HJBC

Norway-based Equinor (NYSE:EQNR) has been a major supplier of natural gas to the EU for many decades and, as you know, that supply became much more valuable after Russia’s war on Ukraine and the resulting decision to cut-off natural gas supplies to the EU as punishment for the EU’s support of Ukraine. That being the case, I doubt the EU will ever trust Russian nat gas supplies again – no matter what the price. Certainly not as long as Putin rules the roost in Moscow. Meantime, LNG exports from around the world – and specifically from the U.S. – have raced to supply badly-needed natural gas to the EU. However, LNG is expensive as compared to pipelined gas from Norway, so EQNR is obviously a big beneficiary of the energy mess that Putin has created. As a result, EQNR has been posting strong financial returns: It has been boosting dividend paid to shareholders and the stock is up ~50% this year. Going forward, Equinor will be ramping up investments in offshore wind projects as it pursues its “net zero” goal by 2050. But O&G will remain EQNR’s bread-n-butter for many years to come.

Investment Thesis

As you can see in the graphic below, the price of the UK NBP benchmark (as the UK National Balancing Point is known) – which is the price at which much of the natural gas in the EU is based on – has come down from its dramatic highs in the days after Putin decided to invade Ukraine in February, and from the panic this summer as nat gas pipeline supplies from Russia were cut-off prior to the typical winter storage build:

tradingeconomics.com

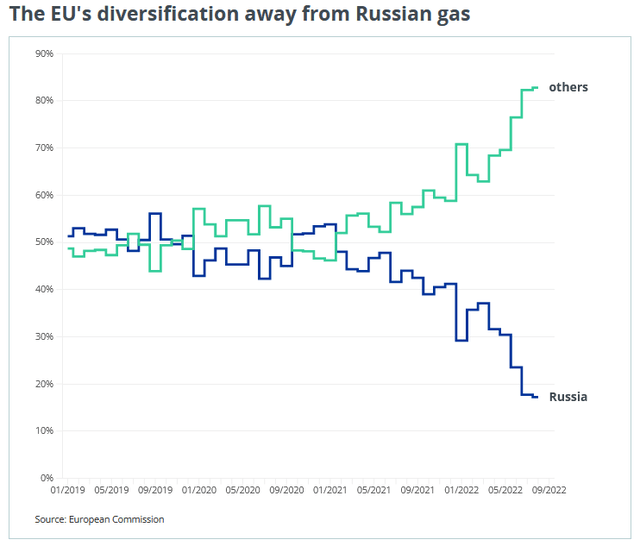

Still, note that prices seem to have settled at around $292, or more than triple the “normal” NBP price over the past decade. Perhaps no other company will benefit from this increase in the price of nat-gas as that of Equinor – which in the first half of 2022 and apart from Russia, was the EU’s largest supplier of natural gas (~22%), the majority of which is via pipeline. And, as a result of Russia proving itself to be a most unreliable partner, there has been a massive shift of EU nat-gas supply away from Russia, and instead, being sourced primarily from Norway and LNG vessels (primarily from the U.S., Qatar, and Nigeria):

www.consilium.europa.eu

It’s my opinion that this shift will be a relatively permanent realignment of the EU’s natural gas supply that will be quite beneficial for Equinor. After all, pipeline delivery is typically much cheaper than having to chill down natural gas in order to transport it over the oceans in the form of LNG.

Earnings

Equinor’s Q3 EPS report was released on Oct. 28, and – as expected – it did not disappoint shareholders. Highlights included:

- GAAP EPS of $2.97/share.

- Revenue of $43.34 billion (up a whopping 79.6% yoy) beat by $2.84 billion.

- Nat gas deliveries to the EU jumped 11%.

Earnings were boosted by significantly higher realized prices:

- Liquids up ~34% to $93/bbl

- European gas up ~240% to $44/mmBtu

- North American gas up ~124% to $7.2 mmBtu

Over the first three quarters of this year, EQNR has generated $21.7 billion of free cash flow. That’s an estimated $6.79/share based on an average of 3.196 million fully diluted shares as of the end of the quarter (see the Q3 supplemental EPS report here).

Dividends

Obviously EQNR has had a step-function jump in profitability and its FCF-generation profile. That bodes very well for shareholders considering its recent (base+variable) dividend declaration ($0.20+$0.70) was only $0.90/share. But at least that was a step up from Q2’s $0.70/share total. Regardless, those dividend obviously pale in comparison with the $6.79/share in FCF over the first three quarters of this year (and with another quarter still to go!).

Once again, I want to remind investors that mainstream financial websites continue to have difficulty accurately reporting dividend yields for O&G companies that have adopted a (base+variable) dividend policy. Note both Yahoo and Seeking Alpha currently report EQNR’s dividend yield as “2.17%” (that is, based solely based on the $0.20/share quarterly base dividend) when TTM variable dividends actually paid and/or declared was $1.60/share – double the annualized base dividend rate. Indeed, over the past 12 months, EQNR’s variable dividend (or “special dividend”) has totaled $1.60/share That being the case, EQNR’s TTM yield is actually ($0.80+$1.60)/$36.32 = 6.61%, or more than 3x what is being reported by the typical financial reporting services.

Buybacks

As noted earlier, Equinor’s FCF profile is vastly out stripping its (base+variable) dividend obligations. But never fear, the company also is buying back stock. In Q3, the company executed what it called its “fourth tranche” of buybacks ($1.86 billion worth) under the existing $6 billion share buy-back program.

Going Forward

Going forward, and like most of the big major oil companies these days, EQNR will maintain its capex discipline and production is likely to be relatively flat over the next few years.

However, EQNR is set to significantly grow its offshore wind business from under 1 GW at year-end 2021 to an estimated 12-16 GW by 2030, an acceleration of its previous 2035 target date. It will accomplish that feat by spending ~$23 billion over the next five years – boosting its renewable cap-ex allocation from 12% to 50% of the total budget by 2030.

Capital also will be allocated to carbon transportation and storage (i.e. the Northern Lights Project – which I like to call “CCS on the NCS”), and clean hydrogen – a field in which the company wants to establish itself as an industry leader. Northern Lights is a big project: Phase 1 includes capacity to transport, inject and store up to 1.5 million tonnes of CO2 per year and, is expected to go in service in 2024.

However, over the near term and the foreseeable future, EQNR will get the vast majority of cash-low and earnings from its oil and gas production. According to the company, the new O&G projects pipeline between now and 2030 have – on average – a breakeven price of less than $35/bbl and will payback their original development costs in less than ~2.5 years.

Valuation

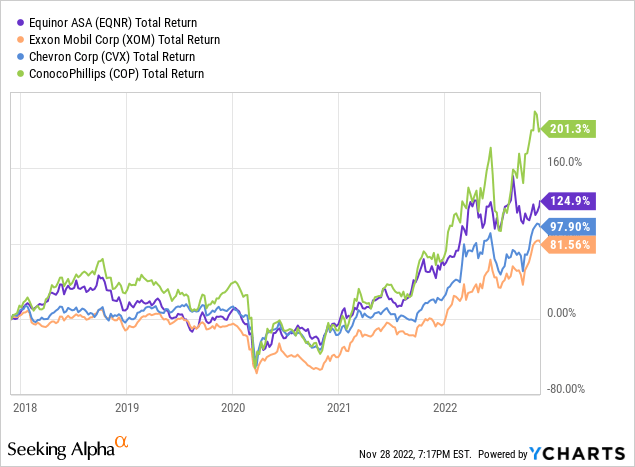

The chart below compares the current valuation level of Equinor vs. some American-based O&G companies: Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) – all of which are either directly, or through JVs, supplying LNG to the EU:

|

TTM P/E (From Yahoo) |

Forward P/E (From SA) |

TTM Yield | |

| Equinor | 4.8x | 5.1x | 6.61%* |

| Exxon Mobil | 9.0x | 8.1x | 3.22% |

| Chevron | 10.2x | 9.6x | 3.09% |

| ConocoPhillips | 8.9x | 8.9x | ~3.8% |

Anyway you look at that chart – either the P/Es or yield, Equinor is significantly undervalued as composed to these peers. Now, I would argue that a company like Chevron – which I consider to be the No. 1 international integrated majors – deserves a premium to a partially state-owned enterprise like StatOil …er, sorry – I’m old school – I meant “Equinor.” However, to trade at such a deep-discount to all three on TTM P/E basis (47% below XOM, 53% below Chevron, and 44% below COP) is not rational in my opinion. Then when you throw in EQNR’s higher dividend yield – the stock appears to be a “no-brainer,” right?

Summary and Conclusions

Equinor’s Norwegian natural gas production is piped to the EU and – as a result – the company is in an excellent competitive position vs. the cost to chill nat-gas and ship it from around the world in the form of LNG. That being the case, EQNR’s free cash flow profile has changed significantly going forward because, I believe, the EU will not rely on Russian-sourced natural gas for many years (and probably not ever as long as Putin remains in power). Yet the stock is currently trading at a deep-discount to three big American competitors – from both a P/E and a yield perspective. Meantime, EQNR’s excellent free cash flow profile bodes well for strong dividend payments going forward.

EQNR is a buy. And I don’t care what the short-term price gyration of oil is. That’s because EQNR is industry competitive at any price… and I don’t see the price of Euro-gas going back to the 10-year average for years to come.

I’ll end with a five-year total returns comparison of all four of the companies compared earlier and suggest that – on a valuation basis – EQNR should be trading much closer to the total returns COP has delivered vs. being closer to Exxon and Chevron:

Be the first to comment