CHUNYIP WONG

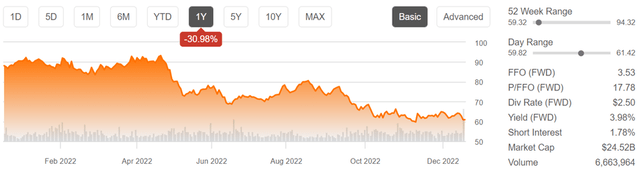

Recent market volatility has created a number of bargains in REITs. This includes high quality multifamily REITs such as Equity Residential (NYSE:EQR), which has traded down by 31% over the past year, as shown below. In this article, highlight why now may be an excellent time to add to this high quality name.

Why EQR?

Equity Residential is a member of the S&P 500 and is focused on the acquisition, development, and management of apartment communities. It was founded in 1993, and has a long track record of performance and has grown to become one of the largest apartment REITs in the United States.

At present, EQR owned or had an ownership interest in 308 properties containing nearly 80,000 apartment units. These properties are located in major cities across the country, including New York, Los Angeles, San Francisco, and Washington D.C.

One of the key advantages of investing in Equity Residential is the company’s focus on high-quality properties in desirable locations. These properties tend to have higher occupancy rates and can command higher rental rates, which translates into increased revenues and profits for the company. In addition, Equity Residential has a strong track record of actively managing and maintaining its properties, which helps to retain tenants and further drive revenues.

Another factor to consider is the stability of the rental housing market. While the demand for rental housing can fluctuate based on economic conditions, the long-term trend has been for an increasing number of people to rent rather than own their homes. This trend has been driven in part by rising home prices and high mortgage rates, which have made it difficult for some people to afford to buy a home.

EQR’s strength is demonstrated by its robust same store revenue growth of 12% YoY during the third quarter, driven by healthy demand for leases. It’s also seeing effective operating leverage, as same store expense grew well below revenue growth, at just 3.5% YoY. For the full year, management now expects respectable 11% same store revenue growth and 96.4% occupancy at the end of the year.

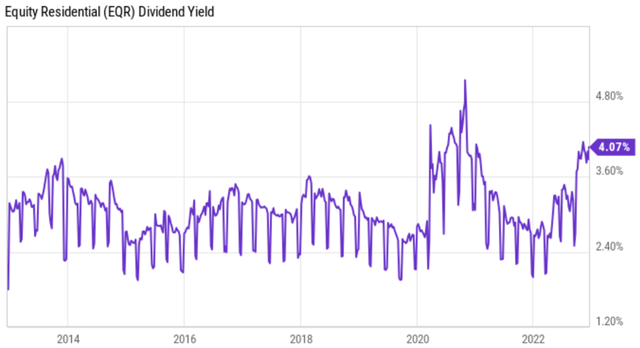

Meanwhile, EQR maintains a strong A- rated balance sheet with a net debt to EBITDA ratio of 5x, and management expects for this leverage ratio to trend down to 4.5x by the end of this year. Moreover, EQR pays a healthy 4.1% dividend yield at the current price, and this is well supported by a low 68% payout ratio, based on the $0.92 in Normalized FFO per share generated during the third quarter. As shown below, EQR’s dividend is currently at one of its highest yields over the past decade.

Risks to EQR include inflation and economic uncertainty, which may affect renter health. However, EQR’s high quality properties attract more affluent and college-educated residents, which are less vulnerable to economic downturns, as highlighted by management during the recent conference call:

The college graduate cohort, which we believe makes up the vast majority of our residents has an unemployment rate of 1.8% and compared to the 3.5% overall unemployment rate. Even if layoffs materialize, we believe that the tighter than average labor market for these knowledge workers will allow them to find replacement jobs quickly.

Finally, although high inflation has impacted everyone’s real incomes, our Affluent Renter is relatively more insulated due to their higher incomes and lower rent-to-income ratios. The average income for the residents who signed new leases with us in the past 12 months is $174,000 or 12% higher than the group who signed with us in the 12 months ending September 2021. These new residents are paying us slightly less than 20% of their income in rent, which is generally consistent with prior rent to income levels.

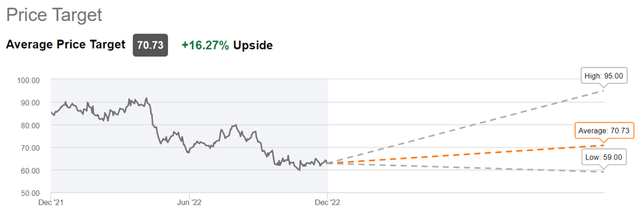

Turning to valuation, I find EQR to be attractive at the current price of $60.83, with a blended P/FFO of 17.3, sitting well below its normal P/FFO of 20.9. I believe EQR deserves to close at least half of this valuation gap considering the high demand that it’s seeing, especially when many would-be homeowners are currently priced out of the market. Analysts have a consensus Buy rating on EQR with an average price target of $71, implying potential for double digit total returns.

EQR Price Target (Seeking Alpha)

Investor Takeaway

Equity Residential is a well-established REIT with a strong track record of performance and a focus on high-quality properties in desirable locations. These factors, combined with the stability and potential for growth in the rental housing market, make it an attractive investment for those looking for income and potential capital appreciation. Lastly, the dividend yield is currently at one of its highest points in a decade, giving income investors something to cheer about.

Be the first to comment