Jozsef Soos/iStock Editorial via Getty Images

The investment thesis

The thesis of this article is really simple. A stock with the quality of the Lockheed Martin Corporation (LMT) should never trade below or near 10x of its pretax earnings according to what I call Buffett’s 10x pretax rule. However, at its current valuation, it is trading close to that. To be more specific, LMT is now traded at about 11.8x of its FW pretax earnings. As such, you will see in the remainder of this article, in the long-term, an investment here is similar to owning an equity bond with an 8.5% yield and at the same with a coupon payment that increases 5.5% per year.

As to the short-term, Russia’s invasion of Ukraine finally came and is triggering a drop in overall stock prices. However, for Lockheed Martin, this may be the catalyst to help it finally break out of its multi-year price range and valuation compression. As of this writing, the S&P 500 future is down by more than 2.2% but LMT is up more than 3% in premarket trading.

Besides the war, the recently-passed $770B defense bill also provides a strong catalyst for LMT. President Biden signed into law the National Defense Authorization Act, or NDAA, for the fiscal year 2022 on Monday, Dec 27, 2021. The bill authorizes $770 billion in defense spending for 2022, and we will see immediately below how this could benefit LMT.

The $770B NDAA

Just this Monday, Dec 27, 2021, President Biden signed into law the NDAA for the fiscal year 2022. The bill authorizes $770 billion in defense spending for 2022. This is 5% more military spending than last year – another year that the defense budget increase surpassed GDP growth. More details of the bill can be found here in this Reuters report. Here I will quote the parts that provide the background and the parts that are most relevant to LMT below. The emphases were added by me and I will elaborate on them later in the article.

- The Senate and the House of Representatives voted overwhelmingly for the 2022 defense bill with strong support from both Democrats and Republicans for the annual legislation setting policy for the Department of Defense.

- It includes a 2.7% pay increase for the troops, and more aircraft and Navy ship purchases, in addition to strategies for dealing with geopolitical threats, especially Russia and China.

- On China, the bill includes $7.1 billion for the Pacific Deterrence Initiative and a statement of congressional support for the defense of Taiwan, as well as a ban on the Department of Defense procuring products produced with forced labor from China’s Xinjiang region.

Within the Department of Defense, its fiscal year 2022 Defense Department budget request also includes the largest-ever research, development, test, and evaluation request – $112 billion, which is a 5.1% increase over fiscal 2021. The budget request highlights include the following items, and the emphasis was added by me to underscore the items directly related to BA:

- $20.4 billion for missile defense

- $6.6 billion to develop and field long-range fires

- $52.4 billion for fourth- and fifth-generation fighter aircraft

- $34.6 billion for a hybrid fleet of manned and unmanned naval platforms

- $12.3 billion for ground force weapons and next-generation combat vehicles

- $20.6 billion for space capabilities

- $10.4 billion for cyberspace activities

- $122.1 billion for training, installation support, and support to allies and partners

Valuation and Buffett’s 10x Pretax Rule

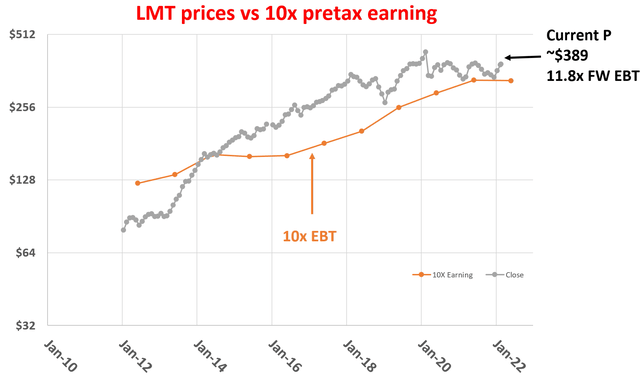

As a starting point, the following chart shows the price history of LMT and its 10x pretax earnings plus its cash position. Pretax earnings are also referred to as “EBT”, Earning Before Taxes, in this article. As seen, a quality stock like LMT should trade with a significant premium above 10xEBT. And whenever the price falls near or below is far above 10x EBT, it has been a good time to buy.

At its current price, LMT is now traded at about 11.8x of its forward pretax earnings. Not quite the ideal example for Buffett’s 10x pretax rule, but quite close. Especially if you adjust its stock price by its cash position, it is currently valued even closer to 10x EBT.

Author based on Seeking Alpha data

In case you are wondering why, out of all the valuation metrics, I chose the pretax earnings? The reasons are detailed in my earlier writings on Buffett’s 10x pretax rule. And a very brief summary is provided below to facilitate the rest of this discussion.

- First, Buffett himself paid ~10x pretax earnings for so many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple. So it cannot be coincident.

- Second, after-tax earnings do not reflect business fundamentals. Taxes can change from time to time due to factors that have no relevance to business fundamentals, such as tax law changes and capital structure changes. Plus, there are plenty of ways to lower the actual tax burden of a company.

- Third, pretax earnings are easier to benchmark, say against bond earnings. The best equity investments are bond-like, and when we speak of bond yield, that yield is pretax. So a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond.

- As a result, if I buy a business with staying power at 10x EBT and even if the business stagnates forever, I am already perfectly happy to be making a 10% return pretax. Any growth is a bonus.

Next, we will see that LMT does not only have stable staying power but also a very healthy growth prospect ahead.

LMT: Does it have any existential issues

For major defense businesses like LMT, I really do not see any existential issues, either in the short term or long term. They have established such a crucial role in the national interest that it is unthinkable that they will have existential issues at all.

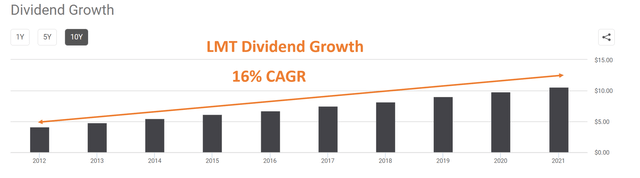

As a simple shortcut to look into this issue, let’s take a look at its dividend. The dividend is one of the most reliable and indicative metrics of a business, certainly more than earning. In LMT’s case, it has been increasing its dividend for 19 years and has been paying dividends for 26 consecutive years – an impressive track record. And the following chart shows that it has been increasing dividend at 16% CAGR in the past decade.

Author based on Seeking Alpha data

Another reliable way to look at existential issues is the backlog. Lockheed Martin ended the third quarter (on Sep 26, 2021) with $134.8 billion in backlog compared with $147.1 billion at the end of 2020. Of this, the Aeronautics segment accounted for $47.9 billion, while Rotary and Mission Systems contributed $34.1 billion.

The current backlog is admittedly a bit lower than a year ago. But when put under perspective, it’s still a very healthy level. The 2021 sales TTM are $67B. So the current backlog is worth more than two years of sales. So the business not only enjoys a wide technological moat but also a massive float in terms of the backlog. With such a float, hiccups like temporary budget uncertainty and even recession would not impact its cash flows.

And the ongoing conflict in Ukraine and the 2021 defense bill will only further strengthen its backlog.

In the even long-term, the business also enjoys a unique product cycle and long-term US government commitment. Apple has to release a new iPhone every year or so. But the product cycles for many of LMT’s products are in decades and its flagship F35 fighters are a good example. Such a unique product cycle and government commitment really provide long-term stability to the business, and also a very stable and predictable return on capital, as to be elaborated more later.

LMT: What are its growth prospects?

Now with existential issues out of the way, LMT’s current valuation around 11.8x FW EBT essentially views it as a business that will either stagnate forever or grow only to match inflation – bringing us to the third and last consideration: growth perspective.

Contrary to being stagnating, LMT has been growing its earnings and demonstrating consistent profitability in the past. As aforementioned, it has been growing its earnings and dividends almost double-digit CAGR in the past decade.

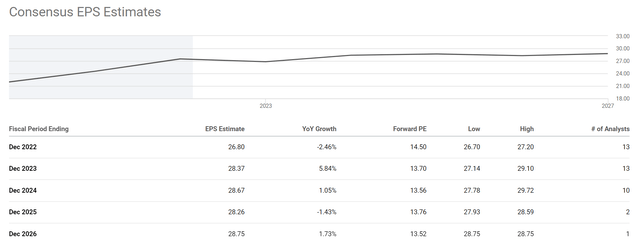

And moreover, there are many growth opportunities immediately ahead too. As aforementioned, the 2021 defense bill authorizes $770 billion in defense spending for 2022, representing 5% more military spending than last year. Both US global defense budget has been increasing faster than GDP and faster than inflation for many years. And this year’s defense bill is just another year that the defense budget increase surpassed GDP growth. Such a trend is projected to further accelerate in the next 10 years according to Global defense budget. As seen, analysts’ consensus projects profit to grow at about 2% CAGR in the next few years to come as shown below.

However, I think Wall Street substantially underestimated the growth potential here.

LMT has been reinvesting about 10% of its income in recent years to expand the capital base. And it enjoys a remarkably consistent return on capital employed (“ROCE”) around 32.5%. As a result, its organic and real growth rate in the long term would be at least 3.25% (10% reinvestment rate x 32.5% ROCE). We then need to adjust for inflation, especially given that 70% of its revenues are from government contracts. To be conservative, only adding a 2.5% of inflation escalator. So as a result, the long-term growth rate is in the mid-digit range 5.7%.

Now to put all the pieces together and conclude:

- Paying 10x EBT for a business that will stagnate forever is like owning a bond with a 10% yield.

- In LMT’s case here, the current valuation is indeed about 11.8x FW EBT, almost exactly equivalent to purchasing a bond yielding 8.5%.

- At the same time, there is a good prospect of ~5.5% long-term growth.

- So an investment here is similar to owning a bond with an 8% yield and, at the same time, with a coupon payment increase of ~8% per year, leading to very favorable odds of double-digit return in the long term.

Risks

First and foremost, I do not see any structural risk associated with LMT at this moment. There are some risks for investors with a shorter investment timeframe (and are largely irrelevant for long-term investors).

Sales have slowed recently due to the nation’s withdrawal from Afghanistan and the supply-chain problems. Its intended $4.4 billion merger with Aerojet Rocketdyne has also been blocked. However, the conflicts in Ukraine may add a catalyst.

LMT depends on U.S. military funding, which is inherently political and thus an uncertain process. The political winds can change and do change from time to time. The stock price of Lockheed Martin just underwent quite a bit of correction early this year due to the U.S. government budgeting uncertainty with the new Biden administration. And less than 12 months later, the $770B defense bill was passed with strong support from both Democrats and Republicans. Such short-term uncertainties will keep resurfacing. In my view, they are not only irrelevant for long-term investors, but also create opportunities for long-term investors.

Conclusion and final thought

LMT is a leader in its sectors, enjoying almost monopoly status in many of its businesses due to technological lead and customer relationships. The thesis here is really simple – a stock like LMT should never trade close to 10x EBT according to what I call Buffett’s 10x pretax rule. However, it is now traded at about 11.8x of its FW pretax earnings. As such,

- It presents excellent prospects for offering double-digit returns in the long term with a wide margin of safety, strong secular support, and long-term financial strength. An investment here is similar to owning a bond with an 8.5% yield and at the same with a coupon payment that increases ~5.5% per year.

- The stock meets all the requirements of Buffett’s 10x EBT rule (except its valuation is a bit about 10x EBT), both on qualitative and quantitative aspects. Given how many times the grandmaster followed the rule himself and the success he had with it, the results from this analysis show good signs that there are favorable odds for a handsome return here.

- Lastly, the Ukraine conflict and the $770B defense bill provide a strong near-term catalyst.

Be the first to comment