simpson33/iStock via Getty Images

Tuesday, April 19th, proved to be an awful day for shareholders in streaming giant Netflix (NASDAQ:NFLX). Despite the company seeing its share price increase for the day, shares eventually plunged after the market closed in response to some unsettling developments for the company and the prospect for that picture to worsen in the near term. This kind of market reaction may make for a decent buying opportunity for long-term investors. But it’s also important to keep in mind that the kind of volatility currently being experienced by the company’s investors is what you can expect from buying into a growth play that fails to achieve the growth the market had priced into it. At the end of the day, Netflix might make for an attractive opportunity given the decline in price it’s experiencing now. But there is no doubt, regardless of the outcome, that risks are extremely elevated at this moment.

Netflix – A harbinger of things to come

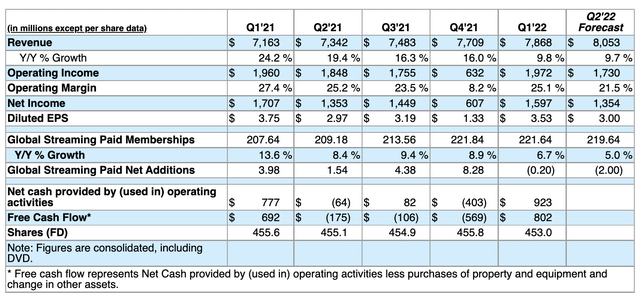

Leading up to the release of data covering the first quarter of the 2022 fiscal year for streaming giant Netflix, investors seemed to have been rather hopeful. The expectation was for the company to generate revenue of $7.94 billion. Had that come to fruition, it would have translated to a year-over-year increase of 10.8%. However, revenue for the company did not climb quite as much as anticipated. Sales of $7.87 billion translated to a year-over-year growth rate of 9.8%. The good news is that, when it came to earnings, the company did perform quite well. For the quarter, analysts were expecting the company to report a profit of $2.91 per share. Instead, the company returned a profit of $3.53 per share. Although this was a positive, it was weaker than the $3.75 per share the company reported just one year earlier.

Netflix

Despite the miss on revenue, the earnings per share normally would have been enough to push the stock higher. Instead, shares of Netflix plunged 25.6% after the market closed, which translates to a total loss for shareholders of about $40.4 billion. This rapid decline was driven last by what the company reported on its top and bottom lines and more by what it reported when it came to subscriber numbers. You see, investors in Netflix are used to seeing subscriber numbers increase every quarter. However, according to the data provided, the company lost about 200,000 subscribers over a three-month window.

Netflix

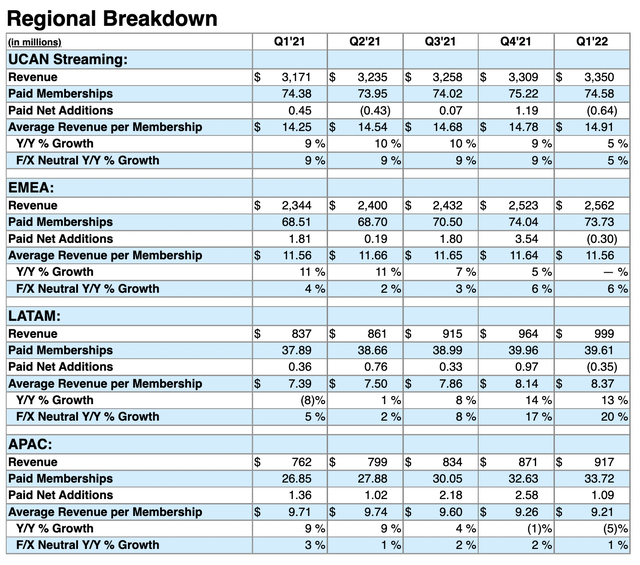

To be fair, some of this pain was self-imposed. In response to Russia’s unwarranted war against Ukraine, the streaming service decided to suspend operations in Russia earlier this year. That alone resulted in a loss of around 700,000 subscribers. Excluding this, the company would have added 500,000 over the past three months. At first glance, this may then seem as though the market is overreacting. However, the company did not experience growth everywhere. For instance, in the EMEA (Europe, Middle East, and Africa) unit, excluding its operations in Russia, the company did add about 400,000 subscribers. It also added a robust 109,000 in the APAC (Asia-Pacific) region. However, the company lost roughly 350,000 subscribers in LATAM (Latin America), with those losses being driven by foreign currency fluctuations and weak macroeconomic conditions. More concerning, however, is the 640,000 loss experienced by the UCAN (US and Canada) unit. Management attributed this decline to a price increase the company previously put in place.

To make matters worse, management expects the near-term outlook to be even worse. Although revenue at the company should climb to $8.05 billion in the second quarter of its 2022 fiscal year, which would represent a year-over-year increase of 9.7% compared to the $7.34 billion reported one year earlier, the company expects to lose a further 2 million subscribers globally during that three-month window. In discussing matters, management has pointed to a few different issues. Initially, they thought that weak growth achieved in 2021 was driven by the front-loading of subscribers that came on during the COVID-19 pandemic in 2020. Basically, instead of seeing two attractive years, the company saw one really great year followed by a mediocre year. But the picture was not so simple.

One issue the company is seeing is a limitation caused by the adoption of connected televisions. The overall trend, management asserts, is positive for the business. But its prospects truly are limited by how quickly consumers adopt connected televisions. Perhaps a bigger issue relates to the fact that, according to estimates, an estimated 100 million households have access to Netflix free because of the company’s decision many years ago to allow sharing of the subscription with friends and family members at no additional charge. This also limits the company’s upside because, in essence, it is dealing with freeloaders. Although the company grew its share of the television viewing market from 6% in May of 2021 to 6.4% by February of this year, it sees the decision by many content providers to create their own streaming platforms has limited the company’s upside. And finally, the company has cited weak macroeconomic conditions such as high inflation that have impacted investors.

Author

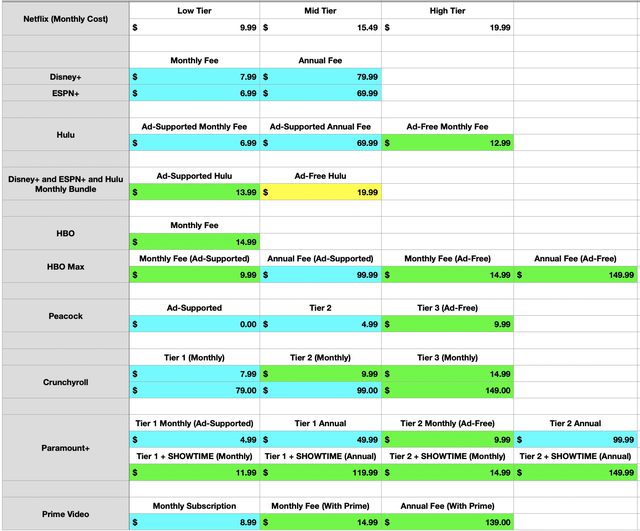

Personally, I have no problem believing that all of these factors have some truth to them. However, one thing I have wondered as other streaming services develop, is the extent to which a higher-cost service like Netflix can continue to thrive. Although Netflix does have a service for as low as $9.99 per month, this particular offering comes at just 480p definition. To really get bang for your buck, you need to go at least one level up to the offering that costs $15.49 per month. In perspective, I need only point to the table above. Any cells that are highlighted blue are those in which the monthly fee or the effective monthly fee but paid annually, can be bought for cheaper than the cheapest tier that Netflix offers. Those cells in green, meanwhile, are those that are more expensive than the lowest tier for Netflix but still cheaper than the mid tier one at $15.49 per month. And any cells that are yellow indicate a price at least equal to Netflix’s most expensive offering at $19.99 per month.

When really put into perspective, you find that any quality experience on Netflix is near the upper end of the pricing range for different services. For instance, Disney+, ESPN+, and Hulu, all of which are owned by The Walt Disney Company (DIS), are significantly cheaper. And these come in at a 4K level of resolution. To get that with Netflix, you need to spend $19.99 per month. To get up to that pricing, you would have to pay for the Disney+, ESPN+, and Hulu bundle that comes with an ad-free experience for Hulu. Both HBO and HBO Max, which are services that are now owned by Warner Bros. Discovery (WBD), but that was previously owned by AT&T (T), are also rather pricey but still cheaper than the most expensive Netflix offering. Peacock, which is owned by Comcast (CMCSA), starts at no cost with advertisements included, but peaks at $9.99 per month for an ad-free experience. For anime, you have Crunchyroll, which is owned by Sony Group Corporation (SONY). You also have multiple offerings by Paramount (PARA) under the Paramount+ banner. And even Prime Video, which is run by Amazon (AMZN), is cheaper.

Although Netflix does have its own content today and invests far more in content creation than many other services, the platform does not yet have the same kind of content library that many of its competitors have accumulated over many decades and countless acquisitions and mergers. By comparison, a company like Disney has been accumulating its content for decades, allowing the business to launch its own streaming service, Disney+, and to grow that platform from nothing in November of 2019 to having 129.8 million subscribers by the start of 2022. Its ultimate goal is to reach between 230 million and 260 million users globally by the end of 2024. To make up for that, Netflix has been spending large amounts of money each of the past several years in order to create its own content. Even so, the platform is falling short on this side compared to other rivals like Disney. In 2021, for instance, Netflix spent around $17 billion on its content. That compares to about $33 billion that Disney should spend this year.

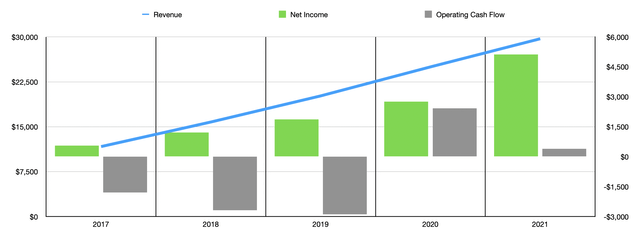

Another problem for investors in Netflix is that the company’s fundamentals are difficult to read and shares are pricey. Revenue, admittedly, has grown consistently over the years, rising from $11.69 billion in 2017 to $29.70 billion last year. Net income has also risen nicely, jumping from $558.9 million to $5.12 billion over the same timeframe. But cash flows are volatile, with a net outflow peaking at $2.89 billion in 2019 before turning positive in the amount of $2.43 billion one year later before plunging to a profit of just $392.6 million in 2021. Ignoring the cash flow picture and valuing the company just based on earnings, you find that, prior to the overnight decline in share price we saw, the company was trading at a price to earnings multiple of 30.3. Though that may not be unrealistic for a company that’s continuing to grow at an attractive pace, it leaves a lot of downside should growth reverse like what we are seeing right now.

Author

None of this is to say that management doesn’t have a plan to address the company’s problems. In their investor release, as well as in subsequent dialogue, the company offered some thoughts on the matter. Apparently, they have been experimenting with charging users who want to be able to share their Netflix subscriptions. They did this in three different markets in Latin America for a short period of time. In Costa Rica, for instance, they allowed users to share their subscription with others for a price of $2.99 per month. The company views this as an opportunity to expand its market. Though it’s unclear how many customers might be alienated because of such a maneuver. Another option the company expressed interest in is to add advertising on its platform with a lower monthly fee for those who don’t mind seeing ads. The company has resisted this strategy for years, but they recently acknowledged that it works for so many of their competitors. Budget conscious consumers could be drawn to a lower monthly fee with ads to support the service. And naturally, management is also continuing to focus on additional content, including original international content because the international markets are where its growth potential lies in the long run. The company has, for years, developed such content. But to really ramp up this kind of initiative, the firm will have to spend more on programming.

Takeaway

At the end of the day, Netflix is still a massive player in a large and growing market. Some investors may feel that the recent decline in subscribers, combined with the larger expected decline moving forward, is a sign of fatigue in the streaming market. Given broader economic issues, this may not be a crazy idea. However, I view lower-priced, but still high quality, alternatives as a major threat to the firm. I have no doubt that, in the long run, Netflix will continue to build up its own original content and, in turn, will generate value for its viewers. But it’s clear that changes are needed and it should serve as a lesson to growth investors about the dangers of buying into a pricey business on the expectation that the future will always be better. I have no idea where the company will go from here. But for those who do think the company can innovate its way out of this, now might be as good a time as ever to consider buying in. Personally, I prefer a more attractive prospect like Disney, But for those who want a pure-play streamer, Netflix may not be a bad business to consider.

Be the first to comment