GOCMEN

Summary

I recommend a BUY rating on Rumble (NASDAQ:RUM). RUM is a platform that gives unrestricted access to users to share, watch, like, upload, and comment on videos. The platform also enables users to subscribe to the channels of their favorite content creators, live stream content, and video-on-demand [VOD]. RUM’s platform can be used on the web, on mobile apps, on connected TV, and in videos that are embedded on websites. According to consensus estimates, RUM could be worth 2.6x more than it is now by FY25.

Company overview

RUM is a platform that gives unrestricted access to users to share, watch, like, upload, and comment on videos. The platform also enables users to subscribe to the channels of their favorite content creators, live stream content, and video-on-demand [VOD]. The RUMs platform can be used on the web, on mobile apps, on connected TV, and in videos that are embedded on websites.

RUM solves the pain point of the video distribution industry

As the day passes, strict policies are being put in place by Big Tech to regulate the activities of content creators across different platforms. On the other hand, these policies serve as constraints for some of these content creators who believe they are subject to prejudice, policies, and algorithms put in place on purpose to promote evolving trends in the digital ecosystem. Because of all of these rules, people who make content are looking for other platforms that are reliable and, most importantly, won’t stop this content from reaching its intended audience.

Also, RUM’s competitors create a platform that continues to enable large creators to thrive while the upcoming creators’ needs are left uncatered for. RUM is one of the few free, independent, and scalable video platforms that is easy to use and doesn’t try to figure out what is fact and what is opinion.

One of RUM’s most important strategies is to ensure that its global user base enjoys the best experience the market has to offer. Consumers find what they are searching for, with no special treatment to the large creators or algorithms that will suppress some points of view. Their open search algorithm enables users to access the entire content library. Because of this, there will be many opportunities, and most importantly, users will get a better experience on RUM.

The users are not the only ones that will benefit from this platform, as the creators are not left out. RUM has built some tools to help with content production, distribution, and monetization. They are also big on attracting the best talents to the platform.

When a creator creates content, their content will be seen and not sidelined by another creator’s work. Because of this, the best content can be monetized. Another feature that RUM is bringing to the table is a world-class SDRM (social and digital rights management). This feature ensures good service for creators, helping them manage their library and ensure the highest efficiency on and off the platform. This will further strengthen the relationship between RUM and its creators.

Additional sources of revenue support growth

Recently, RUM has been considering how to monetize its distribution, and below are the four primary sources of revenue being considered.

- Advertising: Presently, the number of display, pre-roll, and mid-roll advertising videos being shown to viewers is limited. RUM announced its alpha version of the advertising marketplace in January 2022. This platform creates exclusivity for ads on RUM to be run on RUM’s advertising system. As the major platform continues to grow, RUM also expects to bring significant value to the table for advertisers through the independent advertising marketplace.

- Subscription/Tipping: The Livestream and tipping functionality were launched on RUM’s web platform in Q3 2021. I would admit that RUM continues to look for ways to diversify its income generation. They are going beyond the traditional way of generating income. In October 2021, they acquired Locals.com. Users can then subscribe to the content creators on a monthly basis and give them tips from time to time.

- Content Licensing: Users can choose different licensing options whenever they upload content to RUM. These licensing methods are:

- Exclusive video management: In this option, RUM is given the exclusive right to represent, promote, and distribute this video on all their platforms. Permission must be sought from RUM if the creator wants to upload the content on any other platform that is not RUM.

- Non-exclusive video license through Rumble Player: With this option, creators can make money off of their content on platforms other than RUM.

- Cloud Infrastructure-as-a-service (laaS): RUM intends to offer small and medium-sized enterprises Rumble Cloud Solutions in exchange for subscription/usage fees. They are also utilizing excess capacity from the cloud infrastructure being built to support the video-sharing business. Although the infrastructure service offerings are still in their early development, they have a tentative road map. This includes video players, email services, storage, and cloud services.

Strong execution history

The growth of RUM from 2020 to 2022 has been impressive and fast. The global MAUs reached 44 million on average in Q2 2022, compared to the 25 million average MAUs reached in 2021. These numbers show us that there has been an increase of 76% just over a year. With time, RUM has demonstrated its ability to get engagement from its users. RUM’s estimates show that minutes watched per month on the platform have grown from 0.2 billion in Q3 2020 to 8.1 billion in Q2 2022. Anyone can tell that this growth is a tremendous one.

Valuation

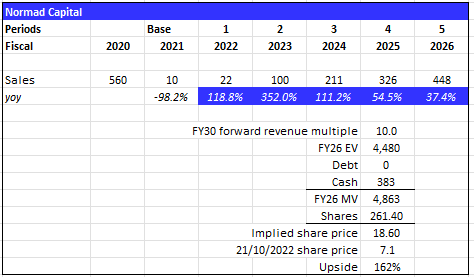

At the current stock price of $7.1 and 259.2 million shares, the market cap is ~$2 billion. I believe the current valuation does not reflect the true value of RUM and it’s a good entry point. I believe RUM will make $448 million in sales in FY26, giving it a market cap of $4.8 billion and a stock price of $18.6 in FY25, assuming it trades at 10x forward revenue in FY25.

Assumptions:

- Sales: to follow consensus’s estimates until FY26. I have no particular view in terms of revenue growth given that RUM is a high-growth company with multiple levers to pull that can juice growth.

- Valuation: I assume no change in valuation and that it should continue to be valued using the current forward earnings multiple of 10x in FY25. Note that Snap (SNAP) traded at similar levels when it was growing really fast in 2017 and 2018.

Normad Capital

Risk

Very competitive industry

The competition for traffic and engagement is intense. RUM constantly competes with companies with larger financial resources and a more extensive user base to attract and engage traffic. These companies also have different values that they are bringing to the table, and as such, these larger companies might attract and engage traffic to the detriment of RUM. This, in the long run, will affect RUM negatively.

Hard to predict the trend for in-demand content

If users are not engaging in new content because they have different tastes and preferences, the business will eventually be affected. Failure to engage traffic and advertisers will lead to a low-income generation.

High concentration of key advertising networks

A substantial amount of RUM’s revenue is generated from some key advertising networks. As of June 2022, a large percentage of RUM’s income was generated from two advertising networks. Google AdSense and Decide. In the future, these advertising networks might decide that they do not want to continue doing business with RUM, or they may decide to reduce the amount they are willing to pay to advertise with RUM, because they think they are not effectively running ads or if they think their investment will not yield positive results.

Conclusion

Investors can expect a healthy return on their money over the next few years at the current price. An investor can benefit in numerous ways from purchasing RUM. RUM has accomplished notable things over the past few years, as can be seen from the foregoing thesis. The site is set up in a way that is sure to appeal to a wide variety of customers. The fact that RUM generates money from a variety of sources means it is less likely to suddenly collapse.

Be the first to comment