halbergman/E+ via Getty Images

NewLake Capital (OTCQX:NLCP) is a smaller up and coming REIT in the cannabis sector. NLCP uses the same net lease structure as more well-known NNN REIT Realty Income (O) but focuses exclusively on investments in the cannabis sector, like larger peer Innovative Industrial Properties (IIPR). The company has been growing rapidly, including recently releasing a strong third quarter report and the stock has since bounced strongly. Moreover, the midterm elections yielded favorable results for NLCP, as there is now increasing chances of adult-use legalization in Pennsylvania. That is a notable observation because NLCP’s problem tenant Calypso operates out of Pennsylvania. At recent prices, NLCP still yields nearly 9% – I explain why the stock remains very attractive here. NLCP is my top pick in the cannabis sector and my top pick for 2023.

Quick Investment Thesis

NLCP trades at a large discount to traditional NNN REITs, with a dividend yield of nearly 9%. I see fair value being in the 3% to 5% dividend yield range. The main catalysts are within the company’s control: continued execution on its investment pipeline should lead to rapid double-digit earnings and dividend growth over the coming years. No innovation is required here to generate double-digit dividend growth – simply placing investments in a capital-starved sector is enough.

Another potential catalyst is that of improving sentiment with regards to its problem tenant based out of Pennsylvania, as that state may see adult-use legalization on the horizon. NLCP has a net cash balance sheet – highly unusual for a NNN REIT – and should be able to easily fund accretive investments even with its stock trading so low. This is a stock which has a high yield coupled with a high growth rate – a rarity in this market.

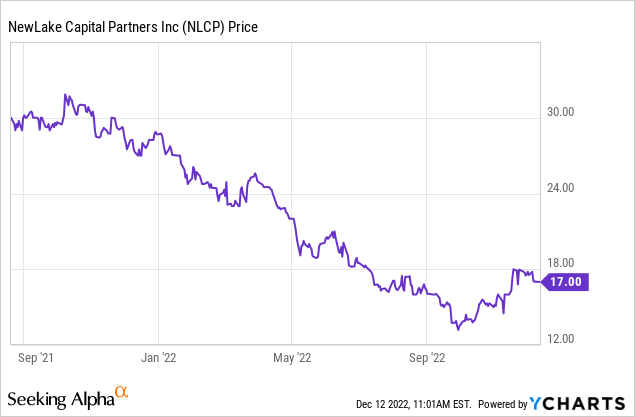

NLCP Stock Price

After coming public at $26 per share in late 2021, NLCP stock has struggled. It has bounced from the lows, but not nearly enough.

At these prices, NLCP is trading at cheaper valuations than its multi-state operator (‘MSO’) tenants, arguably unusual considering that it shows stronger fundamentals and long-term growth potential. NLCP remains highly, highly buyable here.

NLCP Business Model

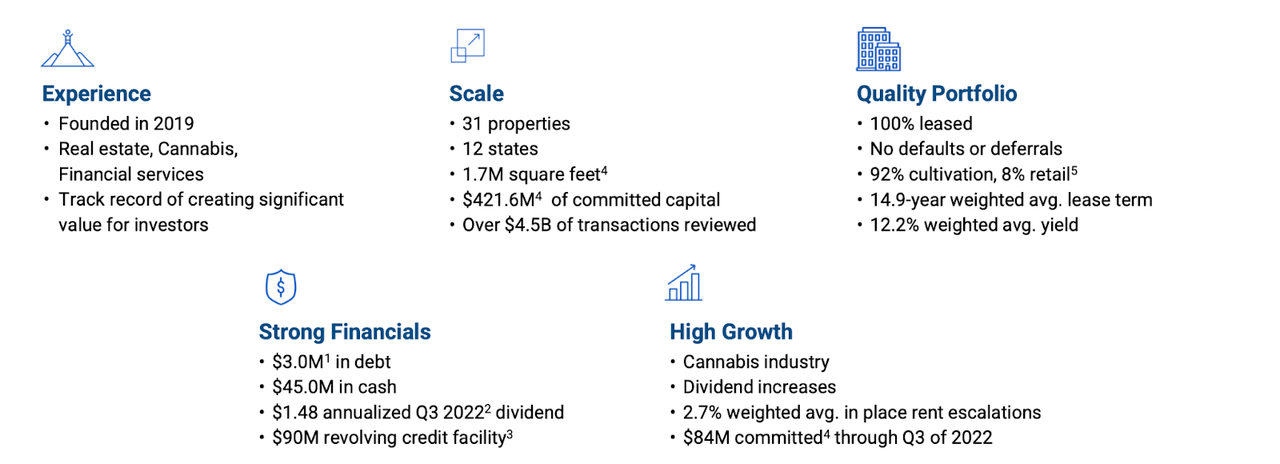

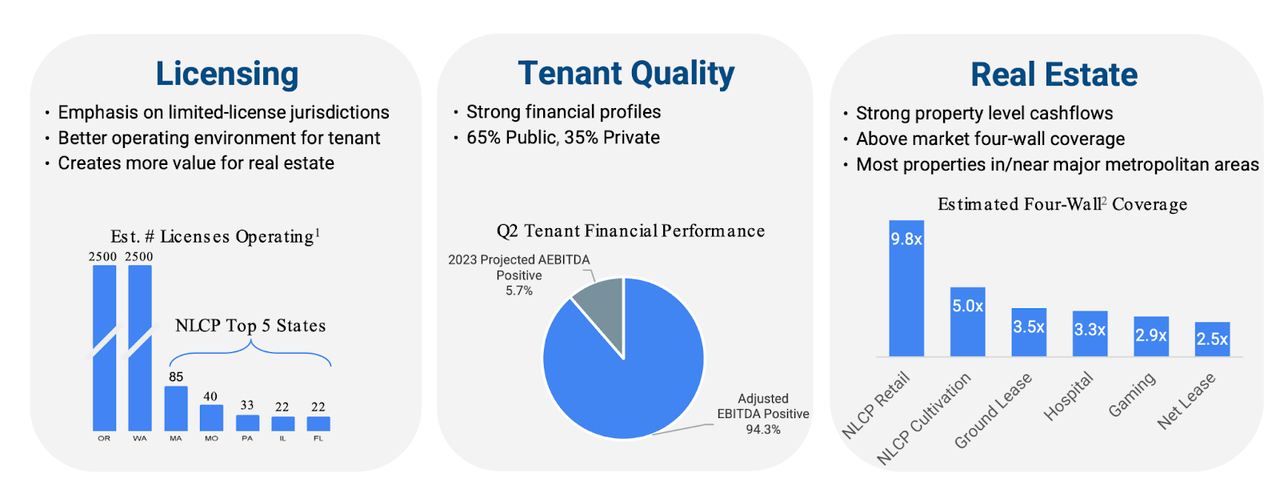

NLCP is an internally managed real estate investment trust (‘REIT’) which invests in cannabis properties.

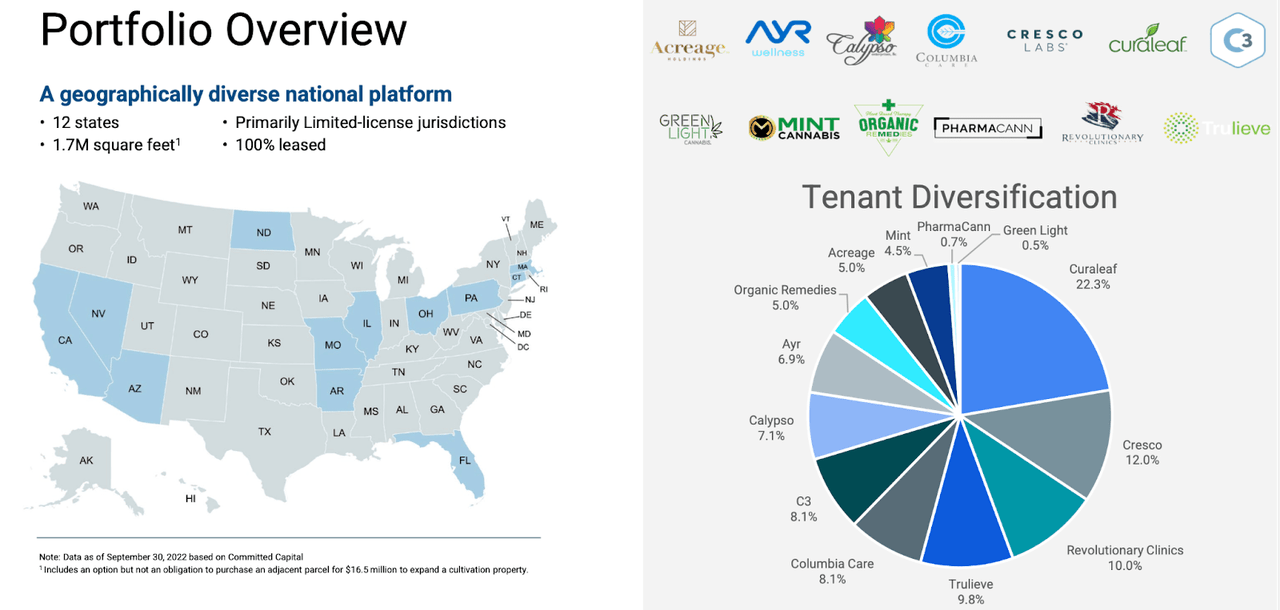

As of the latest quarter, NLCP owned 31 properties spread across 12 states. The vast majority of the property value is from cultivation facilities, but NLCP does own many dispensaries. NLCP acquires its assets through “sale and leaseback” transactions which means that NLCP purchases properties from companies who at the same time sign long term lease agreements, thus becoming tenants. Intuitively, I like to think of these transactions as “real estate financing” and being very similar to traditional debt financing, with the main differences being that NLCP gets full ownership of a real estate property and the lease expires instead of matures as debt does.

NLCP uses triple net leases which means that its tenants have to pay for real estate taxes, insurance, and maintenance capital expenditures (‘the triple nets’). That enables NLCP to generate high free cash flow margins from which it can reward shareholders with high dividend payouts. Another way to put it: whereas the typical REIT might have to invest heavily in recurring capital expenditures, NLCP does not, making adjusted funds from operations (‘AFFO’) a very good proxy for free cash flow available for shareholders. AFFO (and therefore free cash flow) stood at 88% of revenues in the latest quarter. Not even tech stocks can compare in free cash flow conversion.

The portfolio has a high 14.9 year weighted average lease term with 2.7% weighted average annual lease escalators and 12.2% average cap rate.

November Presentation

NLCP’s top tenants are mostly some of the most well-known multi-state operators (‘MSOs’), highlighted by industry leaders Curaleaf (OTCPK:CURLF) and Trulieve (OTCQX:TCNNF).

November Presentation

Cannabis is legal medically and recreationally in many states but remains illegal on the federal level. That means that the MSOs, even though they operate in legal jurisdictions, face limited access to capital. This strict regulatory environment has created an attractive opportunity for cannabis REITs like NLCP as they are able to demand significantly more attractive lease terms than the typical NNN REIT – leading to much faster growth as I discuss later. High financing rates are one thing – but cannabis operators also have a voracious appetite for capital, as growth cannot come without cultivation facilities and dispensaries. What’s more, many of the top MSOs have levered up their balance sheets over the past few years in order to fund M&A, creating further demand for sale leasebacks as they refinance maturing debt and are essentially tapped out from a leverage perspective. NLCP is benefitting from the fact that MSOs have a high demand for capital and are willing (or forced, rather) to pay up for it.

NLCP Stock Key Metrics

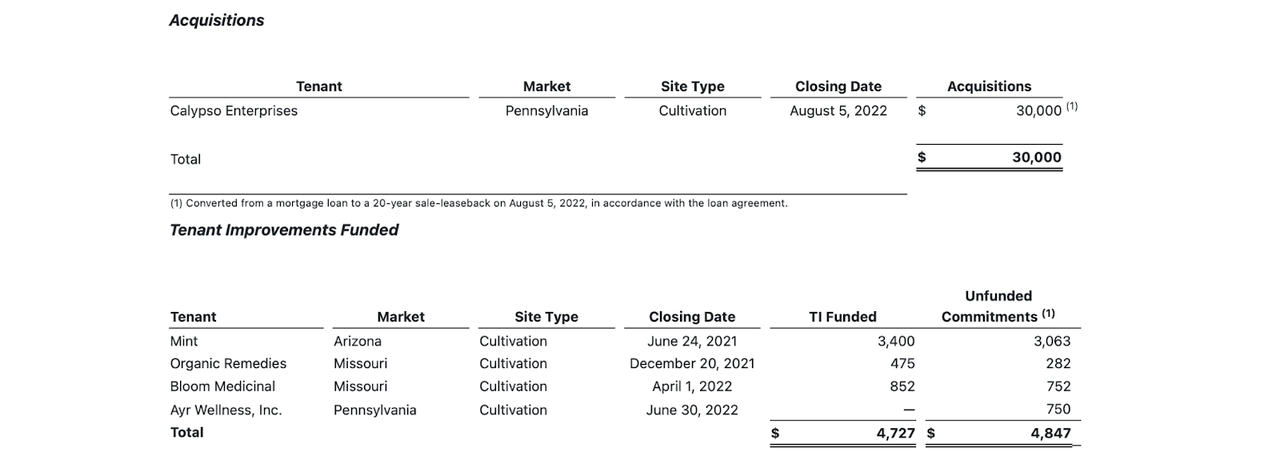

Sale and leaseback transactions were muted in the quarter, largely due to the macro environment. MSOs are pausing expansion projects amidst a tough macro backdrop and potentially also waiting (or hoping that is) for the passage of SAFE banking, which may help to lower the cost of capital. I do not expect the impasse to last forever. NLCP did see the automatic conversion of its $30 million investment in Calypso, which was originally structured as a mortgage loan but has since transitioned to a 20-year lease.

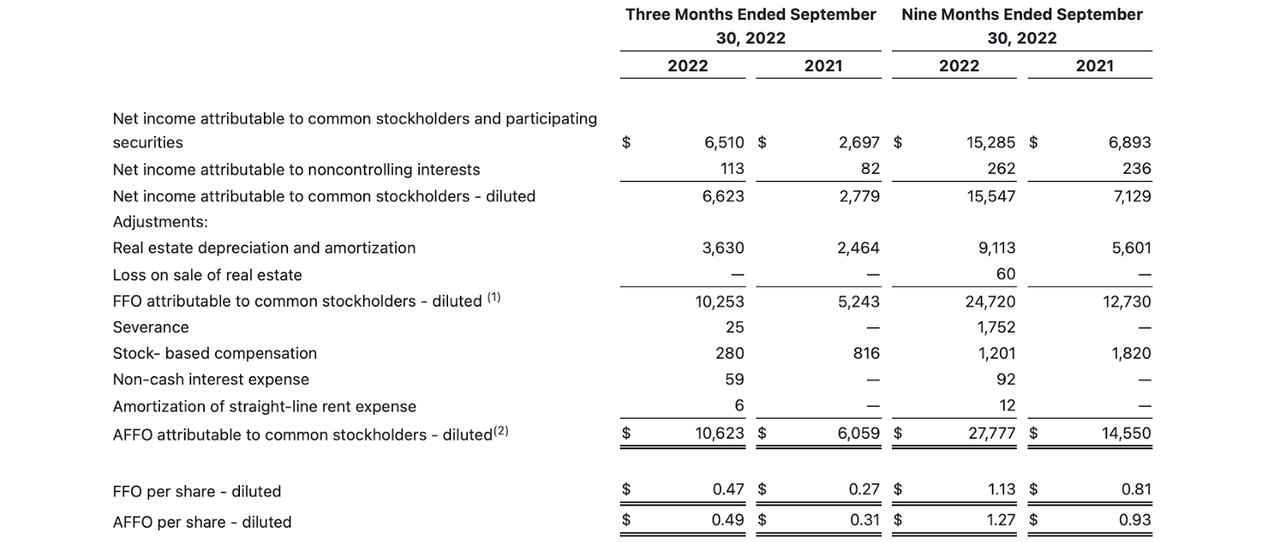

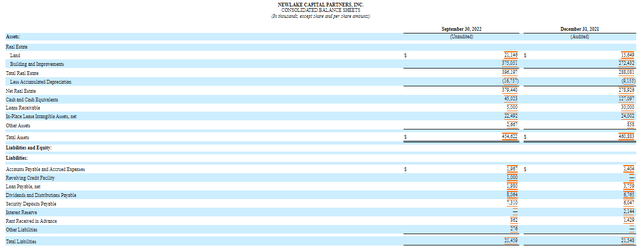

2022 Q3 Earnings Release

NLCP ended the quarter with $45 million in cash and just $3 million of debt. The company has access to a $90 million revolving credit facility which bears interest at a 5.65% interest rate. I expect the company to use this credit facility in earnest as NNN REITs typically can maintain significant leverage. For reference, Realty Income has debt to EBITDA of over 5x and is considered more conservatively leveraged as compared to peers.

NLCP generated strong cash flow growth, with adjusted funds from operations (‘AFFO’) growing 58% YOY to $0.49 per share. That is not a typo – REITs seldom are growing this fast, let alone with their equities trading at such distressed valuations (NLCP traded at a 10+% dividend yield for the majority of the quarter).

2022 Q3 Earnings Release

That comfortably covers the $0.37 quarterly dividend – I expect the dividend to continue growing rapidly moving forward.

NLCP has a clean balance sheet with $45 million of cash versus $3 million of debt.

Is NLCP Stock A Buy, Sell, or Hold?

NLCP has traded low for so long that it may be difficult to see the upside. NLCP’s tenant coverage ratios are superior to that of traditional REITs.

November Presentation

Sure, one could make the argument that due to 280e taxes and high financing costs, the MSOs are generating less cash flow than traditional net lease tenants. At the same time, though, MSOs benefit from secular tailwinds such as ongoing legalization of adult-use sales at the state level, and arguably benefit from pent-up investor appetite for the sector.

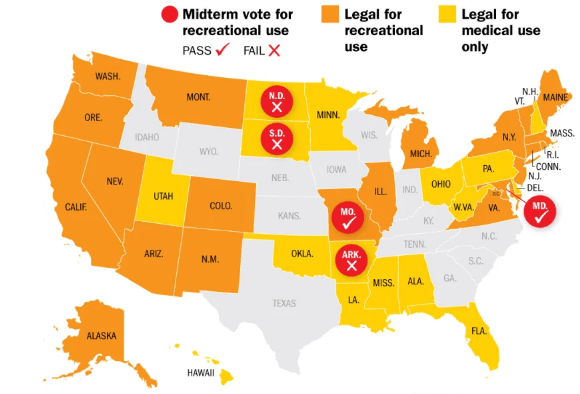

The main troubled tenant remains Calypso in Pennsylvania – on the conference call management noted that it “continues to perform and we continue to collect rent as expected. That company continues its sale process. So no meaningful update for you there.”

That might not sound so promising, but it is important to remember that Pennsylvania is a limited license state, which should help support financial recovery in the event of tenant default. Perhaps more importantly, Pennsylvania is still a medical-only market with adult-use legalization being a future catalyst. Maryland voters helped pass adult-use legalization in the recent midterms, meaning that Pennsylvania is now bordered by many states which have legalized adult-use sales.

National Conference of State Legislatures

Pennsylvania voters for their part voted in Democrat governor Josh Shapiro, who has voiced support for adult-use legalization, and voters also gave the state House a Democratic majority. While the Pennsylvania state senate remains a Republican majority, there is now real hope for adult-use legalization on the horizon as senate Republicans would be the “roadblock” of any reform. Such an event helps reduce the risk from NLCP’s troubled tenant – and beg question as to why the stock still trades at a dividend yield in excess of 8%.

The company also announced a $10 million share repurchase program, stating the following:

“Prospects for our business and opportunities to invest in attractively priced investments continue to be great. However, we can’t ignore the discount that our share price reflects providing an attractive investment opportunity. This action underscores our confidence in the quality of our portfolio, our robust pipeline and the growth opportunity of the cannabis industry for many years to come.”

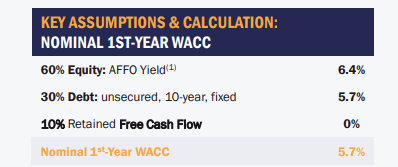

Why am I so bullish on NLCP? NLCP is trading at an 8.7% yield and 8.7x AFFO. In contrast, Realty Income is trading at a 4.6% yield and 16x FFO. That represents a greater than 40% discount, yet NLCP arguably should trade at a huge premium. Here’s why.

I discussed this in the business model section, but it is worth repeating. NNN REITs typically grow primarily through external acquisition and secondarily through their annual lease escalators. NLCP’s 2.7% annual lease escalators are higher than the 1% lease escalators at Realty Income. NLCP’s external growth prospects are also significantly more attractive. NLCP is acquiring properties at around 12.2% cap rates whereas Realty Income targets a 6% cap rate. With O trading at 16x FFO, it is difficult to acquire new properties accretively without relying on debt.

Realty Income 2022 Q3 Presentation

O may be lucky to get a 1% spread at these valuations.

Yet even with its stock trading at these levels, NLCP can still acquire properties with a >2% spread if using only equity, and 5% spread if using a similar cap structure as shown above. NLCP would get a 7% spread if using only debt. That difference in investment spreads has a huge difference on projected growth rates. If NLCP acquires just $114 million of assets annually, then that would lead to around 10% AFFO per share growth from external acquisitions (based on a 5% spread). NLCP could keep this up for around 3 years using just its existing $90 credit facility (based on a 7% spread, this may lead to 19% growth), but I’d expect the company to find more funding sources and see multiple expansion as it generates growth. Together with the 2.7% annual lease escalators, this is a name which can grow AFFO by around 12% to 15% annually even with its equity trading so cheaply. Meanwhile, Realty Income and other traditional NNN REITs will likely see their growth rates compress to around 2% to 3% moving forward. That growth discrepancy suggests that NLCP should trade more like industrial REIT Prologis (PLD) which trades at a sub-3% dividend yield.

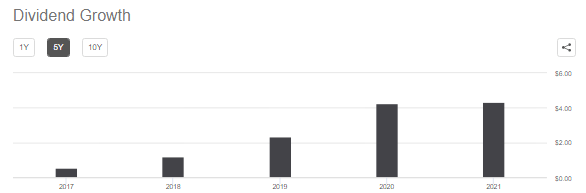

At the very least, I argue that NLCP should trade at a comparable valuation to O – and the curious thing to note is that as NLCP trades higher, its growth likely accelerates due to declining cost of capital. Just look at how peer Innovative Industrial Properties was able to nearly 10x its dividend in only 4 years’ time.

Seeking Alpha

While I would never invest in a stock solely based on the potential for bubbles, I note that this business model is highly favorable for the formation of bubbly valuations because growth accelerates rapidly as the cost of equity capital declines. There is a reason why IIPR traded at a 1% to 3% dividend yield for nearly 4 years. It would not be so easy to call NLCP overvalued at a 3% dividend yield if it is also growing its dividend at a 50% to 100% rate.

How does NLCP compare relative to the MSOs? Curaleaf is trading at around 17x adjusted EBITDA. Green Thumb (OTCQX:GTBIF) trades at around 12x adjusted EBITDA. There is a large difference between adjusted EBITDA for MSOs and AFFO for NLCP. After accounting for taxes and interest, “free cash flow” is 19% of adjusted EBITDA at CURLF. In sharp contrast, 100% of AFFO for NLCP is available for shareholders. NLCP trades cheaper on the basis of AFFO than MSOs trade on the basis of adjusted EBITDA.

Is that reasonable? There are 2 reasons why it is not. First, the rental revenue stream at NLCP is more secure than the retail revenue stream at MSOs, as they are contracted revenues and not subject to supply and demand.

But growth rates for NLCP are likely to keep up if not exceed that of the MSOs. CURLF and other MSOs are expected to grow revenues at a 15% clip annually for several years. So far that has not quite panned out for 2022. Adjusted EBITDA growth may not keep up with that due to price compression. Meanwhile, we just saw that NLCP can maintain ~15% earnings growth even based on the current high cost of capital. NLCP offers superior growth prospects and arguably more reason for multiple expansion. NLCP thrives in the absence of legalization, making it a good hedge for MSOs, but it can be a strong investment in its own right. Legalization for its part can also be a bullish catalyst for NLCP due to it helping to strengthen its tenant credit quality (more on this in the “Risk Factors” section). NLCP appears to be a superior investment to MSOs in every scenario except an MSO-hype-mania. This makes NLCP worthy of being a legitimate core investment on the cannabis sector.

Risk Factors

The most commonly discussed risk for cannabis REITs like NLCP is that they often “overpay” for their assets. Based on capital investment divided by square footage, NLCP has paid approximately $217 psf for its assets. Prologis, an industrial REIT, in contrast has paid around $100 psf. While NLCP trades at 88% of book value, if values are adjusted to match industrial REIT peers, then NLCP would trade at approximately a 90% premium to book value. The proposed bearish catalyst would be federal legalization, which would enable institutional investment in the sector and thus lead to the tenants seeking cheaper sources of capital. In my view, such a take is too simplistic. For starters, net leases are typically backed by a corporate guarantee, which means that the tenants must fulfill lease obligations until the end of the lease term before having the option to walk away from the property. NLCP’s portfolio had a 14.9 average lease term as of the latest quarter. Next, we must understand why the value of these properties is so high. As disclosed in the 2021 10-K, NLCP focuses “on states and municipalities where licensed cannabis properties are in high demand and connected to the operating license.” It is not so trivial to construct new competing cannabis cultivation facilities in these jurisdictions due to that point, as local governments and its citizens often are not thrilled to see so many cultivation facilities (at the very least, there can be a smell). That characteristic increases the replacement value of these assets and explains why they are not valued just like any other industrial real estate asset. Regarding how legalization would affect NLCP’s business, I am actually of the view that ongoing cannabis reform would be a net positive for the stock – at least at current valuations. NLCP’s discount appears to be largely due to tenant credit quality. Legalization – or any sort of regulatory reform – may help to reduce the cost of capital of the MSOs which in turn boosts NLCP’s tenant credit quality. If NLCP were trading at a 2% dividend yield, then I would be more concerned about legalization. But with the stock at a yield greater than 8%, legalization may have the crude impact of solidifying strong cash flows and dividends over the next 15 years. What would be the potential negatives from legalization? There are two: tenants may renew expiring leases at lower rental rates and cap rates on external acquisitions may compress. I am doubtful that rental rates would go down as much as feared due to the zoning issues detailed above. But this is admittedly an unclear outcome and one very difficult to predict – for example, what if some limited license jurisdictions change their policies and suddenly allow cultivation facilities to be placed at every block? At the very least NLCP’s current leases stand to pay out far more than 100% of the asset purchase prices by the end of their terms, but this may be a potential tail-end risk. The latter risk, that of reduced cost of capital, is more fear than substance especially in the near to medium term. Sale and leaseback transactions are highly popular even outside of the cannabis sector. Spirit Realty (SRC) has seen cap rates creep up to the mid-7’s. I would expect cap rates for cannabis assets to command some premium, so cap rates might compress down to the 8.5% to 10% range. That is indeed lower than the 12.2% average cap rate at NLCP currently, but hardly the end of the world.

One must also note that it may be many years, if not a decade or more before legalization occurs. In particular, the SAFE Banking Act – a bill that falls short of legalization – first passed in the House of Representatives in 2019 but has since failed to pass in the Senate. While there are potential risks from legalization as discussed above, I personally am of the view that our politicians may delay legalization for far longer than people expect. This means that NLCP can likely grow rapidly, continuing to diversify its portfolio until any supposed negative outcome from legalization.

Another risk is that of the severe tenant concentration. NLCP has only has a handful of tenants, and addressing tenant defaults would be considerably harder than it is for Realty Income. Whereas Realty Income may be able to quickly sell off nonperforming properties, NLCP may instead prefer to wait for a replacement tenant. The fact that NLCP operates primarily in limited license states should help any recovery process, but this is nonetheless a unique risk to the cannabis real estate sector.

Another risk to NLCP is that of a sector-wide collapse – perhaps the US cannabis economic landscape gradually becomes more like that seen in Canada. This could occur if supply growth outpaces normalization. As previously mentioned, NLCP is positioned mainly in limited license states. The limited license model may help support long term profit margins due to the inherent cap on supply. NLCP is not directly at risk from margin compression, but may face negative financial consequences if its margins compress so much that its tenants are unable to fulfill lease obligations. That said, the population of the United States dwarfs that of Canada and is arguably an important reason why US MSOs are able to sustain positive adjusted EBITDA even as Canadian operators are unable to sustain positive gross margins.

Another risk is if synthetically grown cannabis at scale becomes a reality as that would render cultivation facilities obsolete. I find this case hard to believe (though it would be wonderful for society if it does come to fruition). This was a risk pointed out by CEO Anthony Coniglio when I interviewed him in October.

I have mentioned NLCP’s troubled tenant in Calypso operating out of Pennsylvania. Calypso made up 7.1% of committed capital as of the latest quarter. I have already discussed why the fears may be overblown here. In the worst case of zero recovery, NLCP might see AFFO decline by 8.1%. In this scenario, NLCP would still cover the dividend. Yet a zero recovery seems too pessimistic, especially considering that IIPR was able to dispose of their Pennsylvania property above its original cost basis in the third quarter of this year.

NLCP trades over-the-counter (‘OTC’) – unlike larger peer IIPR which trades on the NYSE. NLCP trades with lower than typical liquidity (averaging just over $300,000 per day), meaning that investors may have some difficulty entering and exiting positions (in my experience some patience helps to alleviate the problem). This may be the most tangible risk that investors may face. There is the possibility that IIPR recovers far faster than NLCP due to the exchange difference. However, I make the argument that NLCP is likely to trade directionally in the same manner due to the constant possibility of IIPR making an all-stock takeover bid for NLCP. I view IIPR as also being undervalued here, but it trades at far less of a discount.

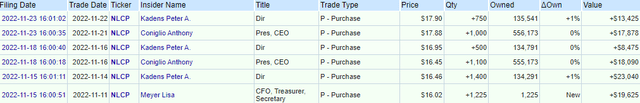

It is worth noting that the CEO owns 2.8% of shares outstanding and there has been some insider purchases in November.

Conclusion

While the 8.7% dividend yield may scream risk, the tail-end legalization risk is more than offset by strong growth prospects, as NLCP benefits from structurally advantaged financial terms. I can see NLCP eventually re-rating to a 5% yield at the very least, and 3% to 4% yield is not unreasonable. At a 5% yield, NLCP offers over 70% upside from multiple expansion alone. I expect growth to lean closer to the 20% range if not higher based on growing demand for cannabis sale & leaseback transactions. NLCP is my top pick for 2023 and one of my largest overall holdings.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment