peshkov

Investment Thesis

Hess (NYSE:HES) is expecting to grow its cash flows by 20% in the coming few years. In fact, the business is set to benefit from the strong Brent pricing, which I believe will continue into 2023.

The biggest bearish aspect here is that Hess’ balance sheet carries a significant amount of debt.

Nevertheless, for investors that buy into the oil bull story, Hess’ story should improve further in the coming 12 to 24 months.

What’s Happening Right Now?

Looking out to 2023, there are a few elements that are bullish. In no particular order, the SPR release will slow down and stop, China will at some point reopen, and the EU Russian import ban will come into the fray.

I’m not going to say that one is more important than the other. What I’m going to say is that the outlook is positive.

The contra argument is that we are likely about to enter a global recession. And that has been the argument for several months. But I’m not a huge believer that we’ll see oil demand substantially falling.

In fact, I strongly believe that people are more likely to cut back on other expenses before they cut back on their oil consumption. In fact, during the Covid period, when the world went into lockdown, oil demand was only down approximately 10%.

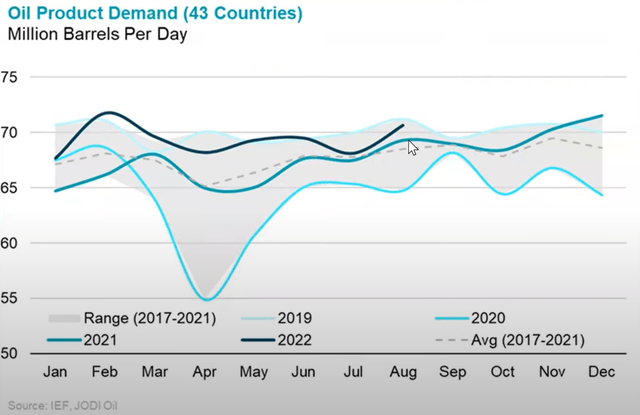

Furthermore, what you see above, in 2022, despite a significant proportion of International flights being cut back, plus China being in a lockdown, oil demand in the summer was within touching distance of 2019 levels.

We are an oil economy. And oil consumption in emerging markets is probably only going to go in one direction. Up.

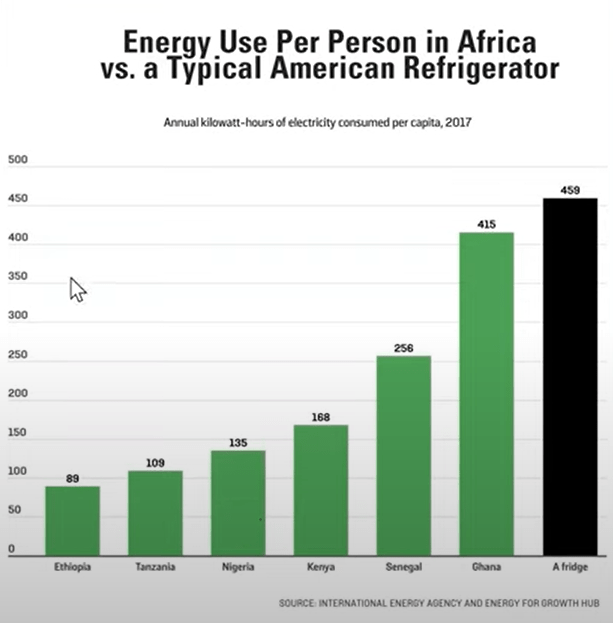

Shubham Garg, YT

As Shubham reminds viewers over his more than 6-hour YT presentation on oil, there are countless people around the globe whose energy consumption fails to match up with an American fridge. Clearly, this reflects the discrepancy between energy demands in developed and emerging economies.

Capital Allocation Profile? Essentially Nonexistent

Hess has very approximately $7 billion of net debt. A portion of that debt is nonrecourse, tied to its Midstream business. Until this debt comes down to a more appropriate level, Hess will struggle to substantially increase its capital allocation program.

Case in point, Hess’ dividend yield of 1.0% is not going to get anyone very excited. Similarly, its share buyback program, which amounted to $150 million in the quarter, or a 1.3% annualized repurchase program will also likely not meaningfully entice shareholders to HES.

Again, the problem here, for now, is that Hess’ balance sheet is getting in the way of the business being in a position to substantially return capital to shareholders. Along these lines, this is what Hess’ CEO John Hess stated,

Based upon a flat Brent oil price of $65 per barrel, our cash flow is forecast to increase by approximately 25% annually between 2021 and 2026 more than twice as fast as our top-line growth, and our balance sheet will also continue to strengthen, with debt to EBITDAX expected to decline to under one time in 2024.

In this paragraph, you see Hess’ bull case depicted. Over the next 24 months, assuming that Brent stays around $65, Hess’ will see its balance sheet dramatically improve. Currently, Brent is priced at $92.

This takes me to discuss Hess’ valuation.

HES Stock Valuation – 18x 2023 Free Cash Flow

For 2022 as a whole, I’m inclined to believe that Hess’ free cash flow will be in the ballpark of $2 billion.

Now, the big question is what will Hess make in 2023? Hess believes that it has a portfolio in place where it can see its cash flow generation growing faster than its revenues.

Not only due to its operating leverage but also due to its low cost of supply, benefitting from a high-price environment.

Altogether, Hess believes that it can see its cash flow generation growing by approximately 25% CAGR in the near term.

That would imply approximately $2.5 of free cash flow in 2023. There’s obviously a myriad of assumptions that goes into those cash flows, least of all where Brent prices end up in 2023. But remember, anything about $65 and these cash flows will move up quickly.

Nevertheless, altogether, HES is being priced at 18x next year’s free cash flow.

The Bottom Line

My two-line summary is this, Hess is well positioned for high oil prices. And I believe that oil prices in 2023 will remain elevated.

For the slightly more prolonged summary, I’ll use CEO Hess’ comments,

First, to make sure that we can fund our high-return programs; second, keep the strong balance sheet; third, increase the dividend. And then anything left over as we go out, not just next year but in the years ahead, and we deliver increasing levels of free cash flow. We expect share repurchases will represent a growing proportion of our capital return program in the years ahead.

This is both the risk and the opportunity. Hess openly notifies investors that they are not going to get a suitable return of capital for some time. This is very much a 2023 to 2024 story.

Hess will revise its base dividend upwards next year, in my view. But there’s also probably not going to be a needle-moving capital return program for shareholders for a while.

Be the first to comment