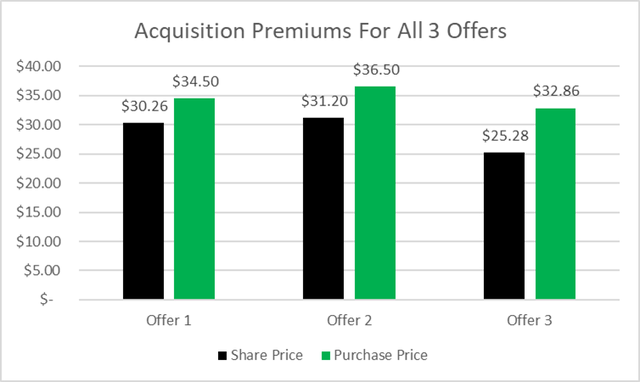

Donerail, an activist investment firm, is making notable efforts to acquire Turtle Beach and is making progress. Turtle Beach recently gave three seats on its board of directors to Donerail and the firm is forming a strategic review committee which will explore options including the sale of the company. Donerail has made multiple offers to acquire Turtle Beach to take the company private but one has yet to be approved.

Donerail first engaged with Turtle Beach in February 2021, where the companies held introductory meetings. The firm would send its first proposal to acquire the company in April 2021 with a 14% premium. However, this proposal was rejected. Donerail would then buy 125,000 shares of Turtle Beach stock and offer a new proposal to purchase the company at a 17% premium in July 2021. The proposal would be revised in December 2021, with Donerail offering a 30% premium to the closing share price.

Premiums of Last Three Offers (Created by Author)

The company and the firm would then go on to attempt to settle acquisition terms in March 2022, with Donerail rejecting Turtle Beach’s settlement proposal this time. The ongoing situation has progressed with Donerail gaining three executive board seats in May as the firm already owns 7.4% of Turtle Beach’s outstanding shares and has been in strong pursuit of acquiring the entire company.

With both parties making counteroffers throughout negotiations, it is clear that both Turtle Beach and Donerail are interested but would like to make a deal that makes sense for both sides. The latest offer included a premium 30% over the share price, and ongoing negotiations could mean that this premium could continue to increase. Donerail’s acquisition of Turtle Beach is a real possibility, as the firm has even gained three seats on the board of directors for the company. Negotiation developments have pushed the premium higher and higher which is bringing greater value to investors and could continue to do so if negotiations further progress.

Valuation

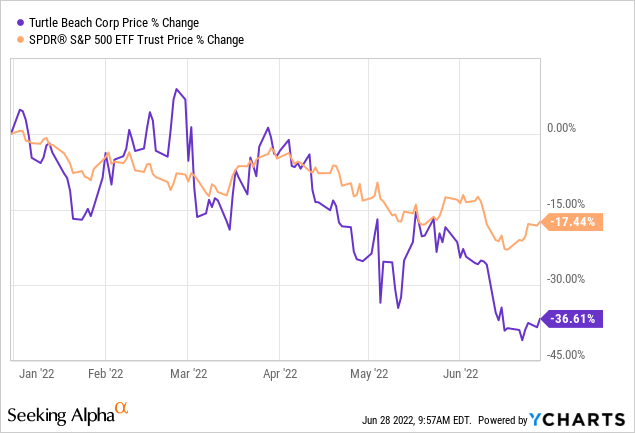

Turtle Beach’s share price is far underperforming the market, which can give plenty of value to investors based on the long term potential the company has.

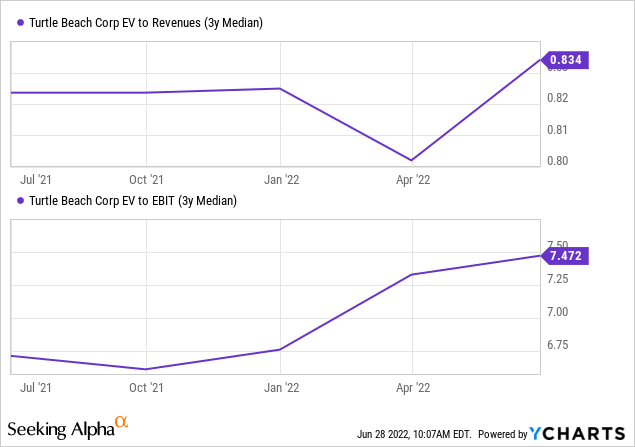

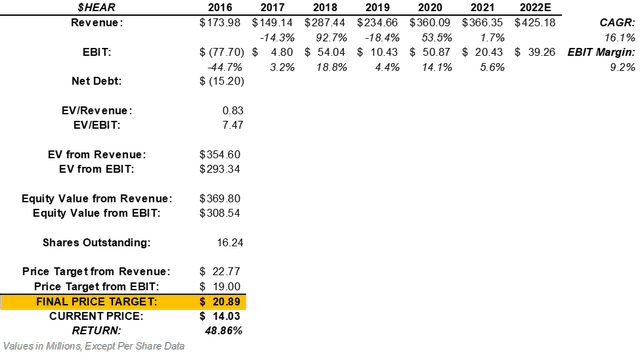

Turtle Beach has seen an increase in its revenue from $173 million to roughly $366 million from FY16 to FY21. This can be directed to a CAGR of 16.1% which could be expanded into the company’s next fiscal year. This forecasts Turtle Beach to produce $425.18 million in revenue in FY22. Also, Turtle Beach has an average EBIT margin of 9.2% over the last 5 fiscal years. Multiplying this margin by the estimated revenue of $425.18 million, projects the company to generate $39.26 million in EBIT next fiscal year. After multiplying these projections by its current EV/Revenue and EV/EBIT multiples, we can find the company’s expected enterprise value.

Adjusting the company’s projected enterprise values for net debt, allows us to come to Turtle Beach’s projected equity value from its revenue and EBIT. After dividing the equity values by the current number of shares outstanding and averaging the price targets, a final price target of $20.89 can be calculated. This means HEAR stock could return an upside of about 48.86%. This upside could also be similar to the premium of a possible acquisition as Donerail has been raising its offer with each proposal.

Valuation of HEAR stock (Created By Author)

The Takeaway For Investors

Turtle Beach has fundamentals that are growing and are solidifying the company as the leading manufacturer of console gaming headsets. The company’s 1Q22 earnings have shown that the company is on track with its expectations, as net revenue and adjusted EBITDA have most notably outperformed estimates. It is important to mention that the most recent quarter has seen some declines when compared to last year. Donerail is making large strides to acquire Turtle Beach, having already made three offers to acquire the company. A potential acquisition could give plenty of value to investors, as Donerail has already offered a premium of 30% in its latest offer. The stock also appears to be greatly undervalued with a potential upside of 48.86%. Therefore, I will apply a Buy rating to the company.

Be the first to comment