cagkansayin

EPR Properties (NYSE:EPR) is a REIT that is still recovering from the COVID-19 pandemic. The company saw its largest tenant type, theatres, shut down by the public health restrictions. This year, with restrictions lifted, the company saw its tenants get back to business. Income investors have three unique options when looking at EPR. Two of those options are the 7.9% yielding common share dividend and a 7.9% yielding preferred share dividend. For those risk adverse to the dangers of the industry, the 2028 maturing bond, which currently yields over 7.5%, are the better investment option.

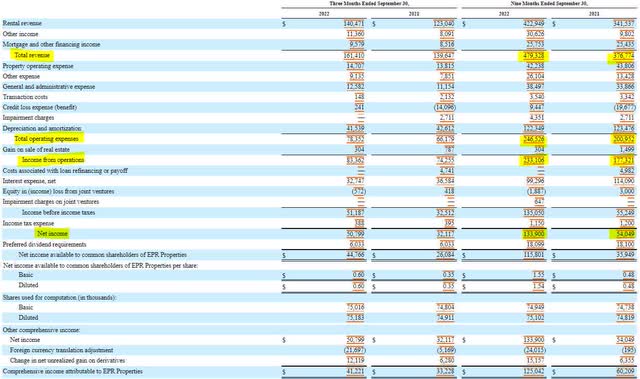

EPR’s income statement shows that the company has made marked improvements since the pandemic. Revenues have grown by more than $100 million in the nine months of this year compared to last year. Additionally, with expenses only growing $46 million in the same period, operating profit has grown by $60 million. The REIT’s decrease in interest expense, also pushed net income higher, up $80 million from the year prior.

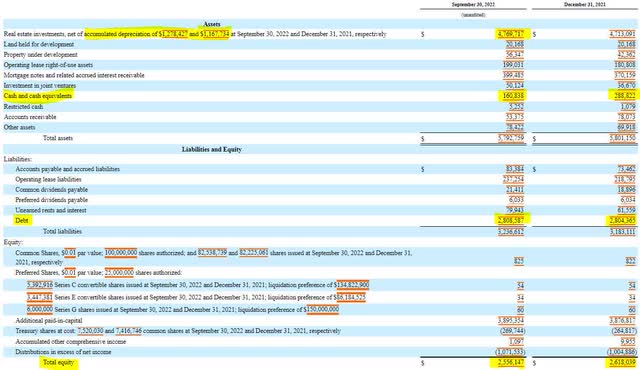

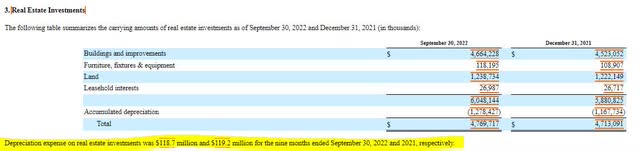

EPR’s balance sheet is quite uneventful. As expected, the company has most of its assets tied up in real estate. Most of its liabilities are in long-term debt. Both balances remained relatively unchanged from the end of last year. The company did see a notable decline in its cash balance. One item of note is the $110 million increase in depreciation. Many REITs lump maintenance capex with development capex when reporting cash flows, so I use depreciation as an indicator as to what appropriate capex should be in analyzing an organization’s cash flow statement. The exact depreciation expense was disclosed in note 3 of the last 10-Q filing.

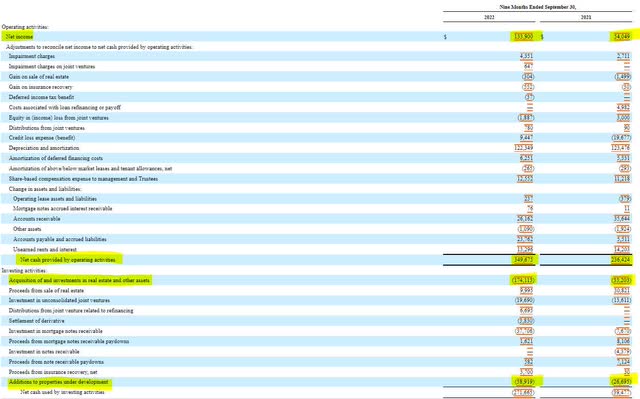

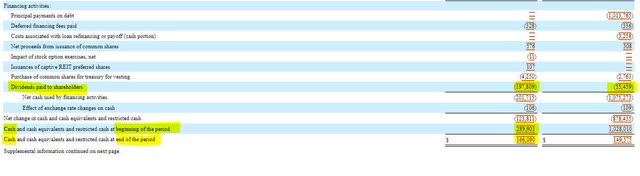

Earnings and changes in working capital account for nearly all EPR’s increase in operating cash flow compared to year to date 2021. The company spent in total capex to the tune of $232 million, although some of this included redevelopment of properties and asset acquisition. After capex, EPR had approximately $117 million to apply towards its dividend payments of $197 million. EPR did not have adequate cash flow to cover its dividend commitments in 2022, but should the company operate towards maintenance capex, the cash flow should be close to adequate to cover the dividends.

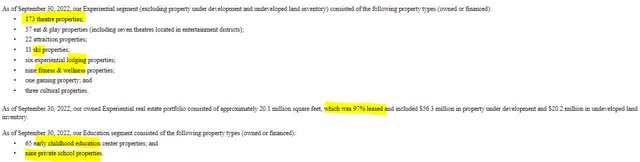

One major risk to EPR’s business is the financial health of its tenants. EPR’s main tenant is movie theatres, which were struggling before the pandemic, let alone during a period of prolonged shutdown. Fortunately, there is some diversification in EPR’s portfolio, including ski and lodging properties, gaming, and education centers.

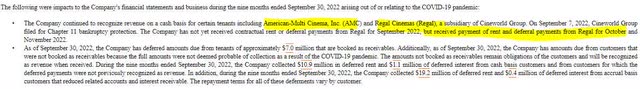

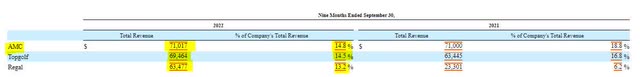

The company has been very transparent in acknowledging some movie theatre tenants have already filed for bankruptcy and the effects of those bankruptcies have not been blistering yet as most of the rent continues to be paid through restructuring. Two of the top three tenants are theatres accounting for 27% of total revenue. EPR should generate approximately $220 million in free cash flow (operating cash flow less depreciation), therefore a loss of $134 million in revenue should keep the company free cash flow positive, but it would present a material weakness to the dividend.

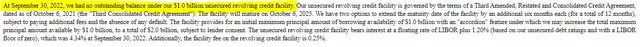

While the company does not provide a maturity schedule, it did disclose that its next debt maturity would be in 2024. In the notes, the company had a $148 million private placement note due in 2024. According to FINRA, the company has$300 million in notes due in 2025, and$400 million in notes due in 2026. Fortunately, EPR has an untapped $1 billion unsecured line of credit to help support any debt maturities that come due during this time should the company find itself locked out of the debt issuance markets.

While the notes are trading at 50 basis points under the common and preferred dividends, I believe that discount is a small opportunity cost for the safety of the investment. If a cloud continues to hang over the movie theatre industry, a cloud will hang over EPR’s ability to pay its existing dividend. The company’s conservative approach to its balance sheet and further diversification in real estate assets will make solvency more probable for debt investors.

CUSIP: 26884UAE9

Price: $88.75

Coupon: 4.95%

Yield to Maturity: 7.546%

Maturity Date: 4/15/2028

Credit Rating (Moody’s/S&P): Baa3/BBB-

Be the first to comment