arild lilleboe/iStock Editorial via Getty Images

Oil and gas company governance structure can be delineated as:

*small and large private,

*public and mainly domestic (US shale and Canadian oil sands companies),

*international majors and super-majors (IOCs), and

*national oil companies (NOCs).

NOCs are distinguished from international majors and super-majors in that NOCs are largely owned and controlled by their home-country government. Very often, a country’s governance targets for its NOC—in addition to providing substantial support for itself and its citizens—also veer toward non-economic, short-term policy goals.

While Equinor ASA (NYSE:EQNR), 67% owned by the Norwegian government, is subject to these NOC pressures and has its share of unprofitable renewables projects, it competes more strategically than Petrobras (PBR), has a larger percentage of outstanding public equity than Saudi Aramco (ARMCO), and is not quite so subjected to green pressure as the nominally more independent IOCs Shell (SHEL) and BP (BP). It is also headquartered in the more (at this time) economically knowledgeable country of Norway, compared with Chevron (CVX), ConocoPhillips (COP), Exxon Mobil (XOM), and others headquartered in the US which are currently subject to (inchoate) US federal policies intent on eliminating both supply of and demand for hydrocarbons.

Equinor produces 70% of Norway’s oil and gas.

In 2021 Norwegian natural gas production was 11.1 BCF/D, most of which (on average 94%) it exports. Indeed, in 2021 Norway was the third-largest gas exporter after Russia and the US. With the severe Russian gas export cutbacks to the UK and Europe, Norway has become an even more significant gas and LNG supplier to its European neighbors.

Like IOCs and super-majors, Equinor is also active abroad, with operations in thirty countries. In the US this includes the Appalachian Basin and the Gulf of Mexico.

However, like many European energy companies, Equinor has made a big commitment to renewable energy. Even here it has an expertise advantage (offshore drilling) in undertaking offshore wind projects.

While Equinor’s fixed dividend yield of $0.80/year (2.1%) is modest, it is also paying a substantial variable dividend ($0.70/quarter for 3Q22) and is implementing another share buyback, of up to $1.83 billion.

I recommend Equinor ASA to investors interested in international oil, gas, and wind production. Equinor has been a key natural gas exporter in the past. It is even more important now given the absence of Russian gas, oil, and distillate exports to the UK and Europe.

Macro

Russia’s invasion of Ukraine and consequent sanctions against Russia led to the cessation of Russian exports of natural gas, oil, and distillates to Europe. This has roiled global energy markets, particularly since Europe relied on Russian gas imports for 40% of its natural gas consumption. With most European storage filled ahead of winter, natural gas prices have moderated but are still 4x those of a year ago.

So, in the immediate term, Equinor is an even more critical natural gas supplier to Europe. It has boosted gas volumes 11% over a year ago. And, for example, in September it signed a 10-year contract to supply Poland’s PGNiG with 2.4 billion cubic meters/year (230 MMCF/D) of natural gas.

Norway has extensive export pipeline infrastructure and in June 2022, Equinor reopened its Hammerfest LNG facility, which has capacity of 700 MMCF/D. It also signed a 15-year purchase agreement with US LNG company Cheniere (LNG) for deliveries starting in 2026.

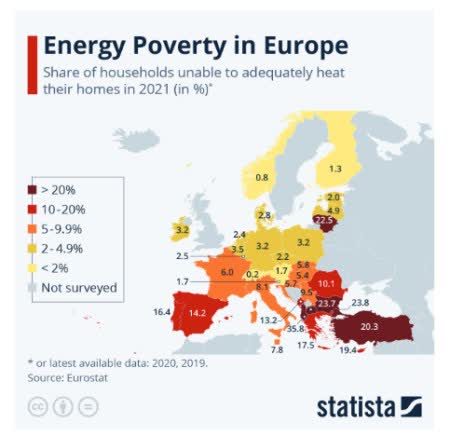

The graphic below shows 2021 energy poverty in Europe, prior to the Russia-Ukraine war. One can expect the same graphic for 2022 will look even more dire.

Statista and oilprice.com

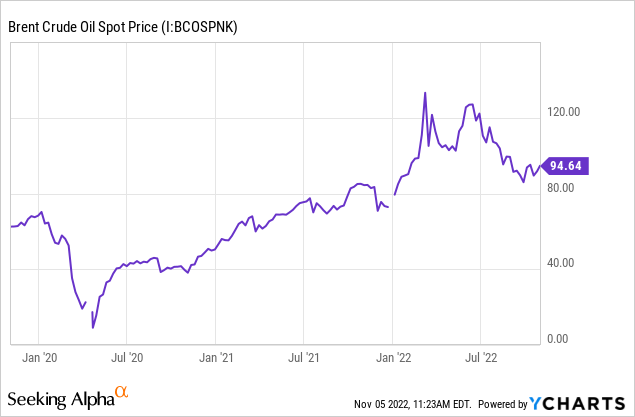

Oil and Gas Prices

Brent oil’s price (European reference) is close to that of US WTI; however, liquefied natural gas is a different story, reflecting the rush to make up for the roughly 40% of natural gas supply imported by pipeline from Russia.

Yet, while still multiples of the US natural gas price, LNG prices now are half their peaks of a few months ago (all are for December 2022 delivery):

*$35.00/MMBTU at the UK’s NBP (National Balancing Point),

*$33.55/MMBTU at TTF (Title Transfer Facility) in the Netherlands, and

*$28.93/MMBTU for the JKM (Japan Korea Marker) Asian reference price.

Compare these to $6.40/MMBTU for the NYMEX price of US gas at Henry Hub.

And on the oil side, on November 5, 2022, the price of the NYMEX contract for:

*Brent crude oil (January 2023) was $98.57/barrel,

*West Texas Intermediate (December 2022) crude oil was $92.61/barrel,

*US heating oil (December 2022) was $3.91/gallon, or $164/barrel.

3Q22 Results and Guidance

In the third quarter of 2022, Equinor earned $9.4 billion of net income, compared to $1.4 billion for 3Q21. Cash flow from operations was $6.6 billion and free cash flow was $2.4 billion.

For the first nine months of 2022, Equinor earned net income of $20.8 billion, compared to $5.2 billion for the first nine months of 2021. Cash flow from operations was $30.9 billion and free cash flow was $21.7 billion.

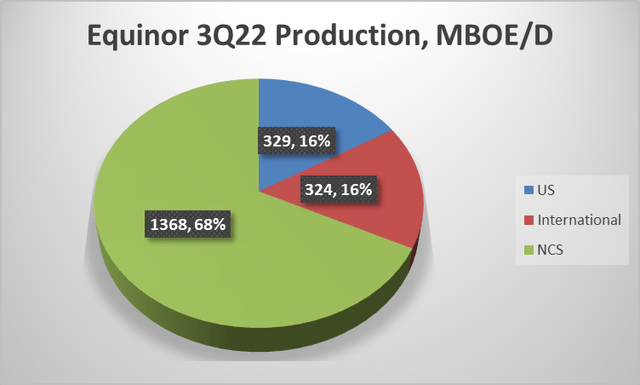

Equinor divides into five primary operating segments: Exploration & Production Norway (EPN), Exploration & Production International (EPI), Exploration & Production USA (EPUSA), Marketing, Midstream & Processing (MMP), and Renewables (REN). For 3Q22, the net operating income primarily came from Norwegian operations.

*Exploration & Production Norway, $21.8 billion,

*Exploration & Production International, $813 million,

*Exploration and Production USA, $1.1 billion,

*Marketing, Midstream & Processing, $1.9 billion, and

*Renewables, loss of -$56 million.

Total production for 3Q22 averaged 2.02 million BOE/day of liquids and natural gas. Volumetrically, this splits almost equally between liquids and natural gas. As the chart below shows, most of Equinor’s production is from the Norwegian continental shelf (NCS).

Starks Energy Economics, LLC and equinor.com

According to Anders Opedal, Equinor’s president and CEO, “The Russian war in Ukraine has changed the energy markets, reduced energy availability and increased prices. Equinor continues to provide stable flow and high production with record levels of gas from the Norwegian continental shelf.”

Indeed, for EPN, gas volumes increased 11% (and liquids decreased by 8%) compared to 3Q2021. Moreover, EPN’s average internal natural gas price for 3Q22 was $42.34/MMBTU, up fourfold from $13.92/MMBTU in 3Q21.

The company may expand its North Sea footprint by buying UK offshore oilfield assets from China National Offshore Oil Corporation (CNOOC) for between $1.9-$2.8 billion. China is reportedly concerned enough about sanctions exposure to consider exiting operations in the UK, US, and Canada.

The company estimates organic capital expenditures at $8.5 billion for 2022, $10 billion annually for 2022-2023, and $12.0 billion annually for 2024-2025.

Reserves

On December 31, 2021, Equinor’s proved reserves were 5.356 billion barrels of oil equivalent (BOE). This included 2.355 billion barrels of oil and condensate (44%), 261 million barrels of natural gas liquids (5%), and 2740 billion BOE (about 16.4 trillion cubic feet) of natural gas (51%).

As a recent Troll Blend crude assay from The Oil and Gas Journal showed, North Sea oil is classically “light, sweet,” that is, an API gravity of 36.3 and sulfur content of 0.167% by weight.

Recall that BOEs are not the same as barrels of oil. The equivalence is based on volume for condensate and natural gas liquids, and on heating value for natural gas.

The SEC PV-10 value of these reserves on December 31, 2021, was $43.8 billion, about 2.5x 2020’s $18.2 billion.

Even prior to the 2022 oil and gas price increases, SEC PV-10 reserve calculations show Equinor’s natural gas nearly quadrupled in price between 2020 and 2021.

Competitors

Equinor ASA is headquartered in Stavanger, Norway.

International competitors, some of whom partner for various projects, include APA Corp. (APA), BP (BP), Chevron, ConocoPhillips, Eni (E), Shell, Total (TTE), Exxon Mobil, and the national oil companies—especially Saudi Aramco and Qatar Energy.

In Brazil Equinor partners with Petrobras. In Suriname, it partners with Exxon Mobil and Hess (HES). Other companies active in Suriname include the state Suriname company Staatsolie, APA Corp., Shell, and Total.

Onshore in the US, Equinor is involved in the gaseous Appalachian basin (Marcellus and Utica shales in Ohio, West Virginia, Pennsylvania). Among its many competitors there are Chesapeake (CHK), Coterra (CTRA), EQT (EQT), Range Resources (RRC), and Southwestern Energy (SWN).

Equinor produces oil and gas from the offshore US in the Gulf of Mexico and competes primarily with super-majors there.

The company develops and operates wind projects and so also competes with other wind project owners.

A recent article noted US wind projects Commonwealth Wind and Ocean Wind 1 offshore New England and New Jersey, respectively, are faltering. Companies involved in the two projects are Public Service Enterprise Group (PEG), Avangrid (AGR), Orsted AS, and Iberdola.

Equinor also has hydrogen and ammonia projects underway.

Governance

Because the Norwegian government owns 67% of Equinor, individual investors’ incentives may not fully align with the government’s incentives.

On October 28, 2022, Institutional Shareholder Services ranked Equinor’s overall governance a 1, with sub-scores of audit (2), board (2), shareholder rights (1), and compensation (4). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

No insiders hold shares of the stock.

At October 14, 2022, shares shorted as a percentage of float was negligible.

Equinor’s beta is 0.69, surprisingly less than that of the overall market, and unusual for energy companies, even large ones. Indeed, one factor may well be the moderating influence of Norway’s ownership of the company.

Equinor’s new CFO, Tongrim Reitan, has 27 years of experience with the company. The prior CFO left after 16 months to become the CFO for Danish brewer Carlsberg.

Equinor’s Financial and Stock Highlights

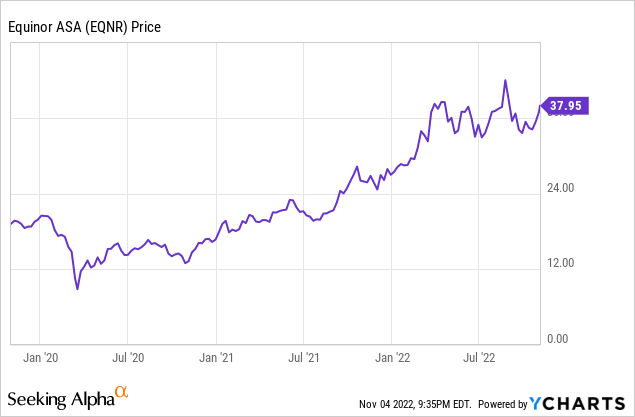

Equinor’s market capitalization is $119.1 billion at a November 4, 2022, stock closing price of $37.98/share.

The 52-week price range is $24.17-$42.53 per share, so its November 4, 2022, closing price is 89% of its 52-week high and 90% of the one-year target of $42.17/share.

Twelve-month trailing EPS was $7.55/share for a current price/earnings ratio (P/E) of 5.0. The averages of 2022 and 2023 EPS estimates are $7.03 and $6.48, respectively, for a forward P/E range of 5.4-5.9.

Returns on assets and equity are both stellar at 31.9% and 60.7%, respectively.

Trailing twelve months’ operating cash flow is $39.0 billion. Levered free cash flow is $48.8 billion.

At September 30, 2022, Equinor had $110.0 billion in liabilities and $152.6 billion in assets giving a liability-to-asset ratio of 72%.

Liabilities include:

*finance debt of $28.5 billion,

*current tax payable of $18.4 billion,

*provisions and other liabilities of $14.8 billion,

*trade, other payables, and current provisions of $12.6 billion, and

*derivative liabilities of $10.4 billion.

The company’s ratio of debt to market capitalization is a small 0.27. The debt-to-EBITDA ratio is quite comfortable at 0.39.

Equinor’s ordinary fixed dividend is $0.80/share/year. However, it paid an additional $0.50/share special dividend in 2Q22 and has announced it will pay an additional $0.70/share special dividend for 3Q22. The dividend is payable January 23, 2023, for shareholders of record January 10, 2023, and the stock goes ex-dividend January 9, 2023.

On October 31, 2022, the company began a fourth tranche of share buybacks—including a proportionate two-thirds share from the Norwegian government—totaling $1.83 billion. This buyback is scheduled to end no later than January 27, 2023.

Equinor’s regular dividend of $0.80/share represents a 2.1% yield. If variable dividends continued each quarter at the same rate as in 3Q22—unlikely—adding in the special dividend of $0.70/share would result in a dividend yield of 9.5%.

One analyst rates Equinor as a “strong buy,” a second considers it very undervalued, and a third rates the company as “hold.”

Notes on Valuation

The company’s book value per share of $13.57 is much less than its market price, a positive indicator. The ratio of enterprise value to EBITDA is a mind-blowing low of 1.3—a huge bargain.

The ratio of market capitalization to production is similar to majors: $58,900/flowing BOE and $117,700/flowing barrel of liquids.

Comparing totals: Equinor’s SEC PV-10 reserve value at December 31, 2021, was $43.8 billion, enterprise value now is $107.0 billion, market capitalization now is $119.1 billion, and asset base on September 30, 2022, was $152.6 billion.

Positive and Negative Risks

The interests of the Norwegian government majority ownership may not align with those of non-Norwegians, especially small investors.

The company recently brought its Brazilian oil field Peregrino back into production, with phase 2 of the project now onstream. The change in Brazilian presidents could affect operations there.

Political risk is an issue worldwide. In the US, federal or state limits on drilling and building more pipeline capacity could limit Equinor’s Appalachian Basin gas prices. The halt on offshore lease sales also limits growth potential. However, Equinor does not have a huge US exposure.

Concern remains that European energy trading and derivatives market could seize up or become illiquid. In early September 2022, margin calls were $1.5 trillion.

Some countries or the EU as a whole could impose a natural gas price cap, as they have discussed doing.

Investors should consider their European oil and natural gas price expectations (including for European LNG) as the factors most likely to affect Equinor.

Recommendations for Equinor ASA

Equinor is a long-time European supplier and now is supplying even-more-critical natural gas to countries cut off from Russian gas exports. While European gas prices have moderated from their extreme highs and more US LNG will enter the picture, Equinor is an important baseload supplier of natural gas (and oil) to Europe.

The company has a steep liability-to-asset ratio of 72%, but its 67% Norwegian government ownership implies even more stability than typical for an NOC. This is evident in its low beta of 0.69 and its excellent governance scores.

The company’s low current and forward price/earnings ratios signal a bargain, as does its extraordinarily low ratio of enterprise value to EBITDA. Cash flow is very healthy, and likely to remain strong even after natural gas prices moderate, as they have and are expected to do.

The company is investor-friendly with a buyback program and a combination fixed-variable dividend. The fixed dividend yields 2.1%. If the special, variable dividend continued at the current rate, the total annual dividend yield would be 9.5%.

Equinor’s stability, evidenced by its low beta, excellent governance score, good returns to investors (including it 67% Norwegian government ownership), and position as a key European supplier (without being subjected to the UK’s windfall profits tax, unlike UK-based North Sea producers) makes it one of the most attractive oil and gas companies among its NOC and IOC peers.

I recommend Equinor to investors interested in a rare, well-governed NOC that’s supplying Europe and the UK with much-needed natural gas, as well as oil.

equinor.com

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment