wellesenterprises

Author’s Note: All figures listed in Canadian Dollars unless otherwise noted.

Investment Thesis

After years of intensive capital investment, TELUS Corporation (NYSE:TU) is nearing the end of its massive fibre-to-the-home (FTTH) buildout. By the end of 2022, TELUS is expected to have completed approximately 85%-90% of its targeted broadband footprint. The company can now realize the benefits of this investment, as TELUS’s full transition to fibre infrastructure will support margin expansion and increase average revenue per user, or ARPU. The completion of this program expected in 2023, will free up significant free cash flow to fund growth through acquisitions, increase the dividend and deleverage the balance sheet.

While still producing consistently strong wireline and wireless operating results, TELUS’s capital intensive build out and its rapid expansion into ancillary ventures through acquisitions has left the company’s balance sheet and dividend payout ratios stretched. The reduction in capex of approximately $1B from 2022 to 2023 will contribute to free cash flow nearly doubling in 2023. In addition to dividend growth and deleveraging, this free cash flow will enable TELUS to continue the development of its promising health, agriculture and TELUS International ventures. This will result in TELUS having more diversified and resilient earnings, which will command a higher valuation multiple.

Company Profile

TELUS is one of the three large telecom providers in Canada that accounts for almost 90% of the $53B telecommunications market. TELUS is the dominant wireline provider in Western Canada, where it competes with rival Shaw Communications Inc. (SJR). As a national wireless carrier, TELUS competes with BCE Inc. (BCE) and Rogers Communications Inc. (RCI). TELUS serves around 9.2 million wireless subscribers and 2.1 million connected device customers.

Headquartered in Vancouver, Canada, TELUS was formed through the privatization and merger of the government-owned Alberta Government Telephone corporation and BC Tel. With a market capitalization of CAD $38B, TELUS trades on both the TSX and the NYSE under the symbol “T” and “TU” respectively with daily average volume of 2.4 and 1.5 million shares respectively.

TELUS has evolved from its core wireline and mobile business to develop connectivity and technology solutions across multiple industries. In 2021, TELUS Corporation spun off TELUS International (TIXT), a provider of digital solutions. TELUS has retained a 55% economic interest in TELUS International, which now accounts for approximately 15% of total TELUS Corporation revenue. For a closer look at TELUS International please see my full analysis “TELUS International: Broad Based Growth With Attractive Valuation”.

Using TELUS International as a model, TELUS Corporation has been scaling up operations in its agriculture and consumer goods division along with its TELUS Health division. The latter recently expanded through the $2.3B acquisition of LifeWorks, Inc., formerly known as Morneau Shepell, a provider of workplace wellness benefits to employers. These business lines promise higher growth than TELUS’s core business and their development and eventual reorganization will support a premium valuation when compared to TELUS’s telecom peers.

Fibre-to-the-Home Build Out

Since 2000, TELUS has invested approximately $220B in infrastructure and spectrum. The firm’s massive investment in infrastructure has enabled TELUS to provide best in class high speed internet speeds, television and home security to homes and businesses. In March 2021, TELUS announced plans to accelerate $1.5B of capital spending slated for 2021 and 2022. Accelerated capital invested during the third quarter of 2022 and first nine months of 2022 was $226 million and $691 million, respectively. This investment has moved up the timeline on the company’s capital plan including its FTTH program and its copper-to-fibre-migration program. As at September 30, 2022, 2.9 million households and businesses in B.C., Alberta and Quebec were connected with fibre-optic cable, up from 2.6 million households at the end of Q3 2021. The FTTH strategy has been a success for TELUS as it has been taking market share from competitor Shaw in its wireline segment.

Capital Requirements Shrinking

On the Q3 2022 earnings call, Management reiterated the expectation for a reduction in capex from $3.5B in 2022 to $2.6B in 2023, resulting in an increase in free cash flow from $1.3B in 2022E to an estimated $2.6B in 2023. This $2.6B includes $100M in capex related to the acquisition of LifeWorks. Taking out the capex related to this acquisition, the capex forecast going forward to 2023 and beyond is a full $1B less annually than in 2022. This has the immediate result of increasing free cash flow from approximately $1.3B in 2022 to an estimated $2.6B in 2023, according to a recent estimate from RBC Capital Markets.

In his 2022 letter to investors, TELUS CEO, Darren Entwistle spoke to the inflection point TELUS has hit in its capital requirements and the resulting free cash flow:

Commencing in 2023, we are targeting a significant decline in our annual capital expenditures to $2.5 billion, or less. Free cash flow will be strengthened by the expected capex decline of approximately $1 billion over 2022, in addition to strong ongoing EBITDA expansion.

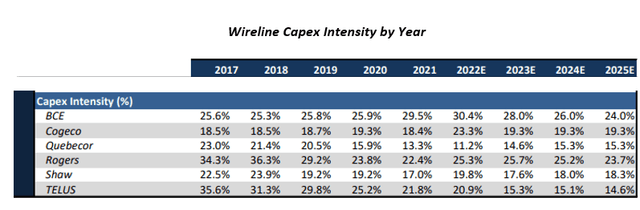

TELUS’s consolidated capex intensity is forecast to decrease from 19% in 2022 to 13% in 2023, this compares to 16%-17% Canadian telecom peers. On the wireline side, this change is even more dramatic, with TELUS being the first in the industry to see a dramatic drop off in wireline capital. BCE will start to see reductions towards the middle of the decade, however their wireline capex intensity will still be approximately 10% higher than TELUS’s over the next few years.

Wireline Capex Spending (RBC Capital Markets)

Source: RBC Capital Markets

Completing this major capex undertaking leaves TELUS better positioned than its rivals to build out its 5G network. Not only will TELUS have the free cash flow to commit to the development of its 5G network, it will also have a multiyear head start over BCE and Rogers through its capital availability.

Revenue Diversification Strategy

Corporate strategy across the Canadian Telecom sector has been driven by how best to reinvest the excess profit from the protected wireline and wireless businesses into areas over higher growth. The three firms accounting for 90% of the wireless market in Canada, the industry is essentially an oligopoly. What differentiates TELUS from its peers, BCE and Rogers is how it has pursued diversification.

While BCE and Rogers have invested in media, TELUS has looked to leverage its technology to enter new markets and new sectors. The pandemic demonstrated that health, agriculture and technology businesses that TELUS has developed, have proven more resilient than the sports, media and entertainment businesses that Rogers and BCE have expanded into.

Dividend Growth

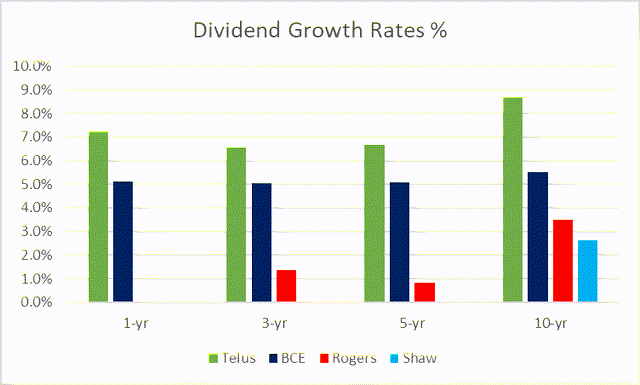

In keeping with its multi-year dividend growth program, on November 4th, 2022, TELUS increased the quarterly dividend to $0.3511 per share. This quarterly dividend reflects an increase of 7.2% from the $0.3274 per share dividend declared one year earlier. At current levels, the company is yielding a little over 5%. 2022 marks 18 consecutive years of dividend increases earning the company’s dividend a 20-year CAGR of 7.5%. This consistent growth far outpaces TELUS’s peers in the telecom sector.

Canadian Telecom Dividend Growth (Author)

Graph Source: Author, Data Source: Canadian Dividend All-Star List

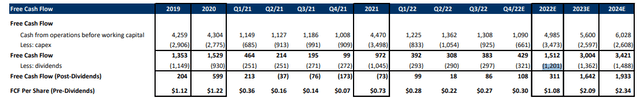

While the company has demonstrated tremendous growth and consistency, the payout ratio has become stretched. Dividends on common shares in 2021 were approximately $1.7B, of which $624M was reinvested through DRIP. The company’s payout ratio in 2020 was 67%, before ballooning to 140% of free cash flow in 2021. Following the step down in capex next year, free cash flow less dividends should surge from approximately $300M in 2022 to approximately $1.6B in 2023 and $1.9B in 2024 according to consensuses estimates.

Telus Free Cash Flow Projections (RBC Capital Markets)

Source: RBC Capital Markets

According to Equity Analyst Matthew Dolgin with Morningstar:

With a payout ratio hovering around 100% of free cash flow (which excludes spectrum purchases), we believe the dividend policy is a little aggressive and such levels of annual increases likely can’t be maintained. However, because we don’t believe the firm is forgoing other investment opportunities or putting itself in a dangerous financial position, we don’t see the policy as overly problematic.

TELUS has a targeted cash dividend payout ratio of 60%-75% of free cash flow. With TELUS nearing the peak of its capital spending, its dividend coverage ratio should moderate significantly over the next few years. Over the long term, TELUS has demonstrated an attractive and responsible pace of dividend growth. While the last two years of growth have stretched the payout ratio, I see this coming back to target range shortly. With nearly 20 years of dividend growth, TELUS wasn’t interested in pausing their dividend streak for what the firm saw as a temporary cash flow issue.

Risk Analysis

On November 29, 2022, DBRS Morningstar downgraded TELUS’s debt rating to BBB from BBB [HIGH]. This downgrade was largely the result of TELUS’s June 2022, announcement to acquire LifeWorks, Inc. for approximately $2.3B and the assumption of $600M in debt. Following this acquisition, TELUS is poised to have a net debt/EBITDA ratio in the vicinity of 3.77X compared with 3.33X at the end of 2021.This compares to BCE and Rogers with leverage of 3.2X and 3.4X respectively. Within the next few years, the company should be able to achieve its targeted net debt/EBITDA range of 2.2X – 2.7X. The ratings agency did confirm that all trends have been changed to stable from negative and that the company’s current leverage is adequate to facilitate spectrum purchases, pursue acquisitions, continue with network investment and continue increasing dividends in the high-single digit range.

Inherent risks to telecom firms include regional competition, the threat of more onerous regulation from the Canadian Radio-television and Telecommunications Commission. While the threat of new regulation is a continued risk to the protected, high-barrier-to-entry Canadian wireless industry. Further revenue diversification from this core business segment reduces overall impact of regulatory risk.

Beyond these standard operating risks, the key concern for TELUS is the effective execution of its diversification strategy. Should the company overspend on an acquisition, or fail to unlock value from its new enterprises, its non-core businesses could end up being costly distractions from TELUS’s primary wireless and wireline businesses. As TELUS continues to diversify away from its core wireless and wireline businesses, it’s valuation will also become harder to compare to its peers.

Bottom Line

Already the best in class name in the Canadian telecom industry, TELUS has positioned itself to lead the pack into the 5G era. With its FTTH capital expenditures substantially complete, TELUS will generate meaningfully more free cash flow. This free cash flow will serve to fortify the company’s balance sheet and provide visibility towards continued dividend growth. I am a long-term holder of TELUS and will continue to add to my position.

Be the first to comment