landbysea

Equinor logo (Equinor homepage)

Investment thesis

In my search to fill my portfolio with a large energy firm back in 2019, I did consider Equinor (NYSE:EQNR) from Norway, where I was born.

My last article on EQNR goes all the way back to the middle of March 2019, when I had a buy stance. At that time, the ADR was trading for USD 22.37. It is now at USD 34.31. the total return is 74%.

Much has happened in the energy space since 2019. It is a good time to check how EQNR is doing.

Financials FH 2022

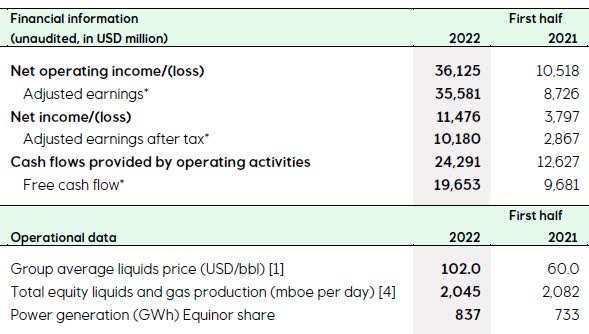

Their adjusted earnings after taxes jumped from USD 2.87 billion in FH of last year to USD 10.18 billion, helped by 70% higher average liquid prices.

EQNR – FH 2022 versus 2021 results (EQNR – FH 2022 results)

Their diluted EPS was USD 3.56 in FH 2022 compared to USD 1.16 in 2021. If we assume that the SH of 2022 will be as good as the FH, an EPS of about USD 7 would imply that EQNR’s P/E is only 4.9

The cash flow from the operation was USD 28.8 billion.

Net debt to capital employed is a comfortable 38.6%.

Returning capital to shareholders

First, let me start by stating that EQNR has been, and still is, returning a lot of economic benefits to Norway. It’s people and its government.

Last year alone, EQNR paid NOK equivalent to USD 8.3 billion in taxes to the Norwegian government. They also returned capital to shareholders in the form of share buyback and dividends of USD 2.1 billion.

Since the government owns 70.7% of EQNR, which includes 3.7% owned by the government pension fund, they also get the bulk of the dividend each year.

Perhaps more important is the ripple effect such a large company creates. As their homepage states:

More than 1800 suppliers in 250 business sectors and 152 municipalities in Norway delivered goods and services to EQNR’s fields in 2021. Their value exceeded NOK 70 billion, representing close to 60,000 man-years”

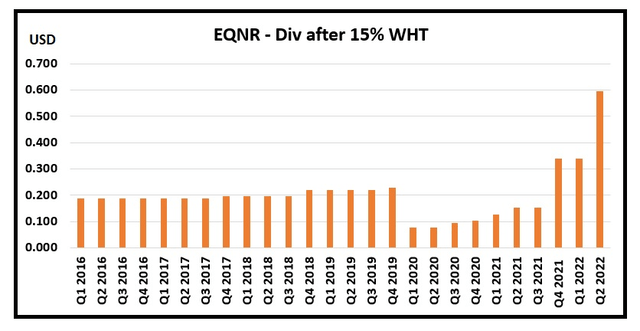

Now let us look at their dividend history.

Equinor’s dividend history (Data from EQNR. Graph by author)

From Q4 of last year, they have been paying an ordinary dividend per quarter of USD 0.20 plus an extra variable dividend. The extra dividend for Q2 this year was as high as USD 0.50.

Bear in mind that in my calculation, not only for EQNR but for any other company I cover here in SA, I only use the net dividend after withholding taxes. This is the only one I am interested in, as I do not think a gross dividend is relevant when I calculate the yield. One example of this is that I pay as much as 30% WHT on any dividend from a U.S. company. What matters to me is how much gets into my bank account.

Presently the WHT in Norway is 15%. The money each investor receives depends on his/her residence status. Assuming that is the only tax you pay, you should receive USD 0.595 as a dividend for Q2 of 2022. Based on its present share price for 1 ADR of USD 34.39 and 12 months trailing dividend of USD 1.428, the net yield is presently 4.15%

Business development

The European oil majors are at the forefront of transforming from a high carbon dependent business to one with a mixed energy.

Shell (SHEL), TotalEnergies (TTE), and EQNR have large investments in renewable energy, carbon capture, and hydrogen production using renewable energy. Many investors have been against this development, but it is going to happen. The shock in gas prices we now see makes many renewable energy sources more attractive.

Although, when we look at their financials for FH 2022, the net operating income from renewable was down as much as 97% from USD 1,310 million to just USD 35 million year-over-year. However, this was due to divestment gains in 2021.

On the topic of disruption in the energy market, SA has just published my article on the LNG transportation company Dynagas LNG Partners (DLNG), which also transports LNG for EQNR with one of their vessels. DLNG is ultimately controlled in Greece, a part of the EU, and has 75% of its business from Russian-controlled entities.

The disruption of gas supply from Russia to Europe is causing huge spikes in the cost of energy in Europe and will ultimately create suffering for many. As in so many tragedies, there are some that actually may benefit from this financially. Wars have often resulted in this.

European Commission President Ursula von der Leyen has been “knocking on the door” to the Norwegian Prime Minister and the leaders of Norwegian companies exporting natural gas. Understandably, she wants cheaper prices.

It remains to be seen what will happen.

Risks to the thesis

One potential risk to the thesis is if EQNR, being controlled by the government, would be willing to give such large discounted prices on oil and gas to the EU as a sign of their solidarity with the trouble the EU is in.

In any event, such discounts would most likely not be permanent, but on a fairly short-term basis, although the EU commission clearly wants cheap long-term solutions.

Conclusion

I wanted to look at how EQNR’s share price has done since my last buy stance was published in comparison with other oil majors.

And the winner is EQNR.

Share price comparison from 14 March 2019 (Yahoo Finance)

It is very tempting to try to time the market, and call it a day now that the share has gone up so much. Let me first state that there is absolutely nothing wrong with taking money off the table. Especially in markets like what we now are going through. Chances for a further decline in all stock markets are elevated and many famous investors have basically predicted a further fall of 10 to 20% from here.

Every investor, or trader, has to find his/her own tactics.

I do believe that energy with oil & gas is going to deliver stellar results in many years to come. My own preference leans towards a buy-and-hold strategy as long as the fundamentals are intact. It is costly to not be in the market when it suddenly improves.

As such my stance is a Hold here.

Be the first to comment