ipopba

Medical Properties Trust Inc. (NYSE:MPW) is now very appealing to investors looking to build a passive income-oriented portfolio comprised mostly of well-managed and rising REIT trusts.

In my opinion, Medical Properties is a terrific investment, based on value, dividend growth potential, and yield, especially in a market plagued by recession fears.

A Top Health Care Trust With A 7.4% Yield

Medical Properties is a health care REIT based in the United States, although it also has hospital investments throughout Europe. The trust’s primary investment concentration is on hospitals that serve patients with acute treatment and rehabilitation services.

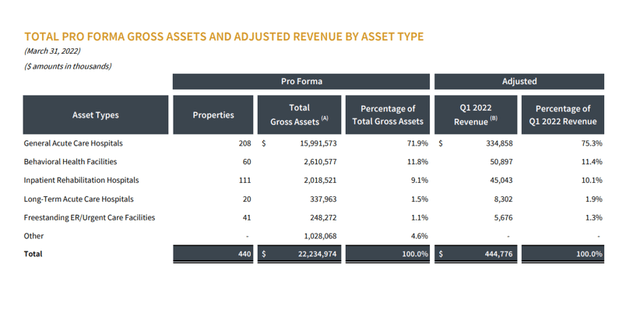

The majority of the trust’s recurring income come from general acute care hospitals, which account for 71.9% of gross assets (before accumulated depreciation) and 75.3% of revenues.

Other facilities and hospitals are also significant for Medial Properties, albeit to a far lower extent than general acute care hospitals, where the trust produces the most money. Medical Properties had two more properties in its portfolio, totaling 440, compared to the prior quarter.

Adjusted Revenue By Asset Type (Medical Properties Trust)

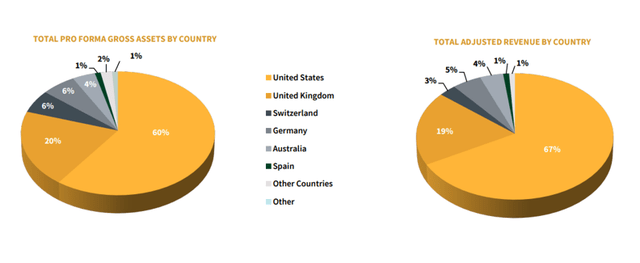

The trust’s real estate assets are focused in only two markets: the United States and the United Kingdom. Both markets account for 86% of Medical Properties’ revenue.

Focus On Two Countries (Medical Properties Trust)

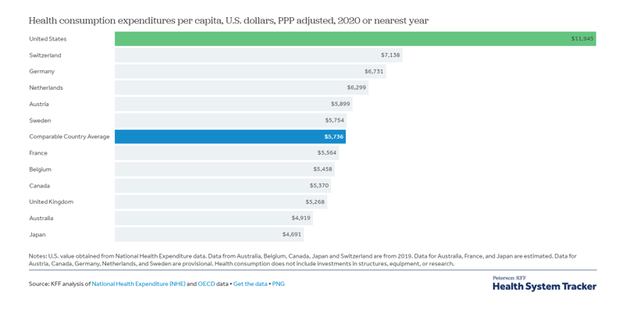

Due to large per capita health spending, the United States is the most lucrative market for health care trusts. No other country spends as much money on health care as the United States does.

In 2020, per capita health expenditures in the United States were about $12K, nearly 67% higher than the second highest spender on a per capita basis: Switzerland.

Health Consumption Expenditure Per Capita (healthsystemtracker.org)

Because Medical Properties’ principal business is investing in hospital and acute care facilities, the trust is largely immune to the potentially disastrous impacts of a recession.

Health care spending is not discretionary, implying a somewhat consistent demand pattern and providing Medical Properties with a high degree of predictability in terms of cash flows and dividend growth.

Potential For Dividend Growth And Payout Ratio Are Directly Linked

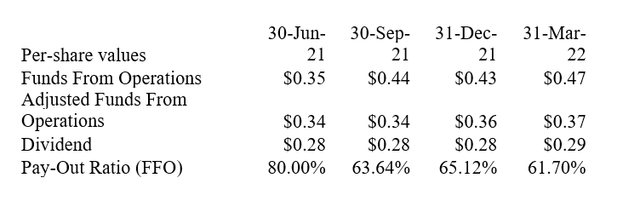

In general, real estate investment trusts with low payout ratios based on funds from operations are the safest REITs in the market.

Low payout ratios, defined as 60-70% of FFO, mean that trusts may afford to increase dividends even if economic difficulties arise.

Given that Medical Properties has a payout ratio of 67% over the previous twelve months, MPW is a stock that could deliver strong dividend increases in the future.

Payout Ratio And Dividend (Author Created Table Using Trust Financials)

Medical Properties intends to increase its quarterly dividend by $0.01 per share each year, so assuming this trend continues, dividend investors will receive an annual payout of $1.20 next year, or a 7.6% return.

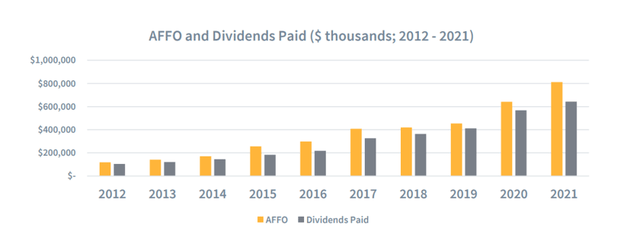

MPW currently has a stock yield of 7.4%. Dividends and adjusted funds from operations have increased over time in the trust.

AFFO And Dividends Paid (Medical Properties Trust)

Cheap FFO Multiple

Medical Properties has a respectable valuation. The valuation multiple I employ for health care REITs, or trusts in general, is based on funds from operations, which is an important statistic used to analyze real estate investment trusts.

According to Medical Properties’ forecast for 2022, the trust expects to earn $1.78-1.82 per share, implying an FFO multiple of 8.7x, the lowest in years. Medical Properties is difficult to resist in terms of both valuation and yield.

Why Medical Properties Could See A Lower FFO Multiple

If the economy enters a slump, Medical Properties’ FFO multiple could fall much further. However, the current macro picture is inconclusive.

While inflation is a warning sign for the economy, the most recent labor market report did not indicate a recession. Nonfarm payrolls rose by 372K in June, showing that the job market is not yet in a slump. However, if the U.S. economy were to enter a recession, we would likely see lower valuation multiples in the health care REIT market.

In terms of specific REIT risks, a decline in key performance measures such as occupancy rates or cash flow could lead to larger problems for the REIT in the future. Because health care spending is relatively recession-resistant, I believe those risks are unwarranted.

My Conclusion

I am now purchasing as much MPW as I can and would purchase even more of the trust’s stock if I had the liquidity to do so.

The most appealing aspect of Medical Properties, in my opinion, is that the trust’s core company is recession resistant. The level of interest, inflation, or GDP growth rates have little bearing on or influence on health care spending.

Because Medical Properties has a low payout ratio (67% based on FFO) and a low FFO multiple, the health care trust represents good value for dividend investors.

Be the first to comment