vzphotos

EQIX Q3 2022 results: an inflection point for the stock price?

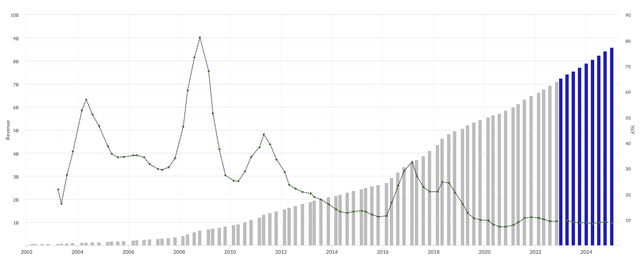

Equinix, Inc. (NASDAQ:EQIX) recently delivered its 79th consecutive quarter of revenue growth, with record gross and net bookings. The company also reported strong demand across all regions.

EQIX is well on its way to reach (and exceed) 20 years of uninterrupted revenue increase, with several expansion projects underway and churn below company’s forecast.

Equinix revenue growth and forecast (Sentieo )

Interconnection, our favorite metric to assess the health status of the business, reached roughly 18.5% of recurring revenues. Interconnection revenues continued to outpace colocation revenues.

EQIX monthly revenue per cabinet remains strong, improving especially in Europe. MRR per cabinet is a sign of strong pricing power.

To summarize, the company is strengthening its leadership as the world-wide leader in the retail network-neutral colocation market – the most interesting, profitable and defendable segment of the so-called “data center” world.

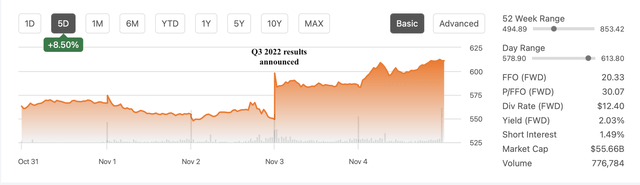

The stock rebounded nicely after Q3 results were announced – we see the numbers announced and the positive commentary made during the conference call as a potential inflection point for the stock price.

Equinix post Q3 results – stock price action (Seeking Alpha)

Data Centers: in the news for the wrong reasons

If we look at a YTD share price chart, we will notice that Equinix, like other real estate investment trusts (“REITs”) and technology stocks, has suffered a steep decline in valuation from the start of the year.

Equinix YTD performance (Seeking Alpha )

There are obviously many reasons behind this stock price decrease. They range from weakening macroeconomic expectations to specific sector-related uncertainties about the inner strength of the colocation offering.

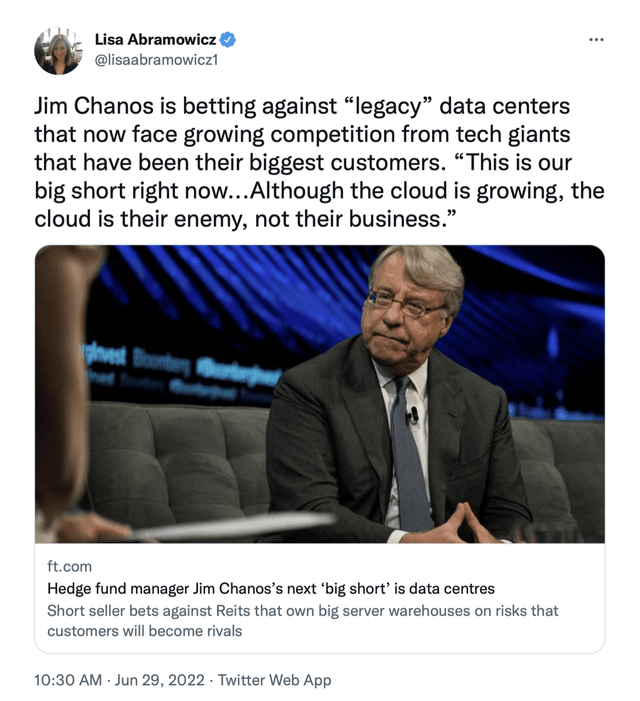

In particular, some short sellers, including Jim Chanos, have been betting against data center REITs. The following is a good summary of Jim Chanos’ thesis, as reported in June 2022 in a twitter post made by Lisa Abramowicz, co-host of “Bloomberg Surveillance.”

Chanos data center short thesis (Twitter )

As Equinix and Digital Realty (DLR) represent about 25% of the global colocation market, according to recent data from Synergy Research Group, Chanos’ short bet seemed to target these two listed companies, in particular.

Chanos’ thesis may be resumed by the antagonism “cloud vs legacy data centers.”

We believe EQIX recent results and outlook proved, if necessary, that the cloud is actually a positive catalyst for an interconnection-rich operator like Equinix, with the company announcing four cloud on-ramp wins just in Q3, bringing Equinix’s portfolio to more than 200 cloud on-ramps across 44 different markets.

If the cloud is growing fast, we do not see any reason why this should penalize the toll roads needed to access it.

Chanos’ call reminds us of a 2009 prediction by Jim Cramer about the data center market: “an industry that’s about to be brought low by new technology, so I think you should sell, sell, sell.” That was also quite wrong on its premises.

There’s no “new technology or cloud enemy” round the corner making interconnection-rich data centers like EQIX obsolete – and Equinix’s history is a testament to a company faithful to its (margin-rich) original business model that has been able, since inception, to take advantage of both positive and negative market conditions.

Equinix: built to help scale the internet, with a focus on interconnection

“[T]here was a fairly sophisticated group of engineers who said that the Internet could never scale and by the end of 1996, it was just going to collapse under its own weight because it was just too distributed.”

That’s Jay Adelson. He’s a serial entrepreneur… back in 1998, he helped to start a company called Equinix – a neutral internet exchange carrier.

Adelson’s Equinix was a company built on a philosophy….born out of the early internet culture that believed in open access. More equality would help the internet grow. And that philosophy also became a business model.

“What we did is we said, let’s make a flat rated cross connect the business model.

Equinix … is a business that was built ultimately to help the Internet scale and reach its potential”.

quotes from Equinix’s podcast “Traceroute” – Episode 1: Interconnection.

As Equinix roots lie in the desire to help the internet scale, interconnection is at the very heart of its business model.

In the early days, allowing customers to exchange data and packets mainly meant to run a cable between two cabinets (a one-time, relatively cheap, cost), and charge a monthly recurring fee to both customers (a very margin-rich business).

Interconnection has since evolved from a simple cable between cabinets, but the financials of Equinix’s interconnection business have remained similar:

Michael Elias, Cowen and Company

I would love if you could unpack for us the difference in terms of pricing and margins between a physical cross-connect versus a virtual one. I believe, just based on what you said, the virtual cross-connects has a usage component, but I would really appreciate your view.

Bill Long, Equinix, Inc. – VP of Interconnection Services

Yes, so a cross-connect, I just think it was a piece of fiber that you pay, there’s an install nonrecurring fee and then a monthly recurring fee for that piece of fiber. On fabric, you pay a relatively low port fee to connect, so between $100 and $200 for that base port. I’d say that’s a 10-gig port is going to be your $200. And then you have connections on top of that, and you’re going to pay for each connection depending on how big, how fast that speed is. So you buy a 10-gig port, then you might buy a 1 gig virtual circuit on top of that. So fabric has those 2 components: a, the port; and then the virtual circuit. When you net all of that out, if you take all of the fabric revenue and divide by the number of connections that are on it, it is marginally higher ARPU than a cross-connect. But it also has marginally higher cost because there’s an actual network there that does it. So when you net it all out, it’s slightly higher revenue, but largely at neutral, neutral margins. So we’re largely agnostic on whether you’re using a cross-connect or a virtual surrogate to connect.

Equinix Inc at Cowen Communications Infrastructure Summit – Aug 10, 2022 – transcript courtesy of Sentieo.

Equinix’s interconnection services now represent a great mix of services catering to its’ customers’ evolving needs:

Kathleen Noel Morgan- Equinix, Inc. – Manager of IR

So starting with Equinix Fabric, we virtualized our interconnection offerings, so customers now have the ability to directly connect with a physical cross-connect or can also leverage Equinix Fabric to connect across our portfolio. Next came Network Edge, which is virtualizing that networking function for customers.

And then lastly would be Equinix Metal, which really, for those who are not as quite tech-savvy in the room, it’s really like automated colocation where we have servers pre-deployed in 19 metros around the world and customers can spin them up quickly for themselves and have an instance and a virtualized appointment without having to shift gear to a metro that may not be part of their current deployment.

Equinix Inc at NAREIT Institutional Investor Forum – June 07, 2022 – transcript courtesy of Sentieo.

Interconnection is important both as it represents Equinix’s largest profit center, and because it helps create a “stickiness” to the company’s colocation business:

Kathleen Noel Morgan- Equinix, Inc. – Manager of IR

The bigger part of our churn is what we call frictional churn, which is moves, adds, changes or deletes, so customers are always re-architecting what they’re doing. So maybe they’re pulling something at one metro but deploying with us in another metro.

Equinix Inc at NAREIT Institutional Investor Forum – June 07, 2022 – transcript courtesy of Sentieo.

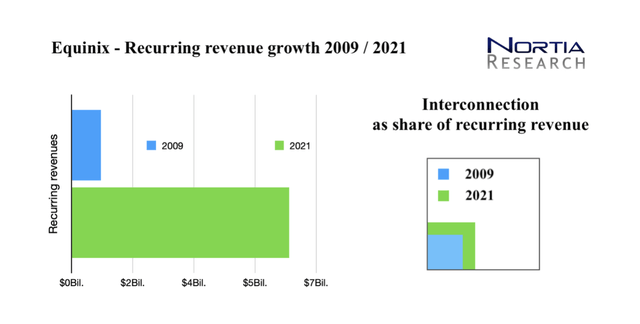

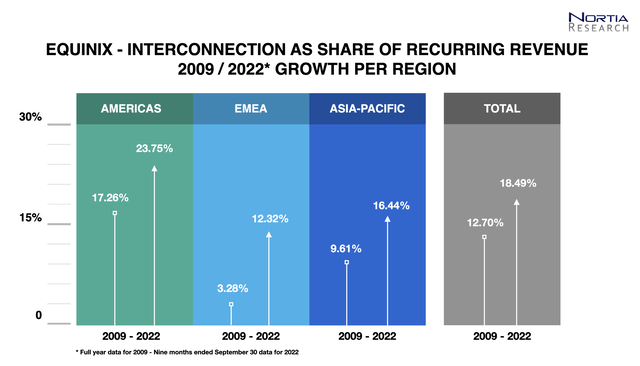

Equinix’s recurring revenue growth in the 2009 to 2021 time frame is even more interesting when we highlight the inner growth of the company’s interconnection services:

Equinix – interconnection as share of recurring revenues (author chart, company’s data)

Total revenues increased from less than $1 billion, in 2009, to $6.6 billion in 2021.

Recurring revenues represent in excess of 90% of total revenues, as they exclude installation services related to new customers’ initial deployments and professional services performed by EQIX.

We believe recurring revenues are a better benchmark than total revenues to relate to interconnection revenue, as they are part of the same product offering.

Interconnection revenues exceeded $1 billion in 2021, reaching a total of $1,161,502.000.

Here’s a more detailed look at Interconnection as a share of recurring revenue in total and in each of Equinix’s major regions:

Equinix – interconnection as share of recurring revenues per region (author chart – company’s data)

EQIX leadership in interconnection services is unmatched, and represents a strong magnet that allows the company to win new customers, additional orders from existing customers, reduce churn and price its colocation services at a premium.

Equinix survived the dot-com bubble, the financial crash and will keep growing through the next financial downturn

Although a relatively young company, EQIX has already successfully navigated through difficult times and tough environments, including a near death experience after the tech bubble burst in 2000.

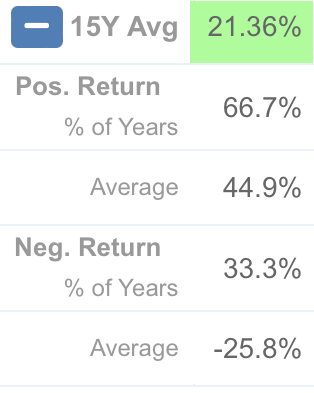

If we have a look at the company’s return over the last 15 years, we will notice that Equinix has delivered strong yearly returns, 21% on average, through negative and positive years.

A stock chart is rarely a straight line with no hiccups, even if the company’s revenue growth trajectory is a perfect, record one.

Investors have enjoyed two positive years out of three – a very good result, if you are a long-term investor:

Equinix 15 Y average return (Sentieo )

Even in the most challenging economic environments (say the post-Lehman crisis), the company has been able to maintain its growing trajectory, often taking advantage of opportunities (like buying assets at distressed prices from competitors) that would have not materialized in a better economy.

We all know that history doesn’t necessarily repeat itself – but that’s not a good reason to ignore EQIX management’s proven capacity to address difficult times proactively.

Equinix recent history has taught us that tough times for the stock price have, so far, turned into good buying opportunities.

Signal and noise

Investors’ concerns surrounding Equinix’s future performance mainly relate to today’s negative macroeconomic environment and its potential effect on data center demand.

The sudden inflationary spike that has strongly impacted energy costs, an important part of colocation cost, has also added a layer of uncertainty to EQIX pricing/margins/churn.

In addition, management will be asked to balance the need to pay a dividend (as required by its REIT status) while, at the same time, having to deal with more challenging market conditions to finance its future growth needs.

We believe most of these concerns are legitimate, but that they are impacting EQIX stock price in a disproportionate way.

As discussed before, churn is relatively low, and has been used proactively to privilege connection-rich customers to larger installations.

Sometimes churn is due to customers re-evaluating their physical presence in different areas, which may not necessarily mean diminished business for the company.

The cost of moving out of a data center is relatively high – especially if it’s interconnection dense, like most Equinix locations.

Even in the worst economic environments, when bankruptcies in the telecom and dot-com sector were relatively frequent, Equinix’s churn remained manageable, and EQIX was often recognized as a critical vendor, minimizing the economic impact of their customers’ Chapter 11 filings.

EQIX is also managing energy costs through hedges that should reduce the impact on their customers. Price escalators are built into the company’s contracts.

Equinix has already started implementing higher pricing to new and existing customers.

Price increases are never good news for clients, but we do not believe they will necessarily translate into an unmanageable loss of customers or business, or into a margin reduction.

The company’s management reiterated that business is as strong as ever, and we see this as a clear signal that EQIX may outperform its peers and navigate through a tougher environment with strength.

At a higher level, the company’s just implemented an ATM that could potentially add $1.5 billion to its strong liquidity position of $ roughly 2.5 billion. Leverage is relatively low, leaving management the possibility to incur in new debt as well, if necessary.

Existing debt has a blended cost of less than 2%, a fixed rate ratio of 96% and an average weighted maturity of more than 8 years.

A technology REIT, an interconnection-rich data center. How to properly evaluate?

We all know that giving a company a proper valuation is 75% art and 25% science because it needs to take into account the story behind the numbers of its business.

Equinix is trading as a REIT, and for that reason, using a multiple of AFFO (adjusted funds from operations) comes to mind as the best metric to use.

However, the company has often enjoyed a rich multiple compared to other sector REITs, because it is also (or mainly) a tech stock, with a strong worldwide leadership in a unique niche of the Telecom infrastructure business, enjoying strong secular tailwinds and economics.

The key, unanswered question hangs in the air: how much is this (framed) stock unit worth?

Equinix stock certificate, old logo (author picture )

In our opinion, one correct way to evaluate EQIX is to think of the company as a data center REIT with a special value, given by its unique, unmatched and probably hard-to-impossible to duplicate interconnection business.

As we noticed, Equinix’s interconnection business exceeded $1 billion in revenues in 2021.

If the company could spin off this single activity, we would probably be using luxury stocks multiples to evaluate it.

While we doubt we will ever experience this Ferrari-like moment, we mentioned this unrealistic possibility to support our take that EQIX deserves being evaluated on a league of its own – not just an average AFFO multiple, but a higher AFFO multiple, with a plus, due to its interconnection services.

We believe that the company will successfully navigate through this uncertain economic environment, and we expect, as long-term holders, to see the stock price to return to the $800 range in the future, due a mixture of improved numbers and rich multiples applied to Equinix’s performance metrics.

Be the first to comment