Oselote

Platinum is a rare industrial and precious metal. Platinum’s density and characteristics make it a metal that cleans toxins from the environment in its application in catalysts. Platinum is also a financial asset that, for many years, market participants considered “rich person’s gold.” That moniker disappeared in 2014 when the price fell below gold and never returned to a premium to its yellow cousin.

Platinum is a thinly traded precious metal. Each NYMEX contract contains fifty ounces of metal, compared to the COMEX contract’s one hundred ounces of gold. On November 30, the total number of open long and short positions in the NYMEX platinum futures market stood at 67,790 contracts or 3,389,500 ounces. At the $1,055 level, the total value of open interest was $3.576 billion. On the same day, gold open interest stood at 429,283 contracts or 42,928,300 ounces. At $1,812 per ounce, the gold contract’s open interest value was $77.79 billion, over twenty times higher than platinum’s open interest value. Gold is a liquid market, while platinum suffers from low volume and open interest. Typically, less liquid markets experience far greater volatility. However, while gold reached a new record high in March 2022 at $2072 per ounce, platinum only reached a high of $1197.00 this year, $1,111.80 below its $2,308.80 per ounce record peak from 2008.

Platinum has been a weak link in the precious metals sector over the past few years, but the potential to awaken from its slumber remains high as we move toward 2023. The Aberdeen Physical Platinum Shares product (NYSEARCA:PPLT) is the most liquid platinum ETF.

Platinum has underperformed the precious metals sector for years

In 2008, the global financial crisis pushed precious metals prices to significant bottoms. Over the past fourteen years, the prices have moved significantly higher, but platinum has been the laggard of the four precious metals that trade on the COMEX and NYMEX futures exchange:

- Nearby gold future’s 2008 low was $681 per ounce. At $1800 on December 1, 2022, the price was 164.3% higher.

- Silver futures fell to $8.78 in 2008. At the $22.65 level on December 1, 2022, the price appreciated by 158%.

- Palladium’s 2008 low was at $160 per ounce. At $1,882 on December 1, the price rallied 1,076%.

- Platinum’s 2008 bottom was $761.80, and at $1052.20 on December 1, 2022, the price was up 38.1%.

Meanwhile, of the four metals, platinum is the only one that made a lower low than the 2008 bottom during the global pandemic. Nearby NYMEX platinum futures dropped below $600 per ounce in March 2020. By any measure, platinum has been the weakest link in the precious metals arena for years.

Platinum has been consolidating around the $1,000 per ounce level

Since 2020, the $1,000 per ounce level has been platinum’s pivot point.

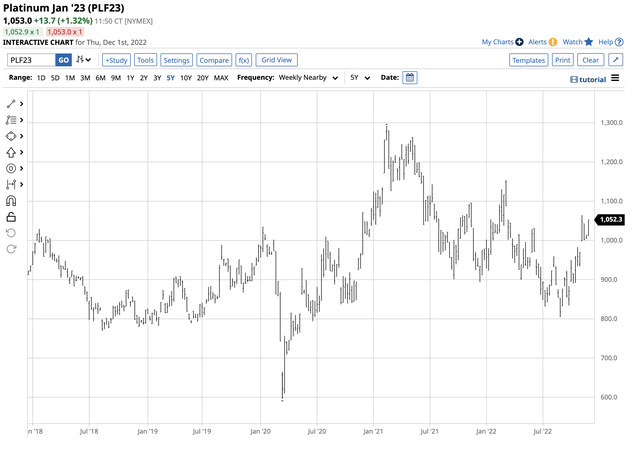

Chart of NYMEX Platinum Futures (Barchart)

The chart shows that $1,000 has been like a magnet for platinum over the past years. Each time the price tried to rally, the pivot point pulled it back below, and each correction resolved with a rally back above the pivot point. Platinum has been in a long-term consolidation pattern around the level.

The case for higher platinum remains compelling

While platinum has been stuck in a range, the potential for price appreciation remains high. The following factors favor platinum in late 2022:

- Most of the annual platinum production comes from two countries, South Africa and Russia. Primary production comes from South African mines, while platinum is a byproduct of nickel output in Norilsk, Siberia. Sanctions on Russia and Russian retaliation can limit supplies in the current environment.

- Platinum continues to be the metal that cleans toxins from the environment. Platinum requirements for catalysts are increasing as the world takes a greener path for the environment.

- The World Platinum Investment Council expects platinum to move into a deficit where the demand exceeds supplies in 2023 after its surplus in 2022. WPIC said automakers would increase their requirements, and investors would flip from sellers to buyers, forecasting that the demand would rise 19% to 7.77 million ounces in 2023. At that level, platinum demand will be the highest since 2020.

- In 2022, most asset prices moved lower, including stocks, bonds, cryptocurrencies, and others. Investors and traders are searching for value, and platinum is a market where the value proposition is compelling and could attract significant buying.

Meanwhile, low liquidity in the NYMEX platinum futures market and the over-the-counter market could cause a significant and violent rally. A limited forward market in platinum leads to no liquid put and call options for platinum because of its limited forward market.

Platinum is the only precious metal that is higher in 2022

While platinum has lagged the other precious metals over the past few years, 2022 has been an exception.

- At $1,801 on December 1, gold was 1.5% lower than the closing price on December 31, 2021, at $1,827.50 per ounce.

- At $22.64 on December 1, silver was 2.95% lower than the closing price at the end of last year at $23.328 per ounce.

- At $1,882 on December 1, palladium was 1.37% lower than the closing price on December 31, 2021, at $1,908.10 per ounce.

- At $1,054.60 on December 1, platinum was 9.35% higher than the closing price on December 31, 2021, at $964.40 per ounce.

After years of underperformance, platinum has moved to the upside in 2022, bucking the trend in precious metals and most assets.

PPLT is the most liquid platinum ETF product

The most direct route for investment or a risk position in platinum is via bars and coins offered by dealers. The NYMEX futures market provides a delivery mechanism, leading futures prices to converge with physical prices during delivery periods. The Aberdeen Physical Platinum Shares product provides an alternative to the physical and futures arenas.

At $96.24 on December 1, PPLT had over $1.1 billion in assets under management. The ETF trades an average of nearly 95,000 shares daily and charges a 0.60% management fee. PPLT’s fund summary states:

Fund Profile for the PPLT ETF Product (Seeking Alpha)

PPLT holds physical platinum bullion. The recent rally took the price of nearby platinum futures from $801.20 on September 1 to $1,074.10 on November 11, a 34% increase.

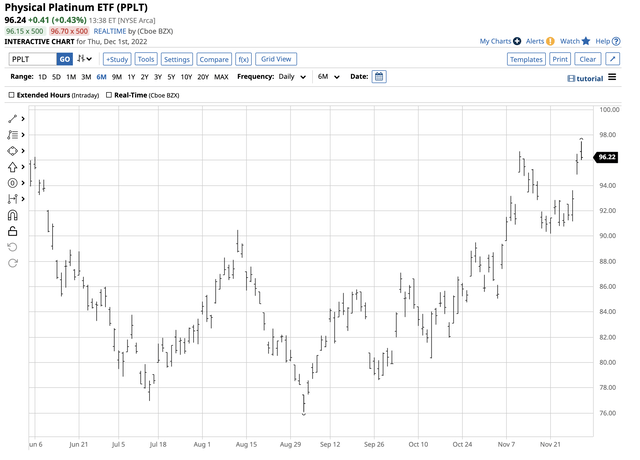

Chart of the PPLT ETF Product (Barchart)

PPLT has moved from $76.09 to $97.50 per share, or 28.1%, over the period. PPLT only trades during U.S. stock market hours, so it can miss highs or lows in platinum during European or Asia trading hours. Meanwhile, the ETF does an excellent job tracking platinum.

Platinum is long overdue for a significant rally, considering the price action in gold, silver, and palladium. Investors looking for value could turn to platinum, and the low liquidity could magnify rallies when the metal finally decides to move.

Be the first to comment