Abstract Aerial Art/DigitalVision via Getty Images

One of the more interesting stories in the energy space over the past several years has been Equinor’s (NYSE:EQNR) remarkable conversion from an oil and gas company into a renewable energy titan. I have discussed this conversion in various past articles, as the company has used the knowledge that it has obtained over its history of offshore construction to become a fairly significant global developer of offshore wind farms. We saw the company’s increasing dedication to this aspect of its business when the company announced that Kirby (KEX) would be the supplier of wind turbines and towers to the Empire Wind project that Equinor and BP (BP) are developing in New York. This marks a significant milestone for the project and clearly shows us that renewables are a major part of the company’s business that could easily become a significant growth engine for it.

About The Empire Wind Project

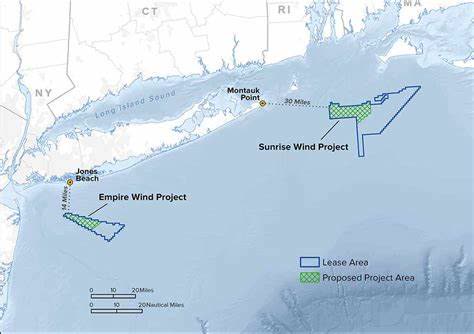

The history of the Empire Wind project dates back to 2017 when Equinor signed a commercial lease for the offshore block from the Department of the Interior. It took until July 2019 for the state of New York to approve the construction of an offshore wind farm at the site, however. The site itself spans 32,374 hectares in Federal waters located about 32 kilometers south of Long Island:

New York State Government

The project originally was intended to produce approximately 816 megawatts but has since been significantly expanded to encompass two phases. The first phase consists of the original 816 megawatts (enough to power more than half a million homes) and the second phase consists of another 1,260 megawatts, which brings the installed total up to more than two gigawatts. This would make the combined Empire Wind projects among the largest offshore wind projects that Equinor has constructed to date:

| Operational Projects | ||

| Project Name | Capacity | Date Operational |

| Sheringham Shoal | 317 MW | 2011 |

| Dudgeon | 402 MW | 2017 |

| Hywind Scotland | 30 MW | 2017 |

| Arkona | 385 MW | 2019 |

| Projects Under Construction | ||

| Hywind Tampen | 88 MW | 2022 |

| Dogger Bank | 3.6 GW | 2023-2026 |

Originally, Equinor was planning to develop and operate the entire project on its own. However, the company sold a 50% stake in it to BP (BP) back in 2020 for approximately $1.1 billion. This was likely a very smart idea given the conditions back in 2020. As everyone reading this is quite likely to remember, 2020 was the year in which the outbreak of the coronavirus pandemic caused the price of crude oil to collapse to generational lows. Naturally, energy companies were struggling to maintain their balance sheet strength in order to weather through the situation as it was quite probable that it may have lasted much longer than it actually did. One way to do that is to engage in risk-sharing and forming joint ventures with other companies so that the financial risks can be shared with someone else. That is apparently what Equinor decided to do here.

One of the nicest things about this project is that Equinor has already obtained a power purchase agreement with the New York State Energy Research and Development Authority. It is admittedly uncertain whether this agreement covers only the output of Empire Wind 1 or both farms, however. When we consider that New York State has the goal of producing 9,000 megawatts from offshore wind farms by 2035, however, it is unlikely that Equinor will have any problem obtaining a power purchase agreement for the entire project if this one does not cover it. The acquisition and use of a power purchase agreement are critical for renewable power because it is in many cases the only way to make these facilities economical to develop. This is mostly because of the intermittent nature of renewable power. After all, the wind does not produce any power if the wind is not blowing and it is impossible to predict with any accuracy exactly what the weather will be over the course of several years. Thus, in the absence of these agreements, it is difficult to predict the cash flows of any given project. The power purchase agreements allow the company to much more accurately know what the cash flows from the renewable project will be and thus allows Equinor to know whether or not constructing the offshore wind farm would be a good investment. This is something that could be very important to know since the Empire Wind farm is expected to cost more than $3 billion to build.

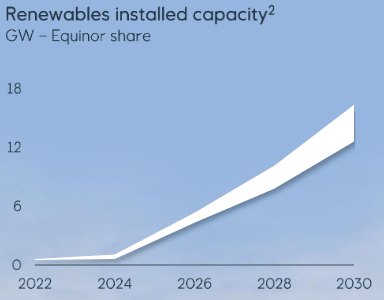

The Empire Wind farm is expected to come online sometime around the middle of the decade so we can expect it to contribute positively to Equinor’s financial performance about that time. Admittedly though, it seems unlikely that this project’s contribution will be anything more than a blip on the radar. During the fourth quarter, Equinor’s entire renewable energy business only generated $21 million in revenue against $32.125 billion for the company as a whole. Thus, the renewable energy unit only accounts for about 0.06% of Equinor’s total revenue today. It seems unlikely that this unit will thus seriously supplant the company’s oil and gas business in the near future. With that said though, Equinor does intend to grow this business going forward as the company plans to have twelve to sixteen gigawatts of installed and operational offshore wind generation capacity by 2030. The company currently has about 1.5 gigawatts operational today:

Equinor Investor Presentation

Thus, we can clearly see that the company intends to grow this figure exponentially by the end of the decade. Thus, while the renewables unit will probably still only account for a fraction of the company’s crude oil and gas revenues, it will more than likely be a much higher percentage of the company’s revenue at that time than it is today.

Long-Term Fundamentals

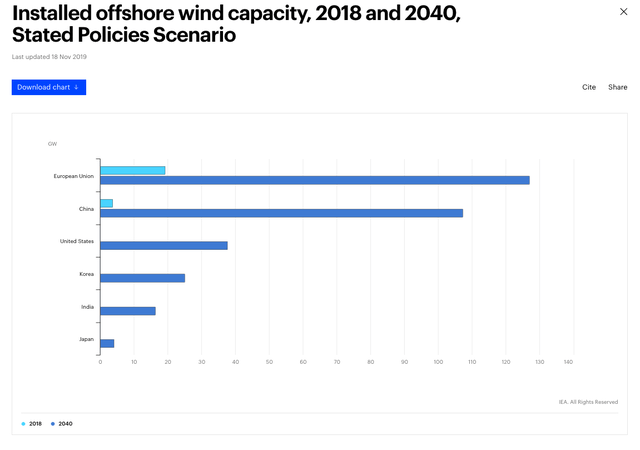

There may be reasons to believe that Equinor’s offshore wind unit may serve to be an engine of growth well past 2030. This is largely because it is expected that this will be a much greater proportion of the world’s energy mix at that time than it is today. According to the International Energy Agency, offshore wind will be a $1 trillion industry by 2040. This represents a substantial increase over the 0.3% of global power generation that it represents today:

This may be due to some of the numerous advantages that offshore wind has over other forms of energy generation, including other renewables. The most significant of these is that offshore wind is more reliable than other forms of renewable energy. This is mostly because of the fact that winds offshore tend to be stronger and more stable than winds onshore. In addition, offshore wind power works at night, unlike solar power.

We can obviously see an opportunity for Equinor here, particularly in the United States and European Union where it has already made significant in-roads into developing its renewable business. Admittedly though, the company has not discussed its plans for the post-2030 period. It has acknowledged that this is an opportunity though, so it does seem likely that it will pursue this opportunity.

Valuation

Fortunately, Equinor appears to be undervalued at the current price. This is immediately obvious by looking at the company’s price-to-earnings growth ratio. This is a modified form of the more familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. A ratio of less than 1.0 could be a sign that the company’s stock is currently undervalued relative to its earnings per share growth and vice versa.

According to Zacks Investment Research, Equinor will grow its earnings per share at a 49.36% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.20. Admittedly, much of this growth will come from the company’s oil and gas unit but we can expect renewables to still play a role, especially since the renewables unit has quite a few projects coming online during that timeframe. Here is how that compares to some of its peers:

| Company | PEG Ratio |

| Equinor | 0.20 |

| TotalEnergies (TTE) | 0.89 |

| BP | 2.19 |

| Eni (E) | 0.53 |

| Shell (SHEL) | 0.90 |

As we can clearly see here, Equinor appears to have the most attractive valuation of any of its European peers, although most of them are somewhat undervalued at present. This is a clear sign that the company could be worth considering for a long-term position while we wait for this story to play out.

Conclusion

In conclusion, Equinor continues to make strides with respect to its renewables business. Although the company is still primarily a fossil fuel titan (and likely will be for quite some time), the renewables business should certainly not be overlooked. This is particularly true when we consider the potential for exponential growth here as that is certainly something that could represent the company’s long-term potential. When we combine that with Equinor’s very attractive valuation, there is certainly a lot to like here.

Be the first to comment