enter89

Maxeon Solar Technologies, Ltd. (NASDAQ:MAXN), a small-cap renewable energy stock of $899.932 million, has yet to become profitable; however, its world has just gotten much more exciting. MAXN was tied to an exclusive distribution contract in the US with SunPower (SPWR). From 2023, the company can expand distribution directly. It released its Q3 results last month, surpassing EPS expectations and increasing revenue by 25% year on year. The company has now rewarded shareholders with 34.86% in returns year-to-date.

Year-to-date stock trend (Seeking Alpha)

I believe there is a lot more upside potential for this company due to the new US market potential, its improved margins, the Inflation reduction act’s impact on the reality of a factory in the US, and the diversification of its DG product line that has been leading to record sales in EU markets. Although shareholders are betting on an unprofitable company and the stock has fallen far from its peak in 2021. This company’s upward sales potential and increased solar capacity are desirable features. Investors may want to take a bullish stance on this growing company.

MAXN and its Growth Drivers

In my first article, I give an overview of MAXN, the spinoff of SunPower. MAXN produces solutions for residential rooftops (DG) and the utility-scale power plant market. MAXN has successfully diversified its DG product line, as seen in the image below. Its DG business has been responsible for the most significant sales and revenue growth in the last few quarters. It will continue to broaden its range by offering battery solutions and EV charging products.

Diversifying DG Business (Pv-tech.org)

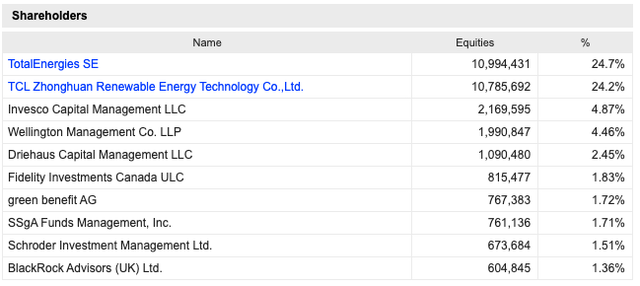

The company has two dominant shareholders: French oil giant Total Energies SE (TTE) and Chinese Tianjin Zhonghuan Semiconductor Co., Ltd. (TJSEMI).

MAXN Significant Shareholders (Marketscreener.com)

Currently, there is no permanent CEO; Mark Babcock, the Chief Revenue Officer, is acting as interim CEO. The company is focused on growing its panel manufacturing capacity, increasing its US market share, and expanding its products beyond panel production.

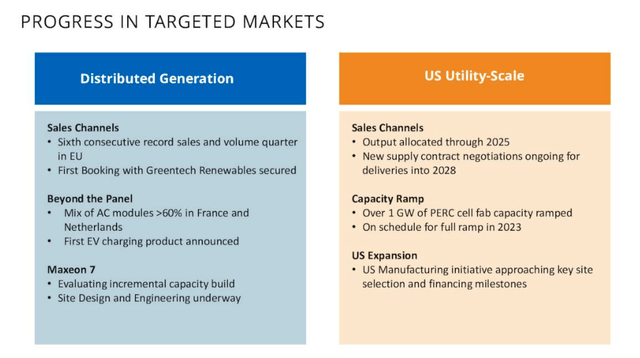

A key growth factor for MAXN is that it now has the legal ability to expand its reach throughout the USA. Although it will continue to be a dominant supplier for SPWR, there are already some new partnerships in place that are set to show growth next year. One channel is through Greentech Renewables, set to start delivery in January. This change in distribution gives MAXN easier access to its end customers and will increase the value of its products in the long run. Some of these new contracts have long-term agreements through 2028.

DG and Utility Growth (Investor Presentation 2022)

Another growth factor is the company’s goal to increase production in 2025. Due to the game changing Inflation reduction act, MAXN can set up a large factory in the future, requiring a $1 billion investment. Although the company is still early in the process, it is making forward-moving steps for its planned US-based three-gigawatt solar factory. The factory will provide over 2000 jobs and a predictable long-term supply of locally manufactured solar panels.

Financials and Valuation

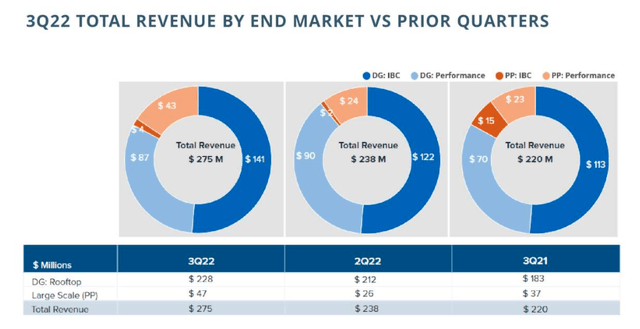

MAXN aims to reach profitability in 2023 and is on its way to delivering results if we look at last month’s Q3 results, which showed an impressive improvement from the prior quarter. It improved its income by 25% year-on-year to reach a loss of $44.7 million. Most of the revenue increase was due to its DG, residential rooftops, and business, accounting for 83% of total revenue.

Yearly revenue increase (Investor Presentation 2022)

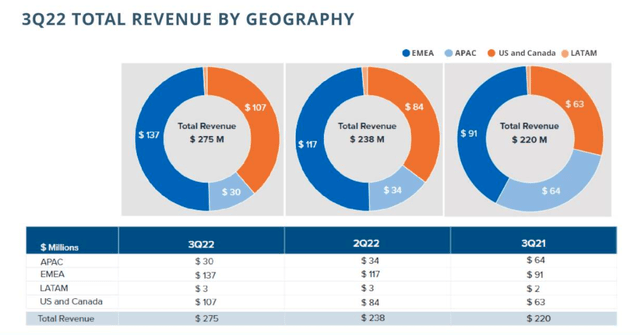

Looking at revenue by geography, we can see that the most significant growth was due to DG business in the EMEA market. The company has had an awe-inspiring performance in France and the Netherlands, with record DG sales and shipments for six consecutive quarters.

Revenue by Geography over the years (Investor Presentation 2022)

Revenue has increased by 25% year-on-year, costs are at a healthy margin of 22%, and it is benefiting greatly from sustainable energy income taxes.

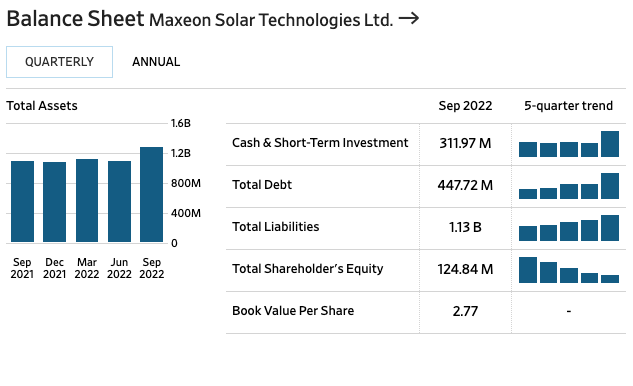

If we look at the balance sheet, the company had $311.97 million in cash and short-term investments, which was higher than the prior quarter of $180 million. MAXN had a negative free cash flow of $54.12 million. Although the company has improved its cost margins, it cannot cover sales expenses alone. However, the company has some large investors with a serious interest in the renewable energy sector, which could make future investments more accessible. It has a book value of 2.77, which does not particularly indicate that the stock is undervalued; however, it is currently in a growth phase and still under an acceptable value of 3.

Quarterly Balance Sheet (wsj.com)

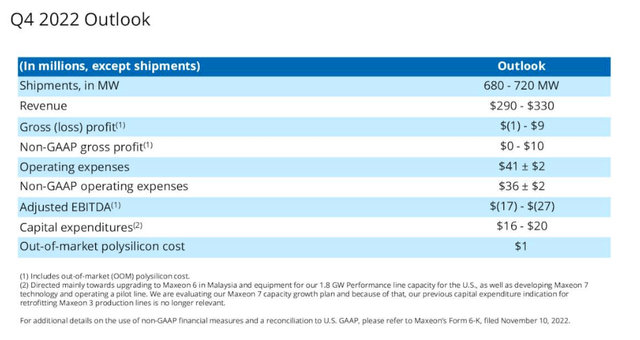

This company is in a growth stage and is set up for a lot more future upside. It has good partners globally and easy access to cash for expansion, and in the image below, we can see positive Q4 guidance.

Q4 2022 Outlook (Investor Presentation 2022)

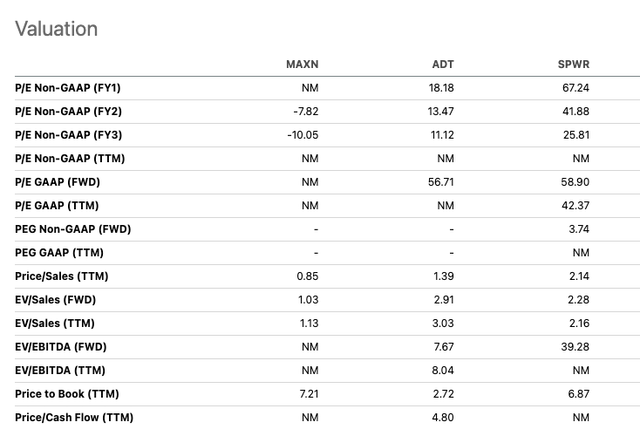

If we look at a Seeking Alpha peer valuation between three of the companies that have been classified as the best solar companies of December 2022 by Forbes, namely ADT Solar by ADT Inc. (ADT) and SunPower who sell MAXN and acquired Blue Raven Solar, we can see that MAXN has the higher valuation rating of the three with a C- compared to D- for the alternatives. Furthermore, MAXN has a price-to-sales ratio of 0.85, indicating investors are investing less than one dollar for every dollar earned.

Peer Valuation (Seeking Alpha)

Risks

Solar stocks have disappointed investors in the past. In 2021 many stocks doubled the numbers we are seeing today and came crashing down. The volatility of a new and developing industry has its risks. We have seen the sensitivity to geopolitical changes, good and bad, such as the positive impact of the Inflation Reduction Act on the trade value of solar stocks. Cautious. We must recognize the fast pace at which the solar market is growing.

Furthermore, there is a very competitive nature of the industry. Many companies are acquired by competitors, such as Blue Raven, one of the quickest growing DG companies at the time, for $165 million, in 2021 by SPWR. Aggressive mergers and acquisitions can quickly change the landscape, strategies, management, and value of the current company.

Final thoughts

MAXN has built a strong foothold in the US market through its partnership with SPWR. However, it was restricted through the exclusive rights SPWR had to sell its products. There is a lot more growth potential now that the company can find alternative distribution channels and increase its direct interaction with end customers. Furthermore, the DG market is becoming increasingly profitable for the company through its product diversification strategy, especially in the EMEA market. Lastly, the company will be increasing its GW capacity in the coming years, assisted by the Inflation Reduction Law through the ability to invest in a sizeable US-based factory. Therefore investors may want to take a bullish stance on this company.

Be the first to comment