Drew Angerer

It was another rough day for stocks Wednesday, with the major indexes falling almost 2%. This added insult to injury as the S&P 500 is now down more than 10% over the past 30 days.

There’s not much bullish spin to put on Fed Chair Powell’s comments Wednesday regarding the latest rate hike. While there are signs of economic weakness, there’s not nearly enough to tip the scales in favor of a pause to the Fed’s rate hiking campaign. As such, investors are bracing for additional monetary tightening ahead, which, in turn, is likely to lead to lower stock prices in the interim.

I’m not prepared to call an immediate bottom on the market. My longer-term bear market target has been for the S&P 500 to fall to 3,400, and we still have 10% further to decline to hit that point. However, prices are low enough now to create some bargain buying opportunities, even with the terrible macroeconomic backdrop. After all, the best entry points come during bear markets when people are worn down and have given up hope.

A good place to look for these capitulation opportunities is on the 52-week lows list.

For the sake of today’s article, I’m picking from companies that made new 52-week lows on Wednesday amid the Fed rate hike selloff. Furthermore, I’ve cut out any company that has less than a 2% dividend yield from the screener. In this sort of market, it’s generally preferable to buy strongly profitable companies that can offer decent income. Finally, I’ve cut it off at the 20 biggest market cap companies that apply. We’ve got plenty of blue chips on sale today, so there’s no need to look at every microcap out there.

Here’s the list of the 20 largest U.S.-listed companies with a 2%+ dividend yield currently at fresh 52-week lows:

- Novartis (NVS)

- Verizon (VZ)

- Comcast (CMCSA)

- AT&T (T)

- SAP (SAP)

- Sanofi (SNY)

- CME (CME)

- Bank of Nova Scotia (BNS)

- GSK (GSK)

- FedEx (FDX)

- Fidelity National Information Services (FIS)

- BCE (BCE)

- Takeda (TAK)

- Dow (DOW)

- Welltower (WELL)

- Digital Realty (DLR)

- TELUS (TU)

- Chunghwa Telecom (CHT)

- Walgreens Boots Alliance (WBA)

- Fortis (FTS)

Let’s see which of these five are the most compelling opportunities going forward. Disagree? Leave a comment below. But these are my five picks.

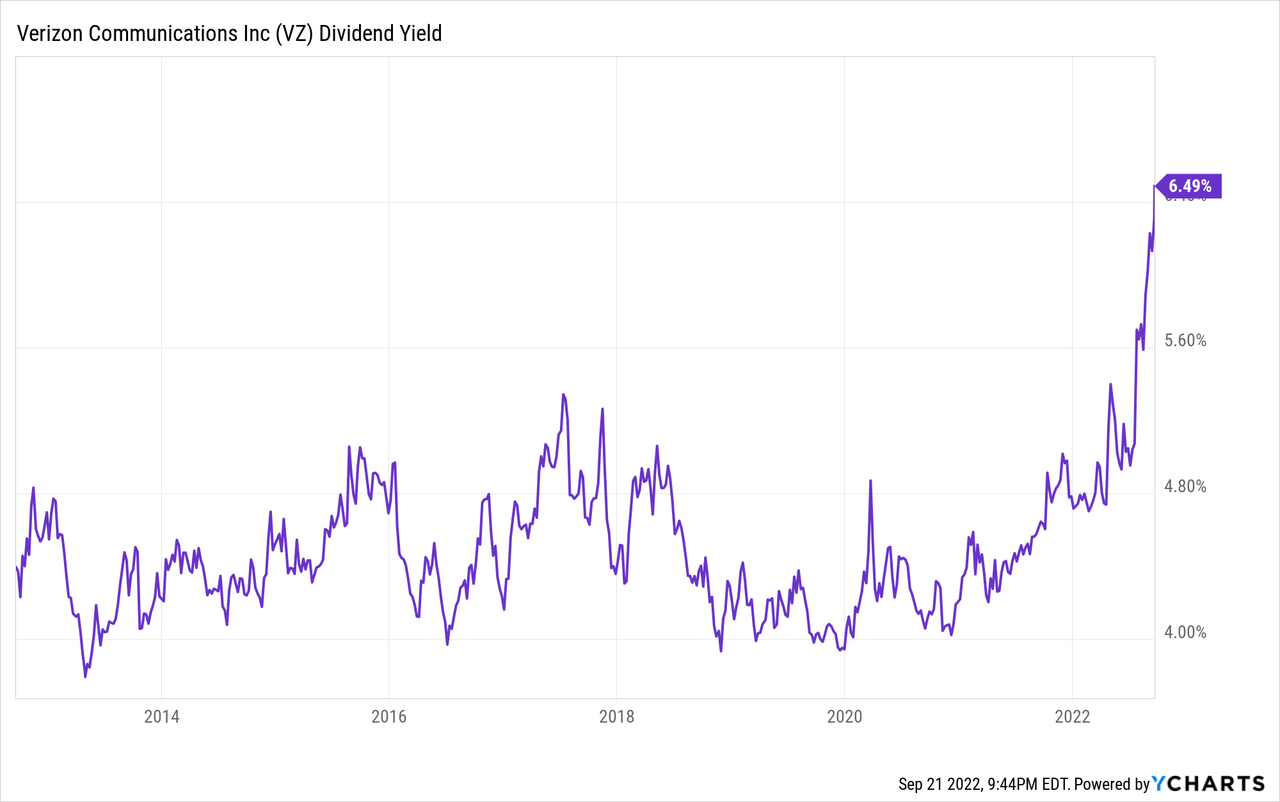

Verizon (VZ)

I’ve generally avoided telecom in recent years. It’s been a tough industry in general. There are numerous poor allocators of capital in the sector, with AT&T in particular being a case study in how not to do M&A. A lack of immediate returns on investment from things such as 5G has further dimmed investor excitement.

At some point, however, enough is enough. I’ve long avoided the U.S. telcos seeing them as simply inferior to other low beta, low volatility defensive stock alternatives. At this price, though, I’m joining the VZ stock bulls.

Verizon’s dividend yield, which consistently ran between 4% and 5% for many years, has now run up to 6.5%. Given how far the Fed has hiked this year, you could argue that’s an entirely fair repricing and that VZ stock is no cheaper on a relative yield basis today than it was this time last year.

But absolute yields also matter. A 6.5% yield is attractive in its own right as long as it can be sustained. I have little doubt that Verizon can pay its current dividend level for an extended period of time going forward.

6.5% is also a healthy premium to where treasury bond yields are today. I’m skeptical that the Fed’s rate hiking campaign will continue all that much longer. The real economy is already slowing dramatically, and additional rate increases will cause further pain in housing, durable goods, and other vulnerable portions of the market. Long story short, the rate hike cycle will inevitably turn back to rate cuts in due time, and a locked-in 6.5% starting yield will look increasingly attractive.

If and when VZ stock trades back to a 5% yield, simply due to interest rates retracing a bit, that would now represent a substantial capital gain as VZ stock would jump to $52 from the current $39.50 level.

It’s not just about the yield, either. Verizon is trading at an estimated 7.9x, 7.8x, and 7.8x estimated 2022, 2023, and 2024 earnings, respectively. I can’t drum up the least bit of excitement for Verizon’s business prospects. But buying companies with stable profits at an 8x P/E ratio and a 6.5% dividend yield is enough to garner my attention, even though I’m thoroughly indifferent to the American telecom industry.

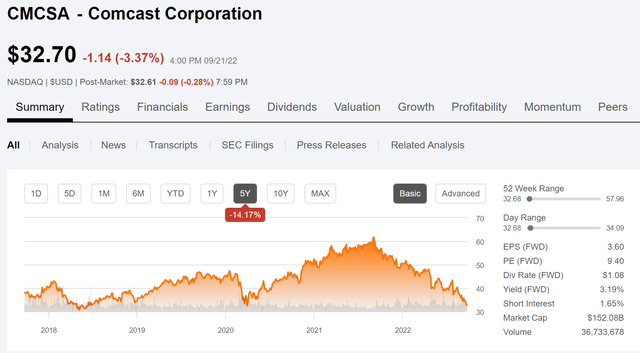

Comcast, like Verizon, is another company in a stagnant industry where the main appeal is valuation. A year ago, Comcast was a popular holding among a certain subset of influential investors thanks to its diverse set of businesses that seemingly had several upside options on assets such as streaming. However, CMCSA stock has been in freefall lately:

CMCSA Stock Chart (Seeking Alpha)

Shares are now down 41% over the past year, and are off 14% since 2017. The stock is only a touch above its five-year low.

It’s not hard to understand why. Cable makes up more than half of Comcast’s business and cable is under fire. Shares of rival Altice (ATUS) have utterly collapsed, and Charter (CHTR) is under fire as well. Traders are understandably taking a ‘sell first, ask questions later’ approach to everyone including Comcast given the slowing subscriber numbers and macroeconomic headwinds.

However, Comcast has steadily taken share in cable as it has invested more heavily than many of its rivals. Meanwhile, it has run its NBC Universal business well, growing net income off that asset dramatically since buying it in 2011. Streaming is currently a sore spot given the tough industry dynamics in 2022, but there should be some ultimate value for Comcast here as well.

With Comcast’s 40% decline, CMCSA stock is now at just 9 times forward earnings and offers a dividend yield of more than 3%. Like Verizon, I don’t love the underlying business, but the valuation is hard to argue with for a stable cash flowing defensive business such as this one.

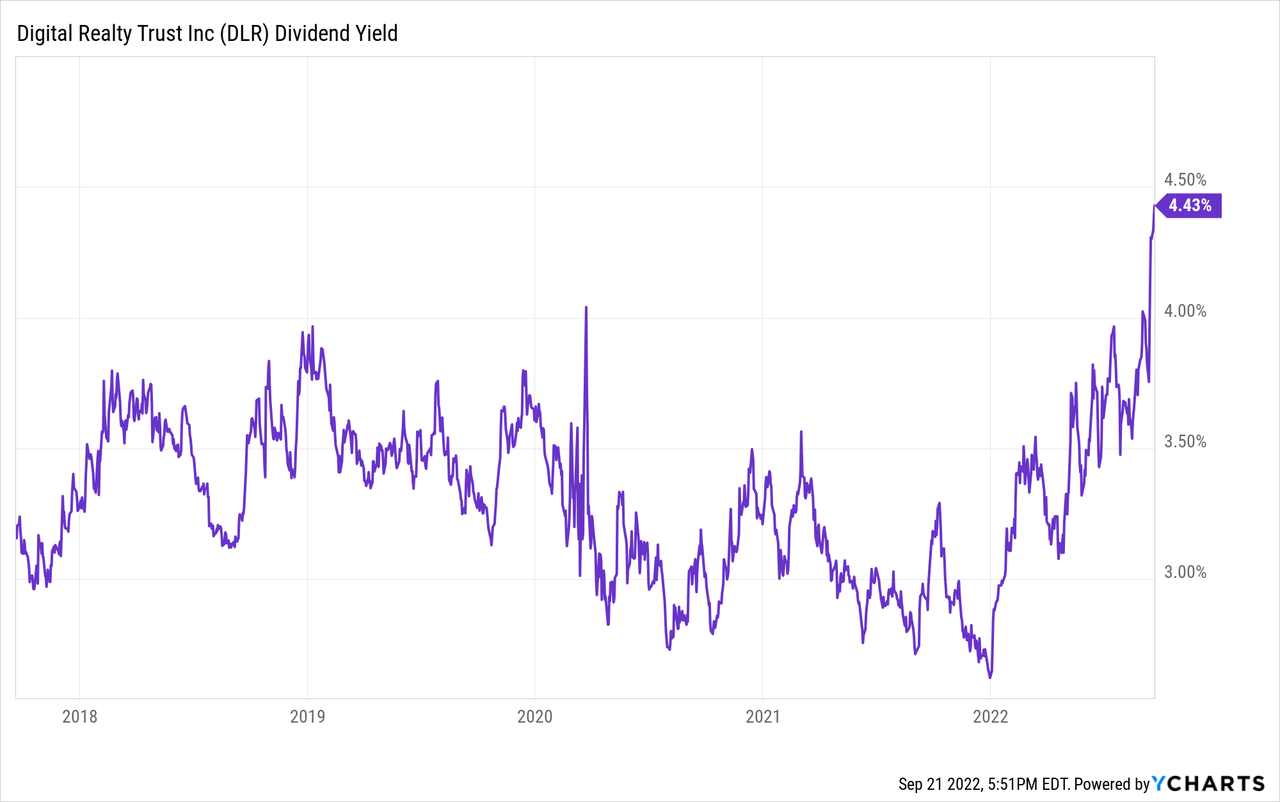

Digital Realty (DLR)

I made the case for Digital Realty earlier this month. I was a long-time bear on DLR stock, but flipped bullish at $119/share as I saw the bear case as having played out. Thanks to the latest sell-off, we’re now down to $109/share.

This has pushed the yield up to 4.5%, taking it to a 5-year high:

In fact, you’d have to look all the way back to 2015 to see Digital Realty offer the same starting yield. At that time, there were serious concerns around the economics and durability of data centers as an investment asset. There is some of that again now; folks such as Jim Chanos are pointing to slowing growth and rising competition from hyperscalers.

However, arguably the bigger factor is simply the rise in interest rates. DLR stock typically yielded 3.5% recently with that dropping to 3.0% over the past two years. Now the yield on DLR stock has spiked 150 basis points to 4.5%. Unless you think Digital Realty’s business has really declined in quality, this should be an attractive entry point that will pay off once the current rate hike cycle subsides.

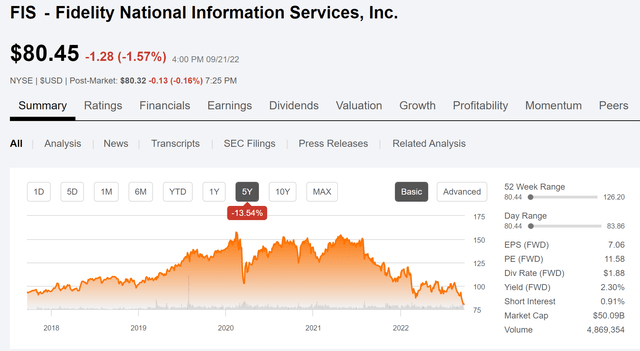

Fidelity National Information Services (FIS)

The payments industry has had an utterly dreadful year. From the big credit card companies on down to the small FinTech start-ups and virtually everything else in between, share prices have been in freefall. Companies in the payment processing and merchant acquirers space, such as Fidelity National have not been spared.

FIS Stock Chart (Seeking Alpha)

Indeed, FIS stock is now off by roughly half from its 2021 peak, and it has now dropped not just below the March 2020 lows but to new 5-year lows altogether.

That might make sense if FIS were a highly-valued payments company like Block (SQ) with a more speculative business model. However, Fidelity National has been in business for many years and is widely diversified. It offers payment processing and core services to banks. The WorldPay acquisition gave it a big position in merchant processing both in the U.S. and overseas. FIS also has a sizable business in providing back office record-keeping sorts of systems for investment managers.

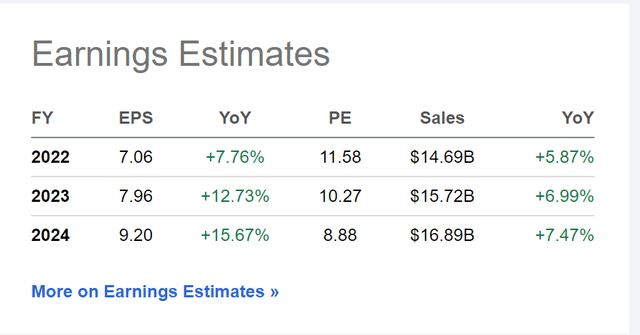

Despite the share price getting slammed, Fidelity National actually is continuing to post earnings growth:

FIS Earnings Estimates (Seeking Alpha)

Shares now go for less than 12x earnings, with earnings set to rise close to 8% this year. Earnings growth is slated to return to double-digit rates in future years, putting the stock at 10x ’23 and 9x ’24 earnings. Again, I get why the likes of Block and PayPal (PYPL) have sold off, but companies like Fidelity National have gotten caught up in the sector-wide selling for no good reason.

Dow is a large diversified chemicals company that came about from the merger and then spin-off series of transactions with DuPont (DD) a while ago.

The specialty chemicals companies have enjoyed tremendous tailwinds over the past two years. The inflationary environment and huge interest in new homes, consumer goods, and the like has created insatiable demand for the chemical industry. Most players are reporting their strongest numbers in many years, if not ever.

Dow, for example, is trading at less than 5x trailing earnings. Several other industry peers are at the same valuation point; the discount is not Dow-specific.

Why are valuations so low? For one thing, investors tend to have a skeptical view of the chemicals industry, seeing it as a commodity business that is cyclical and with low margins. Arguably Dow is on better footing though. It has a lot of proprietary technology and efficient operations inherited from its DuPont roots.

Earnings are expected to decline somewhat, with Dow selling closer to 8x normalized earnings. So it isn’t quite as cheap as it looks at first glance. But that’s still a fine entry price nonetheless. Additionally, the energy crisis in Europe should give Dow and other U.S.-based chemical companies some degree of competitive advantage over rivals based elsewhere.

The time to buy cyclical companies is during economic hard times when folks become overly pessimistic. Dow is now offering a 6% dividend yield to shareholders willing to ride out the economic downturn as well.

Be the first to comment