dem10

Investment Thesis

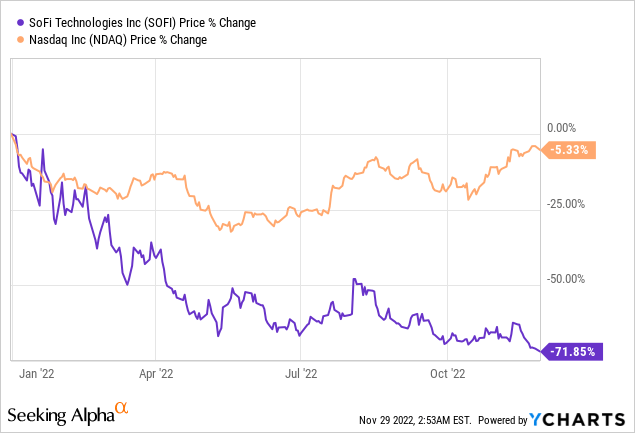

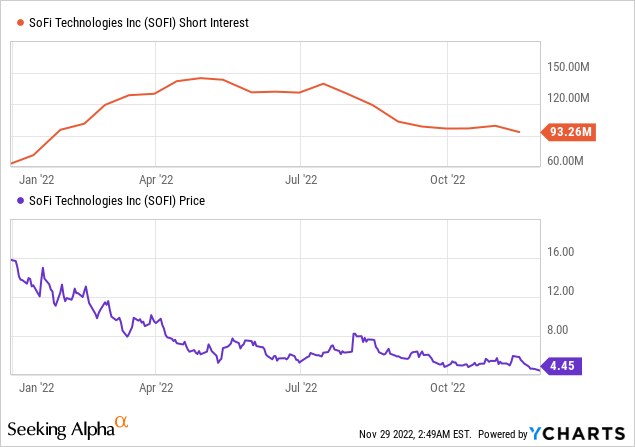

SoFi Technologies, Inc. (NASDAQ:SOFI), along with other growth names, have eventually faced reality, and the stock now trades below its book value per share. As a result, SOFI could move sideways and is also exposed to further drop until the short interest recovers to previous low levels.

However, its robust credit profile and improving competitive advantage provide ground for an entry point. Considering the current risk/reward profile, I wouldn’t overweight a position yet.

Online Banking For Underserved High Earners

The first online bank to go public, SoFi is advancing on a growth trajectory. It has grown its revenues while consistently reducing loss per share. In addition, the company has started to reap the benefits of its long quest for a banking license, obtained in January via acquisition. This brings a reduced cost of capital, more interest income, and added products.

SoFi is building a one-stop shop for financial services, providing differentiation that leads to lower customer-acquisition costs. Its single-mobile-app platform offers a speedy setup, easy access, helpful tools, and an integrated view that most traditional banks lack. In addition, its technology platform helps other banks and fintech do the same, soon in the cloud.

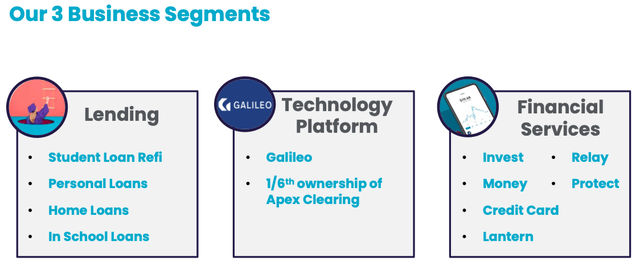

Business Segments (SOFI)

SoFi has the first-mover advantage and targets younger and underserved demographics. Neobanks, such as SoFi, have started a paradigm shift in digital banking, and this trend will only improve following the changing consumer behavior.

SoFi has strategically pursued high-earning customers not well served by other financial institutions, carrying a limited risk and offering them cross-selling opportunities. In many cases, the company established relationships with them via student loan refinancing, its original business, aiming to cross-sell additional products based on speed, selection, content, and convenience.

All banks aim to build multifaceted relationships with their customers. However, SoFi’s technology and business model give it an edge over many rivals. SoFi delivers the advantages of speed in opening accounts, getting loan decisions, and making transactions; better content via education, data, budgeting, and credit checking; and a convenient online platform.

Credit Outlook & Challenges

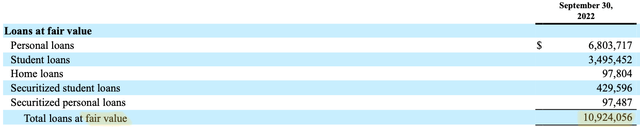

Most of SOFI’s loans are classified as available-for-sale (AFS), measured at fair value (FV), and these loans are intended for sale within a year to a few third-party whole loan purchases.

10-Q Form (SOFI)

On page 115 of the latest 10-Q form, management raises the following risk due to SoFi’s exposure to a concentrated number of whole loan purchasers.

If any of these purchasers significantly reduces the dollar amount of the loans it purchases from us, we may be unable to sell those loans to another purchaser on favorable terms or at all, which may have a material adverse effect on our revenues, results of operations, liquidity and cash flows.

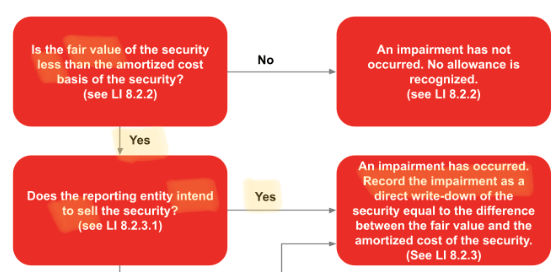

According to ASC 326, AFS securities are subject to ongoing impairment testing (write down in value). In a severe recession, the loan demand from those whole loan purchasers will dramatically fall or trade at a steep discount, which would force SoFi to recognize significant impairment losses. From an accounting perspective, unrealized changes in AFS debt do not affect SoFi’s net income, as those changes go to Other Comprehensive Income (OCI) in equity, which affects the bank’s capital.

ASC 326 Impairment Model (SOFI)

Some conditions to keep the loans as AFS are the sale to be probable within one year and the management to have an active plan for locating a buyer. Thus, if the AFS criteria are not met, these loans would go through a reclassification adjustment as held-to-maturity (HTM).

Suppose there is a hard landing in the economy. In that case, SoFi might transfer debt securities from AFS to HTM to shield its portfolio from experiencing additional write-downs due to impairments and reduce its regulatory capital volatility.

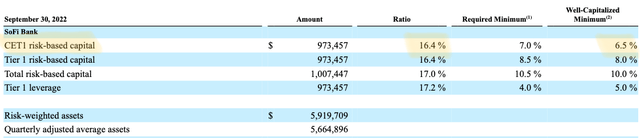

As a result, having AFS and unrealized losses through OCI in equity significantly reduces the book capital levels. However, now that the AOCI filter (Basel III) is no longer available, the OCI will be a component of CET1 regulatory capital. Therefore, if large losses exist, it would weigh on the bank’s regulatory capital, which means additional capital is needed.

On the contrary, classifying a significant portion of its portfolio as HTM would limit the bank’s liquidity, limiting its ability to sell those debt securities in the future. Under a severe recession scenario, since SoFi has never been in a crisis, management should be selective and conservative in the accounting treatment. Nevertheless, SoFi bank is well capitalized with a sufficient capital margin of safety to navigate a recession.

10-Q Form (SOFI)

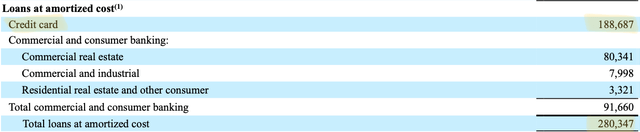

The second category of loans, HTM, are measured at amortized cost, and they capture a much smaller portion of the company’s assets, with credit card loans being the leading category.

10-Q Form (SOFI)

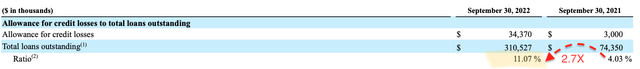

The ratio for credit losses on loans has dramatically increased by 2.7x times compared to a year ago. The current ratio stands at 11.07%, meaning that 11 out of 100 outstanding loans are not likely to recover. The increase was attributable to the credit cards due to an increase in the average balance and ECL estimates.

10-Q Form (SOFI)

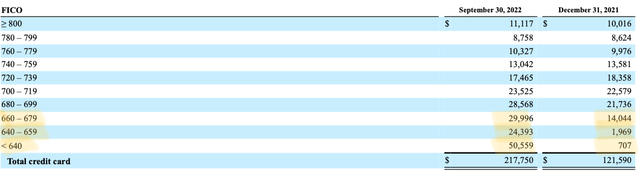

There is a notable deterioration in credit cards FICO rates which saw an unfavorable spike toward the lower quality rates. Thus, this worsens the overall credit profile of SoFi, and in case of a worse-than-expected recession, the poor-quality FICO borrowers are subject to defaults. However, such a scenario is not expected to have a material impact on the company.

10-Q Form (SOFI)

The ECL for credit cards accounts for 70% of the overall $34.4 million in allowances for credit losses, and due to its nature, credit card maturities are no longer than 12 months. Thus, if the US economy is heading to a soft landing, the improving environment might lead to a downward reversal of the ECL estimates, enhancing the company’s credit profile.

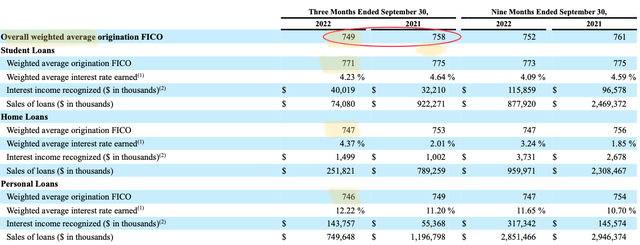

Nevertheless, there is no material deterioration in overall FICO scores; the weighted average currently stands at 749, representing an above-average score. With many investors concerned about a looming recession, this issue remains a concern for SoFi management and investors. Lastly, SoFi’s CFO reiterated the high-FICO nature of its borrower base, with a weighted average of 746 on personal loans (largest segment) in Q3 2022, as a strong positive.

10-Q Form (SOFI)

Diversification In Progress

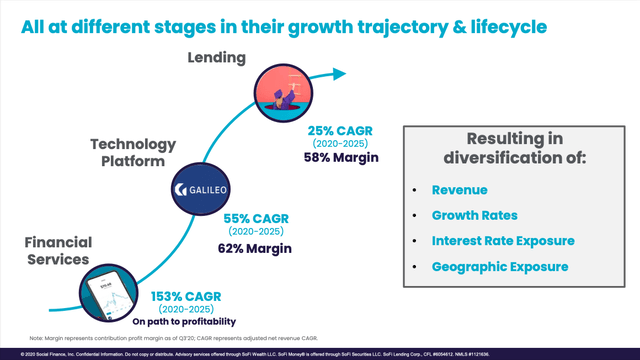

SoFi’s original lending business remains its largest, ~70% of revenue; however, its size and maturity may cap the segment’s growth. The Financial Services segment can generate growth from its small base and lower annual revenue per product. The competitive advantage for SoFi is relatively low client acquisition costs due to vertical integration.

SoFi pays to acquire the customer once. After the first product, users can opt-in to other features when they get into the app ecosystem, thus leveraging its ROI per acquired customer through cross-selling. As of Q3 2022, SoFi continued to acquire new members at a price consistent with the company’s long-term EBITDA margin target of 30%.

Between SoFi’s lending and financial services segment is the Technology segment, with ~20% of revenue from Galileo, a platform for institutions to offer cards and other services. Acquired in May 2020, Galileo brings recurring revenue under long-term contracts and vertical integration benefits for superior margins. However, customer concentration is relatively high, with a few accounts bringing in most of the revenue.

As SoFi evolves into a more diversified fintech company, it becomes more resilient and agile in navigating macro events during downturns and pivoting throughout economic climates. As a result, the company remains on track to become a super financial app.

SoFi Pres (SOFI)

Galileo’s Pricing Structure May Offer Resilience In A Potential Downturn

Galileo’s diversified growth strategy includes growth in new verticals, products, and geographies. In addition, unlike some competitors, Galileo’s pricing is on a per-transaction basis. This feature may prove beneficial if the economy were to weaken as the number of transactions (e.g., filling a gas tank or going to the supermarket) is unlikely to decline as much as volumes.

Long-term, Galileo can tap more B2B verticals (e.g., expense management). For example, in Q3, Galileo signed ten new clients and made big strides in its strategy, with 30% of new deals in the B2B space. Moreover, seven of these ten new deals have existing subscribers, portfolios, or payment businesses, reflecting continued demand for SoFi’s services.

With the ongoing student loan moratorium and the housing market struggles, SoFi’s loan business has been the crutch holding up the Lending segment. In Q3, personal loans grew by 71% YoY. Although this is down from the 91% YoY growth in Q2, it represents double-digit sequential growth for three quarters in a row in 2022. Furthermore, the management iterated that the delinquency rates “remain healthy” and are still below pre-COVID levels, which is another positive for investors.

Student-Loan Forgiveness Less Dramatic Than Feared

Earlier in August, President Biden’s announcement called for forgiving $10,000 of student loans for borrowers who make <$125,000/year, and the recently announced extension is positive. However, student loan forgiveness would not likely have a meaningful impact on the typical SoFi consumer.

This is primarily due to the strength of SoFi’s borrower base. SoFi’s student loan borrowers have a weighted average income of $170,000 (vs. the $125,000 cap on forgiveness) and a weighted average FICO of 771. Hence, it would be reasonable to assume that only a small portion of SOFI borrowers qualify for the $10K forgiveness. Additionally, SoFi’s average loan size is ~$70,000; therefore, $10K in forgiveness is a relatively small portion of the overall balance.

In Q4 2021, student loans benefited from accelerating demand ahead of the then-January federal student loan payment moratorium deadline and anticipated rate increases in 2022. Consequently, in Q4, student loan originations increased by 51% QoQ. In addition, the expiration of the loan moratorium may also result in an uptick in Refi demand in the next quarter or two, similar to what happened in late Q4 2021.

Key Risks

- SoFi’s loans are sold to a concentrated number of whole loan purchasers, which could negatively impact the company’s multiple or earnings during partner loss or uncertainty periods.

- Increased political and regulator focus is also a consideration, particularly around the student lending market. Moreover, credit risk is relatively low on SoFi’s balance sheet.

- SoFi’s limited profitability today could hurt the company’s ability to generate capital in the future as needed if the market becomes less confident in the fintech’s ability to disrupt and take market share, particularly as competition likely only increases from here from other digitally native platforms.

Valuation Becomes More Attractive

SOFI, similar to other growth stocks, has been hit hard, but the rising short-interest levels have eased for now. With a price-to-book value of around 0.80x, SOFI trades at an attractive valuation point for long-term investors. However, certain risks tied to the stock do not justify a strong buy rating yet.

Conclusion

Despite the 72% plunge in its stock price in 2022, SoFi’s strong execution and the nature of its resilient business model are reflected in its recent results. In addition, the credit profile of the company’s borrower base remains robust, which protects the downside in case of a downturn caused by a worsening macro-environment. Finally, with the continued launch of new products and features, and the growth in the company’s members count, SoFi is well-positioned to continue on its path to net profitability in the coming years.

Be the first to comment