Ford Launches F-150 Lightning Electric Truck

Bill Pugliano/Getty Images News

The U.S. auto industry, traditionally cyclical in nature, appears headed for one of its periodic doldrums. Ford Motor Co. (NYSE:F), one of the larger players, isn’t immune, although the automaker managed to post an increase in unit sales for June and the second quarter of 2022.

Ford sales news (Ford Motor Co.)

The reason for Ford’s sales increase – particularly in June – has much to do with disproportionately few sales it reported a year ago when Ford was suffering more than its peers from a semiconductor shortage and too few vehicles to sell due to a fire at one of its suppliers in Japan. The semiconductor shortage continues, with several analysts forecasting no relief until late 2023 or sometime in 2024.

Buyers getting nervous?

Slow industry sales as a result of inadequate supply of vehicles soon could be replaced by slow industry sales as a result of falling consumer demand. Falling oil prices, inventory gluts and other signs of a slowing economy abound. Taken together with rising interest rates, the prospect for an industry-wide rebound in vehicle sales looks uncertain at best.

Ford is in the midst of a costly and potentially disruptive transition from internal combustion engines to battery-powered electric vehicles (BEVs). Ford’s strategy is to be a major global provider of BEVs and has committed a whopping $50 billion worth of investment in BEV technology and production capacity through 2026. Since Ford’s market capitalization currently stands at $44.5 billion, it’s fair to say that CEO Jim Farley is literally betting the company’s future on electric vehicles.

Bronco Wildtrak for 2022 (Ford Motor Co.)

I have written and opined with regard to Ford and other global automakers, such as General Motors Co. (GM), that the risk of aggressive investments in electric vehicles is tied to the development of a public charging infrastructure, the rising cost of basic materials and the uncertainty of consumer demand for such vehicles. Yes, future vehicles eventually will be powered by electricity – but how long will it take for that future to arrive? How long will investors wait for a payoff?

Lightning strikes

Starting at about $40,000 and reaching $90,000 in price, Ford’s new F150 Lightning battery-powered pickup is all important to the company’s future. Ford’s entire balance sheet depends on full-size pickup trucks, 726,004 of which were sold through U.S. dealerships in 2021. All ran on fossil fuel.

The 2,296 Lightnings sold in the first two months of production this year represent the first drop in the bucket toward Ford’s strategy of replacing gas-guzzling pickups as much as possible with zero-emission versions. The waiting list of buyers is impressive, but the deliveries must grow steadily and continuously to fulfill Ford’s aspirational transition to electricity and to justify the massive spend on battery manufacture.

Consumer demand for BEVs will be influenced by macroeconomic factors such as employment, inflation and wage growth – demand also will be influenced by confidence in the new technology, which is experiencing birthing pains. In mid June, Ford recalled nearly 50,000 Ford Mach-e BEVs and told its dealers to stop delivering the vehicles pending correction, via an over-the-air software update, of a defect that causes possible overheating of its batteries’ “main contactors,” resulting in a loss of power or the inability to start the vehicle.

Battery technology is tricky. The lithium-ion battery used in most BEVs sold today is in its relative infancy compared to the ICE engines that have been developed, refined and improved over more than a century. GM was forced to recall all of the roughly 140,000 Chevrolet Bolt BEVs it sold due to fewer than two dozen fires caused by battery overheating due to a manufacturing defect. GM and other automakers say they’re confident that battery technology will keep getting better and that consumers eventually won’t worry about fires and overheating.

Old reliable

In the meantime, ICE-powered vehicles have never been more reliable, efficient and durable, though spiking gasoline prices prove devastating to many household budgets, especially those of low-income workers. Ford knows how to exploit Americans’ affection for gas-powered engines as well as the fashion trends they favor. Witness the growing success of its Bronco line of vehicles.

The development of gas-electric hybrids pioneered by Toyota Motor Corp. (TM), starting in the late 1990s gave the industry a chance to improve propulsion efficiency and thus reduce the emission of CO2. Toyota is pursuing a more conservative strategy of introducing BEVs at a slower and more deliberate pace than its rivals, consistent with market demand.

The combination of federal and state pressure toward zero CO2 emissions – inspired by regulatory pressure in California – triggered decisions over the past five years by Ford, GM, Volkswagen AG (OTCPK:VWAGY) and others to accelerate the transition to batteries. How this will work out for the automakers and for consumers remains to be seen.

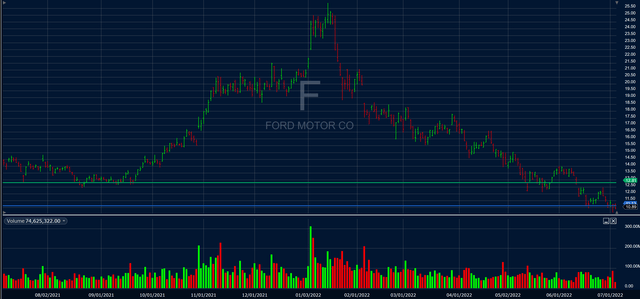

One-year Ford share price chart (Fidelity)

For the investors who view Ford’s electrification strategy as visionary, the latest slide in the stock price will be regarded as a buying opportunity, particularly with the prospect of a 3.5% yield from dividends. The chance to load up on shares at the current price when so recently they were selling at more than twice as much should prove irresistible. Ford is a great name that has bounced back before, contradicting naysayers and pessimists.

Rent vs. buy

To others, this writer included, Ford and others in the electrification camp still must surmount major unanswered questions about government support for infrastructure, improvements in battery technology and macroeconomic conditions in light of the Ukraine conflict, supply chain snags, inflation and Federal Reserve monetary policy.

Traditionally, the automotive stocks are “rented,” not bought and held. The current doldrums might be the time to rent Ford shares. Of course, such renters must stay alert when the moment arrives to move on to new digs.

For the long-term investor, who requires solid earnings and dividend growth, Ford may qualify as a portfolio addition only when electrification becomes – or is on the way to becoming – a mainstream technology for the average car buyer. In the meantime, steer clear.

Be the first to comment