Drew Angerer/Getty Images News

It seems like Palantir Technologies Inc. (NYSE:NYSE:PLTR) is once again a topic of debate in various investing forums. Its key executives sold off another 1.4 million of their Class A shares in the last month alone, and 3.2 million shares year to date, which has fueled bearish speculation about how these insiders are looking to jump ship before it eventually sinks. While that’s a legitimate concern, the ground reality isn’t all that dire. In this article, I’ll attempt to explain why Palantir’s insider sales aren’t an issue anymore. Let’s take a closer look at it all.

The Concerning Data

Let me start by saying that the SEC mandates company insiders – which can be officers, 10%-plus shareholders, directors or key executives – to disclose their trading activity in their company through Form 4 filings. These key personnel usually have real-time information about their company’s financial and operating performance and, so, tracking their trading activity can sometimes provide us with leading insights about how their upcoming earnings report might look like. The problem here is that, like all trading strategies, this one’s not perfect either, and it often generates false positives.

Let’s look at Palantir’s data. Its insiders have collectively sold about 1.4 million Class A shares in the last month alone, which is worth around $8.3 million per the transaction records. Since the company went public in September 2020, its insiders have sold nearly 130 million Class A shares worth approximately $2.3 billion, which is nearly 15% of the company’s entire market capitalization at the time of this writing.

These figures in isolation present an alarming picture. It suggests that insider selling is still rampant and the company’s key executives are selling all their holdings as fast as they can before the ship eventually sinks. Moreover, if the selling continues, then there’s the possibility that the increased supply of shares can, in theory, drag Palantir’s shares even lower. But this isn’t necessarily the ground reality here.

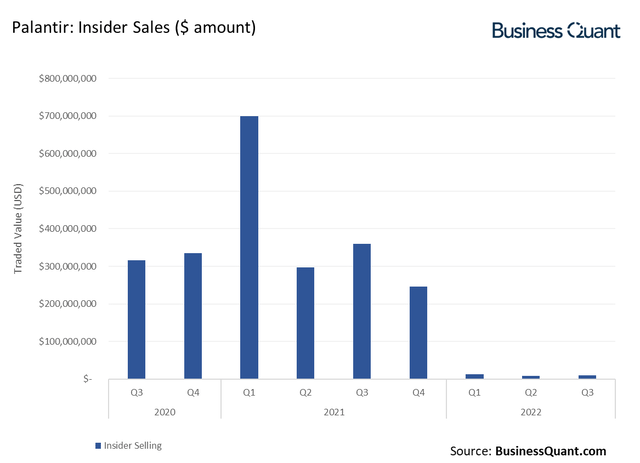

An interesting picture comes to light when we look at a time-series chart for these transactions. As it turns out, insider sales in Palantir dropped 95% in Q1 2022 on a sequential basis. The figure dropped another 34% in Q2 and remained at subdued levels in Q3. So, while Palantir’s insider sales were rampant till last year, it hasn’t been a matter of concern this year.

This leads us to the next set of questions – what does this mean for investors, and why is insider selling down in the first place?

Impact for Investors

There are broadly two ways in which this data affects shareholders. First, Palantir’s rampant insider sales left the Street wondering that, perhaps, its key executives didn’t believe in the company’s prospects and were looking to exit their holdings as quickly as they could. But now that these sales have waned off considerably, such speculative theories about the management’s intent and their faith in the company’s future can be put to rest.

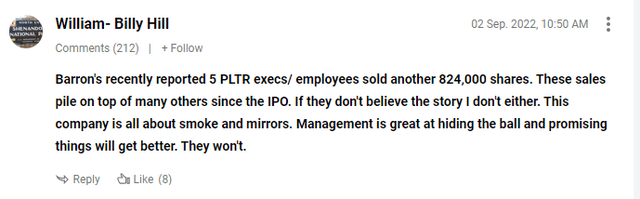

Here’s one such comment on my prior article:

Secondly, it’s evident that Palantir’s executives aren’t flooding the market with new shares anymore. This reduced supply of shares, in theory, should give ample time for the market demand to catch up, help in stabilizing the stock price and limit downward volatility in the stock going forward. So, overall, the reduced insider selling in Palantir should help in improving investors’ sentiment.

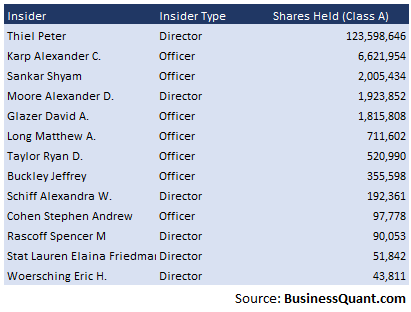

Now, one might argue that Palantir’s insider sales are currently low because company executives have already sold the bulk of their holdings. But that’s not really the case here. Per their respective Form 4 filings, most of Palantir’s insiders are still left with a significant number of Class A shareholdings. Peter Thiel and Alex Karp, for instance, collectively own over 130 million Class A shares, which is roughly 6.5% of the company’s total shares outstanding.

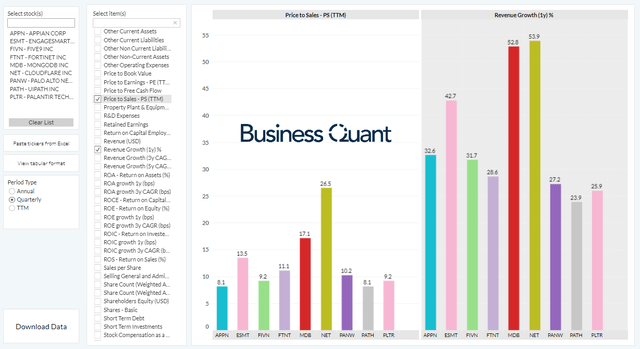

BusinessQuant.com

Bear in mind that the above table only comprises of Class A shareholdings, and doesn’t include Class B shares, Class F shares or stock options. So, I think it’s needless to say, but Palantir’s insiders still own a sizable stake in the company, and they choose to retain their holdings, instead of engaging in fire sales and abandoning ship. This leads me to believe that these insiders sold their holdings to unlock their paper wealth, diversify their holdings, and to cover the tax liability presented by their stock awards.

It’s important to understand that insider sales can happen due to personal reasons, too, and don’t always imply that there’s something nefarious or criminal happening in such transactions. I’d have been concerned if these insider sales continued in 2022 and these company executives were left with a negligible stake in the company, but that evidently isn’t the case here.

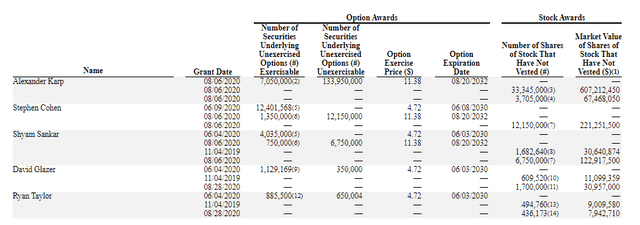

Moving forward, I expect Palantir’s insider sales to remain subdued for a few quarters at the very least. The company filed its DEF14A document earlier this year, which is a treasure trove of information with regard to its employee compensation. Note in the table below how the nearest options expiration date, across all key company executives, falls in the year 2030.

This means Palantir’s insiders will have to wait a few years before they can exercise their stock options and subsequently sell their Class A holdings.

Final Thoughts

The takeaway here is that Palantir’s insider selling was a matter of concern till last year, but it isn’t an issue anymore. The selling pressure has waned off considerably, and it’s likely to remain down in the foreseeable future as well. So, investors may want to ignore bearish speculation on the topic and focus on analyzing Palantir’s operational and financial performance instead.

The stock is trading at 9-times its trailing twelve-month sales at the time of this writing. This is quite low and attractive when compared to some of the other rapidly growing stocks in the software industry. So, investors with a multi-year time horizon may want to accumulate Palantir’s shares on potential price corrections. As far as I’m concerned, I remain bullish on Palantir, as detailed in my previous article here. Good Luck!

Be the first to comment