BlackJack3D/E+ via Getty Images

One of the really great things about buying into value stocks, particularly those that are incredibly low priced, is that it’s difficult for them to get much cheaper. Absent an unfavorable change in fundamental condition, buyers will eventually come in if the stock gets pushed down too far. The positive aspect of this is not only greater upside potential, but also greater stability during scary times when the market is taking a tumble. A great example of this can be seen by looking at Superior Industries International (NYSE:SUP). Between how cheap shares of the company are and the firm’s recent performance, I have been a fan of the business. Even as the market has plunged, shares of the company have moved up slightly. And the beautiful thing is that, as cheap as the company still is, I do think that further upside potential exists moving forward.

Taking Superior Industries for a spin

Back in April of this year, I wrote an article about Superior Industries International, wherein I described the company as a deep value prospect. I acknowledged, at that time, the company’s volatile operating history. In particular, I found myself disappointed with the company’s struggle to generate profits in prior years even as cash flows were consistently positive. However, I noted that recent performance was favorable, and I called the company’s stock incredibly cheap. These factors, combined, led me to rate the firm a ‘buy’, indicating my belief that shares would likely outperform the broader market moving forward. So far, this call has proven to be a good one. I say this because, even though the S&P 500 is down by 12.6% since I published that article, shares of Superior Industries International have risen by 3.8%.

Superior Industries International

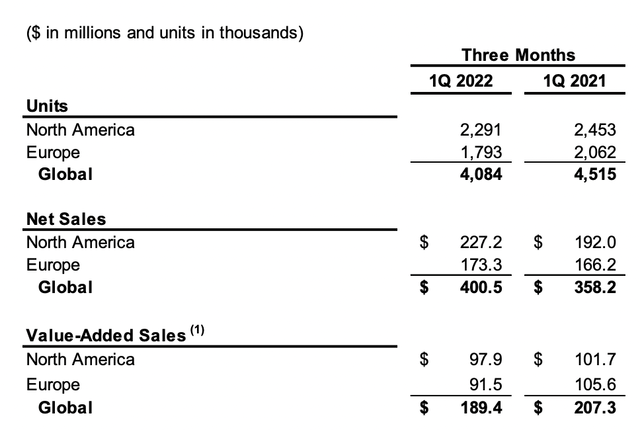

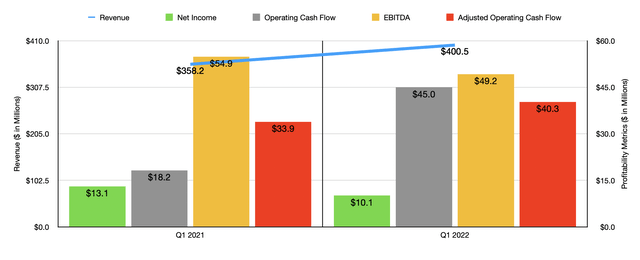

When I last wrote about the enterprise, we had data covering through the end of the company’s 2021 fiscal year. Since a short time has passed, the only new data we have covers the first quarter of its 2022 fiscal year. So far, management has continued to deliver in most regards. Revenue in the latest quarter, for instance, came in at $400.5 million. That represents an increase of 11.8% over the $358.2 million the company generated the same time one year earlier. What’s really impressive is that this growth came even at a time when automotive industry production is down by 10.4% between North America, Western Europe, and central Europe combined. As a note, the decrease in North America is a much smaller 1.8%. As a result of this contraction, the number of wheel unit shipments for the company declined, dropping from 4.5 million in the first quarter of 2021 to 4.1 million the same time this year. Instead, the increase was driven by $60.5 million in additional costs that were passed through to the company’s OEM customers because of higher aluminum and other related expenses.

Author – SEC EDGAR Data

On the bottom line, the picture did suffer a little bit. Net income went from $13.1 million last year to $10.1 million this year. However, other profitability metrics showed improvement. Operating cash flow surged from $18.2 million to $45 million. If we adjust for changes in working capital, the improvement was smaller, with the metric climbing from $33.9 million to $40.3 million. Another profitability metric to pay attention to is EBITDA. It ultimately came in at $49.2 million for the latest quarter. That was actually down from the $54.9 million experienced in the first quarter of 2021.

Superior Industries International

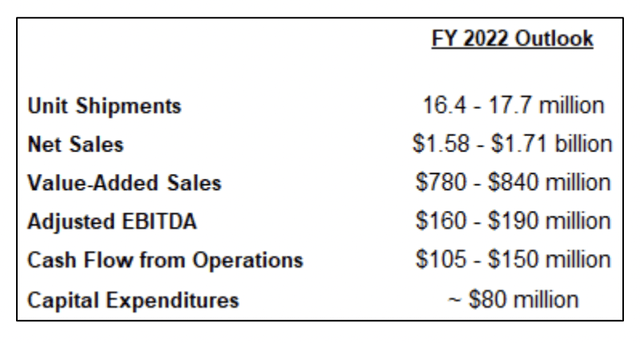

Despite the problems experienced in the first three months of the year, the company did cite IHS, an independent automotive industry analysis firm, as saying that 2022 vehicle production will be 11.7% higher than it was last year in the key markets in which the business operates. Even though this sounds impressive, it would still translate to volume being 9.7% lower than it was in 2019. Because of this forecast, management decided to hold their revenue projections for 2022 unchanged from when I last wrote about the firm. The company expects sales of between $1.58 billion and $1.71 billion. At the midpoint, that would translate to a year-over-year increase of 18.8%. When it comes to profitability, management expects operating cash flow of between $105 million and $150 million, while EBITDA should be between $160 million and $190 million.

Author – SEC EDGAR Data

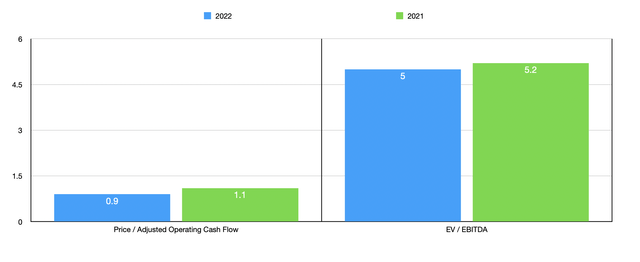

Using these forecasts, we can easily price the company. On a price to operating cash flow basis, the company is trading, on a forward basis, at a multiple of 0.9. This compares to the 1.1 multiple that we get if we rely on 2021 results. The EV to EBITDA multiple, meanwhile, should come in at 5. That’s down slightly from the 5.2 reading that we get if we use the 2021 results. To put the pricing of the company into perspective, I decided to compare it to the same five firms that I compared it to in my last article. On a price to operating cash flow approach, these companies ranged from a low of 7.4 to a high of 161. In this case, Superior Industries International was the cheapest of the group. And when it comes to the EV to EBITDA approach, the range is from 6 to 17.2. Once again, our prospect is the cheapest of the companies presented here.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Superior Industries International | 1.1 | 5.2 |

| Standard Motor Products (SMP) | 11.6 | 7.8 |

| Tenneco (TEN) | 7.4 | 6.2 |

| LCI Industries (LCII) | 161.0 | 6.0 |

| Visteon Corp. (VC) | 110.3 | 15.0 |

| Dorman Products (DORM) | 34.5 | 17.2 |

Takeaway

At this point in time, I understand why some investors would be concerned about the automotive space. If the global economy is slowing down or heading into a recession, it’s entirely possible that the demand for these products will drop temporarily. At the same time, shares are so cheap now that I have a difficult time believing that they could get much cheaper. And when you consider that management is holding their own forecasts steady despite concerns and market volatility, that should add some comfort to the equation. Because of these factors, I have decided to retain my ‘buy’ rating on the company for now.

Be the first to comment