MF3d

On the throne of the world, any delusion can become fact.” ― Gore Vidal, Julian

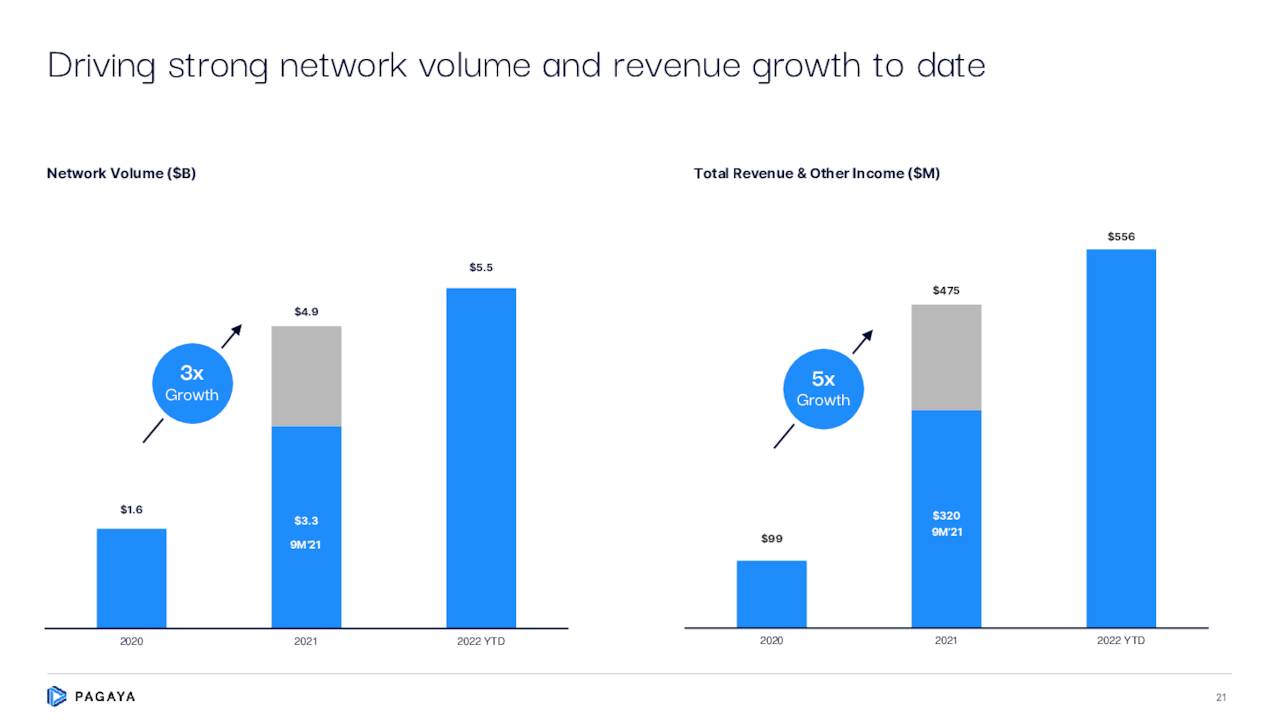

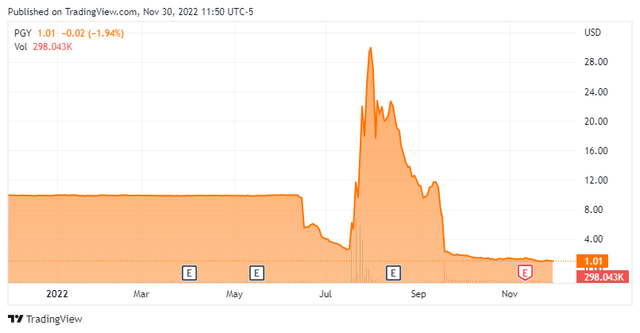

Today, we are going to take our first look at a small cap company called Pagaya Technologies Ltd. (NASDAQ:PGY). As can be seen in the chart below, the shares have imploded in recent months. That said, revenue growth is impressive and the stock has a reasonable price to sales ratio. An analysis follows below.

Company Overview:

November Company Presentation

Pagaya Technologies Ltd. is located in Tel Aviv, Israel. The company develops and implements proprietary artificial intelligence technology and related software solutions to assist partners to originate loans and other asset. Its partners/clients include high-growth financial technology companies, incumbent financial institutions, auto finance providers, and brokers.

November Company Presentation

The company was founded in 2016 and went public through a SPAC called EJF Acquisition (EJFA) early this year. At the time, the entity had a pro forma implied enterprise value of $8.5 billion. The stock now sells for a buck a share and has an approximate market capitalization of just $700 million.

November Company Presentation

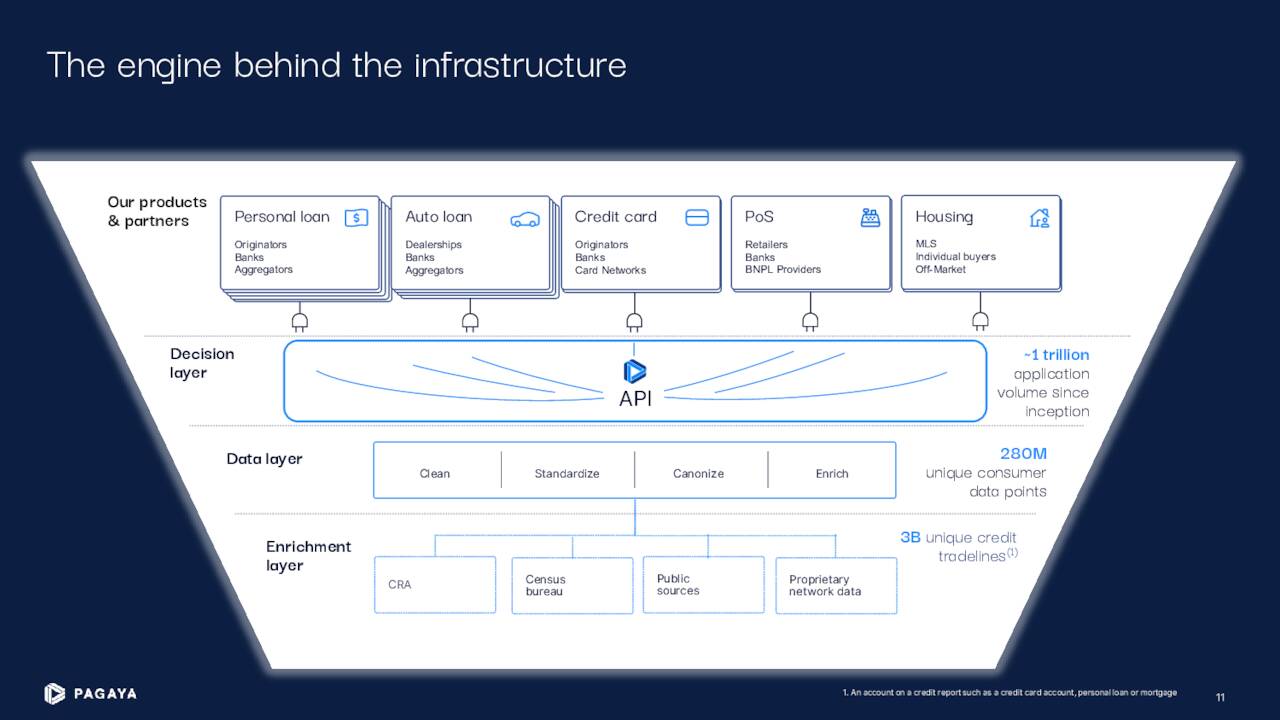

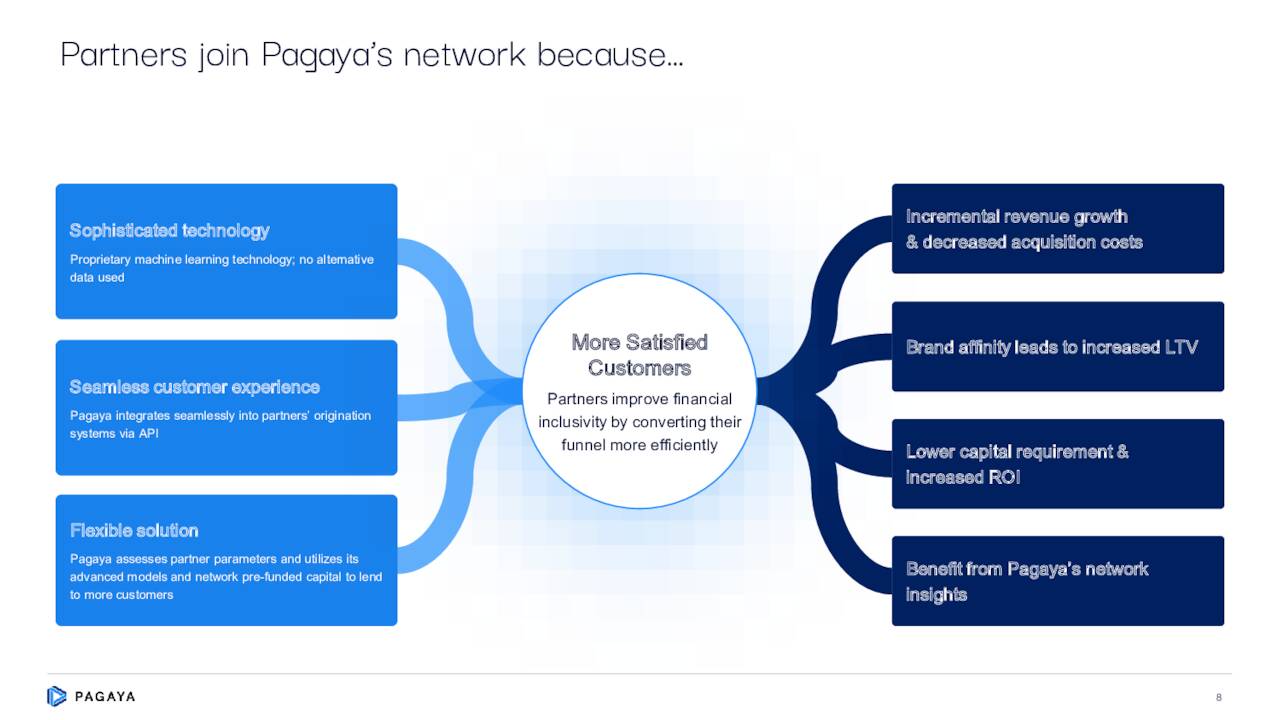

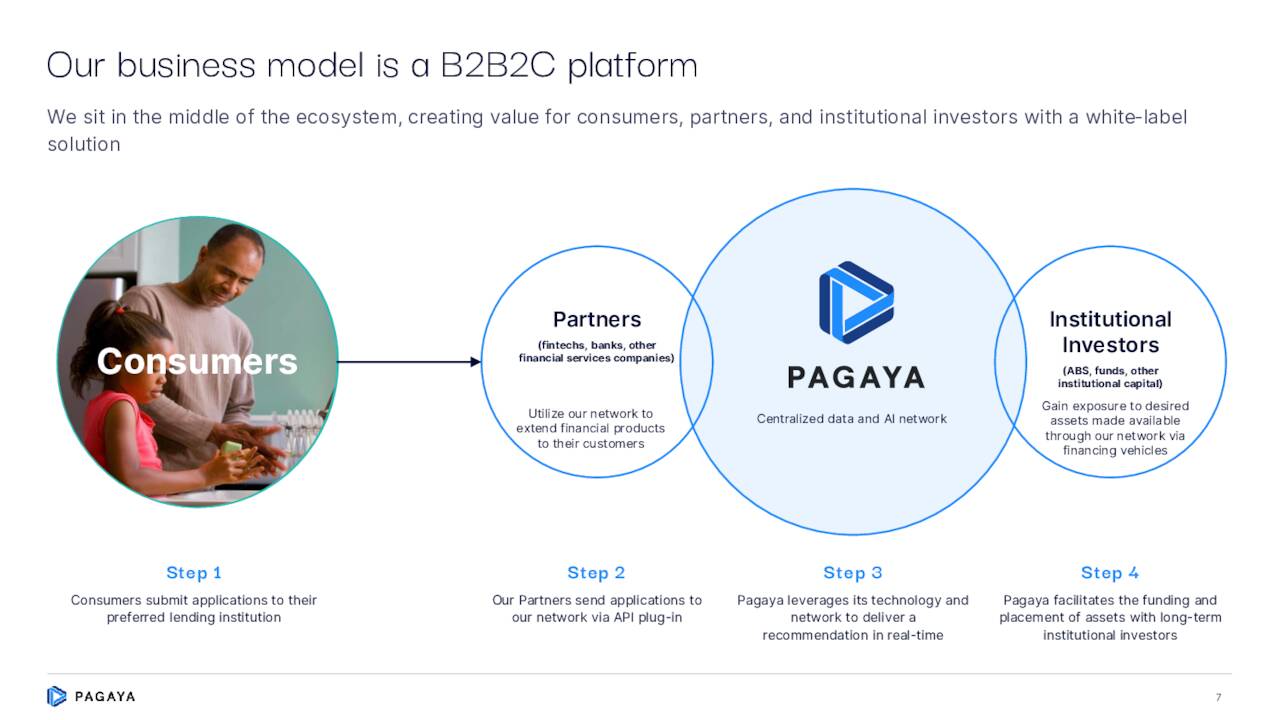

Management is focused on building the artificial intelligence infrastructure for the financial ecosystem. The company acts as the intermediary between its funding investors and its partners who receive loan applications from their clients such as auto dealerships, banks and other financial institutions.

November Company Presentation

Pagaya believes its AI driven platform can reduce delinquency rates as well as reach more customers.

Third Quarter Results:

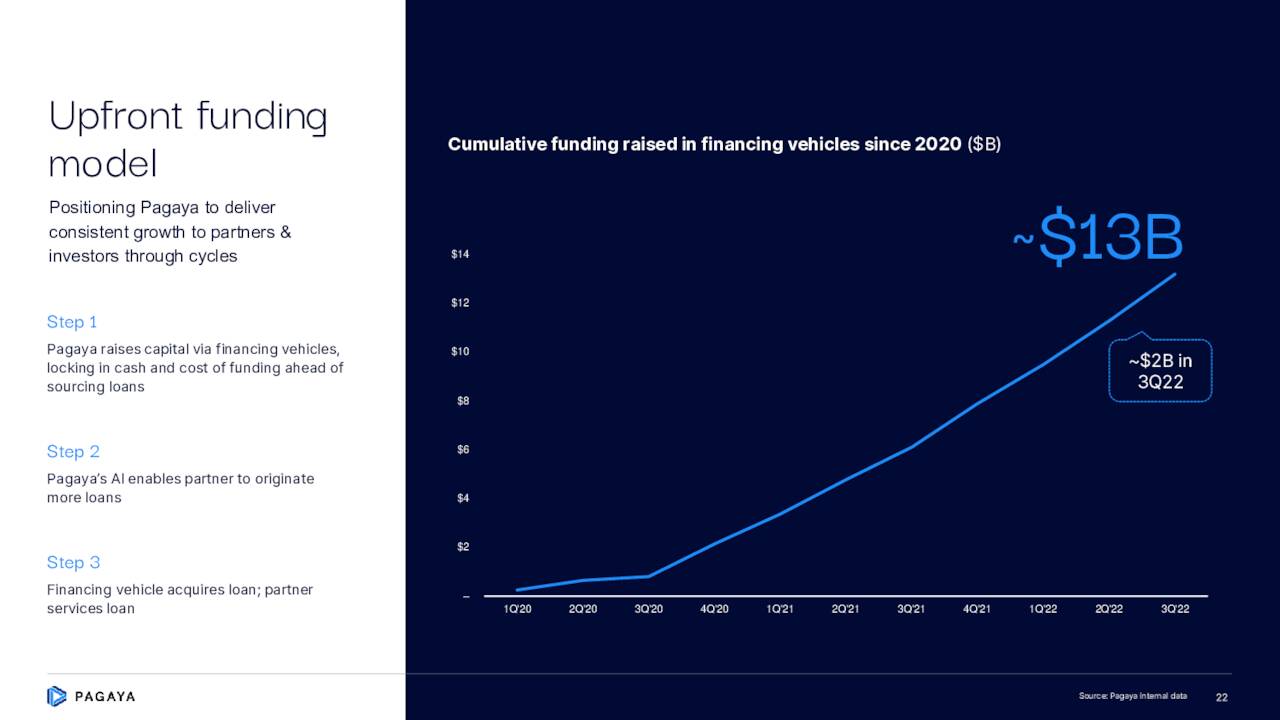

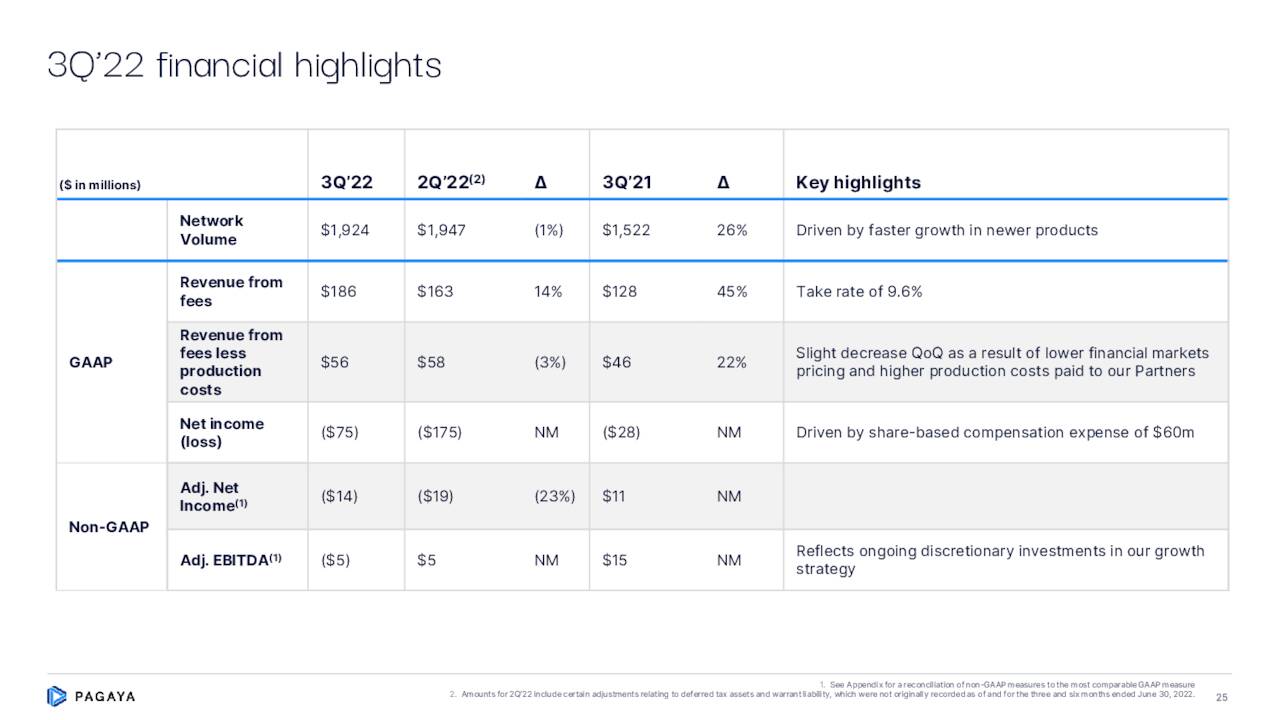

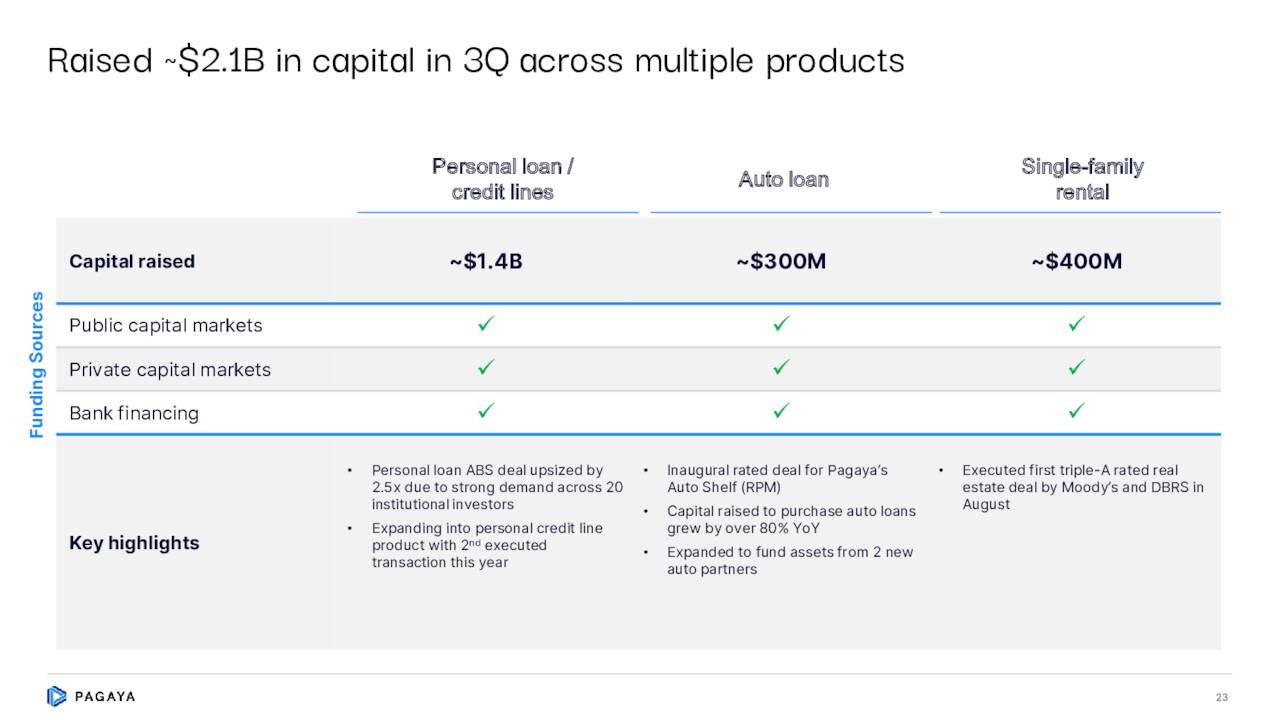

On November 4th, Pagaya posted third quarter numbers. The company had a non-GAAP loss of two cents a share. Adjusted EBITDA was a negative $5.2 million for the quarter. The adjusted net loss for the quarter was $14.4 million. Revenue rose just over 49% on a year-over-year basis to $204 million, which beat the consensus by over $25 million.

November Company Presentation

Network volume was up 26% from the same period a year ago, to $1.9 billion. 41 million applications were evaluated in the first nine months of 2022, representing 120% growth compared to the same period last year.

November Company Presentation

Analyst Commentary & Balance Sheet:

Three weeks ago, both Wedbush and Moffett Nathanson reiterated Hold ratings with identical $2.00 price targets on PGY. They are the only analyst firms I can find that cover this stock despite a sizable market capitalization. Most likely, this has to do with the fact that Pagaya is headquartered outside of the United States.

November Company Presentation

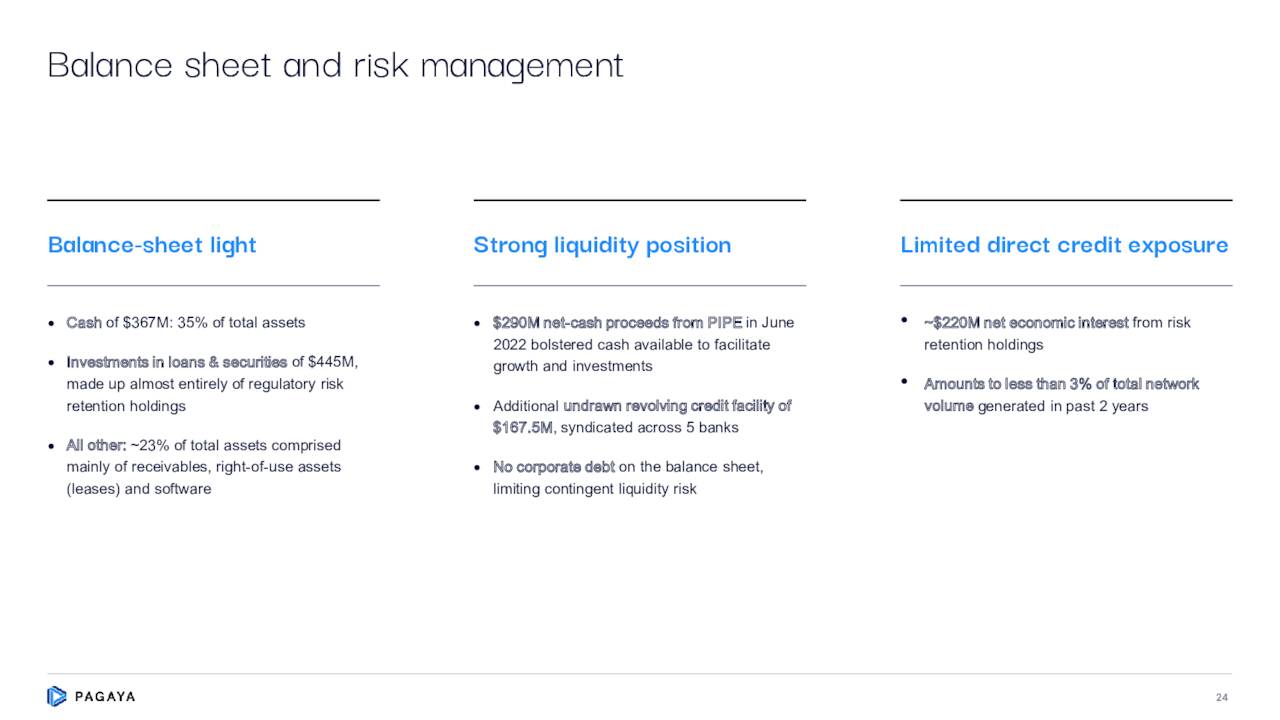

Approximately one percent of the outstanding float is currently held short. The balance sheet as of the end of the third quarter is highlighted above.

November Company Presentation

Verdict:

The two analyst firms that follow the company have it losing between 38 cents to 43 cents a share in FY2022 on roughly $720 million in revenue. As a recent article on Seeking Alpha noted, the stock has faced headwinds since insider lockups starting to expire this September. Share-based compensation totaled $60.3 million in the third quarter.

Management has a long term goal of getting $25 billion in annual loan volume on its platform. Rising interest rates obviously makes the cost of funding more dear. The demand for auto and other loans could also dissipate thanks to higher financing costs. In addition, the economy looks headed into a recession at some point in 2023, and the consumer has lost approximately six percent of their buying power since the beginning of 2021 thanks to the ravages of inflation. Neither trend should be good for delinquency rates.

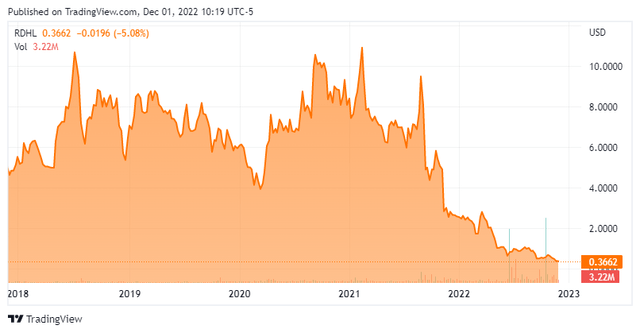

The company also has little analyst coverage, and that which it has is currently negative. Add in that Pagaya is based in Israel, a place I have not done well investing in small caps historically. RedHill Biopharma (RDHL) being one painful example of. Finally, SPAC-birthed firms have largely done little but destroy shareholder value over the past 12-18 months. Therefore, I am passing on any investment recommendation on PGY despite impressive revenue growth and a relatively attractive price to sales ratio.

November Company Presentation

A writer who is afraid to overreach himself is as useless as a general who is afraid to be wrong.”― Raymond Chandler

Be the first to comment